Lowest Cost Auto Insurance

In the realm of financial planning and personal budgeting, one often-overlooked expense is auto insurance. While it is a mandatory requirement for vehicle owners, the cost of insurance can vary significantly based on numerous factors. This comprehensive guide aims to explore the intricacies of obtaining the lowest cost auto insurance, offering expert insights and practical tips to help you make informed decisions and potentially save money.

Understanding Auto Insurance Costs

The cost of auto insurance is influenced by a myriad of factors, each playing a crucial role in determining your premium. These factors include your driving history, the make and model of your vehicle, your location, and even personal demographics. Insurance providers use these details to assess the risk associated with insuring you, which directly impacts the price you pay.

Driving Record’s Impact

Your driving record is a key determinant of your insurance premium. A clean driving record with no accidents or traffic violations often results in lower insurance costs. Conversely, a history of accidents or moving violations can significantly increase your premiums. Insurance companies view drivers with a history of accidents as higher risk, leading to higher insurance costs.

| Driving Record | Impact on Premium |

|---|---|

| Clean Record | Lower Premiums |

| Accidents or Violations | Higher Premiums |

For instance, a driver with a clean record for the past 5 years may receive a 10% discount on their insurance premium, whereas a driver with a recent at-fault accident could see their premium increase by 25% or more, depending on the severity of the accident and their insurance provider's policies.

Vehicle Factors

The make and model of your vehicle also play a significant role in determining your insurance costs. Generally, newer and more expensive vehicles tend to have higher insurance costs due to the cost of repairs and replacement parts. Additionally, vehicles with a higher risk of theft or those known for their powerful engines and speed capabilities may also attract higher insurance premiums.

For example, insuring a luxury sports car like a Ferrari or Lamborghini will typically cost more than insuring a standard sedan like a Toyota Corolla or Honda Civic. This is because sports cars are more expensive to repair and are often targeted by thieves due to their high resale value.

Location-Based Differences

Your location, whether it’s your residence or where you typically drive, can also impact your insurance costs. Areas with higher rates of car theft, vandalism, or accidents often see increased insurance premiums. Similarly, densely populated urban areas may have higher insurance costs due to increased traffic congestion and the potential for more frequent accidents.

Take the example of two drivers with similar profiles: Driver A lives in a rural area with low traffic density and a low crime rate, while Driver B resides in an urban center with high traffic and a higher crime rate. Driver A's insurance premium is likely to be significantly lower than Driver B's due to the reduced risk factors associated with their location.

Strategies for Obtaining the Lowest Cost Auto Insurance

Now that we’ve explored the factors that influence auto insurance costs, let’s delve into strategies to help you secure the lowest cost auto insurance.

Shop Around and Compare Quotes

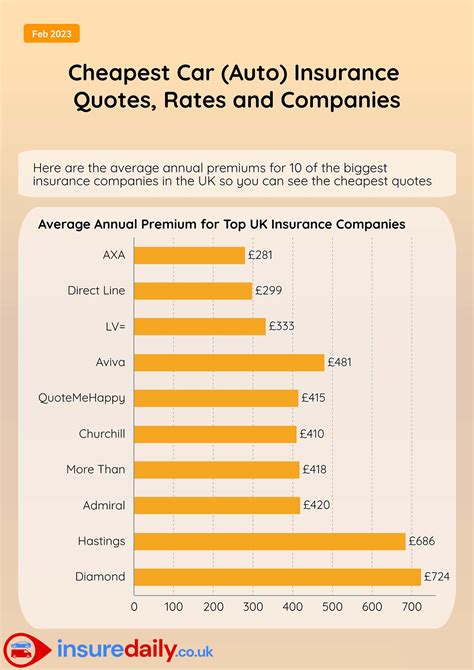

One of the most effective ways to find the lowest cost auto insurance is to compare quotes from multiple insurance providers. Insurance rates can vary significantly between companies, even for the same coverage. By shopping around and obtaining quotes from several providers, you can identify the company offering the best rates for your specific circumstances.

For instance, let's consider a driver in search of comprehensive auto insurance. By obtaining quotes from various providers, they discover that Company X offers the lowest premium for their specific coverage needs, while Company Y has the best customer service ratings. This comparison allows the driver to make an informed decision, balancing cost and service quality.

Explore Discounts and Bundling Options

Insurance providers often offer a range of discounts that can significantly reduce your insurance premium. These discounts may include safe driver discounts for maintaining a clean driving record, multi-policy discounts for bundling your auto insurance with other policies (such as home or life insurance), or good student discounts for young drivers with good academic records.

Additionally, bundling your auto insurance with other policies can result in substantial savings. By combining your auto insurance with home, renters, or even life insurance, you may be eligible for bundling discounts that can lower your overall insurance costs.

Consider Higher Deductibles

Opting for a higher deductible can lead to lower insurance premiums. A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. By choosing a higher deductible, you’re essentially taking on more financial responsibility in the event of an accident or claim, which can result in lower monthly premiums.

For example, if you typically have a $500 deductible, increasing it to $1,000 could result in a 10-20% decrease in your insurance premium. However, it's important to ensure that you can afford the higher deductible should the need arise.

Maintain a Good Credit Score

Your credit score can also impact your insurance premium. Many insurance providers use credit-based insurance scoring to assess the risk of insuring you. Generally, individuals with higher credit scores are viewed as lower risk and may be eligible for lower insurance premiums.

For instance, a driver with an excellent credit score may receive a 15% discount on their insurance premium, while a driver with a poor credit score could see their premium increase by 20% or more, depending on the insurance provider's policies.

The Future of Auto Insurance: Technological Advancements

The auto insurance industry is undergoing significant transformation due to technological advancements. Telematics and usage-based insurance (UBI) are two notable innovations that are changing the way insurance premiums are calculated.

Telematics and Usage-Based Insurance

Telematics involves the use of technology to monitor a vehicle’s movements and driving behavior. With telematics, insurance providers can collect real-time data on driving habits, such as acceleration, braking, and mileage. This data is then used to calculate insurance premiums, often resulting in more accurate and fair pricing.

Usage-based insurance takes this a step further by offering insurance policies that are priced based on actual miles driven. With UBI, drivers who drive less often or who have safer driving habits may be eligible for lower insurance premiums, as they present a lower risk to the insurance provider.

For example, a driver who typically drives 10,000 miles per year may be eligible for a 15% discount on their insurance premium through a UBI policy, while a driver who drives 20,000 miles per year may pay a standard rate or even a slightly higher premium to account for the increased risk associated with more miles driven.

Conclusion: Securing the Lowest Cost Auto Insurance

Obtaining the lowest cost auto insurance involves a combination of understanding the factors that influence insurance premiums and implementing strategies to reduce your risk profile and take advantage of available discounts. By comparing quotes, exploring bundling options, considering higher deductibles, and maintaining a good credit score, you can significantly reduce your insurance costs.

Additionally, staying informed about technological advancements in the insurance industry, such as telematics and usage-based insurance, can help you make more informed decisions and potentially access even lower insurance premiums. Remember, securing the lowest cost auto insurance is not just about saving money; it's about ensuring you have the coverage you need at a price that fits your budget.

Can my credit score really impact my insurance premium?

+Yes, many insurance providers use credit-based insurance scoring to assess the risk of insuring you. Generally, individuals with higher credit scores are viewed as lower risk and may be eligible for lower insurance premiums. However, the impact of your credit score on your premium can vary depending on your state’s regulations and the insurance provider’s policies.

How can I improve my chances of getting the lowest cost auto insurance?

+To improve your chances of getting the lowest cost auto insurance, consider the following strategies: shop around and compare quotes from multiple providers, explore available discounts and bundling options, maintain a clean driving record, and consider increasing your deductible if you can afford it in the event of a claim. Additionally, keeping a good credit score can also help reduce your insurance premium.

What is usage-based insurance (UBI), and how can it benefit me?

+Usage-based insurance (UBI) is an insurance policy that is priced based on the actual miles driven. It offers drivers the opportunity to pay for insurance based on their individual driving habits and mileage. UBI can benefit drivers who drive less often or who have safer driving habits, as they may be eligible for lower insurance premiums compared to traditional insurance policies.