Lowest Rate Auto Insurance

Securing the lowest rate auto insurance is a crucial aspect of being a responsible driver. Not only does it ensure you meet legal requirements, but it also provides peace of mind and can save you a significant amount of money in the long run. With the vast array of insurance providers and policies available, it can be a daunting task to navigate the market and find the best deal. This comprehensive guide aims to provide an expert-level analysis, offering valuable insights and strategies to help you secure the most cost-effective auto insurance coverage tailored to your specific needs.

Understanding the Fundamentals of Auto Insurance

Before delving into the strategies to secure the lowest rates, it’s essential to have a solid grasp of the fundamental concepts and factors that influence auto insurance costs. This knowledge will empower you to make informed decisions and navigate the insurance market with confidence.

Key Components of Auto Insurance Policies

Auto insurance policies are typically comprised of several key components, each serving a specific purpose and contributing to the overall cost of your coverage. These include:

- Liability Coverage: This covers damages and injuries you cause to others in an accident. It’s mandatory in most states and is a critical aspect of your policy.

- Collision Coverage: This optional coverage pays for repairs to your vehicle after an accident, regardless of fault. It’s particularly beneficial for newer or more valuable vehicles.

- Comprehensive Coverage: Another optional coverage, comprehensive protection covers damages caused by non-collision events like theft, vandalism, or natural disasters.

- Medical Payments Coverage: This optional coverage pays for medical expenses for you and your passengers after an accident, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover the damages.

Factors Influencing Auto Insurance Rates

Several factors play a significant role in determining your auto insurance rates. Understanding these factors can help you make informed decisions and potentially lower your premiums.

- Vehicle Type and Usage: The make, model, and year of your vehicle, as well as how you use it (e.g., commuting, pleasure, business), can impact your rates. Generally, newer, more expensive vehicles and those used for business purposes may result in higher premiums.

- Driver’s Profile: Your age, gender, driving record, and credit score are key factors. Younger drivers and those with a history of accidents or traffic violations may face higher premiums. Additionally, a poor credit score can negatively impact your rates.

- Location: Where you live and where you primarily drive your vehicle can affect your rates. Urban areas with higher traffic density and crime rates may result in higher premiums.

- Coverage and Deductibles: The level of coverage you choose and the deductibles you select can significantly impact your premiums. Higher deductibles usually mean lower premiums, but you’ll pay more out-of-pocket if you need to file a claim.

- Discounts and Bundles: Many insurance providers offer discounts for various reasons, such as good driving records, safe vehicles, or bundling multiple policies (e.g., auto and home insurance) with the same provider.

Strategies to Secure the Lowest Rate Auto Insurance

Now that we’ve covered the fundamentals, let’s delve into the strategies you can employ to secure the lowest rate auto insurance coverage.

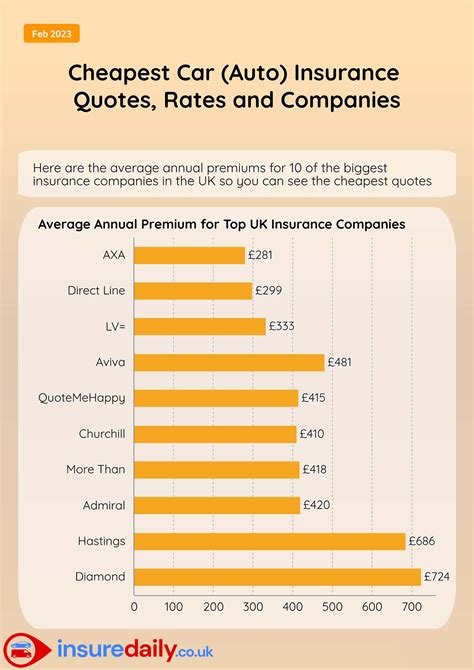

Shop Around and Compare Quotes

One of the most effective ways to find the lowest rates is to shop around and compare quotes from multiple insurance providers. Each provider uses its own formula to calculate rates, so quotes can vary significantly. Use online quote comparison tools or directly contact insurance providers to get a sense of the market and find the best deal.

Understand Your Coverage Needs

Before seeking quotes, it’s essential to understand your specific coverage needs. Consider your vehicle’s value, your financial situation, and the risks you’re willing to take. For instance, if you have an older vehicle with a low market value, you might consider dropping collision and comprehensive coverage to lower your premiums.

Review Your Policy Regularly

Auto insurance rates can change over time due to various factors, such as changes in your driving record, vehicle, or location. It’s a good practice to review your policy annually to ensure you’re still getting the best deal. If your circumstances have changed, you may be eligible for additional discounts or lower rates.

Consider Higher Deductibles

Opting for higher deductibles can significantly reduce your premiums. However, it’s essential to ensure you can afford the deductible in the event of a claim. Higher deductibles make sense if you have a good driving record and are confident you won’t need to file frequent claims.

Explore Discounts and Bundles

Insurance providers often offer a range of discounts to attract and retain customers. These can include discounts for good driving records, safe vehicles, loyalty, or bundling multiple policies. Additionally, consider bundling your auto insurance with other policies, such as home or renters insurance, to potentially save more.

Improve Your Driving Record

A clean driving record is one of the most influential factors in determining your auto insurance rates. Avoid traffic violations and accidents to maintain a good record. If you have a less-than-perfect record, consider taking a defensive driving course to potentially reduce points on your license and lower your premiums.

Maintain a Good Credit Score

Your credit score can have a significant impact on your auto insurance rates. Insurance providers often use credit-based insurance scores to assess the risk of insuring a driver. Maintaining a good credit score can help you secure lower premiums. If you’re looking to improve your credit score, consider paying bills on time, reducing debt, and monitoring your credit report for errors.

Consider Usage-Based Insurance

Usage-based insurance (UBI) is an innovative approach where your insurance rates are based on your actual driving behavior. This is often measured through a device installed in your vehicle or an app on your smartphone. If you’re a safe and cautious driver, UBI can potentially lower your premiums. However, it may not be suitable for everyone, as it requires constant monitoring and can be invasive.

Explore Telematics Devices

Telematics devices, such as GPS trackers or black boxes, can be installed in your vehicle to monitor your driving behavior. These devices provide real-time data on factors like speed, acceleration, and braking. While this may seem invasive, it can potentially lead to lower premiums if you drive safely. Some insurance providers offer discounts for installing these devices, so it’s worth exploring this option.

Negotiate with Your Current Provider

If you’ve been with the same insurance provider for a while, it’s worth negotiating your rates. Many providers are willing to offer loyalty discounts or adjust your policy to better suit your needs and budget. Be prepared to discuss your coverage needs and any changes in your circumstances that may impact your rates.

Understand the Fine Print

When comparing quotes and policies, it’s essential to understand the fine print. Ensure you know exactly what’s covered and what’s not. Some policies may offer lower premiums but have higher deductibles or exclude certain types of coverage. It’s crucial to thoroughly review the policy terms and conditions to ensure you’re getting the coverage you need at a fair price.

Seek Expert Advice

If you’re unsure about the best approach to secure the lowest rate auto insurance, consider seeking advice from an insurance professional. They can provide personalized guidance based on your specific circumstances and needs. An insurance broker or agent can help you compare policies, understand your coverage options, and negotiate with providers to get the best deal.

Conclusion

Securing the lowest rate auto insurance requires a combination of knowledge, strategy, and negotiation. By understanding the fundamentals of auto insurance, comparing quotes, and exploring various options and discounts, you can find a policy that provides adequate coverage at a competitive price. Remember, it’s essential to regularly review and adjust your policy to ensure it remains cost-effective and meets your evolving needs.

FAQs

How often should I review my auto insurance policy?

+

It’s a good practice to review your auto insurance policy annually to ensure it still meets your needs and to take advantage of any potential discounts or changes in your circumstances that may affect your rates.

Can I switch insurance providers mid-policy term?

+

Yes, you can switch insurance providers at any time. However, it’s important to note that some providers may charge a fee for cancelling your policy early. Ensure you understand the terms and conditions of your current policy before making the switch.

What is the average cost of auto insurance in the United States?

+

The average cost of auto insurance in the United States varies depending on factors such as your location, vehicle type, driving record, and coverage levels. According to the Insurance Information Institute, the national average for auto insurance premiums was $1,674 per year in 2021. However, this can range significantly depending on individual circumstances.

Are there any government programs that can help reduce auto insurance costs for low-income individuals?

+

Yes, some states offer low-cost or discounted auto insurance programs for low-income individuals. These programs typically have eligibility criteria based on income level and driving record. Check with your state’s insurance department or a local insurance agent to see if you qualify for any such programs.

How can I improve my credit score to potentially lower my auto insurance rates?

+

Improving your credit score can take time and effort. Some strategies to enhance your credit score include paying bills on time, reducing debt, and monitoring your credit report for errors. You can also consider using a credit-building tool like a secured credit card or a credit-building loan. Additionally, maintaining a good driving record and avoiding frequent insurance claims can also positively impact your credit score.