Marketplace Insurance

In today's complex insurance landscape, a new player has emerged to revolutionize the way we access and manage our coverage. Marketplace Insurance is an innovative concept that offers a fresh perspective on traditional insurance practices, aiming to provide a more accessible, efficient, and personalized experience for policyholders. With the rise of digital platforms and changing consumer preferences, this innovative insurance model has gained significant traction, challenging the established norms of the industry.

Marketplace Insurance operates on the principle of aggregating multiple insurance providers onto a single, user-friendly platform. This aggregation allows consumers to compare a wide range of insurance policies from various companies, making it easier to find the best coverage at the most competitive prices. The model is particularly appealing in an era where consumers are increasingly seeking convenience, transparency, and value for their money.

The Evolution of Insurance: A Digital Revolution

The insurance industry has undergone a significant transformation in recent years, largely driven by technological advancements and evolving consumer expectations. Traditional insurance models, characterized by face-to-face interactions and paper-based processes, are rapidly giving way to digital platforms and online services. This shift has been accelerated by the COVID-19 pandemic, which has emphasized the need for contactless services and digital convenience.

Marketplace Insurance is at the forefront of this digital revolution, leveraging technology to streamline the insurance experience. By bringing together a diverse range of insurance providers, it offers a one-stop shop for consumers, making the process of purchasing insurance more efficient and transparent. This evolution not only benefits consumers but also provides insurance companies with a powerful tool to reach a wider audience and showcase their products more effectively.

The Benefits of Marketplace Insurance

Marketplace Insurance offers a host of advantages that traditional insurance models often struggle to match. Firstly, it provides unparalleled convenience, allowing consumers to compare and purchase insurance policies from the comfort of their homes. This is especially beneficial for those with busy schedules or limited mobility, as it eliminates the need for physical visits to insurance offices.

Secondly, Marketplace Insurance platforms often utilize advanced algorithms and data analytics to personalize the insurance experience. By analyzing a user's specific needs and preferences, these platforms can recommend tailored insurance packages, ensuring that consumers receive coverage that is not only affordable but also comprehensive and suited to their individual circumstances.

Furthermore, the competitive nature of Marketplace Insurance drives down prices, as insurance providers strive to offer the best value to attract customers. This competition can lead to significant savings for consumers, particularly when compared to the often inflated prices of traditional insurance providers. Additionally, the transparency offered by these platforms allows consumers to easily understand the features and benefits of different policies, empowering them to make informed decisions.

Marketplace Insurance in Practice: Real-World Applications

Marketplace Insurance is not just a theoretical concept; it has already made significant inroads into various insurance sectors, demonstrating its versatility and effectiveness.

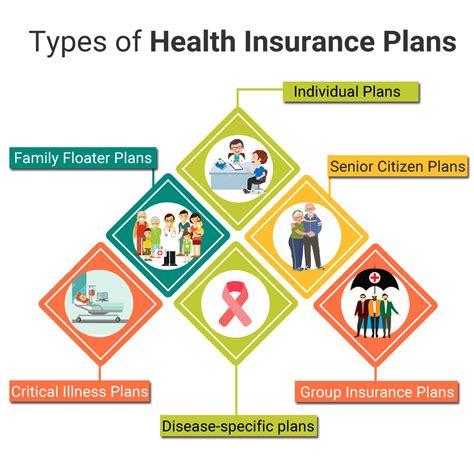

Health Insurance Marketplaces

One of the most prominent applications of Marketplace Insurance is in the health insurance sector. In many countries, including the United States, government-run or supported health insurance marketplaces have been established to provide a centralized platform for individuals and families to compare and purchase health insurance plans. These marketplaces have played a crucial role in increasing access to affordable healthcare, particularly for those who may not have employer-sponsored coverage.

| Marketplace | Number of Enrollees (2022) |

|---|---|

| Healthcare.gov (US) | 13.8 million |

| Covered California | 1.5 million |

| New York State of Health | 4.1 million |

These health insurance marketplaces typically offer a wide range of plans from multiple insurers, allowing consumers to compare costs, coverage details, and provider networks. The introduction of these marketplaces has not only increased competition among insurers but has also made the process of obtaining health insurance more transparent and accessible.

Auto Insurance Marketplaces

The auto insurance sector has also embraced the Marketplace Insurance model, providing a convenient platform for drivers to compare quotes and purchase coverage. These marketplaces often utilize advanced algorithms to take into account various factors, such as the driver’s age, location, driving history, and the type of vehicle being insured, to provide personalized quotes from multiple insurers.

By aggregating a large number of insurance providers, auto insurance marketplaces offer consumers a broader range of options, ensuring they can find the coverage that best suits their needs and budget. This competitive environment has led to more affordable rates and better customer service, as insurers strive to differentiate themselves and attract customers.

Home Insurance Marketplaces

Similar to the auto insurance sector, home insurance marketplaces have emerged to provide a one-stop shop for homeowners and renters to compare and purchase insurance policies. These platforms take into account factors such as the property’s location, size, and construction materials, as well as the coverage limits and deductibles desired by the policyholder, to generate personalized quotes from multiple insurers.

Home insurance marketplaces not only make the process of obtaining coverage more efficient but also help consumers understand the nuances of home insurance, such as the differences between replacement cost and actual cash value policies. By educating consumers and providing transparent pricing, these marketplaces have empowered homeowners to make more informed decisions about their insurance needs.

The Future of Marketplace Insurance: Trends and Innovations

As the insurance industry continues to evolve, Marketplace Insurance is poised to play an even more significant role in shaping the future of the sector. Several emerging trends and innovations are set to further enhance the capabilities and appeal of Marketplace Insurance platforms.

Artificial Intelligence and Machine Learning

The integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies is expected to revolutionize Marketplace Insurance. These technologies can analyze vast amounts of data to provide highly personalized insurance recommendations, taking into account not only traditional factors like age and location but also more nuanced variables such as lifestyle choices, health conditions, and even genetic predispositions.

By leveraging AI and ML, Marketplace Insurance platforms can offer dynamic insurance products that adapt to the changing needs of consumers. For instance, a health insurance policy could automatically adjust coverage limits or premiums based on an individual's health status or lifestyle changes, ensuring that the policy remains relevant and cost-effective over time.

Blockchain Technology

Blockchain technology, with its decentralized and secure nature, has the potential to transform the insurance industry, particularly in the context of Marketplace Insurance. By using blockchain, insurance transactions can be recorded and verified in a secure, tamper-proof manner, reducing the risk of fraud and enhancing transparency.

Additionally, blockchain can facilitate the seamless transfer of insurance data between different platforms and providers, making it easier for consumers to switch policies or insurers. This interoperability can enhance competition and drive down prices, as consumers are no longer locked into specific insurance providers.

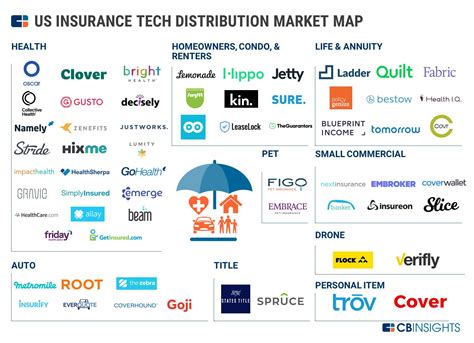

Insurtech Partnerships

The rise of Insurtech startups, focused on developing innovative insurance solutions, presents an exciting opportunity for Marketplace Insurance platforms. By partnering with these startups, Marketplace Insurance providers can offer cutting-edge products and services to their customers, staying at the forefront of the industry’s digital transformation.

Insurtech partnerships can lead to the development of new insurance products tailored to the unique needs of specific demographics or industries. For instance, a Marketplace Insurance platform could collaborate with an Insurtech startup to offer specialized coverage for gig economy workers, addressing the unique risks and challenges faced by this growing workforce.

Conclusion: Embracing the Marketplace Insurance Model

Marketplace Insurance represents a significant departure from traditional insurance models, offering a more accessible, efficient, and personalized experience for consumers. By leveraging technology and aggregating multiple insurance providers, these platforms have disrupted the industry, driving down prices, enhancing transparency, and empowering consumers to make informed decisions about their coverage.

As the insurance landscape continues to evolve, with digital platforms and innovative technologies playing an increasingly central role, the success of Marketplace Insurance is poised to grow. By embracing this model, insurance providers can not only reach a wider audience but also offer a more dynamic and tailored insurance experience, meeting the diverse needs of today's consumers.

How does Marketplace Insurance benefit consumers?

+Marketplace Insurance offers consumers a one-stop shop for comparing and purchasing insurance policies, providing convenience, transparency, and competitive pricing. It allows consumers to easily understand their options, find the best coverage for their needs, and save money by comparing quotes from multiple insurers.

What types of insurance can be purchased through Marketplace Insurance platforms?

+Marketplace Insurance platforms offer a wide range of insurance types, including health insurance, auto insurance, home insurance, life insurance, and even specialty coverages like pet insurance or travel insurance. The specific types of insurance available may vary depending on the platform and the region it serves.

How does Marketplace Insurance drive down prices for consumers?

+Marketplace Insurance drives down prices by creating a competitive environment where multiple insurers compete for customers. By aggregating a large number of insurance providers, these platforms allow consumers to easily compare prices and coverage, encouraging insurers to offer more competitive rates to stand out in the marketplace.