Marketplace Insurance 1095 A

In the intricate landscape of healthcare, understanding the complexities of insurance is paramount. One crucial document that often emerges in the realm of health insurance is the 1095-A form, a key component of the US Affordable Care Act. This form plays a pivotal role in verifying health coverage and is integral to the process of claiming tax credits for health insurance premiums. As we delve into the specifics of the 1095-A, we uncover its significance, its contents, and its impact on individuals and businesses alike.

Understanding the 1095-A Form: A Comprehensive Overview

The 1095-A form, officially known as the Health Insurance Marketplace Statement, is a document issued by the Health Insurance Marketplace to individuals and families who have enrolled in a qualified health plan. It serves as a vital record, providing detailed information about the health coverage obtained through the Marketplace during the previous year. This form is a critical piece of the puzzle in the broader context of healthcare reform, acting as a bridge between insurance coverage and tax obligations.

The introduction of the 1095-A form is a direct result of the Affordable Care Act (ACA), often referred to as Obamacare. The ACA, signed into law in 2010, aimed to make healthcare more accessible and affordable for all Americans. A key component of this law was the establishment of Health Insurance Marketplaces, where individuals and small businesses could shop for and purchase health insurance plans. The 1095-A form is a direct outcome of this legislation, designed to streamline the process of verifying health coverage and facilitating the claim of tax credits.

The 1095-A form is typically sent to enrollees by January 31st of each year, covering the previous year's insurance coverage. It is a mandatory document for those who have purchased health insurance through the Marketplace, as it is required for tax filing purposes. The form contains critical information such as the enrollee's name, address, and Social Security number, along with details about the health plan, including the plan type, coverage period, and any applicable premium tax credits or cost-sharing reductions.

Key Components of the 1095-A Form

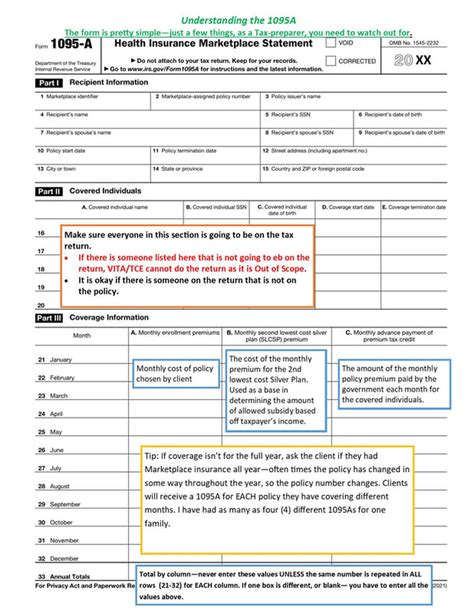

The 1095-A form is divided into several sections, each providing specific and essential information:

- Personal Information: This section includes the enrollee's identifying details, such as name, address, and Social Security number. It also lists the names and birthdates of any dependents covered under the plan.

- Coverage Details: Here, the specifics of the health plan are outlined. This includes the plan type (such as bronze, silver, gold, or platinum), the coverage period (start and end dates), and any applicable premium tax credits or cost-sharing reductions. It also provides information on whether the plan provides minimum essential coverage, as defined by the ACA.

- Additional Information: This section may include any relevant notes or instructions regarding the form. It might also provide information on how to contact the Marketplace or the health insurance provider if there are any discrepancies or questions about the coverage.

The 1095-A form is a critical document for both individuals and businesses. For individuals, it serves as proof of health coverage, which is essential for avoiding penalties under the ACA's individual mandate. It also provides the necessary information for claiming tax credits on their federal income tax returns. For businesses, particularly small businesses that offer health insurance to their employees through the SHOP Marketplace, the 1095-A forms for their employees are crucial for compliance with reporting requirements.

The Impact of the 1095-A Form on Healthcare and Taxation

The introduction of the 1095-A form has had a significant impact on both the healthcare and taxation landscapes. On the healthcare front, it has played a pivotal role in increasing transparency and accountability within the insurance industry. By providing detailed information about coverage and costs, the form empowers individuals to make more informed decisions about their health insurance plans. It also serves as a tool for identifying and addressing potential discrepancies or errors in coverage, ensuring that individuals receive the benefits they are entitled to.

From a taxation perspective, the 1095-A form is a game-changer. It simplifies the process of claiming tax credits for health insurance premiums, which was a complex and often confusing task prior to the ACA. The form provides all the necessary information for individuals to calculate and claim their premium tax credits, making tax filing more efficient and accurate. Additionally, it helps to ensure that individuals who are eligible for tax credits receive them, promoting financial accessibility in healthcare.

Streamlining the Tax Filing Process

One of the most notable benefits of the 1095-A form is its role in streamlining the tax filing process. Prior to its introduction, individuals who purchased health insurance through the Marketplace had to manually calculate their premium tax credits, a process that was time-consuming and prone to errors. With the 1095-A form, all the necessary information is presented in a clear and organized manner, making it easier for taxpayers to understand their coverage and tax benefits.

Furthermore, the form simplifies the process of verifying coverage for tax purposes. The IRS uses the information on the 1095-A form to match with tax returns, ensuring that individuals who claim premium tax credits are indeed eligible for them. This verification process helps to prevent fraud and misuse of tax credits, maintaining the integrity of the tax system.

Promoting Access to Healthcare

The 1095-A form is not just a bureaucratic requirement; it is a vital tool in promoting access to healthcare. By providing a clear record of coverage and costs, the form encourages individuals to maintain their health insurance, even if they experience changes in their income or family situation. This is particularly important for those who are eligible for premium tax credits, as the form serves as a reminder of the financial benefits they can receive by staying insured.

Moreover, the form helps to bridge the gap between healthcare and taxation, making it easier for individuals to understand the financial implications of their health insurance choices. This integration of healthcare and taxation is a key aspect of the ACA's goal to make healthcare more affordable and accessible to all Americans.

Future Implications and Evolving Landscape

As the healthcare landscape continues to evolve, the 1095-A form is likely to play an even more significant role. With ongoing debates and changes in healthcare policy, the form will need to adapt to new requirements and standards. For instance, as more states expand Medicaid coverage or introduce their own healthcare initiatives, the 1095-A form may need to incorporate additional information to accommodate these changes.

Furthermore, as technology advances, there is a growing opportunity to digitize and streamline the 1095-A form process. Digital platforms and mobile applications could provide a more user-friendly and accessible way for individuals to receive, review, and store their 1095-A forms. This could enhance efficiency, reduce paper waste, and improve overall user experience.

Potential Challenges and Solutions

Despite its benefits, the 1095-A form is not without its challenges. One of the primary concerns is the potential for errors or discrepancies in the form, which can lead to confusion and delays in tax filing. To address this, improved communication and education about the form’s purpose and contents are essential. Clear and accessible resources, such as online guides or helplines, can help individuals understand the form and take appropriate action if errors are identified.

Another challenge is the complexity of the form itself. With multiple sections and detailed information, it can be overwhelming for some individuals, particularly those who are not familiar with healthcare or tax terminology. Simplifying the language and providing clear explanations of each section can help make the form more user-friendly and accessible to a wider audience.

Conclusion: Navigating the Complexities of Healthcare with the 1095-A Form

The 1095-A form is a critical component of the US healthcare system, serving as a bridge between insurance coverage and tax obligations. Its introduction through the Affordable Care Act has had a profound impact on both healthcare and taxation, promoting transparency, accessibility, and financial accountability. As we navigate the complexities of healthcare, the 1095-A form stands as a vital tool, empowering individuals to make informed decisions about their health coverage and tax benefits.

As the healthcare landscape continues to evolve, the 1095-A form will undoubtedly adapt and innovate to meet new challenges and opportunities. By staying informed and engaged with the latest developments, individuals and businesses can ensure they are making the most of this crucial document, ultimately improving their healthcare experiences and financial outcomes.

What is the purpose of the 1095-A form?

+The 1095-A form is used to report health insurance coverage information to the IRS and to individuals who enrolled in a qualified health plan through the Health Insurance Marketplace. It provides details about the coverage, including the plan type, coverage period, and any premium tax credits or cost-sharing reductions.

Who receives the 1095-A form?

+The 1095-A form is typically sent to individuals who enrolled in a qualified health plan through the Health Insurance Marketplace. It is also sent to any dependents covered under the plan.

How does the 1095-A form impact tax filing?

+The 1095-A form is a critical document for tax filing purposes. It provides the necessary information for individuals to claim premium tax credits on their federal income tax returns. Without this form, individuals may not be able to accurately calculate and claim their tax credits, which can impact their tax liability.

What should I do if I receive a 1095-A form with errors or discrepancies?

+If you notice any errors or discrepancies on your 1095-A form, it is important to take action promptly. Contact the Health Insurance Marketplace or your health insurance provider to report the issue and request a corrected form. Ensure that you have accurate information before filing your taxes to avoid potential penalties or delays.