Marketplace Insurance Contact Number

Insurance marketplaces, often established as part of government initiatives, play a crucial role in facilitating access to affordable health coverage for individuals and families. These marketplaces, also known as exchanges, provide a platform where insurance providers can offer their plans, and eligible individuals can compare and purchase coverage that suits their needs. Navigating the insurance landscape can be complex, and many people seek assistance through dedicated contact numbers to address their queries and concerns. This article aims to provide an in-depth exploration of the contact number services available through insurance marketplaces, shedding light on the support and guidance they offer to prospective policyholders.

The Role of Contact Numbers in Insurance Marketplaces

Contact numbers serve as a vital link between insurance marketplaces and the public, offering a direct channel for communication and support. These numbers are designed to assist individuals throughout the insurance enrollment process, from initial inquiries about plan options to resolving complex issues related to eligibility, subsidies, and coverage specifics.

Assisting with Plan Comparisons and Enrollment

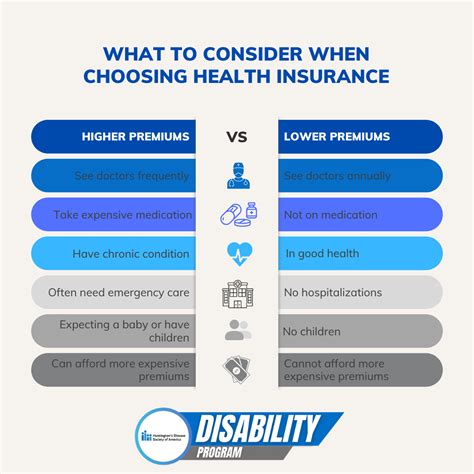

Insurance marketplaces typically offer a wide array of plans from various providers, each with unique features and pricing structures. Contact numbers are invaluable resources for individuals seeking guidance in navigating these options. Customer service representatives can provide detailed information about plan benefits, deductibles, and out-of-pocket expenses, helping callers make informed decisions about their coverage needs.

| Plan Type | Premium | Deductible | Key Benefits |

|---|---|---|---|

| Silver Plan | $450/month | $2,000 | Covered prescription drugs, dental care |

| Gold Plan | $520/month | $1,500 | Expanded network, vision coverage |

| Platinum Plan | $600/month | $1,000 | Comprehensive coverage, no network restrictions |

By engaging with the marketplace's contact number services, individuals can receive personalized recommendations based on their healthcare requirements and budget constraints, ensuring they select the most suitable plan.

Addressing Eligibility and Subsidy Concerns

Insurance marketplaces often provide subsidies and tax credits to make health coverage more accessible. Contact numbers play a crucial role in helping individuals understand their eligibility for these benefits and how to apply for them. Customer service representatives can guide callers through the necessary documentation and processes to ensure they receive the maximum available assistance.

Handling Special Circumstances and Complex Cases

Some individuals may face unique challenges when enrolling in insurance plans, such as pre-existing conditions, income fluctuations, or family status changes. Contact numbers are especially valuable in these situations, as they provide a dedicated channel for addressing such complex cases. Trained specialists can offer tailored solutions and ensure that individuals receive the coverage they need while navigating any potential obstacles.

Enhancing Accessibility and Customer Experience

Insurance marketplaces recognize the importance of making their contact number services as accessible and user-friendly as possible. To cater to a diverse range of needs, they often offer multiple contact options, including toll-free numbers, online chat support, and even dedicated email addresses for inquiries.

Multilingual Support

In recognition of the diverse populations they serve, many insurance marketplaces provide contact number services in multiple languages. This ensures that individuals can receive assistance in their native tongue, breaking down language barriers and enhancing the overall customer experience.

Extended Hours and Prompt Response Times

Marketplace insurance contact numbers are typically available during extended hours, including evenings and weekends, to accommodate the varying schedules of prospective policyholders. Additionally, marketplaces strive to maintain prompt response times, ensuring that callers receive timely assistance without long wait periods.

Online Support Tools

In addition to traditional contact methods, insurance marketplaces often offer online support tools to further assist individuals. These tools may include comprehensive FAQs, interactive plan comparison features, and step-by-step guides for enrollment, providing an added layer of self-service support.

Future Trends and Innovations in Marketplace Support

As technology advances and consumer expectations evolve, insurance marketplaces are continuously seeking ways to enhance their contact number services. Here are some anticipated trends and innovations that may shape the future of marketplace support:

-

AI-Powered Assistance: Artificial intelligence (AI) is likely to play an increasingly prominent role in marketplace support. AI-powered chatbots and virtual assistants could handle routine inquiries, freeing up human agents to focus on more complex issues. These AI systems could provide instant responses and personalized recommendations, further streamlining the customer experience.

-

Video Conferencing and Screen Sharing: To offer more interactive and personalized support, insurance marketplaces may integrate video conferencing and screen-sharing capabilities into their contact number services. This would allow agents to guide callers through complex processes visually, ensuring a clearer understanding of plan options and enrollment procedures.

-

Integration with Digital Health Platforms: As digital health solutions gain traction, insurance marketplaces could explore partnerships with these platforms to offer more holistic support. For instance, integrating with telemedicine services could enable marketplaces to provide real-time medical advice alongside insurance guidance, enhancing the overall health and wellness experience.

Conclusion

The contact number services offered by insurance marketplaces are instrumental in helping individuals navigate the complex world of health insurance. Through dedicated support, personalized guidance, and a commitment to accessibility, these services ensure that prospective policyholders can make informed decisions about their coverage. As the healthcare landscape continues to evolve, insurance marketplaces will undoubtedly play a pivotal role in shaping a more accessible and equitable healthcare system.

How do I find the contact number for my local insurance marketplace?

+You can typically find the contact number for your local insurance marketplace by visiting their official website. Alternatively, you can search for “marketplace insurance contact number” followed by your state or region to find the relevant information. Many marketplaces also provide toll-free numbers for easy access.

What kind of support can I expect when calling the insurance marketplace contact number?

+When calling the insurance marketplace contact number, you can expect assistance with plan comparisons, enrollment guidance, and clarification on eligibility for subsidies or tax credits. Customer service representatives are trained to provide personalized recommendations and address any concerns you may have about coverage options.

Are insurance marketplace contact numbers available in languages other than English?

+Yes, many insurance marketplaces recognize the need for multilingual support and offer contact number services in multiple languages. When calling, you may be prompted to select your preferred language or have the option to request assistance in a specific language. This ensures that individuals can receive guidance in their native tongue.