Marketplace Insurance Plans Georgia

The insurance landscape in Georgia is dynamic and diverse, catering to the needs of its residents with a range of options. Understanding the nuances of marketplace insurance plans in this state is crucial for individuals and families seeking affordable healthcare coverage. This comprehensive guide delves into the specifics of these plans, offering insights into their features, benefits, and how they can be tailored to meet the unique healthcare requirements of Georgians.

Navigating the Georgia Marketplace

Georgia’s insurance marketplace, governed by the Affordable Care Act (ACA), provides a platform for residents to compare and enroll in health insurance plans. With a focus on affordability and accessibility, the marketplace offers a range of options tailored to different budgets and healthcare needs. Understanding the process and the plans available is key to making informed decisions.

Key Features of Georgia Marketplace Plans

Georgia’s marketplace plans offer a comprehensive set of benefits, ensuring residents receive the healthcare services they need. These plans typically include coverage for doctor visits, hospital stays, prescription medications, and preventive care. Additionally, they often provide coverage for mental health services, substance abuse treatment, and maternity care, ensuring a holistic approach to healthcare.

| Plan Type | Benefits |

|---|---|

| Bronze Plans | Covers 60% of medical costs, offers lower premiums, ideal for those who are generally healthy and don't require frequent medical care. |

| Silver Plans | Covers 70% of medical costs, provides a balance between premiums and out-of-pocket costs, suitable for individuals with occasional healthcare needs. |

| Gold Plans | Covers 80% of medical costs, offers higher premiums but lower out-of-pocket expenses, best for those with frequent or ongoing medical conditions. |

| Platinum Plans | Covers 90% of medical costs, provides the highest level of coverage with the lowest out-of-pocket expenses, ideal for those with extensive medical needs. |

Each plan category offers a unique balance between premiums and out-of-pocket expenses, allowing Georgians to choose the plan that best aligns with their healthcare needs and financial situation.

Affordability and Subsidies

A key advantage of marketplace plans in Georgia is the availability of premium tax credits and cost-sharing reductions. These subsidies can significantly reduce the cost of monthly premiums and out-of-pocket expenses, making healthcare more affordable for low- and middle-income households. The eligibility for these subsidies is based on income, with those earning up to 400% of the federal poverty level qualifying for some form of assistance.

Enrollment and Deadlines

The annual open enrollment period for marketplace plans in Georgia typically runs from November 1st to December 15th. During this time, residents can enroll in a new plan, switch plans, or renew their existing coverage for the upcoming year. Outside of this period, individuals can only enroll in a marketplace plan if they qualify for a special enrollment period due to certain life events, such as losing job-based coverage, getting married, or having a baby.

Special Enrollment Periods

Special enrollment periods (SEPs) are crucial for those facing changes in their life circumstances that affect their healthcare coverage. In Georgia, SEPs can be triggered by events such as moving to a new area, changes in income that affect subsidy eligibility, or gaining citizenship or lawful presence status. Understanding these triggers and acting promptly can ensure uninterrupted healthcare coverage during life’s transitions.

Choosing the Right Plan

Selecting the right marketplace insurance plan in Georgia involves careful consideration of personal healthcare needs and financial capabilities. Factors such as the frequency of medical visits, prescription medication requirements, and anticipated out-of-pocket expenses play a crucial role in this decision.

Evaluating Plan Options

When comparing plans, it’s essential to look beyond just the monthly premium. Deductibles, copays, and coinsurance rates should also be considered, as these can significantly impact the overall cost of healthcare. Additionally, reviewing the plan’s network of providers is crucial to ensure access to preferred doctors and hospitals. Some plans offer more flexibility with out-of-network coverage, while others may have more restrictive networks, so it’s important to assess personal preferences and needs.

Utilizing Plan Benefits

Understanding the full scope of plan benefits is key to maximizing the value of marketplace insurance. This includes not only the coverage for standard medical services but also the often-overlooked benefits such as preventive care, which can include screenings, immunizations, and wellness visits. Many plans also offer wellness programs and incentives to encourage healthy behaviors, which can lead to better overall health and potentially lower healthcare costs.

The Future of Marketplace Insurance in Georgia

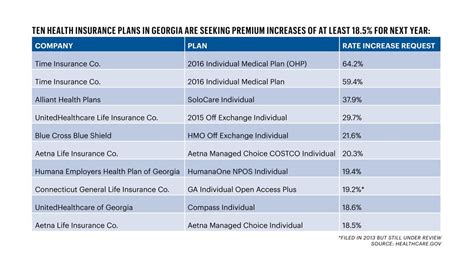

The landscape of marketplace insurance in Georgia is continually evolving, driven by changes in federal and state policies, as well as shifts in the healthcare industry. While the Affordable Care Act remains the foundation of these plans, ongoing discussions and potential legislative changes could bring about significant transformations.

Potential Policy Changes

Policy changes at the state and federal levels could impact the structure and availability of marketplace plans. For instance, expansions or modifications to Medicaid could influence the number of residents eligible for marketplace plans. Similarly, changes to the premium tax credit structure or cost-sharing reductions could affect the affordability and accessibility of these plans.

Industry Innovations

The healthcare industry is constantly innovating, and these advancements can significantly impact marketplace insurance plans. The integration of technology, such as telemedicine and digital health platforms, offers new avenues for healthcare delivery and could influence the design and delivery of marketplace plan benefits. Additionally, the development of new treatments and medications can impact the cost and coverage of healthcare services, which may in turn affect the premiums and benefits of marketplace plans.

Conclusion

Georgia’s marketplace insurance plans offer a vital safety net for residents, providing access to affordable, comprehensive healthcare. By understanding the features, benefits, and potential future developments of these plans, Georgians can make informed decisions to secure the healthcare coverage that best suits their needs.

What is the cost of marketplace insurance plans in Georgia?

+The cost of marketplace insurance plans in Georgia varies based on factors such as age, location, tobacco use, and the specific plan chosen. Premiums can range from a few hundred dollars to over a thousand dollars per month. However, it’s important to note that premium tax credits can significantly reduce these costs for eligible individuals.

How can I determine if I’m eligible for premium tax credits in Georgia?

+Eligibility for premium tax credits in Georgia is primarily based on income. Individuals and families earning up to 400% of the federal poverty level may qualify for some form of assistance. It’s recommended to use the Health Insurance Marketplace’s eligibility calculator to determine your specific eligibility and the amount of potential savings.

What happens if I miss the open enrollment period for marketplace plans in Georgia?

+If you miss the annual open enrollment period, you can only enroll in a marketplace plan if you qualify for a special enrollment period (SEP). SEPs are triggered by life events such as losing job-based coverage, moving, getting married, or having a baby. It’s important to act promptly when these events occur to ensure uninterrupted healthcare coverage.

Are marketplace plans in Georgia suitable for families with children?

+Absolutely! Marketplace plans in Georgia offer a range of benefits specifically tailored to the needs of families with children. These plans typically include coverage for pediatric care, immunizations, and well-child visits. Additionally, many plans offer dental and vision coverage for children, ensuring comprehensive healthcare for the whole family.