Maximum Out Of Pocket Expense For Health Insurance

In the realm of health insurance, understanding the financial aspects is crucial for policyholders. One of the key considerations is the Maximum Out-of-Pocket (MOOP) expense, which sets a limit on the financial burden an individual or family may face in a given benefit period.

Understanding Maximum Out-of-Pocket Expenses

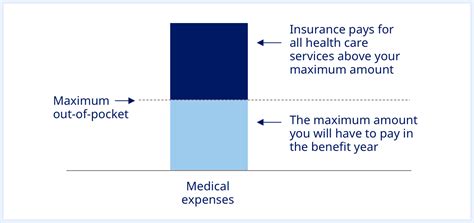

The Maximum Out-of-Pocket expense, often referred to as MOOP, is a critical component of health insurance plans. It acts as a financial safety net, capping the amount an individual or family must pay for covered services in a single year or benefit period. This includes a range of healthcare expenses, such as deductibles, copayments, and coinsurance.

MOOP is designed to provide financial predictability and protection to policyholders. Once an individual's or family's healthcare expenses reach the MOOP limit, the insurance plan covers 100% of the costs for covered services for the remainder of the benefit period. This can significantly reduce the financial strain on individuals, especially those with chronic conditions or unexpected medical emergencies.

Importance of MOOP in Health Insurance

The MOOP feature of health insurance plans is particularly beneficial for individuals who require frequent medical care or have pre-existing conditions. It offers peace of mind, knowing that there is a limit to the financial responsibility they will face in a year. MOOP is an essential consideration when choosing a health insurance plan, as it can significantly impact one’s overall healthcare costs.

Moreover, MOOP plays a crucial role in promoting accessibility to healthcare services. By setting a cap on out-of-pocket expenses, it ensures that individuals can access necessary medical treatments without the fear of overwhelming financial burdens. This aspect is especially important in the context of the rising costs of healthcare, where even routine procedures can lead to substantial expenses.

Calculating Maximum Out-of-Pocket Expenses

The calculation of MOOP expenses varies depending on the type of health insurance plan. Generally, MOOP is the sum of the plan’s deductible, copayments, and coinsurance, but it does not include out-of-network costs or expenses for non-covered services.

For example, let's consider a health insurance plan with a deductible of $2,000, a copayment of 20% for office visits, and a coinsurance of 30% for specialized procedures. In this case, the MOOP would be the sum of these expenses, typically resulting in a higher amount than the deductible alone. It's important to note that the specific MOOP limit can vary significantly between different plans and insurance providers.

It's also worth mentioning that MOOP expenses are typically reset annually or at the start of each benefit period. This means that individuals or families must track their healthcare expenses throughout the year to ensure they stay within the MOOP limit. Some insurance providers may also offer tools or resources to help policyholders monitor their out-of-pocket expenses and plan their healthcare budget accordingly.

Factors Influencing MOOP

Several factors can influence the MOOP limit of a health insurance plan. These include the type of plan (such as PPO, HMO, or HSA), the policyholder’s age and health status, and the geographic location. Additionally, certain plans may offer lower MOOP limits for individuals or families who opt for a higher monthly premium.

For instance, a younger, healthier individual may be offered a plan with a relatively low MOOP limit, as they are less likely to require extensive medical care. On the other hand, an older individual with pre-existing conditions may have a higher MOOP limit to accommodate their potentially higher healthcare needs. These variations in MOOP limits reflect the individualized nature of health insurance plans and the need for policyholders to carefully assess their own healthcare requirements when choosing a plan.

Out-of-Pocket Expenses and Cost-Sharing

Understanding the relationship between out-of-pocket expenses and cost-sharing is essential for navigating health insurance plans effectively. Out-of-pocket expenses are the costs that policyholders pay directly for healthcare services, including deductibles, copayments, and coinsurance. These expenses are typically paid before the insurance plan begins to cover the costs.

Cost-sharing, on the other hand, refers to the division of healthcare costs between the insurance provider and the policyholder. It includes deductibles, copayments, and coinsurance. Deductibles are the fixed amount an individual must pay before the insurance plan starts covering costs. Copayments are flat fees paid by the policyholder for specific services, while coinsurance is a percentage of the cost of a service that the policyholder must pay after the deductible is met.

Managing Out-of-Pocket Expenses

To effectively manage out-of-pocket expenses, it’s crucial for policyholders to understand their insurance plan’s cost-sharing structure. This includes knowing the specific amounts for deductibles, copayments, and coinsurance, as well as the services they cover. By being aware of these costs, individuals can budget and plan their healthcare expenses accordingly.

Additionally, policyholders should explore ways to reduce their out-of-pocket expenses. This can include utilizing in-network providers, which often have negotiated rates with the insurance company, resulting in lower costs. Some plans may also offer incentives or discounts for using certain providers or participating in wellness programs. By actively managing their healthcare expenses, individuals can make the most of their insurance coverage and minimize financial strain.

The Impact of MOOP on Healthcare Accessibility

The implementation of MOOP limits in health insurance plans has had a significant impact on healthcare accessibility. By setting a cap on out-of-pocket expenses, MOOP ensures that individuals have a predictable and manageable financial responsibility for their healthcare needs. This, in turn, encourages individuals to seek necessary medical care without fear of overwhelming financial burdens.

Moreover, MOOP limits can promote preventative healthcare measures. When individuals are aware of their out-of-pocket expenses and have a clear understanding of their healthcare costs, they are more likely to prioritize preventative care, such as regular check-ups and screenings. This proactive approach to healthcare can lead to early detection and treatment of potential health issues, ultimately reducing the need for more costly and extensive medical interventions down the line.

Future Trends and Developments

Looking ahead, there are several trends and developments in the healthcare industry that may impact MOOP limits and out-of-pocket expenses. The increasing focus on value-based care and the shift towards patient-centered models of healthcare delivery may lead to more innovative and flexible MOOP structures. Additionally, advancements in healthcare technology and telemedicine may also influence the way out-of-pocket expenses are calculated and managed.

Furthermore, the ongoing debate surrounding healthcare reform and the potential for universal healthcare coverage could significantly impact MOOP limits. If implemented, universal healthcare could streamline the MOOP structure, making it more uniform and accessible to all individuals, regardless of their financial situation or health status. This would represent a significant shift in the way healthcare is financed and accessed, with potential implications for the entire healthcare industry.

Conclusion

Understanding the Maximum Out-of-Pocket expense in health insurance is crucial for policyholders to navigate their healthcare costs effectively. MOOP provides a financial safety net, ensuring that individuals and families have a manageable financial responsibility for their healthcare needs. By calculating and managing out-of-pocket expenses, individuals can make informed decisions about their healthcare and maximize the benefits of their insurance coverage.

As the healthcare landscape continues to evolve, it is essential to stay informed about the latest trends and developments in health insurance. Keeping abreast of changes in MOOP limits and out-of-pocket expenses can empower individuals to make the most of their healthcare coverage and access the care they need without financial barriers.

How is the MOOP limit calculated for a health insurance plan?

+The MOOP limit for a health insurance plan is typically calculated by adding up the plan’s deductible, copayments, and coinsurance. However, it’s important to note that the specific MOOP limit can vary between different plans and insurance providers.

Can MOOP expenses be reset or adjusted during the benefit period?

+MOOP expenses are usually reset annually or at the start of each benefit period. However, some insurance providers may offer plans with rolling MOOP limits, where the limit is adjusted based on the policyholder’s healthcare utilization.

Are there any out-of-pocket expenses that are not covered by the MOOP limit?

+Yes, certain out-of-pocket expenses, such as out-of-network costs and expenses for non-covered services, are typically not included in the MOOP limit. It’s important to review your insurance plan’s details to understand which expenses are covered by the MOOP limit.