Md State Unemployment Insurance

Maryland's Unemployment Insurance (UI) program is an essential safety net for individuals who find themselves out of work. Understanding the intricacies of this system is crucial for both claimants and employers alike. This comprehensive guide aims to delve into the specifics of Maryland's UI program, providing a detailed analysis of its features, benefits, and implications.

The Fundamentals of Maryland’s Unemployment Insurance

Maryland’s Unemployment Insurance program is administered by the Maryland Department of Labor, specifically through the Division of Unemployment Insurance. This state-level agency ensures the program’s adherence to federal guidelines while adapting to Maryland’s unique economic landscape.

The UI program in Maryland is funded by employers through unemployment insurance taxes, which are based on the employer's payroll and their previous experience with employee turnover and unemployment claims. This funding mechanism ensures the program's sustainability while incentivizing employers to maintain stable employment conditions.

Eligibility Criteria for Claimants

To qualify for unemployment benefits in Maryland, individuals must meet certain criteria. Firstly, they must have earned a minimum amount of wages during their base period, which is defined as the first four of the last five completed calendar quarters prior to their application. This ensures that claimants have a recent history of employment and financial need.

Additionally, claimants must have lost their job through no fault of their own, such as being laid off due to company downsizing or lack of work. This excludes voluntary departures, terminations for cause, or other instances where the claimant is deemed responsible for their unemployment.

Furthermore, claimants are required to actively seek employment and provide evidence of their job search efforts. This ensures that the UI program is supporting individuals who are genuinely committed to re-entering the workforce and not abusing the system.

| Eligibility Factor | Description |

|---|---|

| Wage Earnings | Must have earned a minimum amount during the base period. |

| Job Loss Circumstances | Unemployment must be through no fault of the claimant. |

| Job Search | Active job search and documentation of efforts are required. |

Benefit Calculations and Payments

The amount of unemployment benefits a claimant receives in Maryland is calculated based on their highest-paid quarter during the base period. This ensures that individuals who have consistently earned higher wages receive a higher benefit amount.

The formula for benefit calculation involves multiplying the claimant's average weekly wage by a predetermined percentage, which is currently set at 42% for most claimants. This results in a weekly benefit amount that is then subject to a maximum benefit limit, which is set at $430 per week in Maryland.

Claimants are required to certify their eligibility each week by providing updates on their job search activities and confirming their continued unemployment status. This certification process ensures that benefits are only paid to individuals who remain actively seeking work and have not found new employment.

Duration of Benefits

The duration of unemployment benefits in Maryland is typically 26 weeks, which is the standard maximum duration for most states. However, during periods of high unemployment or economic downturn, the state may extend the duration through Emergency Unemployment Compensation (EUC) programs or other federal initiatives.

The duration of benefits can also vary based on the claimant's work history and earnings. Individuals with longer work histories and higher earnings may be eligible for an extended benefit period, known as Extended Benefits (EB), which can provide an additional 13 weeks of support.

| Benefit Duration | Description |

|---|---|

| Standard Duration | 26 weeks for most claimants. |

| Extended Benefits | Available for claimants with longer work histories and higher earnings, providing an additional 13 weeks. |

| Emergency Extensions | May be offered during periods of high unemployment, providing further extensions beyond the standard 26 weeks. |

Maryland’s UI Program: A Comprehensive Overview

Maryland’s Unemployment Insurance program is a critical component of the state’s social safety net, providing financial support to individuals who have lost their jobs through no fault of their own. The program’s design is intentional, aiming to balance the needs of claimants with the economic realities faced by employers.

By requiring claimants to have a recent work history and actively seek employment, Maryland's UI program ensures that benefits are provided to those who are genuinely in need and committed to re-entering the workforce. This approach strikes a delicate balance between offering support and maintaining the integrity of the system.

The benefit calculation method, which is based on the claimant's highest-paid quarter, ensures that those with higher earnings receive a commensurate benefit amount. This progressive approach recognizes the varying financial needs of claimants and aims to provide a level of support that is proportional to their previous earnings.

Maryland’s UI Program in Action

In practice, Maryland’s UI program has been instrumental in supporting individuals and families during economic downturns. During the COVID-19 pandemic, for instance, the state’s UI system was crucial in providing financial relief to those who lost their jobs due to business closures and reduced economic activity.

The program's ability to adapt to changing circumstances, such as through the implementation of Emergency Unemployment Compensation and other federal initiatives, has been vital in ensuring that claimants receive the support they need during challenging times. This flexibility is a testament to the program's effectiveness and responsiveness to the needs of Maryland's workforce.

Furthermore, Maryland's UI program has been a catalyst for economic recovery, providing individuals with the financial means to sustain themselves while they seek new employment opportunities. This support not only benefits individual claimants but also contributes to the overall economic health of the state by maintaining consumer spending and reducing the strain on social services.

Conclusion: The Future of Maryland’s Unemployment Insurance

Maryland’s Unemployment Insurance program is a robust and adaptable system that has proven its value in supporting the state’s workforce during times of economic uncertainty. As the economy continues to evolve and face new challenges, the program will need to remain agile and responsive to changing needs.

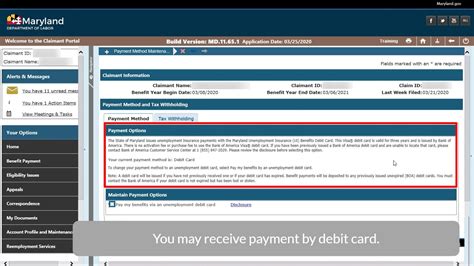

One area of focus for the future of Maryland's UI program may be enhancing its digital infrastructure. With the increasing importance of online services and the growing preference for remote interactions, ensuring that the UI system is accessible, user-friendly, and secure will be crucial for maintaining claimant satisfaction and program efficiency.

Additionally, as the state's labor market evolves and new industries emerge, the UI program will need to adapt its eligibility criteria and benefit calculations to reflect these changes. This may involve reevaluating the definition of "work" and "earnings" to include emerging gig economy jobs and alternative work arrangements.

In conclusion, Maryland's Unemployment Insurance program is a critical pillar of the state's social safety net, providing vital support to individuals facing unemployment. By understanding the program's intricacies and staying informed about its evolving nature, claimants and employers can navigate the system effectively and contribute to the overall economic resilience of Maryland.

How often do unemployment benefit amounts change in Maryland?

+Unemployment benefit amounts in Maryland are reviewed annually and can change based on economic factors and legislative decisions. The state may adjust the maximum weekly benefit amount and the percentage used in the benefit calculation formula to ensure the program remains sustainable and provides adequate support to claimants.

Can self-employed individuals claim unemployment benefits in Maryland?

+Self-employed individuals in Maryland may be eligible for unemployment benefits through the Pandemic Unemployment Assistance (PUA) program. This program was established in response to the COVID-19 pandemic and provides support to self-employed workers, contractors, and others who are not typically eligible for regular UI benefits.

How does Maryland’s UI program handle fraud and abuse?

+Maryland’s UI program has implemented various measures to prevent and detect fraud and abuse. These include rigorous eligibility checks, data verification, and fraud detection algorithms. Claimants are required to provide accurate information and may be subject to audits and investigations if there are suspicions of fraud.