Medical Disability Insurance

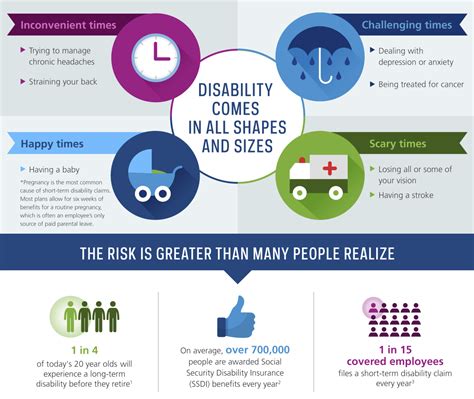

Medical Disability Insurance is a crucial aspect of financial planning and risk management, offering individuals and families a safety net during times of unexpected illness or injury. This form of insurance provides financial support to policyholders when they are unable to work due to a medical condition, ensuring their income and livelihood are protected. In an era where healthcare costs can be unpredictable and often astronomical, the importance of medical disability insurance cannot be overstated.

Understanding Medical Disability Insurance

Medical Disability Insurance, often referred to as disability income insurance or simply disability insurance, is a contract between an individual and an insurance company. This contract ensures that if the policyholder becomes disabled and unable to work, they will receive a portion of their regular income as a benefit. The specific terms of the policy, including the definition of disability, the benefit amount, and the duration of coverage, are outlined in the policy document.

The concept of disability insurance is founded on the principle of income replacement. It recognizes that an individual's ability to earn an income is one of their most valuable assets, and it aims to protect this asset in the event of an unforeseen circumstance that renders them unable to work. This could include a wide range of medical conditions, from short-term illnesses to long-term disabilities.

Types of Medical Disability Insurance

Medical Disability Insurance policies can be categorized into two main types: short-term disability insurance and long-term disability insurance. As the names suggest, these policies are designed to cover different durations of disability.

- Short-Term Disability Insurance - This type of policy provides coverage for a specified period, typically ranging from a few weeks to a couple of years. It is designed to offer financial support during the initial stages of a disability, when an individual might be recovering from an injury or illness and unable to work full-time. Short-term disability insurance often has a waiting period, which is the time that must elapse before benefits begin.

- Long-Term Disability Insurance - In contrast, long-term disability insurance covers disabilities that last for an extended period, often defined as 6 months or more. These policies are designed to provide income replacement for the long haul, ensuring that individuals with chronic or severe medical conditions can maintain their financial stability. Long-term disability insurance typically has a longer waiting period and a higher benefit amount.

Both types of disability insurance play a crucial role in financial planning, and individuals often opt for a combination of both to ensure comprehensive coverage.

Key Features and Benefits

Medical Disability Insurance offers a range of features and benefits that make it an essential component of personal financial security.

Income Protection

The primary benefit of disability insurance is the protection of income. In the event of a disability, individuals may face a significant loss of income, as they are unable to work and earn a paycheck. Disability insurance steps in to fill this gap, providing a regular income stream that can cover essential expenses such as rent, mortgage payments, groceries, and utilities.

Customizable Coverage

Disability insurance policies can be tailored to an individual’s specific needs and circumstances. Policyholders can choose the level of coverage they desire, with options to select the benefit amount (usually a percentage of their regular income) and the duration of coverage. This flexibility allows individuals to design a policy that aligns with their financial goals and the nature of their work.

Protection Against Inflation

Many disability insurance policies offer an inflation adjustment rider, which ensures that the benefit amount increases over time to keep pace with inflation. This feature is particularly valuable, as it protects the policyholder’s purchasing power and ensures that their benefits remain relevant and valuable over the long term.

Non-Taxable Benefits

In most cases, the benefits received from a disability insurance policy are non-taxable. This means that the full benefit amount can be used to cover expenses without any deductions for taxes, making it a more effective form of income replacement.

Additional Riders

Disability insurance policies often offer a variety of optional riders that can enhance coverage. These riders may include provisions for cost-of-living adjustments, residual disability benefits (which provide partial benefits if an individual can work part-time), and return-to-work incentives (which offer benefits if an individual attempts to return to work but is unable to maintain full-time employment).

| Riders | Description |

|---|---|

| Cost-of-Living Adjustment | Ensures benefit amount increases with inflation. |

| Residual Disability Benefit | Provides partial benefits for reduced work capacity. |

| Return-to-Work Incentive | Offers benefits for attempting to return to work. |

Who Needs Medical Disability Insurance?

Medical Disability Insurance is relevant to a wide range of individuals, regardless of their profession or income level. While certain professions might have a higher risk of disability, such as manual laborers or those in high-risk occupations, the truth is that anyone can become disabled due to an illness or injury.

Self-Employed Individuals

Self-employed individuals often rely heavily on their ability to work consistently. A disability could significantly impact their income and business, making disability insurance a critical component of their financial planning. With disability insurance, self-employed individuals can ensure that their business and personal finances are protected during times of disability.

Professionals with High Earning Potential

Professionals in fields such as medicine, law, finance, or technology often have high earning potential. A disability could result in a significant loss of income for these individuals, making disability insurance an essential risk management tool. The income protection offered by disability insurance can help maintain their standard of living and financial stability.

Individuals with Chronic Conditions

For individuals with pre-existing or chronic medical conditions, disability insurance can provide peace of mind. It ensures that if their condition worsens or if they experience a flare-up, they will have financial support to manage their medical expenses and maintain their lifestyle. Disability insurance can be particularly valuable for those with conditions that may not be covered by other forms of insurance.

How to Choose the Right Medical Disability Insurance

Selecting the right medical disability insurance policy involves careful consideration of several factors. It’s important to understand your specific needs and the unique aspects of your situation to make an informed decision.

Assess Your Income and Expenses

Start by evaluating your current income and the expenses you would need to cover if you were unable to work. This includes not just your regular living expenses, but also any debt payments, savings goals, and ongoing medical costs. Understanding your financial needs will help you determine the level of coverage you require.

Define Your Risk Tolerance

Consider your risk tolerance and how much financial risk you are comfortable with. This will influence the type of disability insurance you choose. If you have a high risk tolerance and can afford to self-insure for a period, you might opt for a policy with a longer waiting period and a lower premium. Conversely, if you prefer more immediate coverage, you might choose a policy with a shorter waiting period and a higher premium.

Review Policy Definitions and Exclusions

Every disability insurance policy has its own definitions of disability and exclusions. It’s crucial to thoroughly review these to ensure that the policy aligns with your expectations. For instance, some policies may exclude certain types of disabilities or require that the disability result from a specific event. Understanding these definitions and exclusions can prevent misunderstandings and ensure that you are adequately covered.

Consider Your Career and Future Earnings Potential

Think about your career path and your future earnings potential. If you anticipate significant income growth in the future, you may want to consider a policy with an future increase option rider, which allows you to increase your coverage level as your income increases. This ensures that your disability insurance remains relevant and adequate as your financial situation evolves.

Choose the Right Waiting Period

The waiting period, or elimination period, is the time that must pass before you begin receiving benefits. Policies typically offer a range of waiting periods, from as short as a week to as long as a year. A longer waiting period usually results in a lower premium, but it also means you will have to self-insure for a longer period if you become disabled. Choose a waiting period that aligns with your financial reserves and risk tolerance.

Real-Life Impact: A Case Study

To illustrate the importance and impact of medical disability insurance, let’s consider the case of Sarah, a 35-year-old self-employed graphic designer.

Sarah had been running her own successful design business for several years, but one day, she was involved in a serious car accident that left her with a back injury. The injury required extensive physical therapy and prevented her from working for several months. During this time, Sarah's income stopped completely, as she was unable to take on new clients or fulfill existing contracts.

Fortunately, Sarah had purchased a long-term disability insurance policy a few years prior. The policy provided her with a monthly benefit that covered her essential living expenses, including rent, utilities, and ongoing medical costs. This financial support allowed Sarah to focus on her recovery without the added stress of financial worries.

After several months of rehabilitation, Sarah was able to return to work part-time. During this transitional period, her disability insurance policy offered a residual disability benefit, which provided her with a partial benefit based on her reduced work capacity. This support helped Sarah ease back into her work routine and gradually rebuild her business.

Sarah's experience highlights the crucial role that medical disability insurance can play in protecting individuals' financial stability and peace of mind during times of unexpected disability.

The Future of Medical Disability Insurance

The landscape of medical disability insurance is continually evolving to meet the changing needs and risks of individuals and families. As medical advancements and societal trends shape the nature of disabilities, insurance providers are adapting their policies and offerings to provide more comprehensive coverage.

Emerging Trends in Disability Insurance

One notable trend in the disability insurance industry is the increasing focus on mental health coverage. With the growing recognition of mental health as a critical aspect of overall well-being, insurance providers are expanding their definitions of disability to include mental health conditions. This shift ensures that individuals struggling with mental health issues have access to the financial support they need to manage their condition and maintain their quality of life.

Another emerging trend is the development of more flexible and customizable policies. Insurance providers are offering a wider range of options and riders, allowing individuals to tailor their coverage to their specific needs and circumstances. This level of customization ensures that policies are more relevant and effective for a diverse range of individuals.

Impact of Technology and Telehealth

The integration of technology and telehealth into the healthcare industry is also influencing the future of disability insurance. With the rise of remote work and the increasing availability of virtual healthcare services, insurance providers are exploring ways to incorporate these advancements into their policies. This could include provisions for disability benefits related to remote work arrangements or coverage for telehealth services.

Additionally, technology is enhancing the claims process, making it more efficient and streamlined. Insurance providers are leveraging digital tools and platforms to facilitate faster and more accurate claims handling, ensuring that policyholders receive their benefits in a timely manner.

Long-Term Care and Disability Insurance

The intersection of long-term care and disability insurance is another area of focus. As the population ages and the demand for long-term care services increases, insurance providers are exploring ways to integrate long-term care coverage into disability insurance policies. This hybrid approach aims to provide more comprehensive coverage for individuals who may require extended care due to a disability.

Conclusion

Medical Disability Insurance is a vital component of personal financial planning, offering individuals and families a crucial layer of protection during times of unexpected disability. By understanding the different types of disability insurance, their key features and benefits, and the process of selecting the right policy, individuals can make informed decisions to safeguard their financial future.

As the insurance industry continues to evolve, it is essential to stay informed about the latest trends and developments in disability insurance. By staying up-to-date with these changes, individuals can ensure that their coverage remains relevant and effective, providing the peace of mind and financial security they deserve.

How much does medical disability insurance cost?

+

The cost of medical disability insurance varies based on several factors, including the type of policy (short-term or long-term), the benefit amount, the duration of coverage, and the policyholder’s age and health status. On average, short-term disability insurance can cost around 1-3% of your annual income, while long-term disability insurance may range from 1-4% of your annual income. It’s important to shop around and compare quotes to find the best coverage at a competitive price.

What happens if I need to file a disability insurance claim?

+

If you need to file a disability insurance claim, you’ll need to gather and submit various documents and information to your insurance provider. This typically includes medical records, doctor’s reports, and proof of income. It’s important to review your policy’s specific requirements and guidelines for filing a claim. Once your claim is submitted, the insurance provider will review the information and make a determination on your eligibility for benefits.

Can I have both short-term and long-term disability insurance?

+

Yes, it is possible and often recommended to have both short-term and long-term disability insurance. Short-term disability insurance provides coverage for a specified period, typically up to a few months, and is designed to cover temporary disabilities. Long-term disability insurance, on the other hand, provides coverage for extended periods, often lasting years, and is intended for more severe or chronic disabilities. Having both types of coverage ensures that you are protected for a range of potential scenarios.

Are there any tax benefits associated with medical disability insurance?

+

Yes, there are potential tax benefits associated with medical disability insurance. The premiums you pay for disability insurance may be tax-deductible, depending on how the policy is structured and whether it’s part of a qualified retirement plan. Additionally, the benefits you receive from a disability insurance policy are generally tax-free, providing a valuable source of income without the burden of additional taxes.