Medical Health Insurance Application

The landscape of healthcare is constantly evolving, and with it, the processes and systems that govern access to medical services. At the forefront of this evolution is the application process for health insurance, a crucial step for individuals and families seeking comprehensive healthcare coverage. This article aims to provide an in-depth exploration of the medical health insurance application, delving into its intricacies, key considerations, and the potential impact on the lives of those seeking insurance.

Navigating the Health Insurance Application Process

Applying for health insurance is a multifaceted process that involves understanding various aspects of the healthcare system and insurance industry. It is a critical step that can significantly influence an individual’s access to medical care and financial stability.

Understanding the Basics

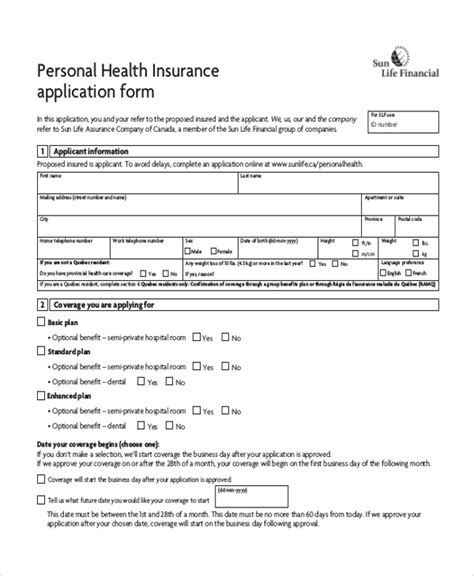

Health insurance applications are intricate documents that require careful attention to detail. They often encompass a wide range of information, including personal details, medical history, employment status, and income levels. Each piece of information is vital, as it contributes to the insurer’s assessment of the applicant’s risk profile and the subsequent determination of coverage and premiums.

The application process typically begins with a thorough review of the insurance provider's website or a consultation with an insurance broker. This initial step allows applicants to gain a comprehensive understanding of the insurance options available, the coverage they provide, and the associated costs.

| Insurance Provider | Coverage Type | Premium Range |

|---|---|---|

| Blue Cross Blue Shield | Comprehensive Health Plan | $450 - $600/month |

| Aetna | Essential Health Benefits | $380 - $520/month |

| UnitedHealthcare | Family Coverage Plan | $550 - $700/month |

Once an individual has identified the most suitable insurance plan, the application process can begin. This involves completing an extensive application form, which often includes sections on:

- Personal Information: Name, date of birth, gender, contact details, and address.

- Medical History: A detailed account of past and current medical conditions, surgeries, and medications.

- Employment and Income: Details about employment status, income, and any existing healthcare benefits through work.

- Lifestyle Factors: Questions about smoking, alcohol consumption, and other lifestyle habits that can impact health.

- Family History: Information on the health status and conditions of immediate family members.

Completing this application form accurately is crucial, as any misrepresentation or omission can lead to complications or even denial of coverage.

The Role of Medical Underwriting

One of the most critical aspects of the health insurance application process is medical underwriting. This is the process by which insurance companies assess an applicant’s health status and determine the level of risk they pose to the insurer. Based on this assessment, the insurer will determine the applicant’s premium and any exclusions or limitations to their coverage.

Medical underwriting involves a thorough review of the applicant's medical history, including any pre-existing conditions. It also takes into account the applicant's age, gender, and lifestyle factors. For instance, a smoker may be charged a higher premium or be subject to smoking-related exclusions.

In some cases, the insurer may require additional medical information or tests to make an accurate assessment. This could involve blood tests, urine tests, or even medical examinations by an independent physician.

The Impact of Health Insurance on Individuals and Families

Health insurance plays a pivotal role in the lives of individuals and families, providing access to essential medical care and financial protection. The application process, though complex, is a necessary step towards securing this vital coverage.

For individuals, health insurance can mean the difference between timely access to medical treatment and potentially catastrophic medical bills. It provides peace of mind, knowing that one is protected in the event of an unexpected illness or injury. For families, health insurance is even more crucial, offering comprehensive coverage for all members and ensuring their well-being.

Moreover, health insurance can also open doors to preventative care and health management programs. Many insurance plans offer incentives or coverages for wellness initiatives, such as gym memberships, nutritional counseling, or smoking cessation programs. These benefits not only improve the overall health of the insured but also help to reduce long-term healthcare costs.

Navigating the Challenges of Health Insurance Applications

Despite the critical importance of health insurance, the application process can be daunting, especially for those who are new to the system or have unique health circumstances. Here are some common challenges and strategies for navigating them:

- Understanding the Jargon: Health insurance applications are often filled with technical terms and industry-specific language. To overcome this, take the time to research and understand these terms. Many insurance providers offer glossaries or help sections on their websites. Alternatively, consulting with an insurance broker or financial advisor can provide valuable guidance.

- Dealing with Pre-Existing Conditions: Pre-existing conditions can present a significant challenge when applying for health insurance. While some countries have laws protecting individuals with pre-existing conditions, others may charge higher premiums or exclude certain conditions from coverage. It's crucial to research and understand your rights and options in such cases. Some insurers may offer specialized plans for individuals with pre-existing conditions, so explore these options thoroughly.

- Assessing Value and Cost: With a myriad of insurance plans available, assessing value and cost can be complex. Consider not just the premium, but also the coverage, deductibles, co-pays, and out-of-pocket maximums. Use online tools and resources to compare plans, and don't hesitate to seek professional advice to make an informed decision.

Conclusion

The medical health insurance application process is a critical component of the healthcare system, offering individuals and families access to vital medical care and financial protection. While it can be complex and challenging, understanding the process and seeking appropriate guidance can help navigate these challenges effectively. Ultimately, the goal is to secure comprehensive health insurance coverage that meets individual needs and provides peace of mind.

How often should I review my health insurance coverage?

+It’s a good practice to review your health insurance coverage annually, especially during open enrollment periods. This allows you to stay updated with any changes in coverage, premiums, or benefits, and make adjustments as needed.

Can I be denied health insurance due to my medical history?

+In some countries, such as the United States, insurers are prohibited from denying coverage based on pre-existing conditions. However, they may charge higher premiums or impose waiting periods for certain conditions. It’s essential to understand your rights and protections under local laws.

What are some tips for choosing the right health insurance plan?

+Consider your specific healthcare needs, including any ongoing treatments or medications. Look at the coverage, deductibles, and out-of-pocket costs. Compare plans using online tools, and don’t hesitate to seek advice from insurance brokers or financial advisors. Also, check for any additional benefits or incentives offered by the insurer.