Medical Insurance Cheap

Navigating the complex world of medical insurance can be a daunting task, especially when you're searching for affordable coverage. In today's market, finding cheap medical insurance that provides comprehensive benefits can seem like a challenge. However, with the right knowledge and strategies, it is possible to secure affordable healthcare coverage that meets your needs without breaking the bank. This comprehensive guide will delve into the intricacies of obtaining cheap medical insurance, offering insights, tips, and real-world examples to help you make informed decisions.

Understanding the Basics of Medical Insurance

Before diving into the search for cheap medical insurance, it's essential to grasp the fundamental concepts that govern this industry. Medical insurance, also known as health insurance, is a contract between an individual and an insurance company. This contract outlines the terms and conditions under which the insurance provider agrees to cover a portion or all of an individual's medical expenses. The main goal of medical insurance is to protect policyholders from the potentially devastating financial impact of unexpected medical events, such as accidents, illnesses, or chronic conditions.

Key components of medical insurance include premiums, deductibles, co-payments, and coverage limits. Premiums are the regular payments made to the insurance company to maintain coverage. Deductibles are the amount an individual must pay out of pocket before the insurance coverage kicks in. Co-payments, or co-pays, are fixed amounts paid by the insured person at the time of receiving medical services. Coverage limits define the maximum amount an insurance company will pay for a specific service or over a specific period.

The Importance of Comprehensive Coverage

While searching for cheap medical insurance, it's crucial to prioritize comprehensive coverage over mere affordability. Comprehensive coverage ensures that a wide range of medical services and treatments are covered, providing peace of mind and financial protection in various healthcare scenarios. Here's a breakdown of some essential components of comprehensive medical insurance plans:

- Hospitalization: Covers expenses related to inpatient stays, including room and board, surgeries, and intensive care.

- Outpatient Care: Provides coverage for medical services received outside of a hospital setting, such as doctor's visits, diagnostic tests, and minor procedures.

- Prescription Drugs: Includes coverage for essential medications, which can be a significant cost-saving benefit.

- Specialist Consultations: Allows access to specialized medical professionals for specific health concerns.

- Preventive Care: Offers coverage for preventive services like annual check-ups, screenings, and vaccinations to maintain overall health.

By ensuring your medical insurance plan includes these components, you can have confidence in your ability to access necessary healthcare services without facing unaffordable out-of-pocket expenses.

Strategies for Securing Cheap Medical Insurance

Finding cheap medical insurance that also provides comprehensive coverage is not an impossible task. By employing the right strategies and understanding the market, you can identify plans that align with your healthcare needs and financial situation. Here are some effective approaches to consider:

Research and Compare Plans

Begin by researching and comparing different medical insurance plans available in your area. Insurance providers often offer a range of plans with varying levels of coverage and costs. Compare the premiums, deductibles, and co-payments to find a plan that best fits your budget. Online comparison tools and insurance brokers can be valuable resources for this step.

| Plan Name | Premium | Deductible | Co-payment |

|---|---|---|---|

| Basic Plan | $250/month | $1,500 | $20 |

| Standard Plan | $320/month | $1,000 | $30 |

| Comprehensive Plan | $450/month | $500 | $40 |

In the table above, you can see a comparison of three different plan options. While the Basic Plan has the lowest premium, it also has a higher deductible, meaning you'll pay more out of pocket before insurance coverage begins. On the other hand, the Comprehensive Plan has a higher premium but offers lower deductibles and co-payments, providing more affordable access to healthcare services.

Evaluate Your Healthcare Needs

Understanding your personal healthcare needs is crucial in choosing the right medical insurance plan. Consider factors such as your age, existing health conditions, prescription medication requirements, and the likelihood of needing specialist care. If you're generally healthy and rarely require medical attention, a plan with a higher deductible and lower premium might be a suitable choice. However, if you have chronic health issues or anticipate frequent medical visits, a plan with lower deductibles and co-payments could be more beneficial.

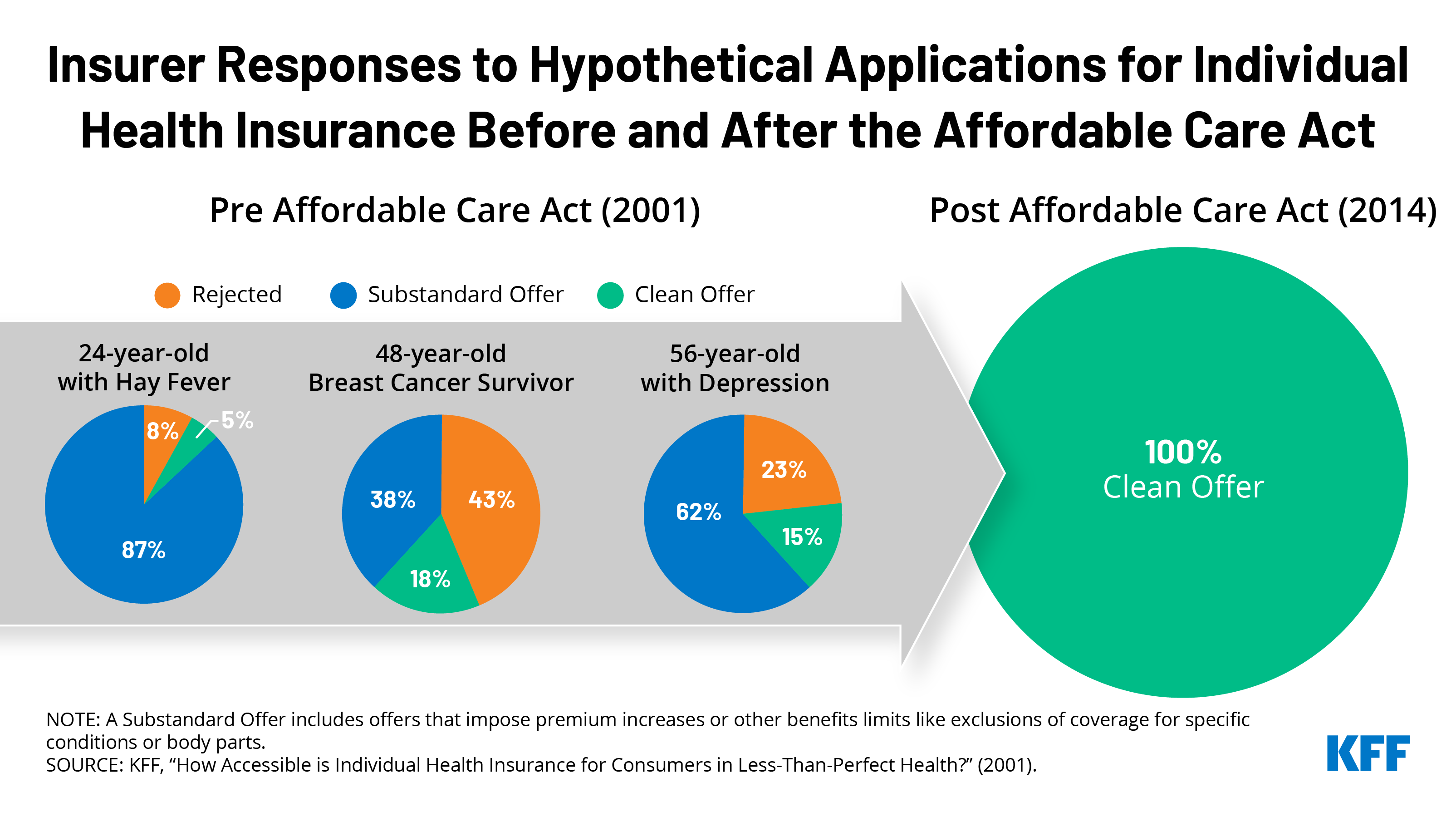

Explore Government-Sponsored Programs

Government-sponsored healthcare programs can be an excellent option for those seeking affordable medical insurance. In many countries, programs like Medicaid or Medicare provide healthcare coverage to eligible individuals, often at reduced or no cost. These programs typically have specific eligibility criteria based on factors such as income, age, or disability status. Researching and understanding these programs can lead to significant cost savings.

Consider High-Deductible Health Plans (HDHPs)

High-Deductible Health Plans are a unique type of medical insurance plan that offers lower premiums in exchange for higher deductibles. These plans are often paired with Health Savings Accounts (HSAs), which allow you to save pre-tax dollars to cover medical expenses. While HDHPs may not be suitable for everyone, they can be an excellent choice for healthy individuals who rarely require extensive medical care. The tax advantages of HSAs can also lead to substantial savings over time.

Maximizing Your Medical Insurance Benefits

Once you've secured cheap medical insurance, it's important to make the most of your benefits. Here are some tips to ensure you're getting the most value from your plan:

Understand Your Coverage Limits

Familiarize yourself with the coverage limits outlined in your insurance policy. This includes understanding the maximum amounts your insurance will pay for specific services, as well as any exclusions or limitations. Being aware of these limits can help you budget and plan for potential out-of-pocket expenses.

Utilize In-Network Providers

Most medical insurance plans have a network of preferred providers, including hospitals, clinics, and healthcare professionals. Utilizing in-network providers can result in significant cost savings, as insurance companies typically negotiate lower rates with these providers. Check your insurance directory or website to find in-network options near you.

Take Advantage of Preventive Care Services

Many medical insurance plans offer coverage for preventive care services, such as annual check-ups, cancer screenings, and immunizations. These services are often fully covered or have minimal out-of-pocket costs. Taking advantage of preventive care can help catch potential health issues early, leading to better health outcomes and potentially reducing future healthcare costs.

Manage Chronic Conditions Proactively

If you have a chronic health condition, managing it proactively can help reduce the need for costly emergency treatments or hospitalizations. Many insurance plans offer disease management programs or resources to support individuals with chronic conditions. These programs can provide valuable guidance and support, helping you stay on top of your health and potentially saving money in the long run.

The Future of Affordable Medical Insurance

The landscape of medical insurance is continually evolving, and the future holds promising developments for those seeking affordable coverage. As healthcare systems and insurance providers adapt to changing demographics and technological advancements, several key trends are emerging:

Telehealth and Digital Health Solutions

The rise of telehealth and digital health solutions is transforming the way healthcare is delivered and accessed. These innovations allow for remote consultations, monitoring, and treatment, often at a fraction of the cost of traditional in-person visits. Insurance providers are increasingly incorporating telehealth services into their plans, offering policyholders convenient and affordable healthcare options.

Value-Based Care Models

Value-based care models are gaining traction in the healthcare industry, focusing on providing high-quality care while reducing costs. These models reward healthcare providers for delivering positive health outcomes rather than simply performing procedures. As insurance companies adopt value-based care strategies, it can lead to more affordable and efficient healthcare services for policyholders.

Increased Use of Health Technology

Advancements in health technology, such as wearable devices and digital health platforms, are empowering individuals to take a more active role in their healthcare. These technologies can track vital signs, monitor chronic conditions, and provide real-time health data. Insurance companies are integrating these technologies into their plans, offering incentives and discounts for policyholders who adopt health-tracking devices.

The Growing Role of Health Savings Accounts (HSAs)

Health Savings Accounts are gaining popularity as a powerful tool for managing healthcare costs. HSAs allow individuals to save pre-tax dollars for medical expenses, offering significant tax advantages. As more people recognize the benefits of HSAs, insurance companies are designing plans that integrate these accounts, providing policyholders with greater control over their healthcare spending.

Expanding Government Programs

Government-sponsored healthcare programs are continually evolving to meet the changing needs of their populations. In many countries, efforts are underway to expand access to affordable medical insurance through these programs. Keeping abreast of these developments can provide opportunities for more individuals to secure affordable healthcare coverage.

Frequently Asked Questions (FAQ)

How can I reduce my medical insurance premiums without sacrificing coverage?

+One strategy is to increase your deductible, which can lower your premium. Additionally, bundling your medical insurance with other types of insurance, such as auto or home insurance, can often result in discounts. Finally, consider exploring group insurance plans, which are typically offered through employers or professional organizations, as they often provide more affordable coverage.

What are some common exclusions or limitations in medical insurance plans that I should be aware of?

+Common exclusions and limitations can include pre-existing conditions, certain types of elective procedures, and specific types of mental health services. It's crucial to carefully review your insurance policy to understand what is and isn't covered, as this can vary significantly between plans.

How can I find out if I'm eligible for government-sponsored healthcare programs like Medicaid or Medicare?

+Eligibility criteria for government-sponsored healthcare programs vary by country and sometimes by state or region. It's best to consult the official websites or resources provided by your local or national government health agencies. These resources will outline the specific requirements and application processes for these programs.

Are there any tax benefits associated with having medical insurance?

+Yes, in many countries, there are tax benefits associated with having medical insurance. These can include tax deductions for premiums paid, tax-free contributions to Health Savings Accounts (HSAs), or tax credits for certain types of insurance plans. Consult with a tax professional or refer to official tax guidelines to understand the specific tax advantages available in your jurisdiction.

By following these strategies, staying informed about the evolving healthcare landscape, and taking advantage of the opportunities presented by technological advancements and government initiatives, you can secure cheap medical insurance that provides the comprehensive coverage you need. Remember, affordable healthcare is within reach, and with the right knowledge and planning, you can navigate the insurance market with confidence and peace of mind.