Medical Insurance Deductible Definition

Understanding medical insurance and its various components is crucial for individuals to navigate the healthcare system effectively. The deductible, a key aspect of insurance plans, often remains a topic of confusion for many. In this comprehensive guide, we delve into the definition, implications, and strategies surrounding medical insurance deductibles, offering valuable insights to empower individuals in their healthcare decisions.

Unraveling the Medical Insurance Deductible

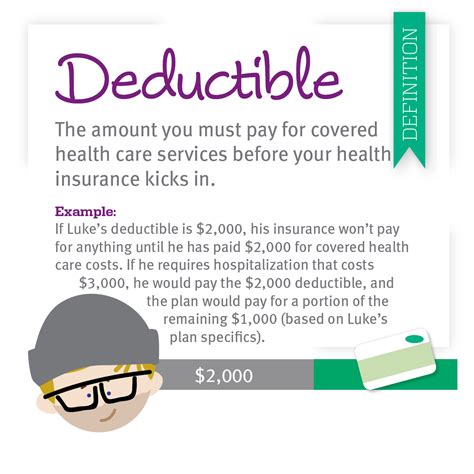

A medical insurance deductible represents the out-of-pocket amount an individual must pay before their insurance plan begins to cover a portion of the healthcare expenses. It serves as a threshold, requiring individuals to meet this financial obligation before the insurance provider steps in to contribute to the cost of medical services.

For instance, if your insurance plan has a deductible of $1,500, you will need to pay the first $1,500 of your medical expenses in a given year before the insurance company starts contributing to your healthcare costs. This deductible amount is typically agreed upon when selecting an insurance plan and remains consistent throughout the policy period.

The deductible concept is designed to promote cost-sharing between the insurance provider and the policyholder. By requiring individuals to pay a certain amount upfront, insurance companies aim to discourage unnecessary healthcare utilization and encourage individuals to be mindful of their healthcare choices.

Types of Deductibles

Medical insurance deductibles can vary based on the type of insurance plan and the specific policy terms. Here are some common types of deductibles:

- Individual Deductible: This deductible applies to each insured individual separately. In a family plan, each family member may have their own individual deductible to meet before insurance coverage kicks in.

- Family Deductible: A family deductible is applied to the entire family unit. Once the cumulative medical expenses of the family members reach the family deductible amount, the insurance coverage begins for all family members.

- Per Condition Deductible: In some plans, a deductible may be set for each medical condition or episode of illness. This means that for each new health issue, the deductible must be met before insurance coverage applies.

- Calendar Year Deductible: Many insurance plans reset the deductible at the beginning of each calendar year. This means that individuals need to meet the full deductible amount anew each year before insurance coverage takes effect.

The Impact of Deductibles on Healthcare Costs

Medical insurance deductibles have a direct influence on an individual’s out-of-pocket healthcare expenses. Understanding the implications of deductibles is essential for financial planning and managing healthcare costs effectively.

When choosing an insurance plan, individuals must consider the balance between the deductible amount and the premium (the monthly cost of the insurance plan). Plans with lower deductibles often have higher premiums, while plans with higher deductibles may have lower premiums. The choice depends on an individual's healthcare needs, budget, and risk tolerance.

For individuals with predictable healthcare needs or those who prefer a more cost-effective approach, a higher deductible plan with lower premiums may be suitable. On the other hand, individuals with complex or unpredictable healthcare requirements may opt for a plan with a lower deductible to minimize their out-of-pocket expenses.

Strategies for Managing Deductibles

Managing medical insurance deductibles requires careful planning and understanding of one’s healthcare needs. Here are some strategies to consider:

- Review Deductible Information: Before selecting an insurance plan, thoroughly review the deductible details, including the amount, type, and any specific conditions or exclusions. Understanding the deductible structure is crucial for financial planning.

- Consider High-Deductible Health Plans (HDHPs): HDHPs are insurance plans with higher deductibles but often come with lower premiums. These plans are ideal for individuals who prioritize affordability and have minimal healthcare needs. HDHPs are often paired with Health Savings Accounts (HSAs), allowing individuals to save money tax-free for future healthcare expenses.

- Utilize Preventive Care: Many insurance plans cover preventive care services, such as annual check-ups, vaccinations, and screenings, without requiring individuals to meet the deductible. Taking advantage of these services can help identify potential health issues early on and reduce future healthcare costs.

- Track and Monitor Healthcare Expenses: Keep a record of your medical expenses throughout the year. This includes doctor visits, prescriptions, and any other healthcare-related costs. By monitoring your expenses, you can estimate when you may reach your deductible and plan accordingly.

- Negotiate Medical Bills: If you find yourself facing a large medical bill, don't hesitate to negotiate with healthcare providers. Many providers are open to discussing payment plans or offering discounts for upfront payments. Negotiating can help reduce your out-of-pocket expenses and potentially lower your deductible burden.

The Role of Deductibles in Healthcare Utilization

Medical insurance deductibles play a significant role in influencing healthcare utilization patterns. Here’s how deductibles impact healthcare access and decision-making:

- Encouraging Cost-Conscious Decisions: Deductibles prompt individuals to be more mindful of their healthcare choices. Before seeking medical services, individuals may consider the cost implications and explore alternative options, such as over-the-counter medications or home remedies, to avoid incurring expenses that would contribute to the deductible.

- Avoiding Unnecessary Healthcare Utilization: By requiring individuals to pay a certain amount upfront, deductibles act as a deterrent for unnecessary healthcare visits or procedures. This can help reduce overutilization of healthcare services and promote responsible healthcare consumption.

- Managing Chronic Conditions: For individuals with chronic conditions, managing healthcare costs can be challenging. Deductibles can incentivize individuals to prioritize cost-effective treatments and explore preventive measures to manage their conditions effectively.

The Future of Medical Insurance Deductibles

The landscape of medical insurance deductibles is evolving, driven by changes in healthcare policies and advancements in healthcare delivery models. Here are some potential future trends and developments:

- Consumer-Directed Healthcare: The shift towards consumer-directed healthcare models is gaining traction. This approach emphasizes individual responsibility and control over healthcare decisions. As a result, insurance plans with higher deductibles and more flexible coverage options may become more prevalent, empowering individuals to make informed choices.

- Value-Based Healthcare: Value-based healthcare models focus on delivering high-quality care while controlling costs. These models may influence the design of insurance plans, potentially leading to more innovative approaches to deductibles, such as reward-based systems for healthy lifestyle choices or incentives for cost-effective healthcare utilization.

- Telehealth and Digital Health Solutions: The integration of telehealth and digital health technologies is transforming healthcare delivery. These advancements may impact the role of deductibles, as virtual consultations and remote monitoring can reduce the need for in-person visits and potentially lower healthcare costs, influencing deductible structures.

As the healthcare industry continues to evolve, staying informed about insurance deductibles and their implications is crucial for individuals to make educated decisions about their healthcare and financial well-being.

Can I choose an insurance plan with no deductible?

+While it is possible to find insurance plans with no deductible, these plans often come with higher premiums. It’s important to consider your healthcare needs and budget when choosing a plan. If you have predictable healthcare expenses, a plan with no deductible may be suitable. However, for those with minimal healthcare needs, a high-deductible plan with lower premiums could be a more cost-effective option.

How often do I have to pay the deductible?

+The frequency of paying the deductible depends on the type of plan you have. In most cases, you only need to pay the deductible once per year or policy period. Once you meet the deductible amount, your insurance coverage starts contributing to your healthcare expenses.

Can I roll over my deductible from one year to the next?

+The rollover of deductibles depends on your insurance plan’s terms. Some plans allow for deductible rollover, where any remaining balance from the previous year is carried over to the next year. However, this is not a universal practice, and it’s essential to review your plan’s specific provisions.

Are there any exceptions to the deductible rule?

+Yes, there are exceptions to the deductible rule. Many insurance plans offer certain covered services, such as preventive care, without requiring individuals to meet the deductible first. Additionally, some plans have separate deductibles for specific services or conditions. It’s crucial to review your plan’s details to understand any exceptions or variations.

Can I negotiate my deductible with the insurance company?

+In most cases, insurance companies determine the deductible amount based on their policies and market factors. While it is less common to negotiate deductibles directly with the insurance company, you can explore different plans with varying deductible structures to find the one that aligns with your healthcare needs and budget.