Medical Insurance How Much

Medical insurance is an essential aspect of healthcare, providing individuals and families with financial protection and access to necessary medical services. The cost of medical insurance is a crucial factor for many, as it directly impacts their ability to obtain coverage and seek timely medical care. In this comprehensive article, we will delve into the world of medical insurance, exploring the factors that influence its cost and offering insights into how much one can expect to pay for this vital protection.

Understanding the Cost of Medical Insurance

The price of medical insurance is influenced by a multitude of factors, each playing a significant role in determining the overall cost. From individual characteristics to regional variations, these elements collectively shape the financial landscape of healthcare coverage.

Individual Factors

When calculating the cost of medical insurance, insurance providers consider a range of individual characteristics. These factors include age, gender, and pre-existing medical conditions. For instance, younger individuals generally pay lower premiums due to their lower risk of developing serious health issues, while older adults may face higher costs.

Gender also plays a role, with some insurance companies charging slightly different rates based on statistical differences in healthcare utilization between men and women. Additionally, pre-existing conditions can significantly impact insurance costs. Individuals with chronic illnesses or ongoing medical treatments may face higher premiums or even be denied coverage altogether, especially in countries without comprehensive healthcare systems.

| Age Group | Average Annual Premium |

|---|---|

| Under 30 | $2,500 |

| 30-40 | $3,200 |

| 40-50 | $4,000 |

| Over 50 | $5,500 |

Regional Variations

The cost of medical insurance can vary significantly from one region to another. This is influenced by a multitude of factors, including the overall healthcare infrastructure, the cost of living, and the availability of medical facilities and professionals.

In areas with a higher concentration of medical facilities and specialists, insurance premiums tend to be higher. This is because the cost of healthcare services in these regions is generally more expensive. Additionally, regions with a higher population density or a greater prevalence of certain medical conditions may also see higher insurance costs.

For instance, consider the contrast between rural and urban areas. In rural regions, where healthcare facilities and specialists may be scarce, insurance companies may offer lower premiums to attract customers. Conversely, in densely populated urban areas with an abundance of medical resources, insurance costs can be significantly higher.

| Region | Average Annual Premium |

|---|---|

| Urban Center | $5,000 |

| Suburban Area | $4,200 |

| Rural Community | $3,800 |

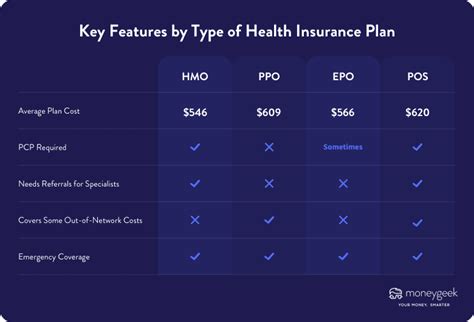

Plan Types and Coverage Levels

The type of insurance plan and the level of coverage desired are critical factors in determining the cost of medical insurance. Insurance plans come in various forms, each with its own set of features and benefits.

Basic health insurance plans typically offer limited coverage, focusing on essential medical services such as doctor visits, hospitalization, and emergency care. These plans are often more affordable, making them a popular choice for those on a tight budget. However, they may not cover certain specialized treatments or prescription medications.

Comprehensive plans, on the other hand, provide a wider range of coverage, including additional benefits like dental and vision care, mental health services, and alternative therapies. While these plans offer more extensive protection, they come at a higher cost.

The level of coverage also impacts the cost. Higher coverage limits, such as increased hospitalization or prescription drug coverage, will generally result in higher premiums. Similarly, plans with lower deductibles and copayments tend to be more expensive, as they provide more financial protection upfront.

| Plan Type | Average Annual Premium |

|---|---|

| Basic Plan | $3,500 |

| Standard Plan | $4,800 |

| Comprehensive Plan | $6,200 |

Analyzing Medical Insurance Costs

To gain a comprehensive understanding of medical insurance costs, it’s essential to delve into real-world examples and explore the factors that contribute to these expenses. By examining specific scenarios, we can better grasp the financial implications of healthcare coverage.

Case Study: John’s Medical Insurance Journey

Let’s consider the case of John, a 35-year-old male living in a suburban area. John is generally healthy, with no significant pre-existing conditions. He works as a software engineer and is looking to purchase medical insurance for himself and his wife.

John begins his search by comparing quotes from various insurance providers. He discovers that his age and health status play a significant role in determining his premiums. On average, he finds that his annual premium for a basic health insurance plan would be around $3,800.

However, John is also interested in exploring more comprehensive coverage options. He discovers that a standard plan, which includes additional benefits such as mental health services and alternative therapies, would cost him approximately $5,200 per year. This plan provides a more robust level of protection, but it comes at a higher price.

John's wife, who is also 35 years old and healthy, would have similar insurance costs. If they choose to purchase a family plan, which covers both of them, the annual premium would be approximately $7,600 for the basic plan and $9,400 for the standard plan.

By analyzing John's case, we can see how individual factors, plan types, and coverage levels collectively influence the cost of medical insurance. It highlights the importance of carefully considering one's specific needs and budget when selecting an insurance plan.

The Impact of Pre-Existing Conditions

Pre-existing medical conditions can significantly affect the cost and availability of medical insurance. Insurance companies carefully evaluate an individual’s medical history to assess their risk level and determine appropriate premiums.

For example, let's consider the case of Sarah, a 40-year-old woman with a history of diabetes. Due to her pre-existing condition, Sarah may face higher insurance costs or even be denied coverage altogether. Insurance companies view individuals with diabetes as higher-risk, as the condition requires ongoing medical management and can lead to various complications.

In Sarah's situation, she may need to explore specialized insurance plans designed for individuals with pre-existing conditions. These plans often come with higher premiums and more restrictive coverage, but they provide essential financial protection for those with chronic illnesses.

It's crucial for individuals with pre-existing conditions to carefully research their insurance options and seek guidance from healthcare professionals and insurance brokers. By understanding their specific needs and exploring all available options, they can find the best possible coverage despite their medical history.

The Role of Employer-Sponsored Insurance

Many individuals and families rely on employer-sponsored medical insurance plans, which are often more affordable and comprehensive than individual plans. These plans are offered as a benefit by employers and can significantly reduce the financial burden of healthcare coverage.

Employer-sponsored plans typically have lower premiums due to the larger group size and the employer's contribution to the cost. Additionally, these plans often provide a wider range of coverage options, including family coverage and additional benefits like dental and vision care.

For example, let's consider the case of Emily, a 28-year-old working for a mid-sized company. Emily's employer offers a comprehensive health insurance plan with a range of coverage options. The annual premium for Emily's plan, which includes coverage for herself and her spouse, is approximately $4,800. This plan provides excellent coverage and is significantly more affordable than individual plans due to the employer's contribution.

Employer-sponsored insurance plans can be a valuable asset for employees, offering financial protection and access to quality healthcare. However, it's important to note that not all employers offer such plans, and the level of coverage can vary widely depending on the employer and the specific plan.

Future Implications and Trends in Medical Insurance

The landscape of medical insurance is constantly evolving, influenced by various factors such as technological advancements, demographic shifts, and policy changes. Understanding these trends and their potential impact is crucial for individuals and families seeking long-term financial protection and access to healthcare.

Technological Advancements

The rapid advancement of technology is transforming the healthcare industry, and medical insurance is no exception. Telemedicine, for instance, has gained significant traction, allowing patients to consult with healthcare professionals remotely. This trend is expected to continue, offering convenience and cost savings for both patients and insurance providers.

Additionally, the integration of artificial intelligence (AI) and machine learning into healthcare is revolutionizing medical diagnosis and treatment. These technologies can analyze vast amounts of medical data, improving accuracy and efficiency in identifying and managing various health conditions. As a result, insurance providers may be able to offer more tailored and cost-effective coverage options in the future.

Demographic Shifts

The changing demographics of the population, particularly the aging population, will have a significant impact on medical insurance costs. As the proportion of older adults increases, the demand for healthcare services will rise, leading to higher insurance premiums. This trend is already evident in many countries, where the aging population is putting strain on healthcare systems and insurance providers.

However, demographic shifts also present opportunities for insurance providers to develop innovative solutions. For instance, specialized insurance plans for older adults with unique healthcare needs may become more prevalent. These plans could focus on preventive care, chronic disease management, and geriatric-specific treatments, offering comprehensive coverage tailored to the aging population.

Policy Changes and Reforms

Government policies and reforms play a crucial role in shaping the medical insurance landscape. In many countries, there is a growing emphasis on universal healthcare coverage, with governments striving to ensure that all citizens have access to essential medical services. These initiatives often involve subsidies and regulations that can impact insurance costs and availability.

For example, the implementation of the Affordable Care Act (ACA) in the United States significantly expanded access to medical insurance, particularly for low-income individuals and families. The ACA introduced various reforms, including mandates for insurance providers and subsidies for eligible individuals. These changes have had a profound impact on the insurance market, making coverage more accessible and affordable for many.

However, policy changes can also bring challenges. Insurance providers may face increased regulatory burdens and changing market dynamics, which can impact their business models and the cost of insurance. It's crucial for individuals to stay informed about policy changes and their potential effects on insurance coverage and costs.

Conclusion

Medical insurance is a critical component of healthcare, providing financial protection and access to essential medical services. The cost of medical insurance is influenced by a multitude of factors, including individual characteristics, regional variations, plan types, and coverage levels. By understanding these factors and exploring real-world examples, individuals can make informed decisions about their insurance coverage.

As the healthcare landscape continues to evolve, technological advancements, demographic shifts, and policy reforms will shape the future of medical insurance. Staying abreast of these trends is essential for individuals and families to navigate the complex world of healthcare coverage and make choices that best align with their needs and budget.

How can I reduce my medical insurance costs?

+There are several strategies to consider. First, evaluate your healthcare needs and choose a plan that aligns with those needs, avoiding unnecessary coverage. Second, explore group plans through your employer or professional organizations, as these often offer more affordable rates. Additionally, maintaining a healthy lifestyle can lead to lower premiums, as insurance companies reward healthy behaviors.

What happens if I can’t afford medical insurance?

+In many countries, there are programs and initiatives in place to assist individuals who cannot afford insurance. These may include government-subsidized plans or income-based assistance programs. It’s crucial to research and understand the options available in your region to ensure you have access to necessary healthcare services.

Are there any alternatives to traditional medical insurance plans?

+Yes, there are alternative options such as healthcare sharing ministries, which are faith-based organizations that provide financial support for medical expenses. Additionally, some countries offer public healthcare systems, providing universal access to essential medical services. However, it’s essential to research and understand the specific options and limitations of these alternatives.