Medical Insurance Plans For Individuals

Welcome to an in-depth exploration of medical insurance plans tailored for individuals. In today's world, navigating healthcare and ensuring financial protection is crucial. This article aims to guide you through the complexities of individual medical insurance, offering a comprehensive understanding of the options available, the benefits they provide, and how to make informed choices to secure your health and peace of mind.

Understanding Individual Medical Insurance

Individual medical insurance, also known as private health insurance, is a type of coverage that individuals can purchase for themselves and their families. Unlike group health plans offered by employers, these plans are tailored to meet the specific needs of individuals, providing flexibility and personalized coverage options. Understanding the nuances of individual medical insurance is essential to make informed decisions and secure adequate healthcare protection.

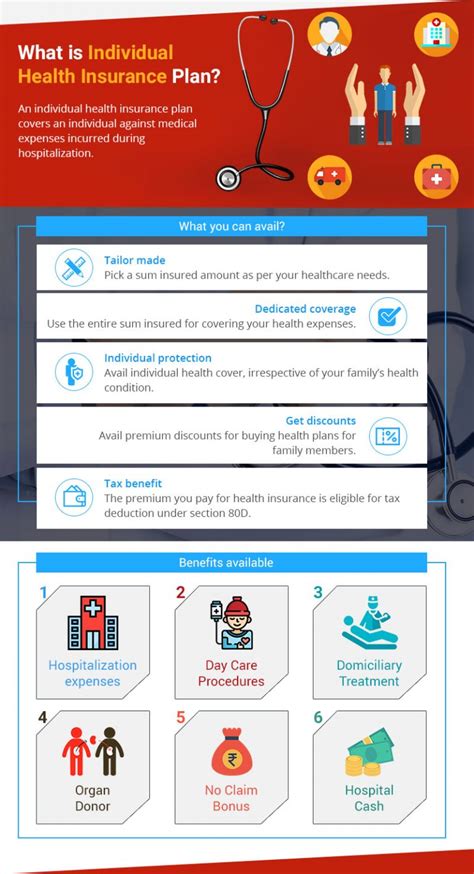

Key Benefits of Individual Medical Insurance Plans

Individual medical insurance plans offer a range of advantages that cater to the diverse needs of individuals. Some of the key benefits include:

- Flexibility and Personalization: These plans allow individuals to choose coverage that aligns with their unique health needs and preferences. Whether you require extensive coverage for pre-existing conditions or prefer a more cost-effective plan, individual insurance offers tailored options.

- Portability: Unlike group plans tied to employment, individual insurance plans are portable. This means you can maintain your coverage even if you change jobs, move to a new location, or start your own business. Portability ensures uninterrupted healthcare protection, regardless of life's changes.

- Comprehensive Coverage: Individual plans often provide comprehensive coverage, including hospitalization, doctor visits, prescription medications, and preventive care. Some plans even offer additional benefits like dental, vision, and mental health coverage, ensuring holistic healthcare.

- Customizable Deductibles and Copays: With individual insurance, you have the flexibility to choose deductibles and copays that fit your budget and risk tolerance. Higher deductibles can lead to lower premiums, while lower deductibles provide more financial protection for unexpected medical expenses.

- Pre-Existing Condition Coverage: Many individual insurance plans now offer coverage for pre-existing conditions, ensuring that individuals with existing health issues can access necessary healthcare without financial strain. This is a significant advantage, as it promotes equal access to healthcare for all.

Navigating the Individual Insurance Market

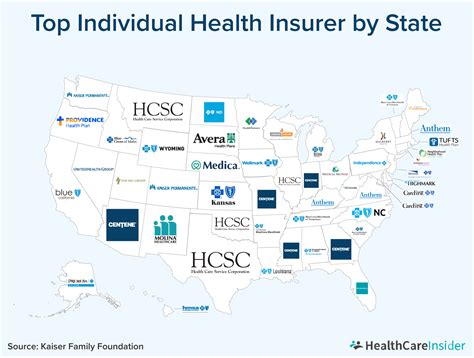

The individual insurance market can be complex, with a vast array of plans and providers to choose from. Here's a guide to help you navigate this landscape and make informed decisions:

Research and Compare Plans

Begin by researching and comparing different individual insurance plans. Consider factors such as coverage limits, network of healthcare providers, prescription drug benefits, and any additional perks offered by the plan. Online marketplaces and insurance brokers can provide valuable resources for comparing plans and understanding their features.

Understand Coverage Options

Individual insurance plans offer a range of coverage options, including:

- Health Maintenance Organization (HMO): HMO plans typically have lower premiums but require you to choose a primary care physician (PCP) and obtain referrals for specialist visits. They often have a more limited network of providers but can be cost-effective for those who prioritize lower costs.

- Preferred Provider Organization (PPO): PPO plans offer more flexibility, allowing you to choose any healthcare provider, whether in-network or out-of-network. While premiums may be higher, PPOs provide greater freedom of choice and can be beneficial for those who prefer a broader network.

- Exclusive Provider Organization (EPO): EPO plans are similar to PPOs but have a more restricted network of providers. They do not cover out-of-network care, except in emergencies. EPO plans can be a cost-effective option for those who prioritize lower premiums and are willing to use in-network providers.

- Point-of-Service (POS) Plans: POS plans combine features of HMO and PPO plans. You choose a primary care physician but can also access out-of-network providers with higher out-of-pocket costs. POS plans offer flexibility and can be suitable for those who want a balance between HMO and PPO features.

Assess Your Healthcare Needs

Before selecting a plan, assess your healthcare needs and preferences. Consider factors such as your current health status, any pre-existing conditions, the frequency of doctor visits, and the type of healthcare services you anticipate needing. This assessment will help you choose a plan that provides adequate coverage without unnecessary expenses.

Understand Cost-Sharing Structures

Individual insurance plans typically involve cost-sharing structures, such as deductibles, copays, and coinsurance. Understanding these terms is crucial for managing your healthcare expenses effectively. Deductibles are the amount you pay out of pocket before insurance coverage kicks in. Copays are fixed amounts you pay for specific services, while coinsurance is a percentage of the cost you share with the insurance company for covered services.

| Cost-Sharing Term | Definition |

|---|---|

| Deductible | The amount you pay before insurance coverage begins. |

| Copay | A fixed amount you pay for specific services, like doctor visits. |

| Coinsurance | A percentage of the cost you share with the insurance company for covered services. |

Consider Premium Costs

Premiums are the regular payments you make to maintain your insurance coverage. When selecting a plan, consider the premium costs and ensure they align with your budget. Remember, lower premiums often come with higher deductibles and cost-sharing responsibilities, so find a balance that suits your financial situation and healthcare needs.

Explore Additional Benefits

Some individual insurance plans offer additional benefits beyond basic healthcare coverage. These can include dental, vision, and mental health services, as well as wellness programs and discounts on health-related products and services. Assess your needs and preferences to determine if these additional benefits are valuable additions to your insurance plan.

Making Informed Choices

When choosing an individual medical insurance plan, consider the following key factors:

- Network of Providers: Ensure the plan has a network of healthcare providers that aligns with your needs. Consider the availability of specialists, hospitals, and other healthcare facilities in your area.

- Prescription Drug Coverage: If you regularly take prescription medications, choose a plan that offers comprehensive prescription drug coverage. Compare the plan's formulary (list of covered drugs) to ensure your medications are included.

- Maternity and Pediatric Care: If you have or plan to have children, consider plans that offer maternity and pediatric care coverage. Ensure the plan covers prenatal care, delivery, and postnatal care for both mother and child.

- Chronic Condition Management: If you have a chronic condition, choose a plan that provides specialized management programs. These programs can help you better manage your condition and may offer additional support and resources.

- Travel Coverage: If you frequently travel or plan to relocate, consider plans that offer coverage outside your primary residence. Some plans have limited or no coverage for out-of-area care, so choose one that provides adequate protection for your travel needs.

The Future of Individual Medical Insurance

The landscape of individual medical insurance is constantly evolving, driven by technological advancements, changing healthcare regulations, and shifting consumer needs. Here's a glimpse into the future of individual insurance:

Digital Health Solutions

Digital health solutions are transforming the way individuals access and manage their healthcare. Telehealth services, virtual consultations, and digital health apps are becoming increasingly popular, offering convenience and accessibility. Individual insurance plans are likely to integrate these digital solutions, providing remote care options and enhancing overall healthcare experiences.

Value-Based Care Models

Value-based care models focus on delivering high-quality healthcare while controlling costs. These models reward healthcare providers for positive patient outcomes rather than the volume of services delivered. Individual insurance plans may adopt value-based care models, encouraging preventive care, chronic condition management, and overall wellness to improve patient health and reduce long-term healthcare expenses.

Enhanced Consumer Empowerment

With the rise of health information technology and consumer-facing tools, individuals are becoming more empowered in their healthcare decisions. Individual insurance plans will likely continue to provide resources and tools to help consumers understand their coverage, compare costs, and make informed choices about their healthcare. This shift towards consumer empowerment can lead to better health outcomes and more efficient healthcare utilization.

Integrated Care Coordination

The future of individual insurance is expected to involve more integrated care coordination. Plans may offer personalized care management programs that coordinate care across various healthcare providers, ensuring seamless transitions between different specialists and services. Integrated care coordination can lead to better health outcomes and improved patient experiences.

Frequently Asked Questions (FAQ)

Can I purchase individual medical insurance if I have a pre-existing condition?

+Yes, many individual insurance plans now offer coverage for pre-existing conditions. However, it's essential to carefully review the plan's terms and conditions to understand any limitations or exclusions related to your specific condition. Some plans may have waiting periods or require additional documentation, so it's crucial to research and compare plans to find one that suits your needs.

How do I choose between an HMO, PPO, or EPO plan?

+The choice between HMO, PPO, and EPO plans depends on your healthcare preferences and budget. HMO plans are typically more cost-effective but have a more restricted network and require referrals. PPO plans offer flexibility and a broader network but may have higher premiums. EPO plans are a middle ground, providing a limited network with lower premiums. Consider your healthcare needs and prioritize either cost-effectiveness or flexibility when making your decision.

What happens if I need emergency care while traveling?

+Most individual insurance plans offer some level of coverage for emergency care, regardless of your location. However, it's important to review your plan's terms and conditions to understand any limitations or exclusions related to out-of-network or out-of-area care. Some plans may require you to obtain prior authorization for emergency services, so be sure to understand the process before traveling.

Are there any tax benefits associated with individual medical insurance plans?

+Yes, in many countries, individual medical insurance premiums are tax-deductible, which can provide a financial benefit. Additionally, some governments offer subsidies or tax credits to individuals who purchase private health insurance. It's essential to consult with a tax professional or financial advisor to understand the specific tax advantages applicable to your situation.

Remember, choosing the right individual medical insurance plan is a crucial decision that impacts your health and financial well-being. By understanding the options available, researching thoroughly, and considering your unique needs, you can make an informed choice to secure comprehensive healthcare coverage.