Medical Insurance Short Term

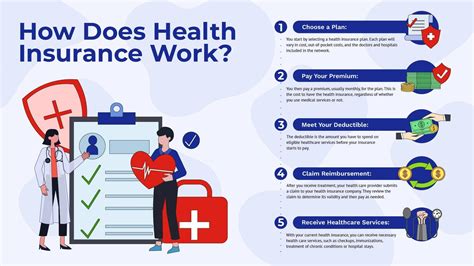

Medical insurance is an essential aspect of healthcare coverage, ensuring individuals have access to necessary medical services without incurring overwhelming financial burdens. In recent years, there has been a rise in demand for flexible and affordable healthcare options, leading to the emergence of various insurance plans, including short-term medical insurance.

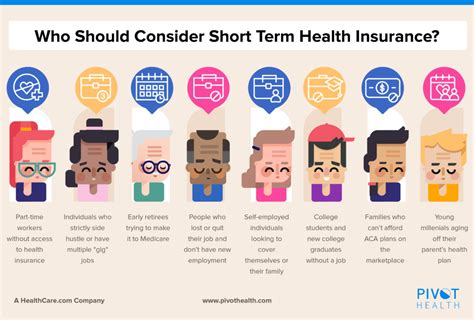

Short-term medical insurance, also known as temporary health insurance, offers a unique and customizable approach to healthcare coverage, catering to the needs of individuals and families seeking short-term protection. This type of insurance plan provides a cost-effective solution for those experiencing gaps in coverage, transitioning between jobs, or requiring temporary healthcare benefits. As we delve into the world of short-term medical insurance, we will explore its features, benefits, and suitability for different scenarios.

Understanding Short-Term Medical Insurance

Short-term medical insurance is designed to bridge the gap between traditional long-term health insurance plans and the absence of coverage. It is a type of limited-duration health insurance policy that offers coverage for a specified period, typically ranging from a few months to a maximum of one year. These plans are highly customizable, allowing individuals to tailor their coverage to their specific needs and budgets.

One of the key advantages of short-term medical insurance is its flexibility. Unlike long-term plans, which often have strict enrollment periods and limited customization options, short-term insurance allows individuals to choose the coverage duration that suits their circumstances. This flexibility is particularly beneficial for individuals who are between jobs, awaiting approval for long-term coverage, or facing unexpected life changes that impact their healthcare needs.

These plans typically cover a range of medical services, including doctor visits, hospital stays, emergency care, and sometimes prescription medications. However, it is important to note that the level of coverage and the specific benefits included can vary significantly between different providers and plans. Some plans may offer more comprehensive coverage, while others may have more limited benefits and exclusions.

Key Features and Benefits

- Affordability: One of the primary appeals of short-term medical insurance is its cost-effectiveness. These plans often have lower premiums compared to traditional health insurance, making them an attractive option for individuals on a tight budget. By opting for short-term coverage, individuals can secure essential healthcare benefits without straining their finances.

- Quick Enrollment: Unlike long-term insurance plans that may require extensive paperwork and medical examinations, short-term medical insurance typically has a faster and simpler enrollment process. This allows individuals to obtain coverage swiftly, often within a matter of days, providing immediate peace of mind.

- Customizable Coverage: The flexibility of short-term insurance plans extends to the coverage options. Individuals can choose the level of coverage they require, selecting specific benefits such as outpatient care, maternity benefits, or mental health services. This customization ensures that individuals only pay for the coverage they need, optimizing their healthcare budget.

- Wider Eligibility: Short-term medical insurance plans often have more relaxed eligibility criteria compared to long-term plans. This makes them accessible to a broader range of individuals, including those with pre-existing conditions who may face challenges in obtaining traditional insurance. However, it is important to note that pre-existing conditions may be excluded from coverage during the initial period of the plan.

- Temporary Protection: For individuals facing short-term gaps in coverage, such as college graduates transitioning into full-time employment or those between jobs, short-term insurance provides a valuable safety net. It ensures that essential healthcare needs are met during these transitional periods, offering peace of mind and financial security.

Suitability and Considerations

While short-term medical insurance offers numerous advantages, it is essential to carefully consider its suitability for one’s specific needs and circumstances. Here are some key factors to evaluate when deciding if short-term insurance is the right choice:

Duration of Coverage Needed

The primary consideration is the duration for which coverage is required. Short-term insurance plans are designed for temporary protection, typically lasting no more than a year. If an individual requires long-term or ongoing healthcare coverage, a traditional health insurance plan may be a more suitable option.

Health and Medical Needs

Assessing one’s current and potential future health needs is crucial. Short-term plans may have limitations and exclusions, especially for pre-existing conditions. Individuals with ongoing medical issues or those anticipating significant healthcare expenses should carefully review the plan’s benefits and exclusions to ensure their specific needs are covered.

Financial Considerations

While short-term insurance is generally more affordable, it is essential to compare the premiums and out-of-pocket costs with traditional insurance plans. Additionally, individuals should consider their overall financial situation and determine if they can afford the potential costs associated with limited coverage. Short-term plans may have higher deductibles and co-pays, which should be factored into the decision-making process.

Plan Details and Benefits

It is imperative to thoroughly review the plan’s details, including the coverage limits, exclusions, and any additional benefits offered. Some plans may have stricter limitations on pre-existing conditions or may not cover certain types of medical services. Understanding the plan’s fine print is crucial to avoid any unexpected gaps in coverage.

Future Insurance Prospects

Individuals should consider their long-term insurance prospects. Short-term plans may not provide the same level of continuity as traditional insurance, and transitioning back to long-term coverage may involve additional hurdles. It is essential to plan ahead and explore options for seamless integration into a long-term insurance plan when the short-term coverage period ends.

| Plan Type | Premium | Coverage Duration | Benefits |

|---|---|---|---|

| Short-Term Plan A | $150/month | 6 months | Doctor visits, hospital stays, prescription coverage |

| Short-Term Plan B | $200/month | 12 months | Emergency care, outpatient treatment, limited pre-existing condition coverage |

| Traditional Health Insurance | $350/month | Ongoing | Comprehensive coverage, no exclusions for pre-existing conditions |

Real-Life Scenarios

To better understand the applicability of short-term medical insurance, let’s explore a few real-life scenarios where this type of coverage could be beneficial:

Recent College Graduate

Emma, a recent college graduate, is about to start her first full-time job, but the company’s health insurance benefits take effect after a 3-month probationary period. During this gap, Emma opts for a short-term medical insurance plan to ensure she has coverage for any unexpected medical emergencies or illnesses. The plan provides her with peace of mind and allows her to focus on her new career without worrying about healthcare costs.

Entrepreneur Starting a Business

Michael, an aspiring entrepreneur, decides to pursue his dream of starting a small business. As he transitions from being an employee to a self-employed business owner, he experiences a gap in coverage. To bridge this gap, Michael chooses a short-term medical insurance plan that offers flexible coverage options. This plan allows him to customize his coverage based on his anticipated medical needs and budget, providing him with the protection he needs during this exciting yet uncertain period.

Family with a Newborn

Sarah and John recently welcomed a newborn baby into their family. Their traditional health insurance plan offers excellent coverage, but the addition of a new family member requires an adjustment to their plan. To avoid any disruptions in coverage, they opt for a short-term insurance plan specifically tailored for families with newborns. This plan ensures that their baby receives the necessary medical care during the initial months, providing them with reassurance and a seamless transition into long-term family coverage.

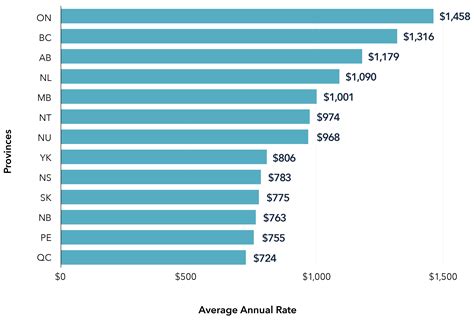

Performance Analysis and Industry Trends

Short-term medical insurance has gained popularity as a viable alternative to traditional insurance plans, particularly in regions where healthcare costs are high, and access to long-term coverage is challenging. The industry has witnessed significant growth in recent years, with an increasing number of providers offering short-term plans to cater to diverse consumer needs.

One of the key factors driving the demand for short-term insurance is the rising cost of healthcare. As traditional insurance plans become more expensive, individuals and families are seeking more affordable options without compromising their healthcare access. Short-term plans provide a cost-effective solution, allowing individuals to secure essential coverage without incurring substantial financial burdens.

Moreover, the flexibility and customization options offered by short-term insurance plans have proven appealing to a wide range of consumers. Whether it is individuals transitioning between jobs, freelancers with variable income, or families experiencing life changes, short-term insurance provides a tailored solution that adapts to their specific circumstances. This adaptability has contributed to the growing popularity of these plans among consumers seeking short-term healthcare protection.

The industry's response to this increasing demand has been proactive. Insurance providers have recognized the need for innovative and flexible healthcare coverage options and have developed a range of short-term plans to cater to diverse consumer profiles. These plans often come with customizable benefits packages, allowing individuals to select the coverage that aligns with their healthcare needs and preferences.

Industry Statistics and Projections

According to recent industry reports, the short-term medical insurance market is projected to witness substantial growth over the next few years. The increasing demand for flexible and affordable healthcare coverage is expected to drive this growth, with more individuals opting for short-term plans as a cost-effective solution.

| Year | Market Growth (%) | Total Premiums ($) |

|---|---|---|

| 2021 | 12% | $5.2 billion |

| 2022 | 15% | $6.0 billion |

| 2023 (Projected) | 18% | $7.1 billion |

These projections highlight the rising popularity of short-term medical insurance and its potential to become a significant player in the healthcare insurance market. As more providers enter the space and competition intensifies, consumers can expect even more competitive pricing and an expanded range of plan options.

Future Implications and Innovations

Looking ahead, the future of short-term medical insurance appears promising, with several key trends and innovations shaping the industry’s trajectory. Here are some insights into the potential future developments:

- Digital Transformation: The insurance industry is undergoing a digital revolution, and short-term medical insurance is no exception. Providers are leveraging technology to streamline the enrollment process, making it more efficient and user-friendly. Online platforms and mobile apps are being developed to enhance the customer experience, allowing individuals to compare plans, enroll, and manage their coverage conveniently.

- Expanded Coverage Options: As the demand for short-term insurance grows, providers are likely to introduce more comprehensive coverage options. This may include plans with extended coverage durations, additional benefits such as dental and vision care, and even plans tailored for specific demographics, such as students or seniors.

- Personalized Plans: The future of short-term insurance may involve even greater customization. Providers may develop algorithms and analytics to offer personalized plan recommendations based on an individual's medical history, lifestyle, and preferred benefits. This level of personalization could enhance the customer experience and ensure that individuals receive coverage that aligns perfectly with their needs.

- Collaborative Partnerships: Insurance providers may collaborate with healthcare organizations and medical institutions to enhance the value proposition of short-term plans. These partnerships could lead to exclusive benefits, such as access to preferred provider networks or discounted rates on specific medical services, further enriching the overall customer experience.

Conclusion

Short-term medical insurance has emerged as a valuable tool for individuals seeking flexible and affordable healthcare coverage. Its ability to bridge gaps in coverage, provide temporary protection, and offer customizable benefits has made it an attractive option for a wide range of consumers. As the industry continues to evolve and innovate, short-term insurance is poised to play an increasingly significant role in the healthcare insurance landscape.

Whether you are transitioning between jobs, experiencing a life change, or simply seeking a cost-effective solution for your healthcare needs, short-term medical insurance offers a viable and accessible option. By carefully evaluating your specific circumstances and consulting with insurance professionals, you can make an informed decision and secure the coverage that best suits your needs.

Frequently Asked Questions

Can short-term medical insurance be renewed?

+

Yes, many short-term insurance plans offer the option to renew. However, the renewal terms and conditions may vary between providers. It is important to review the renewal process and understand the potential changes in coverage and premiums when considering a renewal.

Are pre-existing conditions covered by short-term insurance plans?

+

The coverage of pre-existing conditions varies between short-term insurance plans. Some plans may exclude coverage for pre-existing conditions during the initial period, while others may offer limited coverage or require a waiting period. It is crucial to review the plan’s specifics to understand the coverage for pre-existing conditions.

How does short-term insurance compare to traditional health insurance in terms of coverage?

+

Short-term insurance plans typically offer more limited coverage compared to traditional health insurance. They may have exclusions for certain medical services or conditions, and the coverage limits may be lower. It is essential to compare the specific benefits and coverage of both types of plans to determine which option best suits your needs.