Medical Insurance State Of California

Medical insurance is a crucial aspect of healthcare access and financial protection, and in the state of California, it plays a significant role in ensuring that residents have adequate coverage and access to essential medical services. With a diverse population and a focus on healthcare reform, California has implemented various initiatives and programs to improve insurance coverage and provide residents with comprehensive healthcare options.

Understanding Medical Insurance in California

California’s healthcare landscape is unique and complex, driven by a combination of state policies, federal regulations, and market dynamics. The state has taken a proactive approach to healthcare, aiming to improve access, affordability, and quality of care for its residents. Here’s an in-depth look at medical insurance in the Golden State.

California’s Healthcare System: An Overview

California boasts a robust healthcare system, with a diverse range of providers, facilities, and insurance plans. The state has a mix of public and private healthcare options, with a strong emphasis on community health and preventive care. Key aspects of California’s healthcare system include:

- A large population of over 39 million residents, making it the most populous state in the US.

- A diverse demographic, with a significant proportion of individuals from ethnic and racial minority groups.

- A strong network of healthcare providers, including hospitals, clinics, and community health centers.

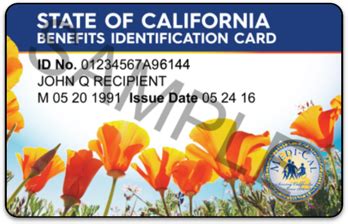

- A focus on Medicaid (known as Medi-Cal in California) and other public insurance programs to ensure coverage for low-income residents.

- An active private insurance market, with a variety of plans offered by major insurers.

The Role of the California Department of Insurance

The California Department of Insurance (CDI) is a key player in regulating and overseeing the insurance industry in the state. It ensures that insurers adhere to state laws and regulations, protecting consumers and promoting fair practices. CDI’s responsibilities include:

- Licensing and regulating insurance companies operating in California.

- Enforcing laws related to insurance practices, including claims handling and rate setting.

- Providing consumer education and assistance, including resources for understanding insurance options and filing complaints.

- Monitoring market conduct to prevent fraud and ensure compliance with state insurance laws.

Healthcare Reform in California

California has been at the forefront of healthcare reform, implementing policies and initiatives to expand coverage and improve healthcare access. Some notable reforms include:

- The California Health Benefit Exchange (Covered California): This state-based marketplace was established as part of the Affordable Care Act (ACA) to help individuals and small businesses find and enroll in qualified health plans. Covered California offers a range of insurance options and provides financial assistance to eligible individuals.

- Medi-Cal Expansion: California expanded its Medicaid program under the ACA, extending coverage to more low-income adults and families. This expansion has significantly reduced the uninsured rate in the state.

- Healthcare Delivery System Reform: California has implemented various reforms to improve the quality and efficiency of healthcare delivery. This includes initiatives to promote value-based care, enhance primary care, and integrate behavioral health services.

Insurance Options in California

California residents have a variety of insurance options, each with its own advantages and considerations. The right choice depends on individual needs, preferences, and eligibility.

Public Insurance Programs

Public insurance programs in California provide coverage for specific populations, often with little or no cost to the insured. These programs include:

- Medi-Cal: California’s Medicaid program, Medi-Cal, offers comprehensive health coverage to low-income individuals and families, including children, pregnant women, seniors, and people with disabilities. Eligibility is based on income and certain other criteria.

- Medi-Cal for Seniors: This program provides healthcare coverage for seniors who meet specific income and asset requirements. It covers a wide range of services, including doctor visits, hospital stays, and prescription drugs.

- Healthy Families Program: A state-sponsored program that offers low-cost health coverage for children in families with incomes too high to qualify for Medi-Cal but who cannot afford private insurance. The program covers doctor visits, immunizations, hospital stays, and more.

Private Insurance Plans

Private insurance plans in California are offered by various insurers and can be purchased through the state’s insurance marketplace, Covered California, or directly from insurance companies. These plans come in different types and levels of coverage, including:

- Health Maintenance Organization (HMO) Plans: HMO plans typically have a lower monthly premium but require members to choose a primary care physician (PCP) and obtain referrals for specialist care. They usually have a limited network of providers.

- Preferred Provider Organization (PPO) Plans: PPO plans offer more flexibility, allowing members to see any provider within the PPO network without a referral. They typically have a higher monthly premium compared to HMO plans.

- Exclusive Provider Organization (EPO) Plans: EPO plans are similar to PPO plans but have a more limited network of providers. Members can see any provider within the network without a referral but may not have coverage for out-of-network care.

- Point-of-Service (POS) Plans: POS plans combine features of HMO and PPO plans. Members typically have a primary care physician but can also see out-of-network providers with higher out-of-pocket costs.

- Catastrophic Health Plans: These plans are designed for individuals under 30 or those who qualify due to financial hardship. They have low premiums but high deductibles and are primarily intended for emergency or catastrophic care.

Choosing the Right Insurance Plan

Selecting the right insurance plan involves considering factors such as cost, coverage, and personal healthcare needs. Here are some key points to keep in mind:

- Premium and Deductible: Evaluate the monthly premium and the deductible (the amount you pay before insurance coverage kicks in). Lower premiums often come with higher deductibles, so consider your budget and anticipated healthcare needs.

- Network of Providers: Review the plan’s network to ensure your preferred doctors and hospitals are included. Out-of-network care can be costly, so consider the importance of network flexibility.

- Coverage Benefits: Check the plan’s coverage for essential health benefits, including primary care, specialist visits, hospital stays, prescription drugs, and mental health services. Ensure the plan covers the specific services you require.

- Cost-Sharing: Understand the plan’s cost-sharing structure, including copayments, coinsurance, and out-of-pocket maximums. Higher cost-sharing may be suitable if you anticipate minimal healthcare needs, while lower cost-sharing can provide more financial protection.

- Additional Benefits: Some plans offer additional benefits such as dental, vision, or wellness programs. Consider these perks based on your personal health and wellness goals.

Navigating Insurance Enrollment and Claims

Enrolling in an insurance plan and understanding the claims process are essential steps in ensuring you have the coverage you need and can access the healthcare services you require.

Enrollment Periods and Special Enrollment Periods

In California, there are specific enrollment periods for insurance plans. The Open Enrollment Period typically occurs annually, offering a window of time when anyone can enroll in a new plan or make changes to their existing coverage. Outside of the Open Enrollment Period, individuals may qualify for a Special Enrollment Period (SEP) due to specific life events, such as marriage, divorce, birth or adoption of a child, loss of other coverage, or changes in income.

Enrolling in Insurance Plans

To enroll in an insurance plan, you can follow these steps:

- Determine your eligibility for public insurance programs like Medi-Cal or the Healthy Families Program.

- If you’re not eligible for public programs, explore private insurance options through Covered California or directly from insurers.

- Compare plans based on cost, coverage, and your specific healthcare needs.

- Submit an application and provide necessary information, such as income and household details.

- Review and accept the plan’s terms and conditions.

Understanding the Claims Process

The claims process involves submitting requests for payment to your insurance company for covered healthcare services. Here’s an overview of the process:

- Receiving Healthcare Services: When you receive medical care, your provider will typically submit a claim to your insurance company.

- Claim Processing: The insurance company reviews the claim to ensure it’s covered by your plan and determines the amount payable.

- Payment: Once the claim is approved, the insurance company pays the provider directly. You may receive an explanation of benefits (EOB) detailing the services provided and the amount covered.

- Out-of-Pocket Costs: You’re responsible for any out-of-pocket costs, such as deductibles, copayments, or coinsurance. These costs are typically paid directly to the provider at the time of service.

- Appealing Claims: If a claim is denied, you have the right to appeal the decision. Contact your insurance company to understand the appeals process and your rights.

Tips for Maximizing Your Insurance Coverage

To make the most of your insurance coverage, consider these tips:

- Stay Informed: Keep up-to-date with your plan’s coverage, benefits, and network of providers. Regularly review your policy documents and stay informed about any changes.

- Understand Cost-Sharing: Know your out-of-pocket costs, including deductibles, copayments, and coinsurance. Budget accordingly to ensure you can afford necessary healthcare services.

- Choose In-Network Providers: Whenever possible, select providers within your plan’s network to avoid higher out-of-pocket costs.

- Utilize Preventive Care: Take advantage of preventive services, which are typically covered at no cost to you. This includes screenings, immunizations, and wellness checks.

- Review EOBs: Regularly review your Explanation of Benefits to ensure you understand the services provided and the costs covered. This helps you identify any errors or discrepancies.

- Seek Financial Assistance: If you’re struggling to afford your insurance premiums or out-of-pocket costs, explore financial assistance options, such as subsidies or payment plans.

The Future of Medical Insurance in California

The landscape of medical insurance in California is continually evolving, driven by changing demographics, healthcare needs, and policy developments. Here are some key trends and potential future developments:

Expanding Coverage and Access

California has made significant strides in expanding insurance coverage, but efforts to improve access and reduce disparities continue. Potential future initiatives include:

- Further expansion of Medi-Cal to cover more low-income adults and families.

- Enhancing outreach and enrollment efforts to ensure all eligible residents are aware of their coverage options.

- Developing strategies to address healthcare disparities, particularly for underserved communities.

Healthcare Innovation and Technology

The integration of technology and innovation in healthcare is expected to play a significant role in the future of medical insurance. Potential developments include:

- Increased use of telehealth and virtual care services, improving access to healthcare for rural and underserved communities.

- Adoption of advanced analytics and artificial intelligence to enhance the efficiency and accuracy of insurance processes, such as claims handling and fraud detection.

- Development of personalized medicine and precision healthcare, allowing for more targeted and effective treatment options.

Addressing Rising Healthcare Costs

Controlling healthcare costs remains a key challenge for insurers, providers, and policymakers. Potential strategies to address this issue include:

- Implementing value-based care models that reward providers for delivering high-quality, cost-effective care.

- Promoting preventive care and wellness initiatives to reduce the need for costly treatments.

- Exploring ways to reduce administrative burdens and streamline healthcare processes.

Consumer Empowerment and Education

Empowering consumers to make informed healthcare decisions is essential. Future initiatives may focus on:

- Enhancing consumer education about insurance options, coverage, and cost-sharing.

- Providing tools and resources to help consumers navigate the healthcare system and make cost-effective choices.

- Promoting health literacy to ensure individuals understand their health needs and the importance of preventive care.

Frequently Asked Questions

What is the average cost of health insurance in California?

+

The average cost of health insurance in California can vary based on factors such as age, location, and the specific plan chosen. According to recent data, the average monthly premium for an individual in California is around 500 to 600, while family plans can range from 1,200 to 1,500. It’s important to note that these are averages, and actual costs can vary significantly based on individual circumstances.

How can I qualify for Medi-Cal in California?

+

Eligibility for Medi-Cal in California is primarily based on income and certain other criteria. To qualify, you must meet specific income requirements, which vary based on factors such as family size and citizenship status. Additionally, certain life events, such as pregnancy or disability, can make you eligible for Medi-Cal coverage. It’s recommended to check the official Medi-Cal website or consult with a healthcare navigator to determine your eligibility.

What are the benefits of enrolling in Covered California plans?

+

Enrolling in Covered California plans offers several benefits. These plans are regulated and approved by the state, ensuring they meet specific standards for coverage and affordability. Additionally, Covered California provides access to a range of insurance options, including plans with financial assistance for eligible individuals. This marketplace also simplifies the enrollment process and offers resources and support to help individuals understand their coverage options.

How do I choose the right insurance plan for my needs?

+

Choosing the right insurance plan involves considering your specific healthcare needs and financial situation. Evaluate factors such as the plan’s network of providers, coverage for essential services, cost-sharing (deductibles, copayments, and coinsurance), and any additional benefits that align with your wellness goals. It’s also important to review plan exclusions and limitations to ensure the plan aligns with your healthcare requirements.

What should I do if my insurance claim is denied?

+

If your insurance claim is denied, you have the right to appeal the decision. Contact your insurance company to understand their appeals process and the necessary steps to initiate an appeal. It’s important to gather and submit relevant documentation to support your case. You may also consider seeking assistance from patient advocacy groups or legal professionals who specialize in insurance matters.