Medicare Company Insurance

Welcome to a comprehensive exploration of the Medicare Company Insurance, a vital healthcare coverage option that plays a crucial role in ensuring the well-being of individuals across the United States. In this in-depth analysis, we will delve into the intricacies of Medicare Company Insurance, shedding light on its significance, key features, and the benefits it offers to enrollees. By the end of this article, you'll have a clear understanding of why Medicare Company Insurance is a trusted choice for many and how it contributes to a robust healthcare system.

Understanding Medicare Company Insurance: An Overview

Medicare Company Insurance, often simply referred to as Medicare, is a federal health insurance program designed to cater to the healthcare needs of individuals aged 65 and older, as well as certain younger individuals with disabilities and specific medical conditions. It is a cornerstone of the American healthcare system, providing essential medical coverage to millions of people across the country.

The program is administered by the Centers for Medicare & Medicaid Services (CMS), a federal agency under the Department of Health and Human Services (HHS). Medicare's primary goal is to ensure that eligible individuals have access to quality healthcare services, regardless of their income or medical history. It achieves this by offering a range of coverage options tailored to meet the diverse needs of its beneficiaries.

Medicare Company Insurance is not a one-size-fits-all solution. Instead, it offers a comprehensive suite of plans, each with its own set of benefits and coverage limitations. These plans are categorized into different parts, allowing individuals to choose the option that best aligns with their healthcare requirements and financial capabilities.

Key Features and Benefits of Medicare Company Insurance

Medicare Company Insurance stands out for its comprehensive coverage, offering a wide range of benefits that address various healthcare needs. Here’s a detailed look at some of its key features and the advantages they bring to enrollees:

Part A: Hospital Insurance

Part A of Medicare provides coverage for inpatient hospital stays, skilled nursing facility care, hospice care, and some home healthcare services. It is often referred to as Medicare Hospital Insurance and is premium-free for most individuals who have worked and paid Medicare taxes for a minimum specified period. This part of Medicare ensures that beneficiaries have access to essential medical care without facing significant financial burdens during their stay in a healthcare facility.

| Category | Coverage Highlights |

|---|---|

| Inpatient Hospital Stays | Covers costs for semi-private rooms, meals, nursing care, and other related services. |

| Skilled Nursing Facility Care | Offers coverage for skilled nursing care, rehabilitation services, and certain medical supplies after a qualifying hospital stay. |

| Hospice Care | Provides support for terminally ill patients, including medical care, pain management, and emotional support. |

| Home Healthcare Services | Covers intermittent skilled nursing care, physical therapy, occupational therapy, and speech-language pathology services. |

Part B: Medical Insurance

Medicare Part B, also known as Medicare Medical Insurance, covers a wide range of outpatient medical services and supplies. This includes doctor visits, outpatient hospital care, certain preventive services, and durable medical equipment. Part B is available to individuals who have enrolled in Part A and typically requires a monthly premium payment.

| Category | Coverage Highlights |

|---|---|

| Doctor Visits | Covers costs for physician services, including office visits, consultations, and certain diagnostic tests. |

| Outpatient Hospital Care | Provides coverage for services received outside of a hospital stay, such as emergency room visits, ambulatory surgical centers, and certain hospital-based services. |

| Preventive Services | Offers a range of preventive screenings and services, including flu shots, mammograms, and certain cancer screenings. |

| Durable Medical Equipment | Covers the cost of certain medical equipment, such as wheelchairs, walkers, and oxygen equipment, when prescribed by a physician. |

Part C: Medicare Advantage Plans

Medicare Part C, or Medicare Advantage Plans, are an alternative way to receive your Medicare benefits. These plans are offered by private insurance companies that contract with Medicare. They typically include all the benefits of Parts A and B, and may also offer additional coverage, such as prescription drug coverage, dental, vision, and hearing services. Medicare Advantage Plans often have lower out-of-pocket costs compared to Original Medicare.

Part D: Prescription Drug Coverage

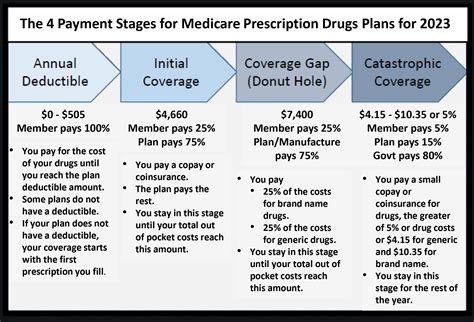

Medicare Part D is a voluntary program that provides coverage for prescription drugs. It is offered through private insurance companies that have contracts with Medicare. Part D plans help cover the cost of prescription medications, which can be a significant expense for many individuals. These plans typically require a monthly premium, copayments, and deductibles, with specific coverage and costs varying depending on the chosen plan.

Enrollment and Eligibility for Medicare Company Insurance

Enrollment in Medicare Company Insurance is a critical process that ensures individuals have access to the healthcare coverage they need. Understanding the eligibility criteria and enrollment timelines is essential for a smooth transition into Medicare coverage.

Eligibility Criteria

Medicare Company Insurance is primarily designed for individuals who meet certain age and disability requirements. Here’s a breakdown of the eligibility criteria:

- Age Eligibility: Generally, individuals who are 65 years or older are eligible for Medicare. However, younger individuals with certain disabilities or end-stage renal disease (ESRD) may also qualify.

- Disability Eligibility: For those under the age of 65, a 24-month waiting period is typically required after receiving Social Security Disability Insurance (SSDI) benefits. This waiting period can be waived for individuals with Lou Gehrig's disease (ALS) or ESRD.

- Work Eligibility: To be eligible for premium-free Part A coverage, individuals must have worked and paid Medicare taxes for a minimum of 40 quarters (10 years) while employed.

Enrollment Periods

Medicare has specific enrollment periods to ensure a structured and organized process. These periods are crucial for individuals to avoid late enrollment penalties and ensure seamless coverage. Here’s an overview of the key enrollment periods:

- Initial Enrollment Period (IEP): This is the first opportunity for individuals to enroll in Medicare when they turn 65 or become eligible due to disability. The IEP lasts for 7 months, beginning 3 months before the month of their 65th birthday, the month of their birthday, and ending 3 months after their birthday.

- General Enrollment Period: For those who miss their Initial Enrollment Period, the General Enrollment Period is an annual opportunity to enroll. It runs from January 1 to March 31, with coverage starting on July 1 of that year.

- Special Enrollment Periods (SEPs): SEPs are available for specific circumstances, such as losing other health coverage or moving to a new area. These periods allow individuals to enroll outside of the standard enrollment periods without facing late enrollment penalties.

Medicare Company Insurance: Navigating the Coverage Options

Medicare Company Insurance offers a diverse range of coverage options to cater to the unique needs of its beneficiaries. Understanding these options is essential for individuals to make informed decisions about their healthcare coverage. Here, we’ll explore the different plans and provide insights to help you navigate the Medicare landscape.

Original Medicare (Parts A and B)

Original Medicare, consisting of Parts A and B, is the traditional fee-for-service Medicare program. It provides basic coverage for hospital stays, outpatient services, and certain preventive care. While Original Medicare offers comprehensive coverage, it may have higher out-of-pocket costs compared to other Medicare plans.

Medicare Advantage Plans (Part C)

Medicare Advantage Plans, or Part C, are an alternative to Original Medicare. These plans are offered by private insurance companies and are required to provide at least the same level of coverage as Original Medicare. However, they often include additional benefits, such as prescription drug coverage, dental, vision, and hearing services. Medicare Advantage Plans may have lower out-of-pocket costs and provide more comprehensive coverage options.

Medicare Supplement (Medigap) Plans

Medicare Supplement, or Medigap, plans are designed to fill the gaps in Original Medicare coverage. These plans are offered by private insurance companies and can help cover costs that Original Medicare does not, such as copayments, coinsurance, and deductibles. Medigap plans are an excellent option for those who want more comprehensive coverage and prefer a simpler payment structure.

Prescription Drug Coverage (Part D)

Prescription drug coverage is an essential component of Medicare, especially for individuals who rely on medications to manage their health conditions. Medicare Part D plans are offered by private insurance companies and provide coverage for a wide range of prescription drugs. These plans can be added to Original Medicare or Medicare Advantage Plans to ensure comprehensive medication coverage.

Medicare Company Insurance: A Comprehensive Approach to Healthcare

Medicare Company Insurance is more than just a healthcare coverage program; it’s a comprehensive approach to ensuring the well-being of millions of Americans. By offering a diverse range of plans and coverage options, Medicare adapts to the unique needs of its beneficiaries, providing them with the tools to maintain their health and manage their medical conditions effectively.

Whether it's through Original Medicare, Medicare Advantage Plans, or Medigap coverage, individuals can find a plan that suits their healthcare requirements and financial situation. The inclusion of prescription drug coverage further emphasizes Medicare's commitment to providing holistic healthcare solutions, ensuring that beneficiaries have access to the medications they need to lead healthy lives.

As we navigate the complex landscape of healthcare, Medicare Company Insurance stands as a beacon of accessibility and affordability. Its role in the healthcare system is invaluable, empowering individuals to take control of their health and make informed decisions about their medical care. With its wide-ranging benefits and tailored coverage options, Medicare Company Insurance is a trusted companion on the journey towards a healthier future.

How do I know if I’m eligible for Medicare Company Insurance?

+Eligibility for Medicare Company Insurance is primarily based on age and certain disability requirements. Individuals who are 65 years or older are generally eligible, while those under 65 may qualify if they have a disability or end-stage renal disease (ESRD). It’s important to check the specific eligibility criteria and understand the enrollment periods to ensure a smooth transition into Medicare coverage.

What is the difference between Original Medicare and Medicare Advantage Plans?

+Original Medicare, Parts A and B, is the traditional fee-for-service Medicare program, offering basic coverage for hospital stays and outpatient services. Medicare Advantage Plans, or Part C, are an alternative option offered by private insurance companies. These plans typically include additional benefits, such as prescription drug coverage, dental, vision, and hearing services. Medicare Advantage Plans may have lower out-of-pocket costs and provide more comprehensive coverage options.

How do I choose the right Medicare plan for my needs?

+Choosing the right Medicare plan involves considering your healthcare needs, preferences, and budget. Evaluate the coverage offered by each plan, including Original Medicare, Medicare Advantage Plans, and Medigap plans. Consider factors such as copayments, deductibles, and prescription drug coverage. It’s also beneficial to consult with a Medicare expert or your healthcare provider to make an informed decision.