Medicare Gap Insurance Coverage

Medicare, the federal health insurance program in the United States, provides essential coverage for millions of individuals aged 65 and older, as well as those with certain disabilities. However, despite its comprehensive nature, Medicare has certain limitations, particularly in terms of cost-sharing responsibilities and gaps in coverage. This is where Medicare Gap Insurance, also known as Medigap, steps in to offer additional financial protection and fill those gaps.

Medicare Gap Insurance plans are designed to cover the out-of-pocket expenses that traditional Medicare doesn't fully cover, such as deductibles, coinsurance, and copayments. These expenses can accumulate quickly and become a significant financial burden for many beneficiaries. By understanding the intricacies of Medicare Gap Insurance, individuals can make informed decisions to ensure they have adequate coverage and peace of mind.

Understanding Medicare Gap Insurance

Medicare Gap Insurance, or Medigap, is a type of supplemental health insurance policy that is specifically designed to work alongside Original Medicare, which consists of Part A (hospital insurance) and Part B (medical insurance). These supplemental plans are standardized and regulated by the Centers for Medicare & Medicaid Services (CMS), ensuring consistency and clarity for beneficiaries.

There are currently 10 standardized Medigap plan types, labeled A through N, with each plan offering a unique combination of benefits. These plans cover a portion or, in some cases, all of the out-of-pocket costs associated with Original Medicare. The level of coverage and the specific benefits provided depend on the plan chosen.

| Medigap Plan | Covered Benefits |

|---|---|

| Plan A | Basic coverage for deductibles, coinsurance, and blood transfusions. |

| Plan B | Includes all Plan A benefits, plus coverage for Part B excess charges. |

| Plan C | Comprehensive coverage with no gaps, including foreign travel emergency coverage. |

| ... | ... |

| Plan N | Offers limited coverage, including copayments for office visits and some other services. |

It's important to note that not all Medigap plans are available in every state, and some states may have additional plans not listed here. Additionally, the specific benefits and costs of each plan can vary depending on the insurance company offering the policy.

Eligibility and Enrollment

To be eligible for Medigap coverage, individuals must be enrolled in both Medicare Part A and Part B. There are specific enrollment periods during which individuals can purchase a Medigap policy without undergoing a medical underwriting process. These periods include the Medicare Initial Enrollment Period (when first becoming eligible for Medicare), the Medigap Open Enrollment Period (the first 6 months of Part B enrollment), and the Medigap Guaranteed Issue Rights, which may apply if certain events occur, such as losing other Medicare coverage.

Outside of these enrollment periods, insurance companies may use medical underwriting to determine an individual's eligibility and premium costs. This means that they may deny coverage or charge higher premiums based on an individual's health status.

Standardized Benefits and Plan Options

The standardized Medigap plans offer a range of benefits, each designed to address specific gaps in Original Medicare coverage. For instance, Plan A is the most basic option, providing coverage for Part A deductibles, Part B deductibles, and blood transfusions. On the other hand, Plan C offers a more comprehensive level of coverage, including foreign travel emergency care. It’s essential to review each plan’s benefits carefully to determine which one aligns best with an individual’s needs and budget.

The Role of Medicare Gap Insurance in Healthcare Coverage

Medicare Gap Insurance plays a crucial role in ensuring that beneficiaries have the financial support they need to access necessary healthcare services without facing significant financial strain. By covering out-of-pocket costs, Medigap plans can make a substantial difference in an individual’s ability to afford the care they require.

Reducing Out-of-Pocket Expenses

One of the primary benefits of Medicare Gap Insurance is its ability to reduce the financial burden associated with out-of-pocket expenses. Original Medicare has deductibles, coinsurance, and copayments that can quickly accumulate, especially for individuals with chronic conditions or those requiring frequent medical care. Medigap plans step in to cover these costs, ensuring that beneficiaries can access the care they need without worrying about excessive financial obligations.

| Out-of-Pocket Expense | Medicare Coverage | Medigap Coverage |

|---|---|---|

| Part A Deductible | $1,556 per benefit period | Varies by plan |

| Part B Deductible | $233 annually | Varies by plan |

| Coinsurance/Copayments | 20% of Medicare-approved amounts | Varies by plan |

For example, consider the Part A deductible, which is currently set at $1,556 per benefit period. This means that for each stay in a hospital or skilled nursing facility, beneficiaries must pay this amount before Medicare begins to cover their costs. A Medigap plan could cover this deductible in full or partially, depending on the chosen plan.

Providing Peace of Mind and Financial Security

Medigap insurance not only reduces financial stress but also provides a sense of security and peace of mind. With the knowledge that their out-of-pocket expenses are covered, beneficiaries can focus on their health and well-being without the constant worry of mounting medical bills. This peace of mind is particularly valuable for those on fixed incomes or with limited financial resources.

Access to Quality Healthcare Services

By covering the costs associated with Original Medicare, Medigap plans enable beneficiaries to access a wider range of healthcare services. This includes specialized treatments, prescription medications, and preventive care, all of which are essential for maintaining good health. With Medigap coverage, individuals can make informed decisions about their healthcare, choosing the best treatment options without financial constraints.

Choosing the Right Medicare Gap Insurance Plan

Selecting the appropriate Medigap plan involves careful consideration of an individual’s healthcare needs, budget, and personal preferences. Here are some key factors to keep in mind when making this important decision.

Assessing Healthcare Needs

The first step in choosing a Medigap plan is to evaluate your current and potential future healthcare needs. Consider your past medical history, any ongoing conditions or treatments, and the likelihood of requiring specialized or frequent care. This assessment will help you determine the level of coverage you require.

For instance, if you have a chronic condition that requires regular doctor visits and prescription medications, you may benefit from a plan that covers copayments and has lower out-of-pocket limits. On the other hand, if you lead an active lifestyle and prioritize preventive care, a plan with broader coverage, including foreign travel emergency benefits, might be more suitable.

Understanding Plan Costs

Medigap plans come with varying premium costs, which can be affected by several factors, including the level of coverage, the insurance company, and your location. It’s crucial to compare premiums and understand the potential financial impact of each plan over the long term.

Additionally, some Medigap plans have an annual deductible or require cost-sharing for certain services. While these plans may have lower premiums, they may not be the most cost-effective option in the long run, especially if you require frequent medical care. It's essential to consider your healthcare needs and financial situation when evaluating plan costs.

Researching Insurance Companies

When selecting a Medigap plan, it’s important to research the insurance companies offering these policies. Look for companies with a strong financial standing and a history of reliable claims processing. You can check ratings and reviews from independent sources to ensure you’re choosing a reputable insurer.

It's also beneficial to compare the customer service and support offered by different insurance companies. Some companies may provide additional resources, such as nurse lines or wellness programs, which can enhance your overall healthcare experience.

Seeking Professional Guidance

The process of choosing a Medigap plan can be complex, and it’s understandable if you feel overwhelmed. Seeking guidance from a licensed insurance agent or a Medicare counselor can be extremely valuable. These professionals can provide personalized advice based on your unique circumstances and help you navigate the various plan options.

Future Trends and Developments in Medicare Gap Insurance

The landscape of Medicare Gap Insurance is constantly evolving, driven by changes in healthcare policies, advancements in medical technology, and shifts in consumer needs. Staying informed about these developments is crucial for making informed decisions about your healthcare coverage.

Policy Changes and Regulatory Updates

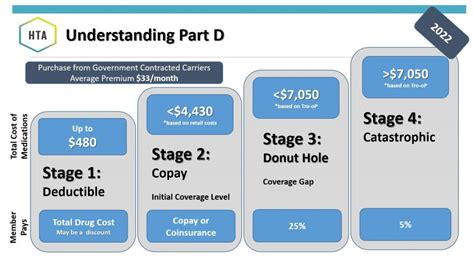

Medicare policies and regulations are subject to change, which can impact the availability and coverage of Medigap plans. It’s essential to stay updated on any new policies or legislation that may affect your coverage. For instance, changes in Medicare Advantage plans or prescription drug coverage can influence the need for Medigap coverage.

The Centers for Medicare & Medicaid Services (CMS) regularly updates its guidelines and standards for Medigap plans. These updates ensure that beneficiaries have access to standardized and reliable coverage. Keeping up with these changes can help you make informed decisions and ensure you're getting the most value from your Medigap plan.

Advancements in Healthcare Technology

Advancements in healthcare technology, such as telemedicine and remote monitoring, are reshaping the way medical services are delivered and accessed. These innovations can influence the need for certain types of Medigap coverage. For example, the increased availability of telemedicine services may reduce the need for in-person visits, potentially impacting the value of certain Medigap plans.

Additionally, as medical technology advances, new treatments and procedures may become available, which could impact the cost of healthcare services. Medigap plans that offer broader coverage may be more adaptable to these changes, ensuring beneficiaries have access to the latest treatments without incurring excessive out-of-pocket costs.

Consumer Preferences and Market Trends

Consumer preferences and market trends play a significant role in shaping the future of Medigap insurance. As individuals become more informed about their healthcare options, they may seek plans that offer greater flexibility, customized benefits, and value-added services. Insurance companies are responding to these trends by introducing innovative plan designs and enhancing customer experiences.

For instance, some Medigap plans now offer wellness incentives, such as discounts on gym memberships or health coaching services, to encourage beneficiaries to take a proactive approach to their health. These value-added benefits can make Medigap plans more appealing and competitive in the market.

Conclusion

Medicare Gap Insurance is an essential component of a comprehensive healthcare coverage strategy for Medicare beneficiaries. By understanding the role of Medigap, assessing personal healthcare needs, and staying informed about the latest developments, individuals can make informed decisions to ensure they have the financial protection they need to access quality healthcare services. With the right Medigap plan, beneficiaries can enjoy peace of mind and focus on maintaining their health and well-being.

Can I have both a Medigap plan and a Medicare Advantage plan?

+No, you cannot have both a Medigap plan and a Medicare Advantage plan simultaneously. Medigap plans are designed to supplement Original Medicare, while Medicare Advantage plans are an alternative to Original Medicare. Choosing one or the other is a personal decision based on your healthcare needs and preferences.

Are Medigap plans available in all states?

+Yes, Medigap plans are available in all 50 states and the District of Columbia. However, the specific plans and benefits offered may vary by state. It’s important to check with your state’s insurance department or a licensed insurance agent to understand the available options in your area.

Can I switch Medigap plans after my initial enrollment period?

+Yes, you can switch Medigap plans outside of your initial enrollment period, but it may be subject to medical underwriting. This means that the new insurance company can review your health status and may deny coverage or charge higher premiums based on your health condition. It’s advisable to consult with a licensed insurance agent before making any changes to your Medigap coverage.