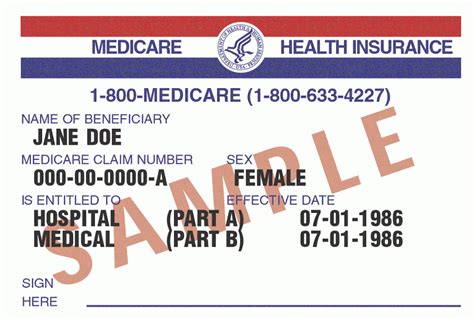

Medicare Health Insurance

Medicare health insurance is a federal program in the United States that provides health coverage to individuals aged 65 and older, as well as certain younger people with disabilities or end-stage renal disease. With an increasing aging population and a growing demand for healthcare services, understanding Medicare and its various aspects is crucial for those approaching eligibility and seeking comprehensive healthcare coverage. This comprehensive guide aims to delve into the intricacies of Medicare, offering an in-depth analysis of its components, benefits, eligibility criteria, and more.

Understanding the Basics of Medicare

Medicare is a vital healthcare program designed to cater to the unique needs of older adults and individuals with specific disabilities. It is administered by the Centers for Medicare & Medicaid Services (CMS), a federal agency within the Department of Health and Human Services. The program is divided into several parts, each covering different aspects of healthcare and offering varying levels of flexibility and benefits.

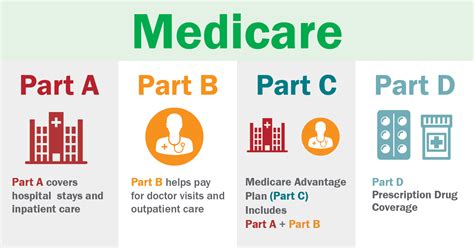

Parts of Medicare

- Part A (Hospital Insurance): This part of Medicare covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home healthcare services. Part A is typically premium-free for those who have worked and paid Medicare taxes for a certain period. It is often referred to as Original Medicare.

- Part B (Medical Insurance): Part B covers outpatient medical services, including doctor visits, lab tests, durable medical equipment, and some preventive services. Enrollees typically pay a monthly premium for Part B coverage.

- Part C (Medicare Advantage): Part C plans, also known as Medicare Advantage, are offered by private insurance companies that contract with Medicare. These plans provide all the benefits of Parts A and B, and often include additional benefits like prescription drug coverage, vision, and dental care. Enrollees must have both Part A and Part B to join a Part C plan.

- Part D (Prescription Drug Coverage): Part D plans are also offered by private insurance companies and help cover the cost of prescription medications. This part of Medicare is crucial for managing chronic conditions and maintaining overall health. There are penalties for not enrolling in Part D when first eligible.

Each part of Medicare has its own set of rules, benefits, and costs. Understanding these nuances is essential for making informed decisions about healthcare coverage.

Eligibility and Enrollment

Eligibility for Medicare is primarily based on age and work history. However, there are also special circumstances that can make individuals eligible at a younger age.

Age-Based Eligibility

The standard eligibility age for Medicare is 65. If you are turning 65, you can enroll during your Initial Enrollment Period (IEP), which starts three months before your birthday month and extends for seven months after. It is crucial to note that failing to enroll during this period may result in late enrollment penalties.

| Eligibility Age | Description |

|---|---|

| 65 years | Standard eligibility age for Medicare Part A and Part B. |

| 66 years | The age at which the full retirement age for Medicare eligibility increases. |

| 67 years | Some individuals born after 1959 may need to wait until they are 67 to enroll in Medicare. |

Work-Based Eligibility

To be eligible for premium-free Part A coverage, you must have worked and paid Medicare taxes for at least 10 years (40 quarters). If you haven't worked enough quarters, you can still buy Part A coverage by paying a monthly premium.

Disability-Based Eligibility

Certain individuals under the age of 65 may qualify for Medicare if they have been receiving Social Security Disability Insurance (SSDI) benefits for at least 24 months. This includes people with disabilities and those with end-stage renal disease (ESRD) requiring dialysis or a kidney transplant.

Coverage and Benefits

Medicare provides a wide range of healthcare services, but it's important to understand what is covered and what is not. Let's explore the key benefits of each part of Medicare.

Part A Benefits

- Inpatient Hospital Care: Covers stays in a hospital or skilled nursing facility.

- Hospice Care: Provides support and care for terminally ill individuals.

- Home Healthcare: Offers skilled nursing care, physical therapy, and other services in the comfort of one's home.

Part B Benefits

- Doctor Visits: Covers services and procedures performed by physicians.

- Preventive Services: Includes annual wellness visits, screenings, and immunizations.

- Diagnostic Tests: Covers lab work, X-rays, and other diagnostic procedures.

Part C (Medicare Advantage) Benefits

Medicare Advantage plans offer all the benefits of Original Medicare (Parts A and B) and may include additional benefits such as:

- Prescription drug coverage (Part D)

- Vision and dental care

- Hearing aids

- Fitness programs

- Chronic disease management

Part D Benefits

Part D plans cover a wide range of prescription medications. Each plan has its own formulary, or list of covered drugs. It's important to choose a plan that covers the medications you need.

Choosing the Right Medicare Plan

With so many options available, choosing the right Medicare plan can be overwhelming. Here are some key considerations to help you make an informed decision.

Assessing Your Healthcare Needs

Evaluate your current and future healthcare needs. Consider factors such as chronic conditions, prescription medications, and the level of flexibility you desire in choosing healthcare providers.

Comparing Plan Costs and Benefits

Review the costs and benefits of different plans. Compare premiums, deductibles, copayments, and out-of-pocket limits. Consider the coverage for your specific healthcare needs, including prescription drugs and any additional benefits you may require.

Enrolling in Multiple Parts

Depending on your needs, you may need to enroll in multiple parts of Medicare. For example, you may need Part A and Part B (Original Medicare) along with a Part D prescription drug plan. If you choose a Medicare Advantage plan (Part C), it will typically include Part A, Part B, and often Part D coverage.

Medicare and Supplemental Insurance

Medicare alone may not cover all your healthcare costs. This is where supplemental insurance, also known as Medigap, comes into play. Medigap policies are sold by private insurance companies and are designed to fill in the gaps in Original Medicare coverage.

Understanding Medigap Policies

Medigap policies are identified by letters A through N, with each offering a different level of coverage. These policies can help cover copayments, coinsurance, and deductibles not covered by Original Medicare. It's important to note that Medigap policies cannot be used with Medicare Advantage plans.

Choosing a Medigap Policy

When selecting a Medigap policy, consider your healthcare needs and budget. Evaluate the coverage offered by each policy and choose one that best fits your requirements. Remember, you can only have one Medigap policy at a time, and there may be health and enrollment restrictions.

Future of Medicare

As the population ages and healthcare costs continue to rise, the future of Medicare is a topic of ongoing discussion and debate. Here are some key considerations for the future of this vital healthcare program.

Addressing Rising Healthcare Costs

With healthcare costs on the rise, Medicare faces the challenge of providing adequate coverage while controlling costs. This includes exploring ways to reduce spending on prescription drugs, improving efficiency in healthcare delivery, and encouraging preventative care.

Expanding Coverage and Access

Efforts are being made to expand Medicare coverage to include more services and address the needs of a diverse population. This includes proposals to cover dental, vision, and hearing services, as well as initiatives to improve access to healthcare in underserved areas.

Modernizing Technology and Administration

The CMS is working to modernize Medicare's technology infrastructure and administrative processes. This includes adopting electronic health records, improving data analytics, and streamlining enrollment and claims processes to enhance efficiency and reduce fraud.

FAQs

When can I enroll in Medicare if I am turning 65 this year?

+If you are turning 65 this year, you can enroll in Medicare during your Initial Enrollment Period (IEP), which starts three months before your birthday month and extends for seven months after. It is important to note that you may face late enrollment penalties if you do not enroll during this period.

What happens if I miss my Initial Enrollment Period for Medicare Part B?

+If you miss your Initial Enrollment Period for Medicare Part B, you may face a late enrollment penalty. This penalty is typically a permanent increase in your monthly premium. It is important to enroll during your IEP to avoid these penalties.

Can I have both Medicare and private insurance coverage at the same time?

+Yes, you can have both Medicare and private insurance coverage at the same time. However, it is important to understand how these plans work together and to avoid duplicate coverage. Some private insurance plans, such as employer-sponsored plans, may coordinate benefits with Medicare.

Medicare is a complex yet vital program that provides essential healthcare coverage to millions of Americans. By understanding the different parts of Medicare, eligibility criteria, and available benefits, individuals can make informed decisions about their healthcare coverage. As the program continues to evolve, staying informed about changes and exploring options like Medicare Advantage and Medigap policies can help ensure access to quality healthcare as we age.