Medicare Insurance

Medicare insurance is a vital component of the healthcare system in the United States, providing essential coverage and peace of mind to millions of individuals. As a complex and often confusing topic, understanding the intricacies of Medicare is crucial for making informed decisions about your healthcare and financial well-being. This comprehensive guide aims to demystify Medicare insurance, exploring its various aspects, eligibility criteria, coverage options, and the benefits it offers to eligible individuals.

Unraveling Medicare: A Comprehensive Overview

Medicare, established in 1965 under the Social Security Act, is a federal health insurance program primarily designed for individuals aged 65 and older. However, it also extends its coverage to younger individuals with specific disabilities or medical conditions. This program plays a pivotal role in ensuring that older adults and those with qualifying disabilities have access to affordable and comprehensive healthcare services.

The Medicare program is administered by the Centers for Medicare and Medicaid Services (CMS), a federal agency within the U.S. Department of Health and Human Services (HHS). CMS oversees the implementation and management of Medicare, working closely with healthcare providers, insurance companies, and beneficiaries to ensure the program's effectiveness and accessibility.

One of the key strengths of Medicare is its ability to adapt to the evolving needs of its beneficiaries. Over the years, the program has undergone several significant changes and expansions, introducing new benefits and options to enhance coverage and cater to diverse healthcare requirements.

The Evolution of Medicare: A Historical Perspective

The origins of Medicare can be traced back to the social and economic transformations of the mid-20th century. As the country experienced rapid industrialization and an aging population, the need for a comprehensive healthcare program became increasingly evident. The Social Security Amendments of 1965, signed into law by President Lyndon B. Johnson, marked a significant milestone, establishing Medicare and Medicaid as critical components of the nation’s social safety net.

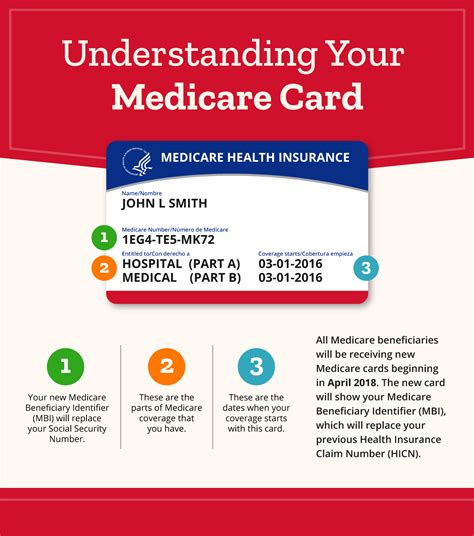

Initially, Medicare consisted of two main parts: Part A, which covered hospital insurance, and Part B, which provided medical insurance. Over time, the program expanded to include Part C (Medicare Advantage plans) and Part D (prescription drug coverage), offering beneficiaries a wider range of options to customize their healthcare coverage according to their unique needs.

The evolution of Medicare has been a response to the changing healthcare landscape and the evolving demands of an aging population. As medical advancements and technologies have transformed the way healthcare is delivered, Medicare has adapted to ensure that its beneficiaries have access to the latest treatments and innovations.

Understanding Medicare Eligibility

Eligibility for Medicare is based on specific criteria, primarily revolving around age and certain disability-related qualifications. Generally, individuals become eligible for Medicare when they turn 65 years old. However, younger individuals with certain disabilities or medical conditions may also qualify for Medicare coverage.

For those who are not yet 65, the primary eligibility criterion is the receipt of Social Security Disability Insurance (SSDI) or Railroad Retirement Board (RRB) disability benefits for at least 24 months. Additionally, individuals with End-Stage Renal Disease (ESRD) or amyotrophic lateral sclerosis (ALS, also known as Lou Gehrig's disease) are eligible for Medicare regardless of their age.

Understanding the eligibility criteria is crucial for planning and preparing for Medicare coverage. It allows individuals to make informed decisions about their healthcare and financial strategies, ensuring a seamless transition into the Medicare program when the time comes.

Parts of Medicare: Navigating the Coverage Options

Medicare is divided into different parts, each offering unique coverage and benefits. Understanding these parts is essential for choosing the right Medicare plan that aligns with your specific healthcare needs and preferences.

Part A: Hospital Insurance

Medicare Part A covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home healthcare services. It is often referred to as the “original” Medicare, as it has been a fundamental component of the program since its inception. Part A is premium-free for most individuals who have worked and paid Medicare taxes for a minimum of 10 years.

Part A provides coverage for a wide range of inpatient services, including hospital stays, skilled nursing care, and hospice care. It offers a safety net for beneficiaries, ensuring that they have access to necessary medical services without incurring significant financial burdens.

One of the key advantages of Part A is its coverage of skilled nursing facility care. This benefit is particularly beneficial for individuals who require post-hospital care or rehabilitation services. Part A also covers a portion of home healthcare services, providing in-home medical care for beneficiaries who meet certain eligibility criteria.

| Medicare Part A Coverage | Details |

|---|---|

| Inpatient Hospital Stays | Covers up to 90 days per benefit period, with a deductible and coinsurance |

| Skilled Nursing Facility Care | Covers up to 100 days per benefit period, with specific criteria |

| Hospice Care | Provides coverage for palliative and end-of-life care services |

| Home Healthcare | Covers certain medical services and equipment for home-based care |

Part B: Medical Insurance

Medicare Part B covers outpatient medical services and supplies, including doctor visits, lab tests, durable medical equipment, and some preventive services. Part B is typically available to individuals upon enrollment in Part A, and it requires a monthly premium payment.

Part B is an essential component of Medicare, as it covers a wide range of outpatient services and supplies that are crucial for maintaining good health. This includes doctor visits, whether in a clinic or hospital setting, as well as various diagnostic tests and procedures.

One of the key benefits of Part B is its coverage of durable medical equipment (DME), such as wheelchairs, walkers, and oxygen equipment. This ensures that beneficiaries have access to necessary medical devices to support their daily activities and overall well-being.

Part B also includes coverage for certain preventive services, such as annual wellness visits, cancer screenings, and immunizations. These preventive measures play a vital role in early detection and management of health conditions, contributing to better long-term health outcomes.

| Medicare Part B Coverage | Details |

|---|---|

| Doctor Visits | Covers visits to physicians, surgeons, and other medical professionals |

| Lab Tests | Includes diagnostic tests and procedures |

| Durable Medical Equipment (DME) | Covers wheelchairs, walkers, oxygen equipment, and more |

| Preventive Services | Annual wellness visits, cancer screenings, and immunizations |

Part C: Medicare Advantage Plans

Medicare Part C, also known as Medicare Advantage, offers an alternative way to receive Medicare benefits. These plans are provided by private insurance companies approved by Medicare and must cover all the services that Parts A and B cover. Part C plans often include additional benefits, such as prescription drug coverage, dental, vision, and hearing services.

Part C plans are a popular choice for many beneficiaries, as they provide a more comprehensive and customizable approach to Medicare coverage. These plans offer a wide range of benefits beyond the traditional Parts A and B, addressing the diverse healthcare needs of individuals.

One of the key advantages of Part C plans is their inclusion of prescription drug coverage. This is particularly beneficial for individuals who require ongoing medication management, as it simplifies the process and reduces out-of-pocket expenses.

Part C plans also often include additional benefits, such as dental, vision, and hearing services. These added perks enhance the overall healthcare experience for beneficiaries, ensuring that their specific needs are met.

Part D: Prescription Drug Coverage

Medicare Part D is a standalone prescription drug plan that can be added to Original Medicare (Parts A and B) or a Medicare Advantage plan. Part D plans are offered by private insurance companies and provide coverage for prescription medications. Enrolling in a Part D plan is optional, but it is crucial for individuals who require ongoing medication management.

Part D plans play a vital role in ensuring that beneficiaries have access to necessary prescription medications at affordable costs. These plans are designed to cover a wide range of drugs, including brand-name and generic medications, to meet the diverse needs of individuals with various medical conditions.

One of the key benefits of Part D plans is their flexibility. Beneficiaries can choose from a variety of plans offered by different insurance companies, allowing them to select the plan that best aligns with their specific medication needs and budget.

It is important to note that Part D plans have different formularies, which are lists of covered drugs. When selecting a Part D plan, it is crucial to consider the medications you regularly take and ensure that they are covered by the plan's formulary.

Medicare Enrollment and Costs

Enrolling in Medicare and understanding the associated costs are crucial steps in ensuring a smooth transition into the program. The enrollment process and cost structure can vary depending on the specific Medicare plan and individual circumstances.

Initial Enrollment Period

The Initial Enrollment Period (IEP) is a critical time for individuals who are approaching Medicare eligibility. This period begins three months before the month of their 65th birthday and extends for seven months, including the birthday month itself. During this time, individuals can enroll in Medicare without incurring any late enrollment penalties.

The IEP is a crucial opportunity for individuals to ensure they are enrolled in Medicare in a timely manner. Missing the IEP may result in late enrollment penalties, which can increase the cost of Medicare coverage. It is essential to be aware of this period and take the necessary steps to enroll during this window.

Late Enrollment Penalties

If an individual fails to enroll in Medicare during their IEP, they may be subject to late enrollment penalties. These penalties can lead to higher monthly premiums for Medicare Part B and Part D coverage. The penalties are based on the number of full, uninterrupted 12-month periods that an individual was eligible for Medicare but did not enroll.

It is important to understand that late enrollment penalties can have a significant impact on the cost of Medicare coverage. These penalties are designed to incentivize timely enrollment and discourage individuals from delaying their enrollment unnecessarily.

Medicare Costs: Premiums, Deductibles, and Copayments

Medicare costs can vary depending on the specific plan and coverage chosen. Generally, Medicare Part A is premium-free for most individuals, while Part B, Part C, and Part D plans require monthly premiums. Additionally, beneficiaries may incur deductibles and copayments for certain services and medications.

Understanding the cost structure of Medicare is essential for financial planning and budgeting. While Medicare provides valuable coverage, it is important to be aware of the associated costs and ensure that they align with your financial capabilities.

Premiums, deductibles, and copayments can vary significantly between different Medicare plans and even within the same plan. It is crucial to carefully review the cost structure of each plan and consider your specific healthcare needs and budget when making your enrollment decision.

Medicare Supplements: Enhancing Coverage

Medicare Supplements, also known as Medigap plans, are designed to fill the gaps in Original Medicare coverage. These plans are offered by private insurance companies and can help cover certain costs that Medicare Parts A and B do not fully cover, such as copayments, coinsurance, and deductibles.

Medigap plans play a crucial role in providing additional financial protection for Medicare beneficiaries. By covering certain out-of-pocket expenses, these plans can significantly reduce the financial burden associated with healthcare services.

One of the key advantages of Medigap plans is their flexibility. Beneficiaries can choose from a variety of plans, each with different benefits and cost structures. This allows individuals to select a plan that best suits their specific healthcare needs and budget.

It is important to note that Medigap plans are only available to individuals who have Original Medicare (Parts A and B). These plans cannot be used with Medicare Advantage plans (Part C) or other forms of Medicare coverage.

Choosing the Right Medigap Plan

Selecting the right Medigap plan requires careful consideration of your healthcare needs and budget. It is essential to review the benefits and cost structure of each plan to ensure that it aligns with your specific requirements.

When choosing a Medigap plan, it is crucial to assess your medical history and anticipate your future healthcare needs. Consider the types of services and treatments you may require and ensure that the plan covers these expenses adequately.

Additionally, it is important to compare the cost of different Medigap plans. While some plans may offer more comprehensive coverage, they may also come with higher premiums. Finding a balance between coverage and affordability is key to making an informed decision.

Medicare and Prescription Drug Coverage

Prescription drug coverage is a critical aspect of Medicare, as many individuals rely on medications to manage their health conditions. Understanding the options for prescription drug coverage is essential for ensuring access to necessary medications at affordable prices.

Medicare Part D Plans

Medicare Part D plans, as mentioned earlier, are standalone prescription drug plans that can be added to Original Medicare or a Medicare Advantage plan. These plans are offered by private insurance companies and provide coverage for prescription medications.

Part D plans are designed to cover a wide range of prescription drugs, including both brand-name and generic medications. Beneficiaries can choose from various Part D plans, each with its own formulary and cost structure. It is important to carefully review the formulary to ensure that your required medications are covered by the plan.

When selecting a Part D plan, consider your medication needs and budget. Some plans may offer lower premiums but have higher copayments or deductibles, while others may have higher premiums but provide more comprehensive coverage. Finding the right balance is crucial for ensuring access to necessary medications without straining your finances.

Medicare Advantage Plans with Prescription Drug Coverage

Medicare Advantage plans (Part C) often include prescription drug coverage as part of their benefits package. These plans are provided by private insurance companies and offer a more comprehensive approach to Medicare coverage.

Medicare Advantage plans with prescription drug coverage combine the benefits of Original Medicare (Parts A and B) with additional perks, such as dental, vision, and hearing services. By enrolling in one of these plans, beneficiaries can enjoy a more streamlined and cost-effective approach to their healthcare needs.

It is important to note that not all Medicare Advantage plans include prescription drug coverage. When considering a Medicare Advantage plan, carefully review the benefits and ensure that prescription drug coverage is included if it is a priority for you.

Navigating Medicare: Resources and Support

Navigating the complexities of Medicare can be challenging, but various resources and support systems are available to assist individuals in making informed decisions.

Medicare.gov

The official Medicare website, Medicare.gov, is a valuable resource for individuals seeking information about Medicare coverage, eligibility, and enrollment. The website provides comprehensive guides, tools, and resources to help beneficiaries understand their options and make informed choices.

Medicare.gov offers a wealth of information, including detailed explanations of each Medicare part, eligibility criteria, enrollment periods, and cost estimates. The website also provides a plan finder tool, allowing individuals to compare different Medicare plans based on their specific needs and location.

Additionally, Medicare.gov offers resources for specific populations, such as individuals with disabilities or those who require language assistance. The website is regularly updated to reflect the latest changes and developments in the Medicare program.

Medicare Information and Counseling Hotline

The Medicare Information and Counseling Hotline is a toll-free number that provides assistance and guidance to Medicare beneficiaries. The hotline is staffed by trained specialists who can answer questions about Medicare coverage, eligibility, and enrollment.

The Medicare Information and Counseling Hotline is a valuable resource for individuals who prefer to speak with someone directly to address their concerns. Specialists can provide personalized advice and guidance based on an individual's specific circumstances and healthcare needs.

The hotline is available Monday through Friday, 8:00 a.m. to 8:00 p.m. Eastern Time. Calls are confidential, and the specialists are committed to providing accurate and up-to-date information to help beneficiaries make informed decisions about their Medicare coverage.

State Health Insurance Assistance Programs (SHIPs)

State Health Insurance Assistance Programs (SHIPs) are state-based programs that provide free, unbiased counseling and assistance to Medicare beneficiaries. These programs are funded by the Centers for Medicare and Medicaid Services (CMS) and are available in every state and U.S. territory.

SHIPs offer a wide range of services, including assistance with Medicare enrollment, plan selection, and appeals. Trained counselors can provide personalized guidance based on an individual’s specific needs and circumstances. They can help beneficiaries understand their Medicare coverage options, compare different plans, and address