Medicare Supplemental Insurance Plans

Medicare Supplemental Insurance Plans, also known as Medigap plans, play a crucial role in enhancing the coverage provided by original Medicare, which includes Part A (hospital insurance) and Part B (medical insurance). These supplemental plans are designed to fill the gaps in coverage, offering financial protection and peace of mind to millions of Americans who rely on Medicare. In this comprehensive guide, we will delve into the world of Medicare Supplemental Insurance Plans, exploring their significance, types, benefits, and how they can be tailored to meet individual healthcare needs.

Understanding Medicare Supplemental Insurance Plans

Medicare Supplemental Insurance Plans, or Medigap, are private insurance policies that supplement the coverage offered by original Medicare. These plans are standardized, meaning that the benefits provided by a specific Medigap plan are consistent across different insurance companies. This standardization ensures that beneficiaries have a clear understanding of the coverage they are receiving, regardless of the provider they choose.

The primary purpose of Medigap plans is to cover the out-of-pocket costs that original Medicare does not typically cover, such as deductibles, co-payments, and co-insurance. By filling these gaps, Medigap plans help individuals manage their healthcare expenses more effectively, reducing the financial burden associated with medical treatments and procedures.

It is important to note that Medigap plans are designed to work alongside original Medicare, not replace it. Enrollees must have both Part A and Part B of Medicare to be eligible for Medigap coverage. Additionally, Medigap plans do not cover prescription drugs, which are typically covered by a separate Medicare Part D plan.

Types of Medicare Supplemental Insurance Plans

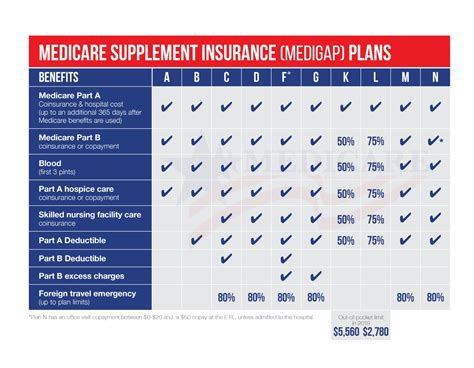

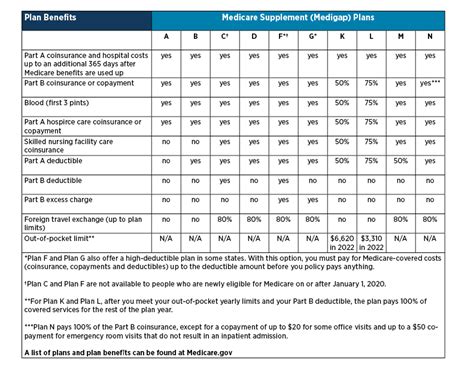

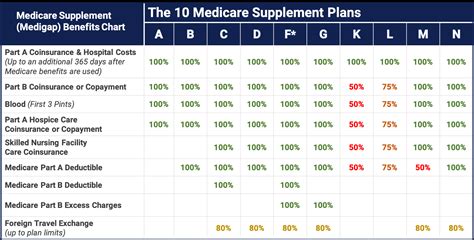

There are currently ten standardized Medigap plans available, labeled A through N, with varying levels of coverage. The specific benefits offered by each plan may vary slightly from one insurance company to another, but the overall coverage remains consistent. Here is a breakdown of the different Medigap plans and the key benefits they provide:

Plan A

Plan A is the most basic Medigap plan, covering the following:

- Part A Deductible: The annual deductible for inpatient hospital stays.

- Part B Deductible: The annual deductible for medical services under Part B.

Plan B

Plan B offers the same coverage as Plan A, plus the following additional benefits:

- Part B Excess Charges: Covers excess charges that Medicare Part B may not pay.

Plan C

Plan C provides a comprehensive level of coverage, including:

- All benefits of Plan A and B.

- Part A Coinsurance or Copayments: Covers additional costs after the Part A deductible is met.

- Blood Deductible: Covers the cost of blood transfusions.

- Foreign Travel Emergency: Provides coverage for emergency care during international travel.

Plan D

Plan D is similar to Plan C, but with a few key differences:

- It includes all the benefits of Plan A and B.

- Offers coverage for Part A coinsurance or copayments and blood deductible.

- Unlike Plan C, Plan D does not provide coverage for foreign travel emergencies.

Plan F

Plan F is the most comprehensive Medigap plan, covering all out-of-pocket costs that original Medicare does not cover. This plan includes:

- All benefits of Plan A, B, C, and D.

- Medicare Part B Excess Charges: Covers any excess charges that may arise.

Plan G

Plan G is similar to Plan F but with one notable difference. It covers all out-of-pocket costs except for the Medicare Part B deductible. Here is a breakdown of its coverage:

- All benefits of Plan A and B.

- Covers Part A coinsurance or copayments, blood deductible, and foreign travel emergency.

- Does not provide coverage for the Part B deductible, making it a cost-effective option for those who prioritize lower premiums.

Plan K and L

Plans K and L are unique in that they offer cost-sharing benefits. These plans cover a percentage of the costs, with the enrollee paying the remaining amount up to a certain limit. Once the limit is reached, the plan covers 100% of the costs. The coverage details are as follows:

- Plan K: Covers 75% of the Part A deductible, Part B deductible, Part A coinsurance or copayments, and foreign travel emergency.

- Plan L: Provides coverage for 50% of the aforementioned costs, making it a more comprehensive option.

Plan M

Plan M is a middle-ground option, offering coverage for some, but not all, out-of-pocket costs. Here are the key benefits:

- Covers Part A deductible and Part B deductible.

- Provides partial coverage for Part A coinsurance or copayments and foreign travel emergency.

Plan N

Plan N is another cost-sharing plan, similar to Plans K and L. It covers a portion of the costs, with the enrollee paying the rest. The coverage details are as follows:

- Covers Part A deductible and Part B deductible.

- Provides partial coverage for Part A coinsurance or copayments, excess charges, and foreign travel emergency.

Benefits and Advantages of Medicare Supplemental Insurance Plans

Medicare Supplemental Insurance Plans offer a multitude of benefits and advantages to individuals enrolled in original Medicare. Here are some key advantages:

Reduced Out-of-Pocket Costs

One of the primary benefits of Medigap plans is the significant reduction in out-of-pocket healthcare expenses. By covering deductibles, co-payments, and co-insurance, these plans ensure that beneficiaries are not burdened with unexpected or excessive costs when seeking medical treatment.

Standardized Coverage

The standardization of Medigap plans means that beneficiaries can easily compare different plans and choose the one that best suits their needs. The consistent coverage across insurance companies simplifies the decision-making process and provides transparency.

Flexibility and Choice

With ten different standardized plans to choose from, beneficiaries have the flexibility to select a plan that aligns with their healthcare requirements and budget. Whether they prioritize comprehensive coverage or cost-effective options, there is a Medigap plan tailored to their preferences.

Peace of Mind

Medigap plans provide peace of mind by offering financial protection and certainty. Enrollees can rest assured that their medical expenses will be covered, reducing the stress and anxiety associated with potential healthcare costs.

Tailored Coverage

Medigap plans allow individuals to customize their coverage based on their specific needs. For example, someone who frequently travels internationally may opt for a plan that includes foreign travel emergency coverage. This level of customization ensures that beneficiaries receive the exact coverage they require.

Performance Analysis and Real-World Examples

Medicare Supplemental Insurance Plans have consistently demonstrated their effectiveness in providing additional financial support to Medicare beneficiaries. Numerous studies and real-world examples highlight the positive impact of Medigap coverage on individuals’ healthcare experiences.

For instance, a study conducted by the Kaiser Family Foundation found that Medigap enrollees had significantly lower out-of-pocket expenses compared to those without supplemental coverage. The study analyzed data from 2016 and revealed that the average annual out-of-pocket spending for Medigap beneficiaries was $2,037, while those without supplemental coverage spent an average of $4,534.

Another real-world example illustrates the value of Medigap plans in a practical scenario. Consider an individual with original Medicare who undergoes a major surgical procedure. Without supplemental coverage, they would be responsible for the Part A deductible, co-insurance, and any excess charges. However, with a Medigap plan, these out-of-pocket costs are significantly reduced or even eliminated, depending on the chosen plan.

Furthermore, Medigap plans have been particularly beneficial for individuals with chronic conditions or those who require frequent medical care. By covering a larger portion of their healthcare expenses, these plans alleviate the financial strain and enable beneficiaries to focus on their well-being without worrying about costly medical bills.

Evidence-Based Future Implications

The future of Medicare Supplemental Insurance Plans looks promising, with ongoing efforts to improve and enhance the coverage options available to beneficiaries. Here are some key implications and potential developments:

Expansion of Coverage Options

There is a growing recognition of the importance of Medigap plans in providing comprehensive healthcare coverage. As a result, there may be a push for the introduction of new plan types or the expansion of existing plans to address specific healthcare needs. This could include plans with more affordable premiums or those tailored to individuals with specific conditions or preferences.

Improved Standardization

To further enhance transparency and ease of comparison, efforts may be made to standardize Medigap plans even further. This could involve streamlining the benefits across all plans or simplifying the language used in policy documents to make it more accessible and understandable for beneficiaries.

Integration with Other Medicare Programs

There is a possibility of greater integration between Medigap plans and other Medicare programs, such as Medicare Advantage (Part C) and Medicare Part D (prescription drug coverage). This integration could lead to more holistic and coordinated healthcare coverage, ensuring that beneficiaries have seamless access to the care they need without gaps in coverage.

Increased Education and Awareness

With the complexity of Medicare and Medigap plans, there is a need for increased education and awareness among beneficiaries. Ongoing efforts to simplify the enrollment process, provide clear and concise information, and offer personalized guidance can empower individuals to make informed decisions about their healthcare coverage.

Technology Integration

The healthcare industry is increasingly leveraging technology to improve efficiency and accessibility. Medigap plans may integrate digital tools and platforms to enhance the overall experience for beneficiaries. This could include online enrollment, real-time claim processing, and digital resources for plan comparison and management.

Enhanced Cost-Sharing Options

To cater to a diverse range of financial situations, there may be a focus on developing more flexible and customizable cost-sharing options within Medigap plans. This could involve introducing new plan types with varying levels of cost-sharing or allowing beneficiaries to choose their preferred level of coverage and cost-sharing.

Addressing Gaps in Coverage

Medicare and Medigap plans have historically had certain gaps in coverage, such as dental, vision, and hearing services. Future developments may aim to address these gaps, providing more comprehensive coverage options to meet the diverse healthcare needs of beneficiaries.

Conclusion

Medicare Supplemental Insurance Plans, or Medigap, play a vital role in enhancing the coverage provided by original Medicare. With a range of standardized plans to choose from, beneficiaries can tailor their coverage to meet their specific healthcare needs and budget. The benefits of Medigap plans, including reduced out-of-pocket costs, standardized coverage, and peace of mind, make them an essential component of a comprehensive healthcare strategy for Medicare enrollees.

As the healthcare landscape continues to evolve, Medigap plans are likely to adapt and improve, ensuring that beneficiaries have access to the financial protection and support they require. With ongoing efforts to expand coverage options, improve standardization, and integrate with other Medicare programs, the future of Medicare Supplemental Insurance Plans looks bright, offering individuals greater control and security over their healthcare journey.

How do I choose the right Medigap plan for my needs?

+Choosing the right Medigap plan involves assessing your specific healthcare needs and budget. Consider factors such as your anticipated medical expenses, prescription drug coverage (which Medigap plans do not cover), and your financial situation. Evaluate the benefits and costs of each plan to find the one that best suits your requirements. It’s also beneficial to consult with a licensed insurance agent or Medicare counselor who can provide personalized guidance.

Are Medigap plans available in all states?

+Yes, Medigap plans are available in all 50 states and the District of Columbia. However, the specific plans and their availability may vary slightly from state to state. It’s important to check with your state’s Medicare office or a local insurance agent to understand the options available in your area.

Can I enroll in a Medigap plan at any time?

+Enrollment in Medigap plans is subject to certain guidelines. You typically have a Medigap Open Enrollment Period when you first become eligible for Medicare Part A and Part B. During this period, insurance companies cannot deny you coverage or charge you more due to pre-existing conditions. It’s important to note that you may face late enrollment penalties if you miss this open enrollment period.

Do Medigap plans cover long-term care expenses?

+No, Medigap plans do not cover long-term care expenses such as nursing home care or assisted living facilities. These expenses are typically covered by separate long-term care insurance policies or Medicaid. It’s important to assess your long-term care needs and explore appropriate coverage options to ensure you have adequate financial protection.

Can I switch my Medigap plan if I’m not satisfied with it?

+Yes, you have the option to switch your Medigap plan if you find that it doesn’t meet your needs or if you discover a more suitable plan. However, it’s important to note that switching plans may have certain implications, such as undergoing a new medical underwriting process or facing higher premiums. Consult with a licensed insurance agent to understand the best course of action and ensure a smooth transition.