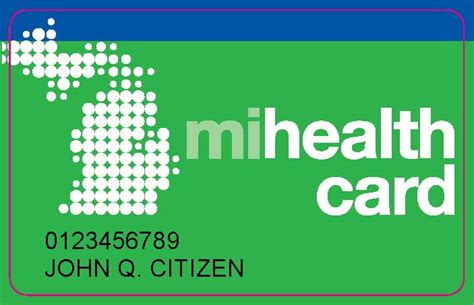

Michigan Health Care Insurance

Navigating the complex landscape of health care insurance can be daunting, especially when it comes to understanding the specific options available in each state. Michigan, with its diverse population and unique healthcare needs, presents a range of insurance plans and policies tailored to its residents. This article aims to provide an in-depth exploration of Michigan health care insurance, offering a comprehensive guide to help individuals and families make informed decisions about their coverage.

Understanding Michigan’s Healthcare Landscape

Michigan’s healthcare system is characterized by a mix of public and private providers, offering a wide range of services across the state. From major metropolitan areas like Detroit and Grand Rapids to rural communities, access to healthcare varies, presenting unique challenges and opportunities for insurers and policyholders alike.

The state's healthcare infrastructure includes renowned medical centers, such as the University of Michigan Health System and Henry Ford Health System, which provide advanced care and cutting-edge treatments. Additionally, Michigan boasts a strong network of community health centers and rural clinics, ensuring that primary care is accessible to residents across the state.

Key Healthcare Challenges in Michigan

Despite these advancements, Michigan, like many other states, faces several healthcare challenges. These include the rising costs of medical treatments, the increasing prevalence of chronic diseases, and the need to address healthcare disparities, particularly in underserved communities.

The COVID-19 pandemic has further highlighted the importance of robust healthcare systems and equitable access to quality care. Michigan's response to the pandemic has involved a combination of public health measures, community outreach, and innovative healthcare solutions, all of which have influenced the state's healthcare insurance landscape.

Michigan’s Health Insurance Market

The health insurance market in Michigan is diverse and competitive, offering a range of plans to cater to the varying needs of its residents. These plans are typically categorized into individual and family plans, as well as employer-sponsored group plans.

Individual and Family Plans

Individual health insurance plans in Michigan are designed for those who are self-employed, not eligible for group coverage, or who simply prefer to manage their own health insurance. These plans offer a variety of coverage options, from basic catastrophic coverage to more comprehensive plans that cover a wider range of services.

Family health insurance plans, on the other hand, are tailored to cover the healthcare needs of an entire household. These plans often include coverage for dependents, such as children or elderly parents, and can provide significant savings over purchasing multiple individual plans.

Employer-Sponsored Group Plans

Many Michigan residents receive their health insurance coverage through their employers. These employer-sponsored group plans are often more cost-effective than individual plans and can offer a wider range of benefits and coverage options. Employers typically contribute to the cost of these plans, making them a popular choice for employees.

Key Features of Michigan Health Insurance Plans

Michigan health insurance plans, whether individual, family, or group, share several key features that distinguish them from plans in other states.

Coverage Benefits

Michigan health insurance plans generally offer coverage for a wide range of services, including:

- Preventive care: Regular check-ups, screenings, and immunizations.

- Hospitalization: Inpatient care, including surgery and emergency services.

- Prescription drugs: Coverage for a range of medications, often with preferred pharmacies.

- Mental health and substance abuse: Treatment for mental health conditions and addiction.

- Maternity and newborn care: Prenatal care, delivery, and postnatal services.

- Dental and vision: Basic dental and vision care, with the option to purchase additional coverage.

Network of Providers

Health insurance plans in Michigan typically have networks of providers, which include hospitals, clinics, and individual healthcare practitioners. These networks are designed to offer policyholders access to a range of high-quality healthcare services while also keeping costs down. Out-of-network care is often more expensive and may not be fully covered by the insurance plan.

Cost-Sharing Measures

To manage healthcare costs, Michigan health insurance plans employ various cost-sharing measures, such as:

- Deductibles: The amount an insured person must pay out of pocket before the insurance company starts to cover claims.

- Copayments: A fixed amount the insured pays for a covered service, in addition to any deductible.

- Coinsurance: The percentage of costs the insured must pay after meeting their deductible, typically until an annual out-of-pocket maximum is reached.

- Out-of-pocket maximums: The limit on the amount an insured person must pay in a year for covered services.

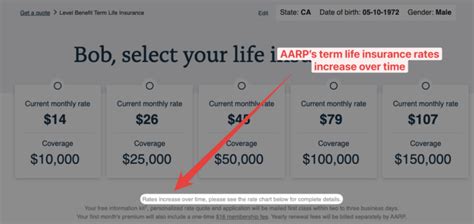

Understanding Health Insurance Premiums

Health insurance premiums are the regular payments made by policyholders to maintain their coverage. In Michigan, these premiums can vary significantly depending on several factors.

Factors Affecting Premiums

The cost of health insurance premiums in Michigan can be influenced by:

- Age: Generally, premiums increase with age, as older individuals are more likely to require healthcare services.

- Location: Premiums can vary between different regions of the state, with urban areas often having higher costs.

- Plan type: Different types of plans, such as Bronze, Silver, Gold, and Platinum, offer varying levels of coverage and have different premium costs.

- Tobacco use: Insurers may charge higher premiums for individuals who use tobacco products.

- Family size: Family plans often offer more comprehensive coverage and may have higher premiums.

Premium Subsidies and Assistance

Michigan residents who purchase health insurance through the state’s Health Insurance Marketplace may be eligible for premium tax credits, which can significantly reduce the cost of their monthly premiums. These credits are based on income and family size, with lower-income individuals receiving larger credits.

Additionally, Michigan offers a variety of health insurance programs for specific populations, such as Medicaid and the Healthy Michigan Plan, which provide low-cost or no-cost health coverage to eligible residents.

Choosing the Right Health Insurance Plan

Selecting the right health insurance plan in Michigan involves careful consideration of individual and family needs, as well as financial circumstances.

Evaluating Coverage Options

When choosing a health insurance plan, it’s important to consider the specific healthcare needs of yourself and your family. Assess the coverage benefits offered by different plans, including the network of providers, prescription drug coverage, and any additional benefits that may be important to you, such as dental or vision care.

Understanding Out-of-Pocket Costs

In addition to premiums, it’s crucial to understand the out-of-pocket costs associated with your health insurance plan. This includes deductibles, copayments, and coinsurance, as well as any maximum out-of-pocket limits. These costs can vary significantly between plans, so it’s essential to choose a plan that aligns with your expected healthcare needs and budget.

Comparing Provider Networks

Review the provider networks of the plans you’re considering. Ensure that your preferred healthcare providers, such as your primary care physician or specialist, are in-network to avoid higher out-of-network costs. If you frequently travel or have family members who live in different parts of the state, consider plans with broader provider networks to maintain access to care.

Navigating Michigan’s Health Insurance Marketplace

The Health Insurance Marketplace, also known as the Health Insurance Exchange, is a key resource for Michigan residents seeking health insurance coverage. This online platform, created as part of the Affordable Care Act, allows individuals and families to compare and purchase health insurance plans.

Open Enrollment Period

The Health Insurance Marketplace typically has an open enrollment period each year, during which individuals can enroll in a health insurance plan or make changes to their existing coverage. It’s important to be aware of these enrollment deadlines to ensure you have continuous coverage.

Special Enrollment Periods

In addition to the open enrollment period, Michigan residents may also qualify for special enrollment periods. These periods allow individuals to enroll outside of the regular open enrollment if they experience certain life events, such as getting married, having a baby, or losing other health coverage.

Utilizing Michigan’s Healthcare Resources

Beyond health insurance, Michigan offers a range of healthcare resources to support the well-being of its residents.

Preventive Care Initiatives

Michigan has implemented various initiatives to promote preventive care and improve the overall health of its population. These include programs that provide free or low-cost screenings for diseases such as cancer and diabetes, as well as initiatives to address mental health and substance abuse issues.

Community Health Centers

Community health centers play a vital role in providing accessible healthcare to underserved communities in Michigan. These centers offer a range of services, including primary care, dental care, mental health services, and pharmacy services. Many community health centers also provide care on a sliding fee scale, making healthcare more affordable for low-income individuals and families.

Future Trends in Michigan Health Insurance

As healthcare evolves, Michigan’s health insurance landscape is also expected to undergo changes and adaptations.

Embracing Telehealth

The COVID-19 pandemic has accelerated the adoption of telehealth services, and this trend is expected to continue in Michigan. Telehealth allows patients to access healthcare services remotely, often at a lower cost and with greater convenience. As insurers and healthcare providers increasingly integrate telehealth into their offerings, it’s likely to become a standard component of Michigan health insurance plans.

Focus on Value-Based Care

Value-based care models, which focus on the quality and outcomes of healthcare services rather than the quantity of services provided, are gaining traction in Michigan. These models aim to improve patient health outcomes while also controlling costs. As Michigan continues to adopt value-based care approaches, it’s likely that health insurance plans will increasingly incorporate these models into their coverage and reimbursement strategies.

Addressing Healthcare Disparities

Michigan, like many states, is committed to addressing healthcare disparities and ensuring equitable access to quality healthcare. This includes efforts to improve healthcare in underserved communities, expand access to mental health and addiction treatment, and reduce healthcare costs for vulnerable populations. These initiatives are likely to shape the future of health insurance in Michigan, with insurers and policymakers working together to create more inclusive and affordable healthcare options.

Conclusion

Navigating Michigan’s health care insurance landscape requires a comprehensive understanding of the state’s healthcare system, insurance options, and available resources. By considering factors such as coverage benefits, provider networks, and out-of-pocket costs, individuals and families can make informed decisions about their health insurance coverage. As Michigan continues to innovate and adapt its healthcare approaches, residents can look forward to a future of improved access, quality care, and financial protection through health insurance.

How do I know if I’m eligible for premium tax credits in Michigan?

+

Eligibility for premium tax credits in Michigan is based on your income and family size. Generally, individuals and families with incomes between 100% and 400% of the federal poverty level may qualify for these credits. You can use the Health Insurance Marketplace’s eligibility calculator to determine if you’re eligible.

What happens if I miss the open enrollment period for health insurance in Michigan?

+

If you miss the open enrollment period, you may still be able to enroll in a health insurance plan if you qualify for a special enrollment period. Special enrollment periods are triggered by certain life events, such as getting married, having a baby, or losing other health coverage. You’ll need to provide documentation to prove your qualifying event.

Are there any low-cost or no-cost health insurance options for Michigan residents?

+

Yes, Michigan offers several low-cost or no-cost health insurance options. Medicaid, the Healthy Michigan Plan, and other state-funded programs provide health coverage to eligible residents. These programs have specific eligibility criteria based on income, family size, and other factors.