Minimum Car Insurance Texas

Texas, known as the Lone Star State, is renowned for its vast landscapes, vibrant cities, and diverse culture. When it comes to car insurance, understanding the minimum requirements is essential for every driver residing in this great state. In this comprehensive guide, we will delve into the world of Texas car insurance, exploring the legal mandates, coverage options, and practical considerations to ensure you are adequately protected on the roads of Texas.

Understanding the Minimum Car Insurance Requirements in Texas

Texas has established specific guidelines to ensure drivers are financially responsible in the event of an accident. The minimum car insurance requirements in Texas are outlined in the Texas Transportation Code, Chapter 601. These requirements are designed to protect both drivers and their passengers, as well as other road users and pedestrians. Let's break down the key components of the minimum car insurance coverage in Texas.

Liability Coverage

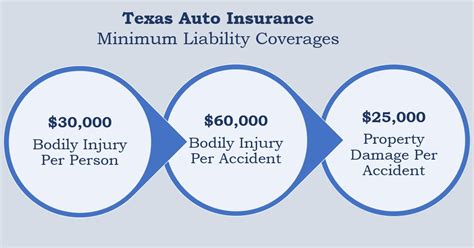

Liability coverage is the cornerstone of car insurance in Texas. It protects you financially if you are found at fault in an accident. The state requires a minimum of $30,000 in bodily injury liability coverage per person and $60,000 per accident. Additionally, Texas mandates a minimum of $25,000 in property damage liability coverage. This coverage ensures that you can cover the costs of injuries and property damage caused to others in an accident you are responsible for.

It's important to note that these minimum limits may not be sufficient for all drivers. If you have significant assets or are concerned about potential liabilities, it is advisable to consider purchasing higher limits to provide better financial protection.

| Liability Coverage in Texas | Minimum Requirements |

|---|---|

| Bodily Injury Liability per Person | $30,000 |

| Bodily Injury Liability per Accident | $60,000 |

| Property Damage Liability | $25,000 |

Personal Injury Protection (PIP) and Uninsured/Underinsured Motorist Coverage

In Texas, Personal Injury Protection (PIP) and Uninsured/Underinsured Motorist (UM/UIM) coverage are not mandatory, but they are highly recommended. PIP coverage provides financial support for your own medical expenses and lost wages if you are injured in an accident, regardless of fault. UM/UIM coverage protects you if you are involved in an accident with a driver who has little or no insurance coverage.

While these coverages are optional, they offer valuable peace of mind and can significantly reduce the financial burden in the event of an accident. Consider your personal needs and circumstances when deciding whether to include these additional coverages in your car insurance policy.

Proof of Financial Responsibility

Texas requires all drivers to maintain proof of financial responsibility, which demonstrates your ability to cover potential damages in the event of an accident. This can be fulfilled through a valid car insurance policy or by obtaining a certificate of deposit or a self-insurance certificate.

It's crucial to keep your proof of financial responsibility readily accessible at all times. Law enforcement officers may request this documentation during traffic stops or after accidents. Failure to provide proof of financial responsibility can result in penalties, including fines and the suspension of your driver's license.

Choosing the Right Car Insurance Coverage for Texas

While the minimum car insurance requirements in Texas provide a basic level of protection, it's essential to consider your specific needs and circumstances when selecting your car insurance coverage. Here are some factors to take into account when choosing the right coverage for you.

Assessing Your Risk Profile

Every driver has a unique risk profile based on various factors such as age, driving history, vehicle type, and location. Understanding your risk profile is crucial in determining the appropriate level of coverage. For example, if you drive an older vehicle, you may opt for liability-only coverage, as comprehensive and collision coverage may not be cost-effective.

On the other hand, if you own a newer or more expensive vehicle, comprehensive and collision coverage can provide valuable protection against damages caused by accidents, vandalism, or natural disasters. Assessing your risk profile will help you make informed decisions about the type and extent of coverage you require.

Comparing Insurance Providers and Policies

Texas is home to numerous insurance providers, each offering a range of car insurance policies with varying coverage options and pricing. It's essential to compare different providers and their policies to find the best fit for your needs and budget.

When comparing insurance providers, consider factors such as financial stability, customer service reputation, claims handling process, and available discounts. Online reviews and ratings can provide valuable insights into the experiences of other policyholders. Additionally, seek recommendations from trusted friends, family, or insurance professionals to make an informed decision.

Understanding Additional Coverages and Endorsements

Beyond the minimum liability coverage, Texas car insurance policies offer a range of additional coverages and endorsements to enhance your protection. These include:

- Comprehensive Coverage: Provides protection against damages caused by non-collision events such as theft, vandalism, natural disasters, and animal collisions.

- Collision Coverage: Covers damages to your vehicle resulting from collisions with other vehicles or objects.

- Medical Payments Coverage (MedPay): Assists with medical expenses for you and your passengers, regardless of fault, up to the policy limit.

- Rental Car Reimbursement: Offers coverage for rental car expenses if your vehicle is being repaired due to a covered loss.

- Roadside Assistance: Provides emergency services such as towing, flat tire changes, and fuel delivery.

It's important to carefully review the policy details and understand the exclusions and limitations associated with each coverage option. Consider your specific needs and potential risks to determine which additional coverages are most beneficial for your situation.

Car Insurance Costs in Texas

The cost of car insurance in Texas can vary significantly depending on several factors, including your driving history, age, vehicle type, location, and coverage choices. On average, Texas drivers can expect to pay between $1,000 and $1,500 annually for car insurance.

However, it's important to note that rates can fluctuate based on individual circumstances. For instance, drivers with a clean driving record and no at-fault accidents may enjoy lower premiums, while those with a history of accidents or traffic violations may face higher costs. Additionally, the make and model of your vehicle, as well as your chosen coverage limits and deductibles, can impact the overall cost of your car insurance policy.

Factors Affecting Car Insurance Rates in Texas

Several factors contribute to the determination of car insurance rates in Texas. These factors include:

- Driving Record: A clean driving record with no accidents or violations can lead to lower insurance rates. Conversely, a history of accidents or traffic citations may result in higher premiums.

- Age and Gender: Younger drivers, particularly those under the age of 25, often face higher insurance rates due to their relative lack of driving experience. Additionally, gender can be a factor, with some insurance providers charging different rates based on gender statistics.

- Vehicle Type and Usage: The make, model, and year of your vehicle, as well as its primary usage (e.g., personal, business, or pleasure), can impact insurance rates. High-performance vehicles or those with a higher risk of theft may attract higher premiums.

- Location: The area where you live and drive can influence insurance rates. Urban areas with higher traffic volumes and accident rates may result in higher premiums compared to rural areas.

- Coverage Choices and Deductibles: The level of coverage you choose and the associated deductibles play a significant role in determining your insurance costs. Higher coverage limits and lower deductibles typically result in higher premiums.

It's worth exploring the various discounts and incentives offered by insurance providers in Texas. These can include safe driver discounts, multi-policy discounts, loyalty discounts, and discounts for defensive driving courses or anti-theft devices. By taking advantage of these discounts, you may be able to reduce your insurance costs significantly.

Tips for Obtaining Affordable Car Insurance in Texas

Finding affordable car insurance in Texas requires a strategic approach. Here are some practical tips to help you secure the best coverage at a competitive price:

- Shop Around: Compare quotes from multiple insurance providers to find the best rates. Online comparison tools and insurance brokerages can streamline the process.

- Maintain a Clean Driving Record: A clean driving record is essential for keeping insurance costs down. Avoid traffic violations and at-fault accidents to ensure you remain in the good graces of insurance companies.

- Consider Bundling Policies: If you have multiple insurance needs, such as home, auto, and life insurance, consider bundling your policies with the same provider. Many insurance companies offer discounts for bundling multiple policies, resulting in significant savings.

- Increase Your Deductibles: Opting for higher deductibles can reduce your insurance premiums. However, ensure that you can afford the increased deductible amount in the event of a claim.

- Explore Discounts: Research and inquire about available discounts. Insurance providers often offer discounts for safe driving, good student status, loyalty, and various safety features installed in your vehicle.

- Review Your Coverage Regularly: Your insurance needs may change over time. Regularly review your coverage to ensure it aligns with your current situation and make adjustments as necessary.

Frequently Asked Questions (FAQ)

What happens if I drive without car insurance in Texas?

+Driving without car insurance in Texas is illegal and can result in serious consequences. If caught, you may face fines, license suspension, and even criminal charges. It's crucial to maintain continuous insurance coverage to avoid these penalties.

Can I choose my own car insurance provider in Texas?

+Absolutely! Texas has a competitive insurance market, allowing drivers to choose from numerous insurance providers. Take the time to compare policies, coverage options, and prices to find the best fit for your needs.

Are there any discounts available for car insurance in Texas?

+Yes, Texas insurance providers offer a variety of discounts. These may include safe driver discounts, multi-policy discounts, good student discounts, loyalty discounts, and discounts for defensive driving courses. It's worth inquiring about these discounts to reduce your insurance costs.

Can I get car insurance if I have a poor driving record in Texas?

+Yes, it is possible to obtain car insurance even with a poor driving record. However, you may face higher premiums and limited coverage options. It's advisable to shop around and compare quotes from different providers to find the best coverage at a competitive price.

Understanding the minimum car insurance requirements in Texas is just the first step towards ensuring your safety and financial protection on the roads. By carefully considering your coverage options, comparing providers, and implementing cost-saving strategies, you can navigate the world of Texas car insurance with confidence. Remember, having the right car insurance coverage provides peace of mind and safeguards your financial well-being in the event of an accident.