Minimum Insurance California

When it comes to insurance requirements, each state in the United States has its own set of regulations and minimum coverage standards. In California, the insurance landscape is shaped by the state's unique laws and the diverse needs of its residents. This article delves into the specifics of minimum insurance requirements in California, providing a comprehensive guide for individuals and businesses operating within the state.

Understanding California’s Insurance Landscape

California is known for its progressive insurance laws and consumer protection measures. The state’s Department of Insurance plays a crucial role in regulating the insurance industry, ensuring fair practices, and protecting the rights of policyholders. Understanding the unique features of California’s insurance landscape is essential for both residents and businesses to navigate the minimum insurance requirements effectively.

One key aspect of California's insurance regulations is the emphasis on liability coverage. The state mandates specific liability limits for various types of insurance policies, including auto, homeowners, and commercial insurance. These liability limits are designed to protect individuals and businesses from financial loss in the event of accidents or claims.

Auto Insurance Minimums in California

California is one of the many states that require drivers to carry auto insurance. The primary purpose of this requirement is to ensure that individuals have the financial means to cover damages and injuries resulting from accidents. The minimum insurance coverage mandated by California’s Vehicle Code is as follows:

- Bodily Injury Liability (BI): $15,000 per person and $30,000 per accident.

- Property Damage Liability (PD): $5,000 per accident.

- Uninsured Motorist Bodily Injury (UMBI): $15,000 per person and $30,000 per accident.

- Uninsured Motorist Property Damage (UMPD): $3,500 per accident.

These minimum liability limits are designed to provide basic coverage for common accidents. However, it's important to note that these limits may not be sufficient for more severe accidents or claims. Many insurance experts recommend purchasing higher liability limits to provide adequate protection and peace of mind.

Real-Life Example: Auto Insurance Claim

Imagine a scenario where a driver in California is involved in an accident that results in severe injuries to another person and significant property damage. The minimum liability limits of 15,000 per person and 30,000 per accident for bodily injury may not be enough to cover the medical expenses and other damages incurred by the injured party. In such cases, the at-fault driver’s insurance coverage might fall short, leading to potential financial hardship.

To avoid such situations, it's advisable to consider purchasing additional coverage options, such as higher liability limits, personal injury protection (PIP), or collision and comprehensive coverage. These optional coverages can provide broader protection and ensure that you are adequately insured in various scenarios.

Homeowners Insurance Requirements

While California does not mandate homeowners insurance, it is highly recommended for property owners. Homeowners insurance provides protection against various risks, including damage to the home, personal property, and liability coverage for accidents that occur on the premises. The specific coverage requirements may vary depending on the location and value of the property.

When purchasing homeowners insurance in California, it's crucial to assess the replacement cost of your home and the value of your personal belongings. This assessment will help you determine the appropriate coverage limits to ensure that you are adequately protected in the event of a loss. Additionally, considering additional coverages such as flood insurance or earthquake insurance may be necessary, especially in high-risk areas.

| Coverage Type | Recommended Limits |

|---|---|

| Dwelling Coverage | Replacement Cost Value of the Home |

| Personal Property Coverage | Actual Cash Value or Replacement Cost Value |

| Liability Coverage | At least $100,000, but higher limits are recommended |

💡 Expert Tip: Assessing Your Home’s Value

When determining the appropriate coverage limits for your homeowners insurance, it’s essential to accurately assess the value of your home and its contents. Consider factors such as the current real estate market, recent renovations or improvements, and the cost of rebuilding or replacing your belongings. Consulting with a professional insurance agent or using online tools to estimate your home’s value can provide valuable insights.

Commercial Insurance for Businesses

Businesses operating in California are subject to specific insurance requirements to protect their operations, employees, and customers. The exact coverage needs vary depending on the nature of the business and the industry regulations. Common types of commercial insurance include general liability, professional liability (errors and omissions), property insurance, and workers’ compensation.

General liability insurance is a fundamental coverage for businesses, providing protection against claims of bodily injury, property damage, and personal and advertising injury. The minimum liability limits in California for general liability insurance are typically $1 million per occurrence and $2 million aggregate. However, depending on the industry and risk factors, businesses may opt for higher limits to ensure comprehensive coverage.

Understanding Liability Limits

Liability limits refer to the maximum amount that an insurance policy will pay for covered claims. In California, the minimum liability limits for auto insurance and general liability insurance are designed to provide a basic level of protection. However, it’s important to recognize that these limits may not be sufficient for all situations.

For instance, if a business faces multiple claims or is involved in a high-profile lawsuit, the standard liability limits may quickly be exhausted. In such cases, having additional insurance coverage, such as excess liability or umbrella policies, can provide an extra layer of protection and financial security.

Performance Analysis: Evaluating Your Coverage

Regularly evaluating your insurance coverage is essential to ensure that you have the appropriate protection in place. This evaluation process involves reviewing your current policies, assessing your changing needs, and considering any new risks or liabilities that may have emerged. By conducting a thorough performance analysis, you can identify gaps in coverage and make informed decisions to enhance your insurance portfolio.

Future Implications and Considerations

As the insurance landscape in California continues to evolve, it’s crucial to stay informed about potential changes and emerging trends. Here are some key considerations for the future:

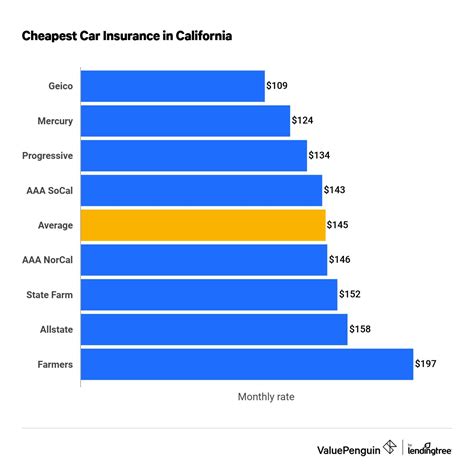

- Rising Costs: Insurance rates can fluctuate over time, and California has experienced periods of increasing premiums. Staying abreast of market trends and comparing quotes from multiple insurers can help you secure competitive rates.

- Changing Regulations: The insurance industry is subject to regulatory changes, and California's insurance laws may evolve to address new risks or consumer protection measures. Staying informed about any updates or amendments to the state's insurance regulations is essential for compliance and adequate coverage.

- Technology Integration: The insurance industry is embracing digital transformation, and technology-driven solutions are shaping the way policies are underwritten and claims are processed. Embracing these innovations can enhance the efficiency and effectiveness of your insurance coverage.

FAQ

Are there any penalties for not having the minimum insurance in California?

+Yes, failing to maintain the minimum insurance requirements in California can result in penalties. If you are caught driving without the required auto insurance, you may face fines, have your vehicle registration suspended, and even have your driver’s license suspended. Additionally, if you cause an accident without adequate insurance coverage, you may be held personally liable for any damages and face legal consequences.

Can I purchase insurance coverage above the minimum requirements in California?

+Absolutely! While California mandates specific minimum insurance coverage, individuals and businesses have the option to purchase additional coverage to enhance their protection. Higher liability limits, optional coverages like collision and comprehensive, and specialty insurance products can provide greater peace of mind and financial security.

How can I find affordable insurance options in California?

+Finding affordable insurance options in California involves a combination of factors. Comparing quotes from multiple insurance providers, considering different coverage levels, and exploring discounts can help you identify the most cost-effective options. Additionally, working with an independent insurance agent who represents multiple insurers can provide valuable guidance in securing the best coverage at competitive rates.

In conclusion, understanding the minimum insurance requirements in California is essential for both individuals and businesses operating within the state. By adhering to these regulations and considering additional coverage options, you can ensure that you are adequately protected against various risks and liabilities. Stay informed, evaluate your coverage regularly, and embrace the evolving insurance landscape to make informed decisions that safeguard your interests.