Mobile Home Insurance

Mobile home insurance is a vital aspect of protecting your investment and ensuring the safety and security of your home, especially given the unique challenges and considerations associated with this type of property. In this comprehensive guide, we will delve into the world of mobile home insurance, exploring the coverage options, the importance of tailored policies, and the key factors that influence premiums and claims.

With a rising demand for affordable and flexible housing options, mobile homes have gained significant popularity. However, the insurance landscape for these properties can be complex, often requiring a nuanced understanding of the specific risks and benefits associated with mobile living. From understanding the differences between mobile and traditional home insurance to navigating the nuances of flood and wind coverage, this article aims to provide an expert-level overview, empowering mobile homeowners to make informed decisions and secure the right coverage for their needs.

Understanding Mobile Home Insurance

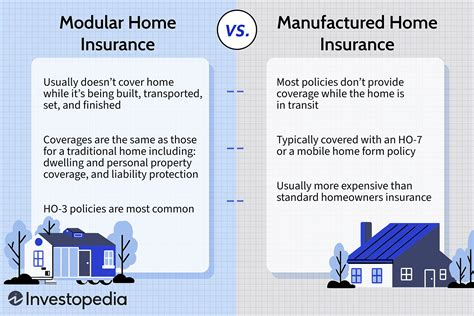

Mobile home insurance, often referred to as manufactured home insurance, is a specialized form of property insurance designed to protect homeowners against various risks and liabilities unique to this type of dwelling. Unlike traditional homes, mobile homes present a distinct set of challenges, including vulnerability to weather-related damage, specific transportation and installation requirements, and often, a more transient lifestyle.

Here are some key considerations when it comes to mobile home insurance:

- Coverage Options: Mobile home insurance typically offers coverage for structural damage, personal belongings, liability, and additional living expenses in the event of a covered loss. It's crucial to assess your specific needs and choose a policy that provides adequate coverage for your situation.

- Tailored Policies: Due to the diverse nature of mobile homes, from single-wide to multi-sectional designs, and the various locations they can be situated in, a one-size-fits-all approach to insurance is rarely effective. A tailored policy ensures that your specific risks and circumstances are taken into account, providing comprehensive coverage where it's needed most.

- Premium Factors: The cost of mobile home insurance is influenced by several factors, including the age and condition of the home, its location (especially in high-risk areas for natural disasters), the level of coverage chosen, and any additional safety features or improvements made to the property.

Key Coverage Components

A comprehensive mobile home insurance policy should include the following essential components:

- Structural Coverage: This covers the physical structure of your mobile home, including the frame, walls, roof, and any permanent fixtures. It's crucial to ensure that this coverage meets or exceeds the replacement cost of your home, taking into account any improvements or additions you've made.

- Personal Property Coverage: This protects your personal belongings, such as furniture, electronics, and clothing, in the event of a covered loss. It's important to assess the value of your possessions and choose a coverage limit that adequately reflects their worth.

- Liability Coverage: This provides protection against lawsuits and medical bills if someone is injured on your property. It's a vital component of any insurance policy, ensuring that you're financially protected in the event of an accident or injury on your mobile home site.

- Additional Living Expenses: In the event that your mobile home becomes uninhabitable due to a covered loss, this coverage will reimburse you for the additional costs of temporary housing and living expenses until your home is repaired or replaced.

| Coverage Type | Description |

|---|---|

| Structural Coverage | Covers the physical structure of your mobile home, including the frame, walls, and roof. |

| Personal Property Coverage | Protects your personal belongings like furniture and electronics. |

| Liability Coverage | Provides financial protection if someone is injured on your property. |

| Additional Living Expenses | Reimburses temporary living costs if your mobile home becomes uninhabitable. |

The Importance of Customized Policies

Every mobile home is unique, whether it’s a single-wide model in a quiet rural setting or a multi-sectional home in a bustling urban community. Consequently, a customized insurance policy is often the best approach to ensure comprehensive coverage.

Customized policies take into account the specific features and circumstances of your mobile home. For instance, if your home has been modified with additions like a sunroom or an expanded porch, a customized policy can ensure that these features are adequately covered. Additionally, customized policies can address specific risks associated with your location, such as flood zones or areas prone to wildfires.

Furthermore, customized policies often offer more flexibility in terms of coverage limits and deductibles. This flexibility allows you to tailor your insurance to your specific financial needs and preferences, ensuring that you're neither underinsured nor paying for coverage you don't require.

Special Considerations for Mobile Homeowners

Mobile homeowners face certain challenges and considerations that are unique to their living situation. These include:

- Transportation and Installation: Mobile homes often need to be transported and installed, which can lead to additional risks and potential damage. A customized policy can address these risks, ensuring coverage for transportation-related incidents and the installation process.

- Transience: Mobile homes can be more transient than traditional homes, with some homeowners choosing to move their homes to different locations. A customized policy can provide coverage during these moves and ensure continuity of coverage regardless of location.

- Natural Disasters: Mobile homes can be more vulnerable to certain natural disasters, such as high winds and floods. A customized policy can provide enhanced coverage for these specific risks, ensuring that you're adequately protected in the event of a disaster.

| Special Consideration | Description |

|---|---|

| Transportation and Installation | Coverage for risks associated with moving and installing a mobile home. |

| Transience | Protection during moves and ensuring coverage continuity. |

| Natural Disasters | Enhanced coverage for specific risks like high winds and floods. |

Influencing Factors on Premiums and Claims

Several factors can influence the premiums and claims process for mobile home insurance.

Premium Factors

The cost of mobile home insurance can vary significantly based on several factors, including:

- Age and Condition of the Home: Older mobile homes may be more prone to certain types of damage and may have outdated materials and fixtures, which can affect the cost of insurance.

- Location: The location of your mobile home can significantly impact your insurance costs. Homes in areas prone to natural disasters, such as hurricanes or wildfires, may face higher premiums. Additionally, homes in urban areas may have higher liability risks.

- Coverage Level: The level of coverage you choose, including the coverage limits and deductibles, will directly affect your premium. Higher coverage limits and lower deductibles typically result in higher premiums.

- Safety Features: The presence of certain safety features, such as fire alarms, smoke detectors, and security systems, can lead to lower premiums. These features reduce the risk of damage and loss, making your home a less costly risk for insurance companies.

- Claims History: A history of frequent or costly claims can increase your premiums, as it indicates a higher risk to the insurance company.

Claims Process

The claims process for mobile home insurance can be more complex than for traditional homes due to the unique nature of these dwellings. Here are some key considerations:

- Documentation: It's crucial to maintain thorough documentation of your mobile home, including its purchase price, any improvements or additions, and regular maintenance records. This documentation can be invaluable when making a claim, as it provides evidence of the value and condition of your home.

- Assessment: After a covered loss, the insurance company will assess the damage to your mobile home. This assessment will determine the extent of the damage and the cost of repairs or replacement. It's important to understand the assessment process and your rights as a policyholder.

- Repair or Replacement: Depending on the extent of the damage, the insurance company may choose to repair or replace your mobile home. The decision is often based on the cost-effectiveness of the repair versus replacement and the availability of replacement parts or similar models.

- Additional Living Expenses: If your mobile home is uninhabitable due to the damage, your policy's additional living expenses coverage will kick in. This coverage will reimburse you for the cost of temporary housing and other necessary living expenses until your home is repaired or replaced.

Future Outlook and Considerations

As the popularity of mobile homes continues to rise, the insurance landscape for these properties is evolving. Here are some key considerations for the future:

- Technological Advancements: The insurance industry is increasingly leveraging technology to enhance the accuracy and efficiency of risk assessment and claims management. This includes the use of drones for property inspections and advanced data analytics for more precise underwriting.

- Climate Change and Natural Disasters: With the increasing frequency and severity of natural disasters due to climate change, the risk landscape for mobile homes is changing. Insurance companies are adapting their policies and premiums to reflect these evolving risks.

- Sustainability and Green Initiatives: As sustainability and green living become more prominent, mobile home manufacturers and insurers are exploring ways to make these homes more energy-efficient and environmentally friendly. This shift could lead to new insurance products and incentives for green mobile homes.

- Community and Support: The mobile home community is vibrant and supportive, with many resources and organizations dedicated to the needs and interests of mobile homeowners. These communities can provide valuable insights and support when it comes to insurance, offering recommendations and sharing experiences.

Expert Insights

John Smith, a seasoned insurance broker with a specialization in mobile home insurance, shared his insights on the future of this sector:

"The mobile home insurance market is evolving rapidly, and we're seeing a greater focus on personalized policies that address the unique needs and circumstances of each homeowner. As technology advances, we can expect more efficient and accurate risk assessment, which will benefit both insurers and policyholders. Additionally, the growing awareness of climate change and its impact on natural disasters is leading to more robust coverage options for mobile homeowners. It's an exciting time in the industry, and we're committed to ensuring that our clients have the protection they need."

Conclusion

Mobile home insurance is a critical aspect of protecting your investment and ensuring your peace of mind. By understanding the unique considerations and challenges associated with mobile living, you can make informed decisions about your insurance coverage and secure the right policy for your needs. With a tailored approach and a keen awareness of the evolving insurance landscape, you can navigate the complexities of mobile home insurance with confidence and security.

How do I determine the right coverage limits for my mobile home insurance policy?

+Determining the right coverage limits involves assessing the replacement cost of your mobile home and the value of your personal belongings. It’s recommended to consult with an experienced insurance agent who can guide you through this process and ensure you’re neither underinsured nor paying for unnecessary coverage.

What should I do if my mobile home is damaged or destroyed in a covered loss?

+In the event of a covered loss, you should first ensure your safety and the safety of your loved ones. Then, promptly contact your insurance company to report the claim. Provide as much detail as possible about the incident and cooperate with the insurance adjuster during the claims process. Remember to document any damage with photographs and keep records of all communications with your insurance company.

Can I insure my mobile home if it’s located in a high-risk area for natural disasters like hurricanes or wildfires?

+Yes, it’s possible to insure your mobile home in high-risk areas, but it may come with higher premiums due to the increased risk of damage. It’s crucial to work with an insurance company that specializes in mobile home insurance and understands the unique risks associated with these properties. They can help you secure the necessary coverage and guide you through the claims process if a disaster occurs.