Montana Marketplace Insurance

Montana's health insurance landscape is an intriguing topic, especially considering the state's unique demographics and healthcare needs. With a vast rural population and specific healthcare challenges, understanding the Montana Marketplace Insurance system is crucial for residents and policymakers alike. This article delves into the specifics of this insurance marketplace, exploring its workings, benefits, and implications for Montanans.

Navigating the Montana Marketplace Insurance

The Montana Marketplace Insurance, also known as the Montana Health Insurance Exchange, is a vital platform for residents to access affordable healthcare coverage. Established under the Affordable Care Act (ACA), this marketplace has played a significant role in improving access to healthcare for many Montanans.

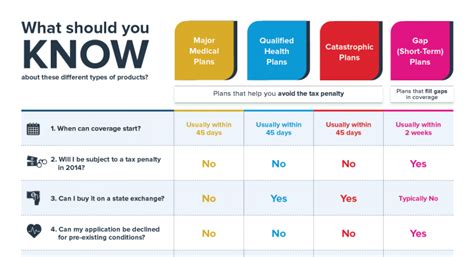

The exchange offers a range of health insurance plans from various providers, catering to different needs and budgets. These plans are categorized into metal tiers, from bronze to platinum, each offering a different balance of premiums and out-of-pocket costs. Bronze plans typically have lower premiums but higher out-of-pocket expenses, while platinum plans offer the opposite, providing more financial protection but at a higher premium cost.

One of the key advantages of the Montana Marketplace is the availability of financial assistance for eligible residents. This assistance, in the form of premium tax credits and cost-sharing reductions, can significantly reduce the cost of insurance premiums, making healthcare more affordable for many Montanans. These subsidies are particularly beneficial for those with lower incomes or those facing higher healthcare costs due to pre-existing conditions.

Enrollment Periods and Special Circumstances

The Montana Marketplace operates on an annual enrollment period, typically from November to December, for coverage starting the following year. However, in recognition of the unpredictable nature of life events, the exchange also allows for special enrollment periods. These periods enable individuals to enroll outside the standard timeframe if they experience qualifying life events, such as marriage, birth of a child, loss of other health coverage, or changes in income.

For instance, imagine a Montana resident, Sarah, who recently got married. Under the Marketplace's rules, Sarah and her new spouse would qualify for a special enrollment period, allowing them to select a health insurance plan that suits their combined needs and coverage requirements.

Plan Comparison and Selection

The Montana Marketplace provides a user-friendly platform for residents to compare and select insurance plans. This platform offers detailed information on each plan’s coverage, including network providers, prescription drug benefits, and cost-sharing details. By considering these factors, individuals can make informed decisions about their healthcare coverage.

For example, John, a resident of a rural area in Montana, might prioritize a plan with a broad network of providers to ensure he has access to the healthcare services he needs, given the potential distances he might need to travel for specialized care.

Montana Marketplace Insurance: A Deeper Dive

While the Montana Marketplace Insurance offers a crucial safety net for many residents, it’s essential to explore its intricacies further to understand its full impact and potential.

The Role of Brokers and Navigators

Navigating the insurance marketplace can be complex, especially for those unfamiliar with the system or for individuals with unique healthcare needs. This is where insurance brokers and navigators come into play. These professionals are trained to guide individuals through the process, helping them understand their options and make informed choices.

Brokers, in particular, can be a valuable resource for Montanans. They can provide personalized advice, taking into account an individual's specific healthcare needs, budget, and even their preferences for certain providers or treatment options. By leveraging their expertise, brokers can help Montanans find the best value for their healthcare dollar.

Community Outreach and Education

The Montana Marketplace recognizes the importance of community engagement and education in ensuring that residents are aware of their healthcare options. Through various outreach programs and educational initiatives, the marketplace aims to reach all corners of the state, including rural areas where access to information might be more limited.

These efforts include hosting community enrollment events, where residents can receive one-on-one assistance with enrollment and have their questions answered. Additionally, the marketplace provides online resources, including videos, guides, and FAQs, to ensure that Montanans have the information they need at their fingertips.

Data and Performance Analysis

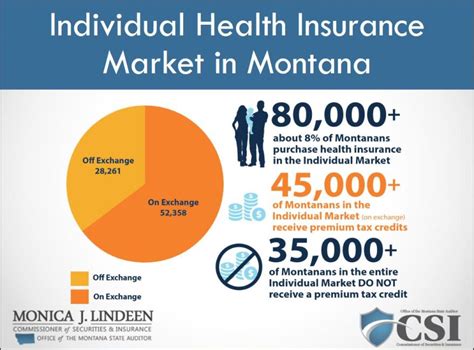

Regular analysis of enrollment data and plan performance is crucial for the ongoing improvement of the Montana Marketplace Insurance. This data provides insights into trends, challenges, and opportunities within the healthcare system, guiding policy decisions and strategic planning.

For instance, analyzing enrollment data can reveal which demographics are being served effectively by the marketplace and which groups might require targeted outreach or additional support. Similarly, tracking plan performance can identify areas where improvements are needed, such as expanding provider networks or enhancing benefits to better meet the needs of Montanans.

| Metric | Value |

|---|---|

| Number of Enrollees (2022) | 120,000 |

| Average Premium Tax Credit | $5,000 |

| Average Reduction in Out-of-Pocket Costs | $3,500 |

| Percentage of Enrollees with Pre-Existing Conditions | 65% |

Future Implications and Potential Innovations

Looking ahead, the Montana Marketplace Insurance has the potential to evolve and innovate to better serve the state’s residents. As healthcare needs and technologies advance, the marketplace must adapt to ensure accessibility and affordability.

Expanding Coverage Options

One area of focus could be expanding coverage options to include more specialized plans. For instance, introducing plans tailored to specific demographics, such as older adults or those with chronic conditions, could provide more targeted and comprehensive coverage. These plans could offer enhanced benefits, such as increased coverage for preventative care or specialized treatment options.

Leveraging Technology for Access

Montana’s vast rural landscape presents unique challenges for accessing healthcare services. However, technology can play a significant role in overcoming these barriers. The marketplace could explore telehealth options, enabling residents in remote areas to access healthcare services remotely, from consultations with specialists to mental health support.

Additionally, the use of mobile apps and digital platforms could enhance the user experience, making it easier for residents to compare plans, enroll, and manage their healthcare coverage. These tools could also provide real-time updates on plan changes, benefits, and healthcare provider networks.

Collaborative Partnerships

Collaborating with healthcare providers, community organizations, and other stakeholders can lead to innovative solutions. For instance, partnerships with local healthcare providers could result in the development of community health plans, offering discounted rates for residents who utilize local healthcare services. These plans could encourage residents to seek preventative care and routine check-ups, leading to better health outcomes.

Policy Advocacy and Reforms

Advocating for policy reforms at the state and federal levels can also have a significant impact on the Montana Marketplace Insurance. Efforts to secure additional funding for subsidies or to expand eligibility criteria could make healthcare more affordable for a wider range of Montanans. Additionally, advocating for policies that support rural healthcare, such as incentives for providers to practice in underserved areas, could enhance access to care.

Continuous Evaluation and Adaptation

As the healthcare landscape evolves, it’s crucial for the Montana Marketplace Insurance to remain agile and responsive. Regular evaluation of the marketplace’s performance, including feedback from enrollees and stakeholders, can identify areas for improvement and guide strategic planning. By continuously adapting to meet the changing needs of Montanans, the marketplace can ensure that healthcare remains accessible and affordable for all.

How does the Montana Marketplace Insurance benefit those with pre-existing conditions?

+The Montana Marketplace Insurance provides crucial support for individuals with pre-existing conditions. Under the ACA, insurance companies are prohibited from denying coverage or charging higher premiums based on pre-existing conditions. Additionally, the availability of premium tax credits and cost-sharing reductions can make insurance more affordable for those with higher healthcare needs.

Are there any resources available to help with understanding and enrolling in a health insurance plan through the Montana Marketplace?

+Absolutely! The Montana Marketplace provides a wealth of resources to assist individuals with the enrollment process. These include online tools for comparing plans, step-by-step guides, and access to brokers and navigators who can provide personalized assistance. Additionally, community enrollment events are often held to provide in-person support.

What happens if I miss the annual enrollment period for the Montana Marketplace Insurance?

+If you miss the annual enrollment period, you may still be able to enroll in a health insurance plan through the Montana Marketplace if you experience a qualifying life event. These events include marriage, birth of a child, loss of other health coverage, or changes in income. By meeting with a broker or navigator, you can determine if you qualify for a special enrollment period.