Monthly Health Insurance Cost

Health insurance is an essential aspect of financial planning and healthcare management, providing individuals and families with access to vital medical services while mitigating the risks and costs associated with unexpected illnesses or injuries. In the realm of personal finance and healthcare, understanding the monthly costs of health insurance is crucial for making informed decisions and ensuring adequate coverage.

The Cost of Health Insurance: A Comprehensive Guide

Navigating the complexities of health insurance can be daunting, especially when considering the myriad of plans, providers, and premiums available. This comprehensive guide aims to demystify the world of health insurance costs, offering a deep dive into the factors that influence premiums, the average expenses across various demographics, and strategies for securing affordable coverage.

Factors Influencing Monthly Health Insurance Premiums

The cost of health insurance is influenced by a multitude of factors, each playing a unique role in determining the monthly premium. Understanding these elements is crucial for predicting and managing health insurance expenses effectively.

- Age: One of the primary factors affecting health insurance costs is the insured's age. Generally, younger individuals pay lower premiums due to their lower risk of developing serious health conditions. As individuals age, their risk of chronic illnesses increases, leading to higher premiums.

- Location: The geographic location where the policyholder resides also impacts insurance costs. Healthcare expenses can vary significantly between regions, with urban areas often incurring higher costs due to the concentration of specialized medical facilities and higher living expenses.

- Plan Type: The type of health insurance plan chosen significantly affects the monthly premium. Different plans offer varying levels of coverage, deductibles, and copays. For instance, Health Maintenance Organization (HMO) plans typically have lower premiums but require the use of specific healthcare providers within their network, while Preferred Provider Organization (PPO) plans offer more flexibility but may come with higher costs.

- Benefit Level: The extent of coverage provided by the insurance plan is a major determinant of its cost. Plans with more comprehensive benefits, such as lower deductibles, broader coverage for prescriptions, and a wider range of covered services, will generally command higher premiums.

- Tobacco Use: Insurers often charge higher premiums for individuals who use tobacco products. This practice is based on the higher health risks associated with tobacco use, which can lead to a range of chronic conditions and increase healthcare costs.

- Family Size: Family health insurance plans, which cover multiple individuals, typically cost more than individual plans. The premium increase is proportional to the number of family members being insured, as more people mean a higher likelihood of healthcare needs.

- Occupation: Certain occupations are considered riskier than others, which can impact insurance premiums. High-risk occupations, such as those involving manual labor or hazardous environments, may result in higher insurance costs due to the increased likelihood of workplace injuries.

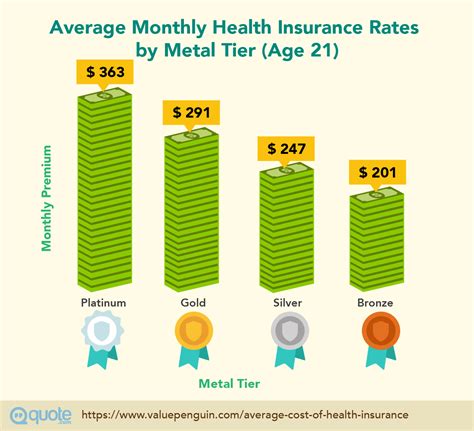

Average Monthly Health Insurance Costs

Understanding the average monthly costs of health insurance can provide valuable context for individuals seeking coverage. While premiums can vary widely based on the factors outlined above, national averages offer a starting point for budget planning and comparison.

| Demographic | Average Monthly Premium |

|---|---|

| Individual, Age 21 | $300 - $450 |

| Individual, Age 40 | $400 - $600 |

| Individual, Age 60 | $600 - $900 |

| Family of 4, with Children under 18 | $1,200 - $1,800 |

These averages are based on national data and may not reflect the specific circumstances of every individual or family. It's important to note that the cost of health insurance can vary significantly based on location, plan type, and other personal factors.

Strategies for Reducing Monthly Health Insurance Costs

While health insurance is a necessary expense, there are strategies individuals can employ to reduce their monthly premiums and make coverage more affordable. Here are some effective approaches:

- Utilize High-Deductible Health Plans (HDHPs): HDHPs offer lower premiums compared to traditional plans. These plans require the policyholder to pay more out-of-pocket expenses before the insurance coverage kicks in, but they can be a cost-effective option for those who are generally healthy and don't anticipate frequent medical needs.

- Take Advantage of Employer-Sponsored Plans: Many employers offer health insurance as a benefit, and these plans often come with significant discounts. Employer-sponsored plans can provide comprehensive coverage at a lower cost, as the employer typically subsidizes a portion of the premium.

- Consider Short-Term Health Insurance: For those between jobs or facing a temporary gap in coverage, short-term health insurance can be a viable option. These plans offer more limited coverage but can be significantly cheaper than traditional plans, providing a stopgap solution until more comprehensive coverage can be secured.

- Explore Government-Sponsored Programs: Depending on income and other factors, individuals may qualify for government-sponsored health insurance programs like Medicaid or the Children's Health Insurance Program (CHIP). These programs offer low-cost or no-cost coverage to eligible individuals and families.

- Negotiate Premiums: In some cases, it's possible to negotiate lower premiums with insurance providers. This is more common for small businesses or self-employed individuals who purchase insurance directly from providers. By shopping around and discussing options, it's possible to find more affordable coverage.

The Impact of Health Insurance Costs on Personal Finance

Health insurance costs can have a significant impact on an individual’s or family’s financial well-being. High premiums can strain budgets, making it difficult to save for other financial goals or emergencies. Moreover, unexpected medical expenses can further compound these financial challenges, especially for those without adequate coverage.

Understanding the cost of health insurance and exploring strategies to reduce these expenses is therefore crucial for long-term financial health. By making informed decisions about health insurance, individuals can better manage their financial resources and ensure access to necessary medical care.

Conclusion: Empowering Financial Decisions with Knowledge

The world of health insurance can be complex and intimidating, but with the right knowledge and tools, individuals can make empowered decisions about their coverage and financial well-being. By understanding the factors that influence health insurance costs, comparing plans, and exploring strategies for reducing premiums, individuals can find the right balance between comprehensive coverage and financial feasibility.

Stay informed, shop around, and don't hesitate to seek expert advice when navigating the intricacies of health insurance. With the right approach, securing adequate coverage at an affordable cost is within reach for everyone.

How do health insurance premiums vary by state?

+

Health insurance premiums can vary significantly by state due to differences in healthcare costs, provider networks, and state regulations. For example, states with higher costs of living or a greater concentration of specialized medical facilities may have higher average premiums. Additionally, some states have implemented unique programs or regulations that can impact insurance costs, such as state-specific mandates for coverage of certain conditions or procedures.

What are some ways to lower health insurance costs for small businesses?

+

Small businesses can explore various strategies to reduce health insurance costs for their employees. These include offering High-Deductible Health Plans (HDHPs) paired with Health Savings Accounts (HSAs), which allow employees to save pre-tax dollars for healthcare expenses. Small businesses can also negotiate group rates with insurance providers, explore state-specific small business health insurance programs, or consider hiring a benefits consultant to help navigate the complex world of health insurance and identify cost-saving opportunities.

Are there any tax benefits associated with health insurance premiums?

+

Yes, there are tax benefits associated with health insurance premiums. For individuals and families, premiums paid for health insurance may be tax-deductible, depending on certain conditions and the specific plan. Additionally, some employers offer tax-advantaged plans, such as Flexible Spending Accounts (FSAs) or Health Reimbursement Arrangements (HRAs), which allow employees to set aside pre-tax dollars to pay for qualified medical expenses.