Monthly Insurance Cost For Car

Determining the monthly insurance cost for a car is a complex process that involves various factors, and it can significantly impact your overall vehicle expenses. The insurance premium you pay is influenced by numerous variables, and understanding these factors can help you make informed decisions about your coverage and potential savings.

Factors Affecting Monthly Car Insurance Costs

The cost of car insurance varies greatly from one person to another and is influenced by a multitude of factors. Here are some key elements that insurance companies consider when calculating your monthly premium:

Vehicle Type and Usage

The make, model, and year of your vehicle play a significant role in determining your insurance premium. Certain types of vehicles, especially luxury or high-performance cars, often come with higher insurance costs due to their expensive repair and replacement parts. Additionally, the primary purpose of using your vehicle, whether for personal or business use, can also impact your insurance rates.

Driver’s Profile and History

Your driving record is a crucial factor in insurance premium calculation. Insurance companies closely examine your history of accidents, traffic violations, and claims made. A clean driving record with no recent accidents or violations can lead to more affordable insurance rates. On the other hand, a history of accidents or violations may result in higher premiums or even difficulty finding an insurance provider willing to cover you.

Coverage Options and Limits

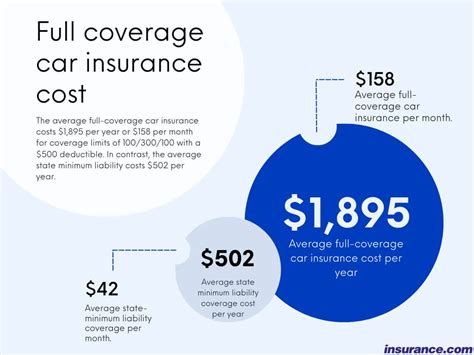

The type and extent of coverage you choose will directly impact your monthly insurance costs. There are various coverage options available, including liability coverage, comprehensive coverage, collision coverage, and additional add-ons like rental car reimbursement or roadside assistance. Each of these coverages has different premium costs, and the limits you select (e.g., higher or lower deductibles) can also influence your monthly payments.

Location and Demographic Factors

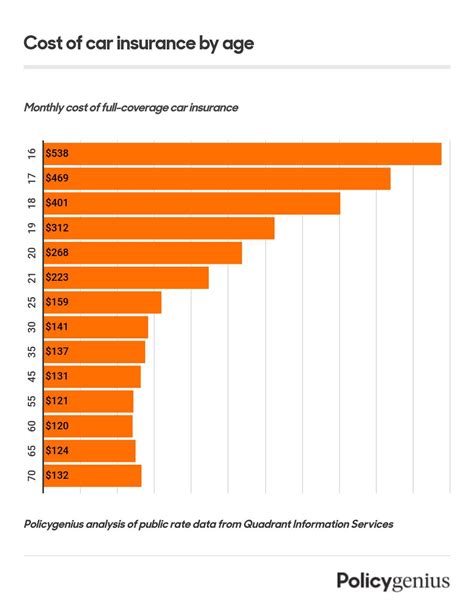

Where you live and your demographic characteristics can significantly affect your insurance rates. Insurance companies consider factors such as crime rates, traffic density, and the frequency of natural disasters in your area. Additionally, your age, gender, and marital status may also play a role in determining your insurance premium.

Credit History

In many states, insurance companies are allowed to use your credit score as a factor in determining your insurance rates. A good credit history can potentially lead to lower insurance premiums, while a poor credit score may result in higher costs.

Estimating Your Monthly Insurance Cost

While it’s challenging to provide an exact figure for your monthly insurance cost without specific details, we can give you a general estimate based on average rates. On average, the monthly insurance cost for a car in the United States ranges from 50 to 200, with the national average being around $100 per month. However, it’s important to note that this estimate is highly variable and can be significantly higher or lower based on the factors mentioned above.

| Average Monthly Insurance Cost | $50 - $200 |

|---|---|

| National Average | $100 |

To get a more accurate estimate for your specific situation, it's recommended to obtain quotes from multiple insurance providers. Comparing quotes will not only help you understand the range of insurance costs available but also allow you to identify the most suitable and cost-effective coverage for your needs.

Tips for Lowering Your Monthly Insurance Costs

If you’re looking to reduce your monthly insurance expenses, here are some strategies you can consider:

- Shop Around: Compare quotes from different insurance companies to find the most competitive rates. Online comparison tools can be particularly useful for this purpose.

- Bundling Policies: Consider bundling your car insurance with other policies, such as homeowners or renters insurance. Many insurers offer discounts for bundling multiple policies.

- Maintain a Good Driving Record: A clean driving history is crucial for keeping insurance costs down. Avoid accidents and violations to maintain a positive record.

- Increase Your Deductible: Opting for a higher deductible can lower your monthly premiums. However, ensure you can afford the deductible amount in case of a claim.

- Explore Discounts: Many insurance companies offer discounts for various reasons, such as good student discounts, safe driver discounts, or loyalty discounts. Inquire about these discounts to see if you're eligible.

- Review Coverage Regularly: Your insurance needs may change over time. Regularly review your coverage to ensure you have the right level of protection and aren't paying for unnecessary features.

Future Outlook and Trends

The car insurance industry is constantly evolving, and several trends are shaping the future of insurance premiums. Here are some key trends to consider:

Telematics and Usage-Based Insurance

Telematics technology, which tracks driving behavior and habits, is gaining popularity. Usage-based insurance programs use this data to offer more personalized and potentially lower insurance rates for safe drivers. This trend may encourage safer driving practices and provide more accurate insurance cost assessments.

Digital Transformation

The digital revolution is transforming the insurance industry, with more companies offering online quoting, policy management, and claims processing. This shift towards digital services can make insurance more accessible and convenient while potentially reducing administrative costs and, consequently, insurance premiums.

Autonomous Vehicles and Safety Innovations

The development of autonomous vehicles and advanced safety features in cars may significantly impact insurance costs in the future. As these technologies become more prevalent, insurance companies may adjust their risk assessments and premium structures accordingly.

Regulatory Changes

Insurance regulations are subject to change, and these changes can impact insurance premiums. For example, some states have implemented reforms to address issues like non-driving-related rating factors, which could lead to more equitable insurance costs for drivers.

Conclusion

Understanding the factors that influence your monthly car insurance cost is essential for making informed decisions about your coverage. By considering variables such as vehicle type, driving history, coverage options, location, and credit history, you can better estimate your insurance expenses and explore strategies to lower your premiums. The insurance industry is dynamic, and staying informed about emerging trends can help you navigate the evolving landscape of car insurance.

How often should I review my car insurance policy?

+It’s recommended to review your car insurance policy annually or whenever your life circumstances change significantly. This review allows you to ensure your coverage is still adequate and explore potential cost-saving opportunities.

Can I negotiate my insurance premium with the provider?

+While insurance premiums are largely determined by standard rates, you can still negotiate with your provider. Discuss your concerns and explore potential discounts or adjustments to your coverage to find a more favorable rate.

What are some common discounts offered by insurance companies?

+Insurance companies often offer discounts for various reasons, including safe driving records, bundling policies, good student status, loyalty, and even for specific occupations or affiliations. It’s worth inquiring about these discounts to potentially lower your insurance costs.