Most Affordable Full Coverage Car Insurance

Finding affordable full coverage car insurance is a priority for many vehicle owners. With the rising costs of automotive maintenance and the potential risks associated with driving, it's crucial to secure comprehensive insurance without breaking the bank. This article aims to guide you through the process of identifying the most affordable full coverage car insurance options available, backed by real-world examples and industry insights.

Understanding Full Coverage Car Insurance

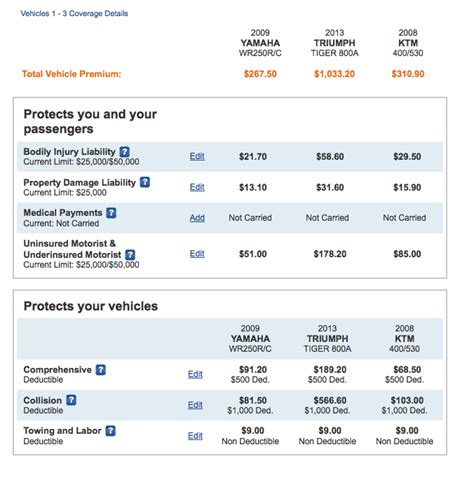

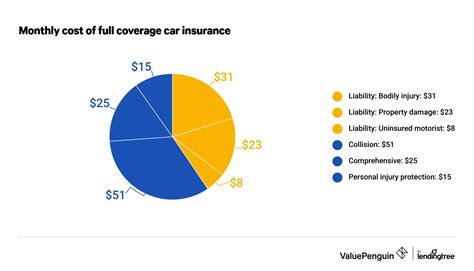

Full coverage car insurance, a comprehensive insurance plan, offers protection for your vehicle against a wide range of risks. This type of insurance typically includes both collision coverage and comprehensive coverage, providing a robust safety net for vehicle owners. Collision coverage protects against damage resulting from accidents, while comprehensive coverage safeguards against non-collision-related incidents such as theft, vandalism, and natural disasters.

However, the cost of full coverage insurance can vary significantly depending on numerous factors. These include your location, the make and model of your vehicle, your driving history, and the insurance provider you choose. Navigating these variables to find the most affordable option requires a strategic approach and a good understanding of the insurance market.

Researching and Comparing Insurance Providers

The first step towards securing the most affordable full coverage car insurance is to thoroughly research and compare various insurance providers. In the United States, there are numerous reputable companies offering car insurance, each with its unique policies and pricing structures. Here’s a breakdown of some of the most prominent providers and their offerings:

State Farm

State Farm is one of the leading insurance providers in the US, offering a wide range of insurance products, including car insurance. Their full coverage insurance plans are tailored to meet the specific needs of their customers, providing comprehensive protection at competitive rates. State Farm’s Drive Safe & Save program rewards safe drivers with potential discounts, making their full coverage plans even more affordable.

| Policy Type | Coverage |

|---|---|

| Full Coverage | Collision, Comprehensive, Liability, Medical Payments, Uninsured Motorist, Roadside Assistance |

| Discounts | Drive Safe & Save, Multi-Policy, Good Student, Good Driver, Safe Vehicle |

Geico

Geico, another prominent player in the insurance market, offers a comprehensive range of car insurance plans. Their full coverage insurance policies are designed to provide extensive protection at affordable rates. Geico’s Military Service Member and Federal Employee discounts further enhance the affordability of their full coverage plans for eligible customers.

| Policy Type | Coverage |

|---|---|

| Full Coverage | Collision, Comprehensive, Personal Injury Protection, Uninsured Motorist, Roadside Assistance |

| Discounts | Military Service Member, Federal Employee, Good Student, Safe Driver, Multi-Policy |

Progressive

Progressive, known for its innovative insurance solutions, offers a wide range of car insurance options, including full coverage plans. Their Snapshot program utilizes telematics to track driving behavior, potentially leading to substantial discounts for safe drivers. Progressive’s full coverage plans are designed to offer extensive protection at competitive prices.

| Policy Type | Coverage |

|---|---|

| Full Coverage | Collision, Comprehensive, Medical Payments, Uninsured Motorist, Rental Reimbursement |

| Discounts | Snapshot, Multi-Policy, Good Student, Good Driver, Homeowner |

Allstate

Allstate is a well-established insurance provider offering a comprehensive suite of insurance products, including car insurance. Their full coverage insurance plans provide extensive protection, covering a wide range of scenarios. Allstate’s Safe Driving Bonus Check program rewards safe drivers with potential discounts, making their full coverage plans more affordable.

| Policy Type | Coverage |

|---|---|

| Full Coverage | Collision, Comprehensive, Liability, Medical Payments, Uninsured Motorist, Rental Car Coverage |

| Discounts | Safe Driving Bonus Check, Multi-Policy, Good Student, Mature Driver, Safe Driver |

Factors Influencing Insurance Rates

When comparing insurance providers and their rates, it’s essential to understand the factors that influence insurance premiums. These factors can vary significantly and play a crucial role in determining the cost of your full coverage car insurance.

Location

Your location is a significant factor in determining insurance rates. Insurance providers consider the crime rate, accident frequency, and cost of living in your area when calculating premiums. Areas with higher crime rates or a history of frequent accidents may result in higher insurance premiums.

Vehicle Type

The make, model, and year of your vehicle also impact insurance rates. Insurance providers consider the vehicle’s safety features, repair costs, and theft frequency when determining premiums. Vehicles with advanced safety features or lower theft rates may be eligible for lower insurance rates.

Driving History

Your driving history is a critical factor in insurance pricing. Insurance providers analyze your driving record, including any accidents, violations, and claims made. A clean driving record with no recent accidents or violations can lead to more affordable insurance rates.

Age and Gender

Your age and gender can also influence insurance rates. Statistical data shows that younger drivers and males tend to be involved in more accidents, resulting in higher insurance premiums for these demographics. However, it’s important to note that insurance providers cannot legally discriminate based on gender, and age-related pricing is subject to regulatory guidelines.

Tips for Securing Affordable Full Coverage

Finding the most affordable full coverage car insurance involves more than just comparing insurance providers. Here are some additional tips and strategies to help you secure the best deal:

Shop Around and Compare Quotes

Don’t settle for the first insurance quote you receive. Take the time to shop around and compare quotes from multiple providers. Online comparison tools can be particularly useful for this, allowing you to quickly assess a range of insurance options and their associated costs.

Understand Your Coverage Needs

Before obtaining quotes, take the time to understand your specific coverage needs. Consider the value of your vehicle, your financial situation, and the risks you face as a driver. This will help you determine the appropriate level of coverage and avoid unnecessary expenses.

Explore Discounts and Rewards

Insurance providers offer a variety of discounts and rewards to attract and retain customers. These can include discounts for safe driving, multiple policy holdings, good student status, and more. Be sure to inquire about these discounts when obtaining quotes to ensure you’re getting the most competitive rates.

Maintain a Clean Driving Record

A clean driving record is one of the most effective ways to secure affordable insurance rates. Insurance providers reward safe drivers with lower premiums, so it’s essential to practice defensive driving and avoid accidents and violations.

Consider Bundling Policies

Many insurance providers offer discounts when you bundle multiple policies, such as car insurance with home or renters insurance. If you’re in the market for multiple insurance products, consider bundling them to take advantage of potential savings.

The Impact of Credit Score on Insurance Rates

Your credit score can also influence the cost of your full coverage car insurance. Insurance providers often use credit-based insurance scores to assess the risk of insuring a customer. These scores are calculated using information from your credit report, including payment history, outstanding debt, and length of credit history. A higher credit score generally indicates lower risk, which can lead to more affordable insurance rates.

It's important to note that the use of credit-based insurance scores varies by state and insurance provider. Some states, like California, Hawaii, and Massachusetts, have banned the use of credit scores in insurance pricing. However, in most states, insurance providers are permitted to use credit scores as a factor in determining insurance rates.

Future Trends in Car Insurance

The car insurance industry is constantly evolving, driven by advancements in technology and changing consumer needs. Here are some trends that are likely to shape the future of car insurance and impact the affordability of full coverage plans:

Telematics and Usage-Based Insurance

Telematics, the use of technology to track and analyze driving behavior, is gaining traction in the insurance industry. Usage-based insurance (UBI) programs, such as State Farm’s Drive Safe & Save and Progressive’s Snapshot, utilize telematics to offer personalized insurance rates based on actual driving behavior. This trend is expected to continue, providing more affordable insurance options for safe drivers.

Connected Car Technology

The integration of connected car technology, which allows vehicles to communicate with other devices and systems, is set to revolutionize the insurance industry. This technology can provide real-time data on driving behavior, vehicle performance, and accident prevention, leading to more accurate risk assessment and potentially more affordable insurance rates.

Autonomous Vehicles

The advent of autonomous vehicles is likely to have a significant impact on car insurance. As self-driving cars become more prevalent, insurance providers will need to adapt their policies and pricing structures. While the safety benefits of autonomous vehicles may lead to lower insurance rates, the potential for new risks and liabilities could also impact insurance costs.

Personalized Insurance

The future of car insurance is likely to be increasingly personalized, with insurance providers offering tailored policies based on individual risk profiles and driving behavior. This shift towards personalized insurance could result in more affordable coverage for those who demonstrate safe driving habits and manage risk effectively.

What is the average cost of full coverage car insurance in the US?

+

The average cost of full coverage car insurance in the US can vary significantly based on factors such as location, vehicle type, driving history, and age. According to data from the National Association of Insurance Commissioners (NAIC), the national average premium for full coverage car insurance in 2022 was $1,735 annually. However, it’s important to note that this average can vary greatly depending on individual circumstances.

How can I lower my full coverage car insurance rates?

+

There are several strategies to lower your full coverage car insurance rates. These include shopping around for quotes from multiple providers, maintaining a clean driving record, exploring discounts and rewards, and considering bundling multiple policies. Additionally, understanding your coverage needs and ensuring you’re not paying for unnecessary coverage can help reduce costs.

What factors influence insurance rates for young drivers?

+

Insurance rates for young drivers are often higher due to their perceived higher risk of accidents and claims. Factors that influence insurance rates for young drivers include age, gender, driving experience, vehicle type, and location. However, some insurance providers offer discounts for young drivers, such as good student discounts or programs that reward safe driving.

How does credit score impact car insurance rates?

+

Credit score can play a significant role in determining car insurance rates. Insurance providers often use credit-based insurance scores to assess the risk of insuring a customer. A higher credit score generally indicates lower risk, which can lead to more affordable insurance rates. However, the use of credit scores in insurance pricing is subject to regulatory guidelines and varies by state.