Motor Insurance Canada

Motor insurance, or more specifically, auto insurance, is a crucial aspect of vehicle ownership in Canada. It provides financial protection to vehicle owners and drivers in the event of accidents, theft, or other unforeseen circumstances. With a diverse range of coverage options and varying provincial regulations, understanding motor insurance in Canada can be complex. In this comprehensive guide, we will delve into the world of motor insurance, exploring its key components, provincial variations, and essential considerations for Canadian motorists.

Understanding Motor Insurance in Canada

Motor insurance in Canada is a legal requirement for all vehicle owners. It serves as a safety net, ensuring that individuals can recover financially from losses and damages resulting from vehicle-related incidents. The coverage provided by motor insurance policies varies based on the chosen plan and provincial regulations.

Types of Motor Insurance Coverage

Canadian motor insurance policies typically offer a combination of the following coverage types:

- Liability Coverage: This covers the policyholder’s legal responsibility for bodily injury or property damage to others resulting from a vehicle accident. It is a mandatory coverage in most provinces.

- Accident Benefits: Also known as Personal Injury Protection (PIP), this coverage provides financial support for medical expenses, lost income, and other costs resulting from an accident, regardless of fault.

- Collision Coverage: This optional coverage pays for repairs or replacement of the policyholder’s vehicle in the event of an accident, regardless of fault.

- Comprehensive Coverage: This coverage protects against damages caused by non-collision events such as theft, vandalism, fire, and natural disasters. It is often required if the vehicle is financed or leased.

- Uninsured/Underinsured Motorist Coverage: This coverage provides protection in the event of an accident with a driver who has no insurance or insufficient insurance coverage.

- Additional Coverages: Some policies may offer optional add-ons such as rental car coverage, roadside assistance, or coverage for custom parts and equipment.

Factors Affecting Motor Insurance Premiums

The cost of motor insurance, known as the premium, can vary significantly based on several factors, including:

- Vehicle Type and Usage: The make, model, and age of the vehicle, as well as its primary usage (e.g., personal, commercial, or pleasure) can impact premiums.

- Driver’s Profile: Age, gender, driving history, and the number of years as a licensed driver can affect premiums. Young drivers and those with a history of accidents or violations may pay higher premiums.

- Location: The area where the vehicle is garaged and driven can influence premiums due to variations in traffic density, accident rates, and crime rates.

- Coverage and Deductibles: The level of coverage chosen and the deductible amount (the portion of a claim paid by the policyholder) can significantly impact premiums.

- Insurance Company and Discounts: Different insurance companies offer varying rates and discounts, so shopping around and comparing quotes is essential.

Provincial Variations in Motor Insurance

Canada’s provincial and territorial governments play a significant role in regulating motor insurance. While there are some commonalities across the country, each province has its own set of rules and regulations, resulting in varying insurance landscapes.

Public vs. Private Insurance Systems

Canada’s motor insurance system can be broadly categorized into two types: public insurance and private insurance. The distinction between these systems is a key factor that sets provinces apart.

- Public Insurance Systems: In public insurance systems, the provincial government acts as the sole insurer for vehicle liability coverage. These systems are typically no-fault, meaning that accident victims receive compensation regardless of who caused the accident. British Columbia, Saskatchewan, Manitoba, and Quebec operate under public insurance systems.

- Private Insurance Systems: In private insurance systems, multiple private insurance companies compete to offer various coverage options to motorists. Ontario, Alberta, Nova Scotia, New Brunswick, Prince Edward Island, Newfoundland and Labrador, and the territories (Yukon, Northwest Territories, and Nunavut) have private insurance systems.

Provincial Differences in Coverage and Regulations

Each province has its own set of regulations regarding mandatory coverage, accident benefits, and other aspects of motor insurance. Here’s a brief overview of some key differences:

| Province | Mandatory Coverage | Accident Benefits | Other Notable Features |

|---|---|---|---|

| Ontario | Third-party liability, accident benefits, direct compensation for property damage | Medical, rehabilitation, income replacement, non-earner benefits, caregiver and attendant care benefits | Insurance companies offer a range of additional coverages and endorsements. |

| Quebec | Liability coverage, accident benefits, uninsured motorist coverage | Medical, rehabilitation, income replacement, death benefits | Quebec has a no-fault system with a unique SAAQ (Société de l’assurance automobile du Québec) compensation scheme. |

| Alberta | Third-party liability, accident benefits | Medical, rehabilitation, income replacement, death benefits, non-earner benefits | Alberta allows for a choice between basic and enhanced accident benefits coverage. |

| British Columbia | Third-party liability, accident benefits, uninsured motorist coverage | Medical, rehabilitation, income replacement, death benefits | ICBC (Insurance Corporation of British Columbia) is the sole provider of basic auto insurance coverage. |

| Saskatchewan | Liability coverage, accident benefits, uninsured motorist coverage | Medical, rehabilitation, income replacement, death benefits | SGI (Saskatchewan Government Insurance) is the public insurer and offers a range of additional coverages. |

| Manitoba | Liability coverage, accident benefits | Medical, rehabilitation, income replacement, death benefits | MPI (Manitoba Public Insurance) is the public insurer and offers a standard and enhanced coverage option. |

| Nova Scotia | Third-party liability, accident benefits, uninsured motorist coverage | Medical, rehabilitation, income replacement, non-earner benefits, death benefits | Nova Scotia allows for a choice between standard and optional accident benefits coverage. |

| New Brunswick | Third-party liability, accident benefits | Medical, rehabilitation, income replacement, non-earner benefits, death benefits | New Brunswick offers a basic and enhanced accident benefits package. |

| Prince Edward Island | Third-party liability, accident benefits | Medical, rehabilitation, income replacement, non-earner benefits, death benefits | PEI allows for a choice between basic and enhanced accident benefits coverage. |

| Newfoundland and Labrador | Third-party liability, accident benefits | Medical, rehabilitation, income replacement, non-earner benefits, death benefits | Newfoundland and Labrador has a unique no-fault system with a range of accident benefits. |

Choosing the Right Motor Insurance Coverage

Selecting the appropriate motor insurance coverage involves careful consideration of several factors. Here are some key aspects to keep in mind:

- Understand Your Needs: Assess your individual needs and the specific risks associated with your vehicle and driving habits. Consider factors like the value of your vehicle, your financial situation, and the likelihood of accidents or theft in your area.

- Compare Quotes: Obtain quotes from multiple insurance providers to compare coverage options, premiums, and additional benefits. This can help you identify the best value for your insurance needs.

- Review Coverage Limits: Ensure that the liability coverage limits and accident benefits provided in your policy are sufficient to cover potential losses. Higher limits may offer greater protection but also result in higher premiums.

- Consider Optional Coverages: Evaluate whether additional coverages, such as rental car coverage or roadside assistance, are worth the added cost based on your personal circumstances.

- Review Deductibles: Choose deductibles carefully. Higher deductibles can lower premiums, but you’ll need to pay a larger portion of any claim out of pocket.

- Bundle Policies: Consider bundling your motor insurance with other insurance policies, such as home or tenant insurance, as this may result in discounts and streamlined management of your insurance needs.

Conclusion: Navigating Motor Insurance in Canada

Motor insurance in Canada is a complex landscape, with a range of coverage options and provincial variations to consider. By understanding the key components of motor insurance, including the types of coverage, factors affecting premiums, and provincial regulations, Canadian motorists can make informed decisions when selecting their insurance policies. Whether you reside in a province with a public or private insurance system, ensuring you have adequate coverage is essential for your financial protection and peace of mind on the road.

What is the average cost of motor insurance in Canada?

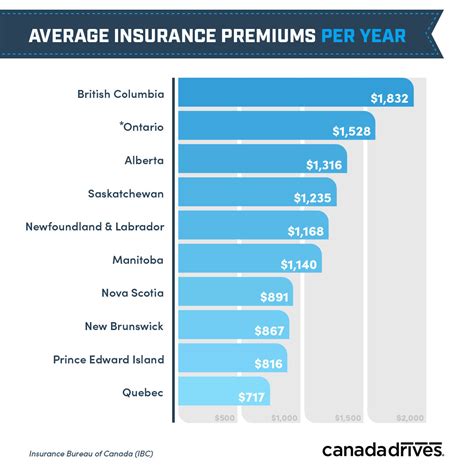

+The average cost of motor insurance in Canada varies based on numerous factors, including the province, the driver’s profile, and the coverage chosen. According to recent statistics, the average annual premium for a standard auto insurance policy in Canada ranges from approximately 1,200 to 1,600. However, this can vary significantly, with premiums in some provinces and for certain driver profiles exceeding $2,000 per year.

Can I get motor insurance if I have a poor driving record or have been involved in accidents?

+Yes, it is still possible to obtain motor insurance with a poor driving record or a history of accidents. However, insurance companies may classify you as a high-risk driver, resulting in higher premiums. In some cases, high-risk drivers may need to seek insurance through specialized providers or consider usage-based insurance programs that assess driving behavior.

Are there any discounts available for motor insurance in Canada?

+Yes, many insurance companies in Canada offer a variety of discounts to policyholders. Common discounts include multi-policy discounts (for bundling multiple insurance policies), good student discounts (for young drivers with good academic records), safe driver discounts (for drivers with clean records), and loyalty discounts (for long-term customers). It’s worth shopping around and asking insurance providers about available discounts.