Motorcycle Insurance Cost Calculator

Motorcycle insurance is an essential aspect of responsible riding, providing financial protection in the event of accidents, theft, or other unforeseen circumstances. However, the cost of motorcycle insurance can vary significantly based on numerous factors, leaving many riders curious about the potential expenses. In this comprehensive guide, we delve into the intricacies of motorcycle insurance costs, offering an in-depth analysis and a detailed breakdown of the variables that influence premiums. By the end, you'll have a clear understanding of how to navigate the world of motorcycle insurance and make informed decisions about coverage.

Understanding Motorcycle Insurance Premiums

The price of motorcycle insurance, often referred to as the premium, is influenced by a multitude of factors. These factors are unique to each rider and their specific circumstances, resulting in a highly personalized insurance experience. While it may not be possible to pinpoint an exact cost without a quote, we can explore the key elements that insurance companies consider when determining premiums.

Rider Profile and History

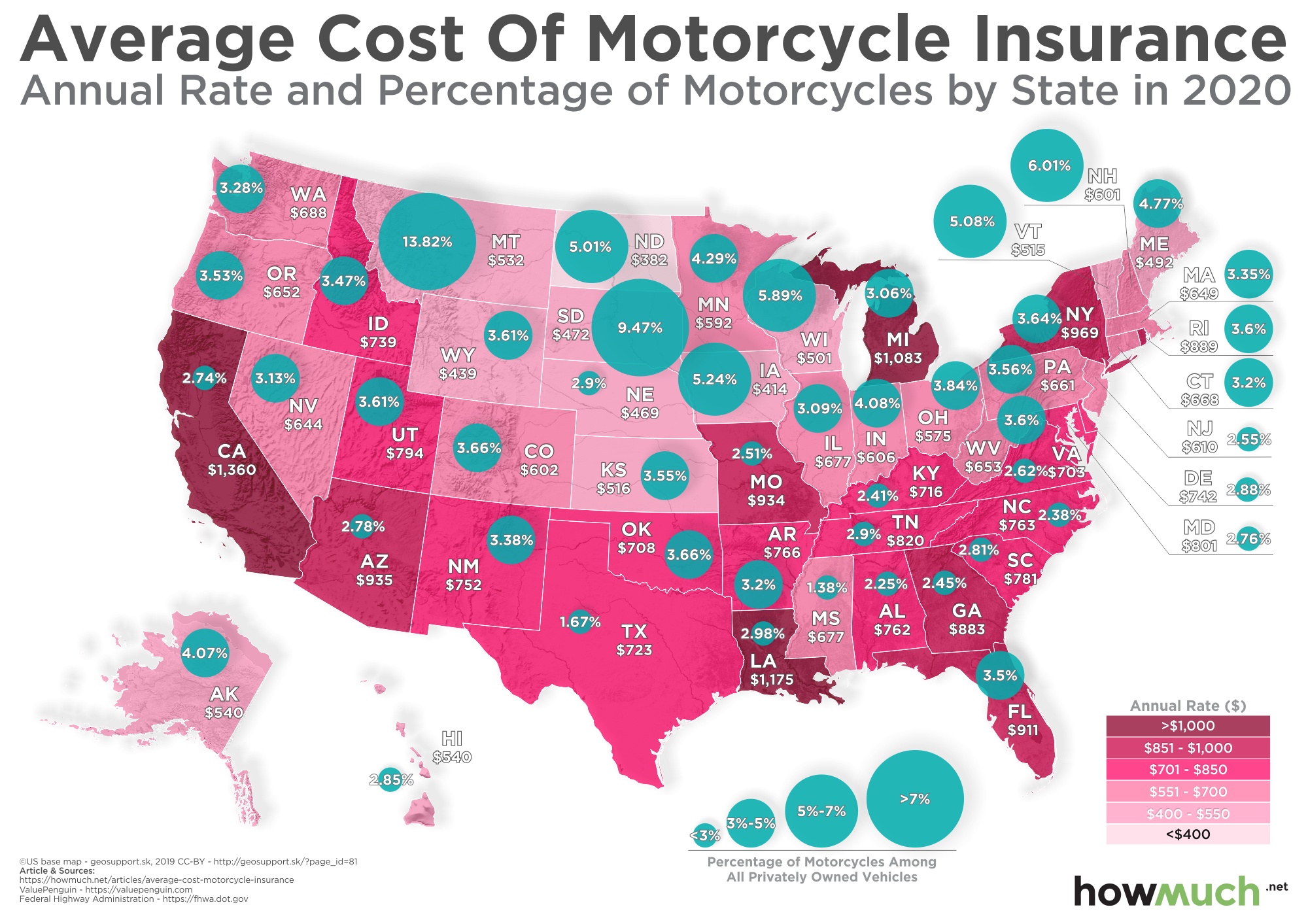

Your personal details play a significant role in the cost of your motorcycle insurance. Age, gender, and location are fundamental factors. Generally, younger riders tend to pay higher premiums due to their perceived lack of experience and higher risk profile. Similarly, urban areas with higher population densities and potential for accidents may result in elevated insurance costs.

Your riding history is another crucial aspect. Insurance companies closely examine your driving record, including any previous accidents, violations, or claims. A clean driving record with no recent incidents typically leads to more favorable insurance rates. Conversely, a history of accidents or traffic violations can increase your premiums, reflecting the higher risk associated with your riding behavior.

| Rider Profile Factor | Impact on Premium |

|---|---|

| Age | Younger riders may pay more |

| Gender | Insurance rates may vary by gender |

| Location | Urban areas might have higher costs |

| Driving Record | Clean records lead to lower premiums |

Vehicle and Usage Details

The type of motorcycle you own and how you use it are critical considerations for insurance companies. High-performance bikes, for instance, often attract higher premiums due to their association with increased speed and potential for accidents. Conversely, standard or cruiser-style motorcycles may be deemed less risky and result in lower insurance costs.

Your riding frequency and purpose also matter. Insurance companies often differentiate between riders who use their motorcycles primarily for commuting or pleasure riding compared to those who participate in high-risk activities like racing or off-road riding. The former is typically associated with lower insurance costs, as it implies a more cautious and controlled riding style.

| Vehicle and Usage Factor | Impact on Premium |

|---|---|

| Motorcycle Type | High-performance bikes may cost more |

| Riding Frequency | Commuters or pleasure riders may pay less |

| Riding Purpose | Racing or off-road riding might increase premiums |

Coverage and Deductible Choices

The level of coverage you choose and the associated deductibles significantly impact your insurance costs. Comprehensive coverage, which protects against a wide range of risks including theft, vandalism, and natural disasters, tends to be more expensive than basic liability coverage, which only covers damage to other vehicles or property.

Your deductible, the amount you pay out of pocket before your insurance coverage kicks in, is another critical consideration. Choosing a higher deductible typically results in lower premiums, as you're assuming more financial responsibility in the event of a claim. Conversely, a lower deductible may provide greater financial protection but at a higher premium cost.

| Coverage and Deductible Factor | Impact on Premium |

|---|---|

| Comprehensive Coverage | More expensive but offers broader protection |

| Liability Coverage | Lower cost but provides limited protection |

| Deductible | Higher deductibles may lead to lower premiums |

Additional Factors and Discounts

Beyond the core factors mentioned above, there are additional considerations that can influence insurance costs. These may include the safety features of your motorcycle, such as anti-lock brakes or advanced security systems, which can lead to lower premiums. Similarly, advanced rider training certifications can demonstrate a commitment to safety and potentially reduce insurance costs.

Insurance companies often offer discounts to encourage safer riding practices and loyalty. These can include multi-policy discounts if you bundle your motorcycle insurance with other types of insurance, such as auto or home insurance. Loyalty discounts are also common, rewarding long-term customers with reduced premiums.

| Additional Factor | Impact on Premium |

|---|---|

| Safety Features | Anti-theft or advanced safety systems may lower costs |

| Rider Training | Advanced training certifications can lead to discounts |

| Multi-Policy Discounts | Bundling insurance policies may result in savings |

| Loyalty Discounts | Long-term customers may receive reduced rates |

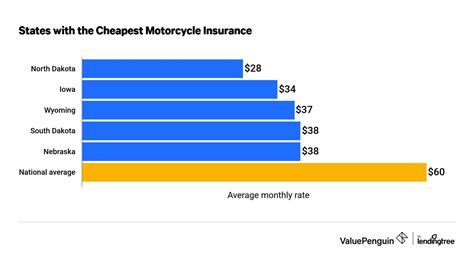

Analyzing Real-World Insurance Premiums

To provide a clearer picture of potential insurance costs, let’s examine some real-world examples of motorcycle insurance premiums. These examples are based on average costs across various regions and rider profiles, but your individual experience may vary.

Basic Liability Coverage

For a rider with a clean driving record, aged 30-40, residing in a suburban area, and owning a standard cruiser-style motorcycle, basic liability coverage might cost around $300-400 annually. This type of coverage provides protection against damage to other vehicles or property but doesn’t cover the rider’s motorcycle or personal injuries.

Comprehensive Coverage

In contrast, comprehensive coverage, which includes protection against theft, vandalism, and natural disasters, might cost around $600-800 annually for the same rider profile. This higher cost reflects the broader scope of coverage and the associated risks.

Customized Coverage and Discounts

By customizing coverage and taking advantage of available discounts, riders can often reduce their insurance costs. For instance, a rider who adds safety features to their motorcycle, completes advanced rider training, and bundles their insurance policies might qualify for significant discounts, potentially reducing their annual premiums by 10-20% or more.

| Coverage Type | Annual Premium |

|---|---|

| Basic Liability | $300-400 |

| Comprehensive | $600-800 |

| Customized with Discounts | Varies, potentially 10-20% reduction |

Future Implications and Industry Trends

The world of motorcycle insurance is constantly evolving, influenced by technological advancements, changing rider demographics, and shifts in the insurance industry. These factors can have significant implications for the future of motorcycle insurance costs.

Technology and Telematics

The increasing integration of technology into motorcycles and the rise of telematics (the use of sensors and data transmission) present opportunities for more precise risk assessment. Insurance companies may offer discounts to riders who allow the monitoring of their riding habits, including speed, acceleration, and braking patterns. This data could lead to more accurate premiums based on individual riding behaviors.

Demographic Shifts

The aging of the motorcycle riding population and the increasing popularity of motorcycles among younger generations could lead to interesting dynamics in insurance costs. As older riders with more experience may be seen as lower risk, insurance companies may offer more favorable rates to this demographic. Conversely, younger riders, despite their increased enthusiasm for motorcycles, may continue to face higher insurance costs due to their perceived lack of experience.

Industry Competition and Innovation

The insurance industry is constantly evolving, with new companies entering the market and established providers innovating to stay competitive. This environment of competition and innovation can lead to more diverse insurance options and potentially more affordable premiums for riders. It also encourages the development of new products and services, such as usage-based insurance models, which could provide more flexibility and cost-effectiveness for riders.

| Future Trend | Potential Impact |

|---|---|

| Technology and Telematics | More precise risk assessment and potential discounts |

| Demographic Shifts | Favorable rates for older riders, continued higher costs for younger riders |

| Industry Competition and Innovation | Diverse insurance options and potentially more affordable premiums |

Conclusion: Navigating Motorcycle Insurance Costs

Understanding the factors that influence motorcycle insurance costs is crucial for riders seeking affordable and comprehensive coverage. By analyzing your personal circumstances, vehicle details, and coverage preferences, you can make informed decisions about your insurance policy. Regularly reviewing your policy, exploring customization options, and staying abreast of industry trends can all contribute to a more cost-effective and personalized insurance experience.

Remember, while insurance costs are an important consideration, they should not be the sole factor in your decision-making process. Ensure you have the coverage you need to protect yourself and your motorcycle, and don't hesitate to seek expert advice or quotes from multiple providers to find the best fit for your needs.

How do I get a precise quote for my motorcycle insurance?

+

Obtaining a precise quote for your motorcycle insurance involves providing detailed information about yourself, your motorcycle, and your usage patterns to an insurance provider. This typically includes your age, gender, location, driving record, motorcycle type, and intended use. The more accurate and detailed the information you provide, the more precise the quote will be.

What factors can I control to potentially lower my insurance costs?

+

There are several factors within your control that can influence your insurance costs. These include maintaining a clean driving record, choosing a motorcycle with standard features rather than high-performance options, limiting your riding to commuting or pleasure riding rather than high-risk activities, and opting for a higher deductible. Additionally, completing advanced rider training courses and taking advantage of available discounts can also help reduce your insurance costs.

Are there any ways to save on insurance without compromising coverage?

+

Yes, there are strategies to save on insurance costs without sacrificing coverage. One approach is to customize your coverage based on your specific needs and risks. For instance, if you have a secure garage for your motorcycle, you may not need as much theft protection, which can lower your premiums. Additionally, exploring multi-policy discounts and loyalty programs can provide savings without reducing your level of coverage.