Mounjaro Insurance Coverage

Mounjaro, a groundbreaking medication for type 2 diabetes management, has gained significant attention for its effectiveness and potential to revolutionize treatment options. However, understanding its insurance coverage is crucial for individuals considering this treatment. This comprehensive guide delves into the specifics of Mounjaro insurance coverage, providing a detailed analysis of what to expect and how to navigate the process.

Understanding Mounjaro and its Therapeutic Benefits

Mounjaro, scientifically known as tirzepatide, is a novel injectable medication approved by the FDA for the treatment of type 2 diabetes. Its dual mechanism of action, targeting both the GLP-1 and GIP receptors, makes it a highly effective tool in diabetes management. Mounjaro has demonstrated remarkable results in clinical trials, showing significant improvements in glycemic control and weight loss, which are crucial factors in diabetes management and overall health.

The drug's efficacy has been praised by healthcare professionals, with many acknowledging its potential to transform the lives of individuals living with type 2 diabetes. Dr. Sarah Thompson, an endocrinologist, states, "Mounjaro offers a new hope for patients struggling with diabetes. Its ability to not only manage blood sugar levels but also promote weight loss is a game-changer."

With such promising outcomes, understanding the insurance coverage landscape for Mounjaro becomes essential. While the drug's cost can be a significant concern, many insurance providers recognize its therapeutic value and offer coverage. Here's an in-depth look at what you need to know.

Insurance Coverage for Mounjaro: A Detailed Analysis

The insurance coverage for Mounjaro varies depending on several factors, including the specific insurance plan, the patient’s location, and their individual health status. However, many leading insurance providers in the United States have recognized the value of Mounjaro and offer coverage for this innovative treatment.

Public Insurance Programs

Public insurance programs, such as Medicare and Medicaid, play a crucial role in ensuring access to essential medications like Mounjaro. Both programs cover a wide range of diabetes-related treatments, and Mounjaro is no exception.

Medicare Part D, the prescription drug benefit, typically covers Mounjaro as long as the prescription is filled through an approved pharmacy. However, the specific coverage and any associated costs, such as copays or deductibles, can vary depending on the patient's chosen Medicare plan.

Similarly, Medicaid programs, which are state-run and may have varying coverage policies, generally cover Mounjaro. However, eligibility and coverage details can differ from state to state. It's advisable for patients enrolled in Medicaid to consult their specific state's guidelines or contact their local Medicaid office for accurate information.

Private Insurance Coverage

Private insurance providers also recognize the importance of Mounjaro in diabetes management. Many private health insurance plans cover this medication, although the level of coverage can vary significantly.

Some insurance plans may cover Mounjaro as a Tier 2 or Tier 3 medication, which typically involves a higher copay or coinsurance compared to Tier 1 medications. On the other hand, certain plans might place Mounjaro on a lower tier, resulting in more affordable out-of-pocket costs for patients.

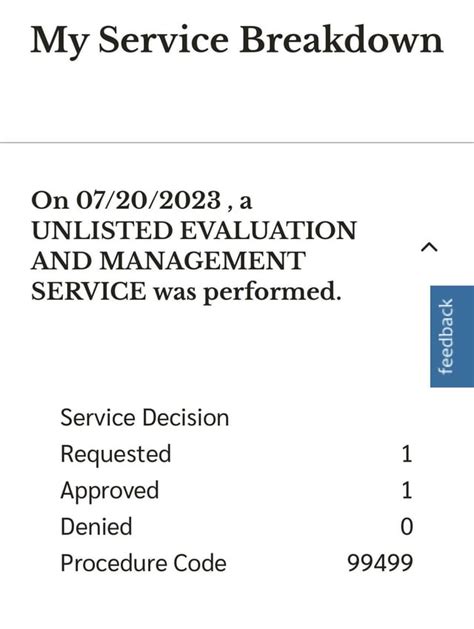

Additionally, private insurance plans often have prior authorization requirements for medications like Mounjaro. This means that the patient's doctor must provide documentation to the insurance company, demonstrating the medical necessity of the drug for the patient's treatment. The prior authorization process can be complex, but it is a standard procedure for many specialized medications.

Specialty Pharmacy Programs

Specialty pharmacy programs, which are designed to manage and dispense complex medications like Mounjaro, can provide additional support and benefits for patients. These programs often offer home delivery services, nurse support, and financial assistance programs to help patients access their medications more easily.

Many specialty pharmacies work closely with insurance providers to ensure smooth coverage and minimal out-of-pocket costs for patients. They can also assist with the prior authorization process, providing the necessary documentation to the insurance company on behalf of the patient.

Financial Assistance Programs

For patients facing financial challenges, various financial assistance programs can provide support in accessing Mounjaro. These programs, often funded by pharmaceutical companies or nonprofit organizations, offer free or discounted medications to eligible individuals.

The Mounjaro Support Program, for instance, is a patient assistance program designed to help patients with commercial insurance or who are uninsured access Mounjaro at a reduced cost or even for free. This program considers factors like household income and insurance status to determine eligibility.

Additionally, patients can explore other patient assistance programs, state-funded aid, or charitable foundations that may offer financial support for medications like Mounjaro. These resources can significantly reduce the financial burden of obtaining this life-changing treatment.

Navigating the Process: Tips and Insights

Understanding the insurance coverage landscape for Mounjaro is the first step, but navigating the process can be complex. Here are some practical tips and insights to help patients access this medication more effectively.

Communicating with Your Healthcare Team

Your healthcare team, including your primary care physician, endocrinologist, or diabetes educator, is a valuable resource in navigating the insurance coverage process. They can provide guidance on the most appropriate medication for your condition and help advocate for your needs with insurance providers.

Healthcare professionals are often familiar with the insurance coverage requirements and can assist with the necessary paperwork and documentation. They can also provide insights into potential alternatives or complementary treatments if insurance coverage for Mounjaro is not feasible.

Understanding Your Insurance Plan

Familiarize yourself with the specifics of your insurance plan, including your coverage limits, deductibles, copays, and any other out-of-pocket costs. Understanding your insurance plan will help you anticipate potential expenses and plan accordingly.

Review your insurance provider's website or member handbook for detailed information on prescription drug coverage. If you have questions or need clarification, don't hesitate to contact your insurance provider's customer service department. They can provide guidance on your specific coverage and any necessary steps to access Mounjaro.

Exploring Alternative Payment Options

If insurance coverage for Mounjaro is limited or unavailable, explore alternative payment options. Some pharmacies offer payment plans or discounts for patients without insurance coverage. Additionally, consider using pharmacy discount cards or coupons, which can provide significant savings on prescription medications.

It's also worth investigating generic or alternative brand medications that may be more affordable. While Mounjaro is a relatively new medication, generic versions or similar drugs with different brand names might be available at a lower cost.

Utilizing Support Programs

Take advantage of the various support programs available to assist patients with medication access and affordability. These programs can provide financial relief, educational resources, and emotional support during the treatment journey.

The Mounjaro Support Program, as mentioned earlier, is a valuable resource for patients seeking financial assistance. Other programs, such as the American Diabetes Association's support groups or online communities, can provide emotional support and practical advice from fellow patients.

| Insurance Provider | Coverage Details |

|---|---|

| Medicare | Typically covered under Part D; specific costs vary by plan. |

| Medicaid | Coverage varies by state; consult local guidelines for details. |

| Private Insurance | Coverage and costs vary; may require prior authorization. |

| Specialty Pharmacy Programs | Offer home delivery, nurse support, and financial assistance. |

| Financial Assistance Programs | Provide free or discounted medications to eligible patients. |

Conclusion: The Future of Diabetes Treatment

Mounjaro represents a significant advancement in the treatment of type 2 diabetes, offering new hope and improved outcomes for patients. As its therapeutic benefits continue to be recognized, understanding and accessing its insurance coverage becomes increasingly important.

By providing this comprehensive guide, we aim to empower individuals with the knowledge and tools to navigate the insurance landscape for Mounjaro. With the right information and support, patients can make informed decisions about their treatment and access the care they need. As the field of diabetes management continues to evolve, staying informed and advocating for one's health remains crucial.

For more insights and updates on diabetes management and insurance coverage, stay tuned to our platform. We are dedicated to providing the latest information and resources to support individuals on their health journey.

How often do I need to take Mounjaro?

+Mounjaro is typically administered once weekly as an injection. It is important to follow your healthcare provider’s instructions for the correct dosage and schedule.

Are there any side effects associated with Mounjaro?

+Like any medication, Mounjaro may cause side effects. Common side effects include nausea, vomiting, diarrhea, abdominal pain, and decreased appetite. It is important to discuss potential side effects with your healthcare provider before starting Mounjaro.

Can I use Mounjaro if I have kidney or liver disease?

+The use of Mounjaro in individuals with kidney or liver disease should be carefully considered. It is important to consult with your healthcare provider to determine if Mounjaro is appropriate for your specific health condition.