National Floodplain Insurance Program

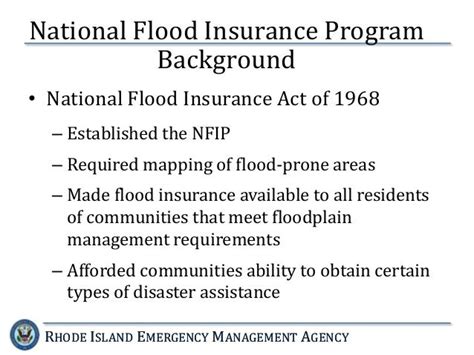

The National Floodplain Insurance Program (NFIP) is a crucial initiative designed to protect homeowners and businesses from the devastating impacts of flooding. Established in 1968, the program has evolved significantly over the decades, adapting to changing flood risks and advancing technologies. This article explores the intricacies of the NFIP, its role in flood management, and its impact on communities across the United States.

Understanding the NFIP: A Comprehensive Overview

The National Floodplain Insurance Program is a federal program administered by the Federal Emergency Management Agency (FEMA). It was created to address the growing concern over flood-related damages and the lack of private flood insurance coverage. The NFIP aims to reduce the impact of flooding by promoting sound floodplain management practices and providing affordable insurance options to property owners.

Key components of the NFIP include:

- Community Participation: The program encourages communities to participate by adopting and enforcing floodplain management regulations. This ensures that new development is directed away from high-risk areas and that existing structures are protected through proper planning and engineering.

- Flood Insurance: NFIP offers flood insurance policies to homeowners, renters, and business owners, even in areas where private insurers may not provide coverage. This insurance provides financial protection against flood damages, helping individuals and businesses recover more quickly.

- Mapping and Risk Assessment: FEMA's flood maps, known as Flood Insurance Rate Maps (FIRMs), are a critical tool in the NFIP. These maps delineate different flood risk zones, helping communities and individuals understand their level of risk. The maps are regularly updated to reflect changing flood patterns and development.

- Mitigation and Prevention: The NFIP promotes mitigation measures to reduce flood risks. This includes elevating structures, implementing flood-proofing techniques, and encouraging natural floodplain functions to minimize the impact of flooding.

The Impact of NFIP on Communities

The National Floodplain Insurance Program has had a profound impact on communities across the United States, especially those in high-risk flood zones. Here are some key ways the NFIP benefits communities:

- Financial Protection: Flood insurance through the NFIP provides a safety net for homeowners and businesses. In areas prone to flooding, this insurance is often a requirement for obtaining a mortgage, ensuring that property owners have the means to rebuild after a flood.

- Reduced Flood Losses: By promoting better floodplain management and providing insurance coverage, the NFIP helps reduce the financial burden of flood events. This, in turn, allows communities to invest in recovery and rebuild more resiliently.

- Community Resilience: The NFIP encourages communities to adopt comprehensive floodplain management strategies. This leads to more resilient communities that are better prepared to withstand and recover from flood events.

- Environmental Benefits: NFIP's focus on natural floodplain functions helps preserve and restore ecosystems. By protecting natural areas, the program contributes to improved water quality, habitat conservation, and the overall health of the environment.

The Evolution of NFIP: Adapting to Changing Risks

Over the years, the NFIP has undergone significant changes to address evolving flood risks and emerging challenges. Here's an overview of some key developments:

Mapping Advances

FEMA’s flood maps have become increasingly sophisticated, utilizing advanced technologies such as LiDAR and remote sensing. These tools allow for more accurate mapping of floodplains and improved risk assessment. The agency also engages in continuous map modernization efforts to keep up with changing landscapes and flood patterns.

Community Rating System (CRS)

The CRS is a voluntary program that provides incentives for communities to go beyond the minimum NFIP requirements. Communities that implement additional floodplain management measures receive discounts on flood insurance premiums, encouraging a more proactive approach to flood risk reduction.

Mitigation Measures

The NFIP has expanded its focus on mitigation, providing grants and technical assistance to communities for projects that reduce flood risks. These measures include elevating homes, installing flood barriers, and implementing natural solutions like wetland restoration.

Insurance Reform

In recent years, the NFIP has undergone reforms to address concerns about its financial sustainability. Changes to the program include adjustments to insurance rates, increased emphasis on risk-based pricing, and the introduction of new policy options to better reflect actual flood risks.

| Reform Initiative | Impact |

|---|---|

| Risk Rating 2.0 | Introduced a more accurate rating system based on individual property risk rather than community-wide averages. |

| Increased Premiums | Adjusted insurance rates to better reflect actual flood risks, providing more financial stability for the program. |

| Flood Insurance Claims Management | Implemented measures to streamline the claims process, ensuring faster and more efficient payouts to policyholders. |

Challenges and Future Directions

While the NFIP has made significant strides in flood risk management, it continues to face challenges. These include the increasing frequency and intensity of flood events due to climate change, the need for more accurate and up-to-date flood maps, and the ongoing debate over the program’s financial sustainability.

Looking ahead, the NFIP is focused on further integrating climate change considerations into its programs. This includes developing more advanced flood models, expanding mitigation efforts, and exploring innovative insurance solutions to better protect communities from the impacts of flooding.

What is the Community Rating System (CRS) and how does it benefit communities?

+The Community Rating System is a voluntary program that rewards communities for implementing floodplain management measures beyond the NFIP’s minimum requirements. Participating communities receive discounts on flood insurance premiums, encouraging a proactive approach to flood risk reduction. This benefits communities by providing financial incentives for better flood management and can lead to reduced flood losses over time.

How has the NFIP addressed concerns about its financial sustainability?

+The NFIP has implemented several reforms to address financial sustainability concerns. This includes adjusting insurance rates to better reflect actual flood risks, introducing Risk Rating 2.0 for more accurate pricing, and improving the claims management process to reduce costs. These measures aim to ensure the program remains financially stable while continuing to provide essential flood insurance coverage.

What role does the NFIP play in mitigating the impacts of climate change on flooding?

+The NFIP plays a crucial role in mitigating the impacts of climate change on flooding by encouraging communities to adopt sustainable floodplain management practices. This includes promoting natural floodplain functions, such as wetland restoration, and implementing structural measures like flood barriers. Additionally, the program is focused on developing more advanced flood models and risk assessment tools to better understand and address the changing flood landscape due to climate change.