Nationwide Pet Insurance Coverage

Unlocking Peace of Mind: A Comprehensive Guide to Nationwide Pet Insurance Coverage

In the vast landscape of pet ownership, one of the most crucial decisions you'll make is choosing the right pet insurance coverage. With a nationwide reach and a comprehensive range of benefits, pet insurance providers offer a safety net for your furry family members. This guide aims to delve deep into the world of nationwide pet insurance, exploring the key features, benefits, and real-life examples that showcase its importance. Let's embark on this journey together, ensuring a brighter and healthier future for our beloved pets.

Understanding Nationwide Pet Insurance

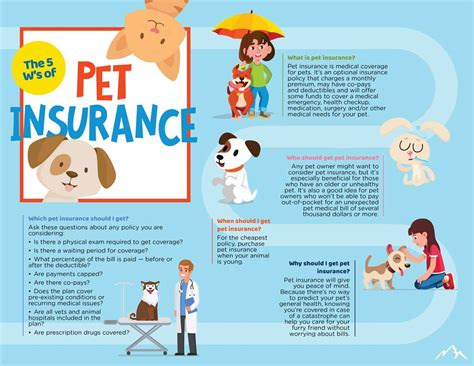

Nationwide pet insurance is a specialized insurance policy designed to cover the medical expenses of pets, ranging from routine check-ups and preventive care to unexpected accidents and illnesses. It is a vital tool for pet owners, offering financial protection and peace of mind in the face of veterinary emergencies. With a nationwide scope, these policies ensure that your pet is covered regardless of their location, providing a sense of security for both urban and rural pet parents.

The Benefits of Nationwide Coverage

One of the key advantages of nationwide pet insurance is its flexibility. Whether you’re traveling across the country or simply relocating to a new city, your pet’s insurance coverage remains intact. This level of portability is especially beneficial for pets with pre-existing conditions, as it ensures continuous care without gaps in coverage.

Additionally, nationwide coverage often comes with a vast network of affiliated veterinarians, giving pet owners access to a diverse range of medical professionals. This network can include specialists, emergency clinics, and even holistic practitioners, ensuring that your pet receives the best possible care, no matter their specific needs.

| Benefit | Description |

|---|---|

| Portability | Pet insurance coverage remains valid nationwide, offering flexibility for traveling or relocating pet owners. |

| Vet Network | Access to a wide network of affiliated veterinarians, including specialists and emergency clinics, ensures comprehensive care. |

| Peace of Mind | Financial protection against unexpected veterinary costs provides peace of mind for pet owners. |

| Preventive Care | Many policies cover routine check-ups, vaccinations, and preventive treatments, promoting overall pet health. |

Real-Life Examples of Nationwide Pet Insurance in Action

To truly understand the impact of nationwide pet insurance, let’s explore some real-life scenarios where these policies made a difference.

Scenario 1: Emergency Roadside Assistance

Imagine you’re embarking on a road trip with your furry companion when, suddenly, your pet falls ill. In such a situation, having nationwide pet insurance can be a lifesaver. With the ability to locate the nearest affiliated veterinarian, you can ensure your pet receives immediate medical attention, no matter your location. This peace of mind is invaluable when traveling with a beloved pet.

Scenario 2: Specialized Care for Chronic Conditions

For pets with chronic conditions like diabetes or arthritis, finding specialized veterinary care is essential. Nationwide pet insurance often covers visits to specialists, ensuring your pet receives the expert treatment they need. Whether it’s regular check-ins with a veterinary endocrinologist or access to cutting-edge therapies, these policies provide a safety net for pets with unique medical needs.

Scenario 3: Peace of Mind for Pet Parents

Simply knowing that your pet is covered nationwide can provide immense relief for pet owners. Whether it’s a routine check-up or an unexpected emergency, having a reliable insurance policy means you can focus on your pet’s well-being without worrying about the financial burden. This peace of mind is a cornerstone of responsible pet ownership and ensures a happier, healthier life for your furry friend.

Choosing the Right Nationwide Pet Insurance Policy

With a multitude of pet insurance providers offering nationwide coverage, selecting the right policy can be a daunting task. Here are some key considerations to guide your decision-making process.

Coverage Options and Customization

Look for policies that offer a range of coverage options, allowing you to tailor the plan to your pet’s specific needs. Whether it’s accident-only coverage for younger, healthier pets or comprehensive plans for senior animals, having the flexibility to choose is essential. Additionally, consider add-ons like routine care coverage or wellness packages to enhance the policy’s benefits.

Claim Process and Customer Service

A seamless claim process is crucial when it comes to pet insurance. Research the provider’s reputation for prompt claim settlements and efficient customer service. Look for online reviews and testimonials to gauge the overall satisfaction of policyholders. A responsive and supportive customer service team can make a world of difference when navigating the complexities of insurance claims.

Policy Limitations and Exclusions

While nationwide pet insurance offers extensive coverage, it’s important to understand the limitations and exclusions of each policy. Some policies may have waiting periods for certain conditions or may not cover pre-existing illnesses. Carefully review the fine print to ensure you’re aware of any potential restrictions and how they might impact your pet’s coverage.

The Impact of Nationwide Pet Insurance on Veterinary Care

Beyond the benefits for pet owners, nationwide pet insurance also has a significant impact on the veterinary industry. By providing financial support for pet owners, these policies encourage regular veterinary visits and promote preventive care. This, in turn, leads to earlier detection of potential health issues and improved overall pet health.

Additionally, the increased accessibility of veterinary care, thanks to nationwide coverage, allows for a more diverse range of pets to receive specialized treatment. This includes underserved communities and pets with unique medical needs, ensuring that quality veterinary care is available to all.

Future Trends and Innovations in Pet Insurance

As the pet insurance industry continues to evolve, we can expect exciting developments and innovations. Here are some potential future trends to watch out for.

Telemedicine and Digital Health

With the rise of telemedicine, pet insurance providers may start incorporating digital health services into their offerings. This could include virtual consultations with veterinarians, remote monitoring of pet health, and even access to specialized apps and platforms for pet owners. These innovations could enhance the convenience and accessibility of veterinary care.

Data-Driven Personalized Plans

As data analytics continue to advance, pet insurance companies may leverage this technology to offer more personalized plans. By analyzing a pet’s breed, age, and health history, insurers could create tailored policies that better suit individual needs. This level of customization could revolutionize the way pet insurance is structured, providing more efficient and effective coverage.

Wellness and Prevention Focus

The future of pet insurance may place a greater emphasis on wellness and preventive care. With more awareness about the importance of early intervention, policies could incentivize regular check-ups, vaccinations, and preventive treatments. This shift could lead to healthier pets and a reduction in costly emergency treatments down the line.

Conclusion: Securing Your Pet’s Future with Nationwide Insurance

In a world where our pets are cherished members of the family, providing them with the best possible care is a top priority. Nationwide pet insurance offers a comprehensive solution, ensuring that your furry friend receives the medical attention they deserve, no matter where life takes you. With a focus on flexibility, specialized care, and peace of mind, these policies are an essential tool for responsible pet ownership.

As we've explored in this guide, the impact of nationwide pet insurance extends beyond financial protection. It promotes better pet health, encourages regular veterinary visits, and provides a safety net for unexpected emergencies. By choosing the right policy, you're not just securing your pet's future—you're investing in a healthier, happier life for your beloved companion.

So, whether you're a seasoned pet owner or a first-time pet parent, consider the benefits of nationwide pet insurance. With a wide range of options and a commitment to pet well-being, these policies are a testament to the love and care we have for our four-legged family members.

How does nationwide pet insurance differ from local or regional policies?

+Nationwide pet insurance offers broader coverage, ensuring your pet is protected regardless of their location. Local or regional policies may have limitations on where they are valid, which can be a concern for pet owners who travel frequently or plan to relocate.

What are the key factors to consider when choosing a nationwide pet insurance provider?

+When selecting a provider, consider factors such as coverage options, claim process efficiency, customer service reputation, and policy limitations. It’s essential to find a balance between comprehensive coverage and a provider that aligns with your pet’s specific needs.

Can I add multiple pets to a nationwide pet insurance policy?

+Absolutely! Many nationwide pet insurance providers offer multi-pet discounts and policies that allow you to insure multiple pets under the same plan. This can be a cost-effective solution for pet owners with multiple furry family members.

Are there any age restrictions for nationwide pet insurance policies?

+Some providers may have age restrictions, especially for older pets. It’s essential to review the policy details to understand any age-related limitations and find a provider that offers coverage for pets of all ages if needed.