Need Insurance

In today's complex and ever-changing world, the need for insurance has become an essential aspect of our lives. From protecting our homes and businesses to safeguarding our health and finances, insurance plays a vital role in providing security and peace of mind. This comprehensive guide will delve into the world of insurance, exploring its various facets and offering expert insights to help you navigate the often-confusing landscape of coverage options.

Understanding the Fundamentals of Insurance

Insurance is a financial safety net that provides protection against potential risks and uncertainties. It is a contract between an individual or entity (the policyholder) and an insurance company, where the latter agrees to compensate the former for any losses or damages incurred, as outlined in the policy.

At its core, insurance operates on the principle of risk sharing. When a large group of individuals or businesses come together and pool their resources, they can effectively manage and mitigate risks. Each policyholder pays a premium, which is a regular payment to the insurance company, in exchange for the promise of financial protection in the event of a covered loss.

Types of Insurance Coverage

The insurance industry offers a wide array of coverage options to suit the diverse needs of individuals and businesses. Here’s an overview of some common types of insurance:

- Property Insurance: This category includes homeowners' insurance, renters' insurance, and business property insurance. It provides financial protection against damage or loss to your property, whether it's your home, rental unit, or commercial space.

- Auto Insurance: Essential for vehicle owners, auto insurance covers damages and liabilities arising from car accidents, theft, or other incidents involving your vehicle.

- Health Insurance: A vital aspect of personal finance, health insurance helps cover the costs of medical care, including hospital stays, surgeries, prescriptions, and preventive care. It ensures you have access to necessary healthcare without incurring significant financial burdens.

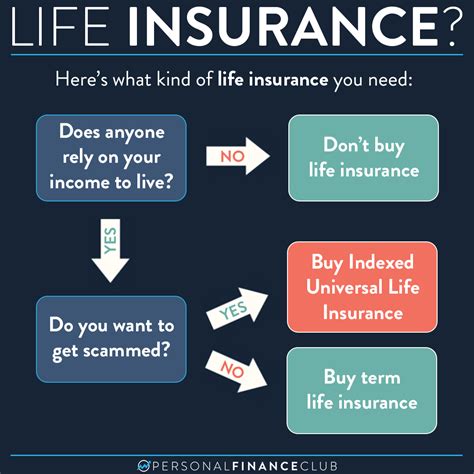

- Life Insurance: Life insurance policies provide financial protection to your loved ones in the event of your untimely demise. It can help cover funeral expenses, pay off debts, and provide a source of income for your family.

- Liability Insurance: This type of insurance protects you from financial losses arising from claims of negligence or other legal liabilities. It's particularly important for businesses and professionals who may face lawsuits.

- Travel Insurance: When you're planning a trip, travel insurance can provide coverage for trip cancellations, medical emergencies, lost luggage, and other travel-related risks.

The Importance of Adequate Coverage

Having insurance is one thing, but ensuring you have adequate coverage is crucial. Inadequate coverage can leave you vulnerable to significant financial losses, especially in the event of a major catastrophe or unexpected event.

For instance, a standard homeowners' insurance policy may not cover certain types of natural disasters, such as floods or earthquakes, which can result in devastating financial consequences. Similarly, a basic health insurance plan might have high deductibles and limited coverage for certain medical procedures, leaving you with substantial out-of-pocket expenses.

Therefore, it's essential to thoroughly review your insurance policies and understand their coverage limits, exclusions, and deductibles. Working with a knowledgeable insurance agent or broker can help you identify gaps in your coverage and tailor your policies to your specific needs.

Customizing Your Insurance Portfolio

No two individuals or businesses have identical insurance needs. Your coverage requirements will depend on various factors, including your personal or business assets, lifestyle, health conditions, and risk tolerance.

Consider the following when customizing your insurance portfolio:

| Factor | Considerations |

|---|---|

| Asset Value | Ensure your insurance coverage matches the value of your assets, whether it's your home, vehicle, or business inventory. |

| Lifestyle and Activities | If you engage in high-risk activities like extreme sports or have a high-value collection, specialized insurance policies may be necessary. |

| Health Conditions | Pre-existing medical conditions or a history of certain illnesses may require specific health insurance plans with adequate coverage. |

| Risk Tolerance | Assess your comfort level with risk. Higher deductibles can lower premiums, but you'll need to be prepared to cover more out-of-pocket expenses. |

Regularly reviewing and updating your insurance policies is crucial, especially when significant life changes occur, such as marriage, the birth of a child, a new business venture, or retirement.

The Process of Insuring Yourself

Insuring yourself or your business involves a series of steps to ensure you obtain the right coverage at a competitive price. Here’s a general outline of the process:

- Assess Your Needs: Start by identifying the types of insurance you require. Consider your assets, liabilities, and potential risks.

- Research Insurance Providers: Look for reputable insurance companies with a strong financial rating and positive customer reviews. Compare their coverage options, premiums, and customer service.

- Obtain Quotes: Request quotes from multiple insurers for the coverage you need. Ensure you understand the terms and conditions of each policy.

- Evaluate Coverage and Premiums: Compare the coverage limits, deductibles, and exclusions of each policy. Balance the level of protection with the cost to find the best value.

- Review Policy Documents: Carefully read the policy documents, including the fine print. If you have questions or concerns, consult an insurance professional.

- Make an Informed Decision: Choose the insurance provider and policy that best meet your needs and budget. Don't hesitate to seek clarification on any aspect of the policy.

- Purchase the Policy: Finalize the purchase by providing the necessary information and paying the initial premium.

- Review and Update Regularly: Periodically review your insurance policies to ensure they align with your changing needs and circumstances. Update your coverage as necessary.

Understanding Policy Exclusions

Insurance policies often come with exclusions, which are specific situations or circumstances that are not covered by the policy. It’s crucial to understand these exclusions to avoid any unpleasant surprises.

For example, a standard homeowners' insurance policy typically excludes damage caused by floods, earthquakes, or acts of war. Similarly, health insurance plans may have limitations on pre-existing conditions or specific medical procedures.

When reviewing insurance policies, pay close attention to the exclusions section. If you have concerns about a particular exclusion, discuss it with your insurance agent or broker to explore alternative coverage options.

Maximizing the Benefits of Insurance

Insurance is not just about financial protection; it also offers several other benefits that can enhance your overall financial well-being.

Peace of Mind

Knowing that you have adequate insurance coverage provides a sense of security and peace of mind. It allows you to focus on your daily life and business operations without constantly worrying about potential risks and their financial impact.

Risk Management

Insurance is a powerful tool for managing risks. By transferring the financial burden of potential losses to an insurance company, you can better plan and prepare for unexpected events. This enables you to make informed decisions and take calculated risks without jeopardizing your financial stability.

Financial Stability

Insurance can help maintain your financial stability in the face of adversity. Whether it’s a medical emergency, a natural disaster, or a business disruption, insurance coverage can provide the necessary funds to cover expenses and help you get back on your feet.

Tax Benefits

Certain types of insurance, such as life insurance and health insurance, may offer tax advantages. Premium payments for these policies can be tax-deductible, reducing your overall tax liability.

The Future of Insurance

The insurance industry is continuously evolving, driven by technological advancements, changing consumer preferences, and emerging risks. Here’s a glimpse into the future of insurance:

Digital Transformation

Insurance companies are increasingly embracing digital technologies to enhance their services. From online policy applications and claims submissions to real-time risk assessment tools, the industry is becoming more efficient and customer-centric.

For instance, telematics devices installed in vehicles can provide real-time data on driving behavior, allowing insurance companies to offer personalized auto insurance rates based on individual driving habits.

Personalized Coverage

With the availability of big data and advanced analytics, insurance companies can now offer highly personalized coverage options. By analyzing individual risk factors and preferences, insurers can tailor policies to meet the unique needs of each customer.

Insurtech Innovations

Insurtech startups are disrupting the traditional insurance landscape with innovative solutions. These companies leverage technology to provide faster, more efficient, and often more affordable insurance options. From peer-to-peer insurance models to blockchain-based smart contracts, Insurtech is reshaping the industry.

Risk Mitigation and Prevention

Insurance companies are increasingly focused on risk mitigation and prevention rather than solely on providing financial protection after a loss. They are investing in technologies and initiatives to help policyholders reduce their risk exposure and prevent losses before they occur.

For example, some insurers now offer home inspection services to identify potential hazards and provide recommendations for mitigating risks, such as fire or water damage.

Environmental and Social Impact

As environmental concerns and social responsibilities become more prominent, insurance companies are adapting their policies and practices to address these issues. They are developing sustainable insurance products and initiatives to support a greener and more socially responsible future.

Some insurers now offer policies that incentivize eco-friendly practices, such as renewable energy adoption or waste reduction, while others are actively investing in climate change resilience and adaptation measures.

Conclusion

Insurance is an essential component of financial planning and risk management. By understanding the fundamentals, customizing your coverage, and staying informed about industry developments, you can navigate the complex world of insurance with confidence.

Remember, insurance is not a one-size-fits-all solution. Regularly review your policies, seek expert advice when needed, and stay proactive in managing your insurance portfolio to ensure you have the protection you deserve.

How often should I review my insurance policies?

+It’s recommended to review your insurance policies annually or whenever significant life changes occur. Regular reviews ensure your coverage remains adequate and aligned with your current needs.

What should I do if I have a claim?

+If you experience a covered loss, contact your insurance company promptly. Provide detailed information about the incident and cooperate with their claims process. Keep records of all communications and be prepared to supply supporting documentation.

Are there any tax benefits associated with insurance premiums?

+Yes, certain insurance premiums, such as those for life insurance and health insurance, may be tax-deductible. Consult a tax professional to understand the specific tax advantages applicable to your situation.