New Driver Car Insurance Cost

Securing car insurance as a new driver can be a complex and often daunting task. With a multitude of factors influencing insurance premiums, it's essential to understand the process and the various aspects that contribute to the overall cost. This article aims to provide a comprehensive guide, exploring the key elements that impact new driver car insurance costs, offering insights into the factors that insurance providers consider, and presenting strategies to mitigate these expenses.

Understanding the Landscape of New Driver Car Insurance

When it comes to car insurance for new drivers, insurance providers assess a wide range of variables to determine the level of risk associated with insuring a particular individual. These variables include demographic factors, driving experience, vehicle type, and location. Each of these elements plays a crucial role in shaping the insurance landscape for new drivers, influencing the overall cost of their insurance policies.

Demographic Factors: Age and Gender

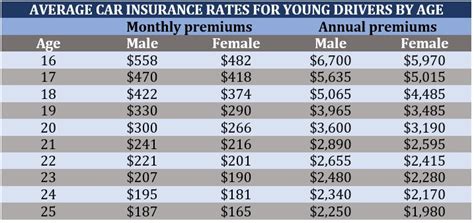

One of the primary considerations for insurance providers is the demographic profile of the driver. Age and gender are significant factors in determining insurance premiums. Statistically, younger drivers, particularly those under the age of 25, are often viewed as higher-risk individuals due to their limited driving experience and higher propensity for involvement in accidents. As a result, insurance providers typically charge higher premiums for this demographic.

Similarly, gender plays a role in insurance assessments. Historically, male drivers have been associated with a higher risk of accidents and more frequent claims, leading to slightly higher insurance premiums compared to female drivers. However, it’s important to note that these gender-based differences are gradually diminishing as insurance providers adopt more nuanced risk assessment models.

Driving Experience and History

The level of driving experience is a critical factor in insurance calculations. New drivers, especially those with less than five years of driving experience, are considered higher-risk individuals. This is primarily because inexperience can lead to a higher likelihood of accidents and claims. Insurance providers often offer discounts or more favorable rates to drivers who have completed advanced driving courses or have a clean driving record, indicating a lower risk profile.

In addition to driving experience, insurance providers also scrutinize a driver’s history of accidents and claims. A clean driving record, free from at-fault accidents or traffic violations, can significantly impact insurance premiums. Conversely, a history of accidents or claims may lead to higher premiums or even difficulty in securing insurance coverage.

| Demographic Factor | Impact on Premium |

|---|---|

| Age | Younger drivers (under 25) face higher premiums due to limited experience. |

| Gender | Male drivers may incur slightly higher premiums historically. |

Vehicle Type and Location

The type of vehicle being insured is another crucial consideration. Insurance providers assess the make, model, and age of the vehicle, as well as its safety features and repair costs. Vehicles that are more expensive to repair or are associated with higher accident rates may result in higher insurance premiums. Additionally, the location where the vehicle is primarily driven and stored can impact insurance costs. Urban areas, for instance, often have higher premiums due to increased traffic density and higher rates of accidents and theft.

Strategies to Mitigate New Driver Car Insurance Costs

While new drivers may face higher insurance premiums due to their limited experience and risk profile, there are several strategies they can employ to mitigate these costs and make insurance more affordable.

Understanding Insurance Options and Providers

The first step in managing insurance costs is to thoroughly understand the various insurance options available. Different insurance providers offer a range of policies and coverage levels, each with its own set of benefits and costs. By researching and comparing these options, new drivers can identify providers that offer more competitive rates for their specific circumstances.

Additionally, it’s important to explore the different coverage options and tailor the policy to individual needs. While comprehensive coverage provides the most protection, it also comes with a higher premium. New drivers should carefully consider their risk tolerance and financial situation when selecting the level of coverage that best suits them.

Leveraging Group and Multi-Policy Discounts

Insurance providers often offer discounts for drivers who belong to specific groups or have multiple policies with the same provider. For instance, many insurance companies provide discounts for students with good academic records or members of certain professional organizations. Additionally, having multiple policies, such as car and home insurance, with the same provider can lead to significant savings through multi-policy discounts.

By leveraging these group and multi-policy discounts, new drivers can reduce their insurance costs while also benefiting from the convenience of having all their insurance needs met by a single provider.

Maintaining a Clean Driving Record

One of the most effective ways for new drivers to lower their insurance costs is by maintaining a clean driving record. Insurance providers closely monitor driving behavior and history, and a clean record can significantly impact insurance premiums. This means avoiding traffic violations, such as speeding or running red lights, and being cautious to prevent accidents.

Additionally, completing advanced driving courses can further enhance a driver’s risk profile. These courses, often offered by insurance providers themselves, teach valuable skills for defensive driving and can result in substantial discounts on insurance premiums. By investing in these courses, new drivers can not only become safer on the road but also save money on their insurance costs.

| Strategy | Impact on Premium |

|---|---|

| Comparing Insurance Providers | Can lead to significant savings by identifying more competitive rates. |

| Multi-Policy Discounts | Combining car and home insurance policies with the same provider can reduce overall costs. |

| Advanced Driving Courses | Completing these courses can result in substantial discounts and improved driving skills. |

Exploring Alternative Insurance Models

In recent years, the insurance industry has witnessed the emergence of alternative insurance models that offer new drivers more flexibility and potential cost savings. One such model is usage-based insurance, where premiums are calculated based on the driver’s actual usage and behavior rather than demographics and driving history. This model can be particularly beneficial for new drivers who may have a lower risk profile than their demographic suggests.

Additionally, some insurance providers offer pay-as-you-drive insurance, where premiums are based on the number of miles driven. This can be advantageous for new drivers who primarily use their vehicles for short commutes or occasional trips, as they can pay a lower premium for their limited usage.

Conclusion

Navigating the world of car insurance as a new driver can be challenging, but with a comprehensive understanding of the factors that influence insurance costs and the strategies available to mitigate them, new drivers can make informed decisions to secure affordable and adequate coverage. By staying informed, comparing options, and adopting safe driving habits, new drivers can not only reduce their insurance costs but also become safer and more responsible motorists.

What is the average cost of car insurance for new drivers?

+The average cost of car insurance for new drivers can vary significantly based on numerous factors, including age, gender, location, and driving record. However, as a general guideline, new drivers can expect to pay anywhere from 1,500 to 3,000 annually for insurance. It’s important to note that these figures are averages and can vary widely depending on individual circumstances.

How can new drivers reduce their insurance costs?

+There are several strategies new drivers can employ to reduce their insurance costs. These include comparing insurance providers to find the most competitive rates, leveraging group and multi-policy discounts, maintaining a clean driving record, and exploring alternative insurance models such as usage-based or pay-as-you-drive insurance.

Are there any discounts available specifically for new drivers?

+Yes, many insurance providers offer discounts specifically for new drivers. These can include discounts for completing advanced driving courses, maintaining a clean driving record, and being a student with good academic standing. Additionally, some providers offer discounts for new drivers who have completed a driver’s education course.