New York Medical Insurance

Understanding medical insurance options is crucial for residents of New York, a state renowned for its diverse healthcare landscape. This comprehensive guide delves into the intricacies of New York Medical Insurance, shedding light on the various plans, coverage, and benefits available to ensure residents can make informed decisions about their healthcare coverage.

Navigating the Complexities of New York’s Healthcare System

New York boasts one of the most robust healthcare systems in the United States, with a wide range of medical facilities, providers, and services. However, this abundance of choices can make selecting the right medical insurance plan a daunting task. Let’s break down the key aspects to consider when navigating the complexities of New York’s healthcare landscape.

Plan Types and Coverage Options

New York offers a plethora of medical insurance plans to cater to the diverse needs of its residents. These plans can be broadly categorized into:

- Individual Plans: Designed for those who are not covered by an employer-sponsored plan, these policies provide comprehensive coverage for a single individual or a family.

- Group Plans: Often offered by employers, group plans provide coverage to a defined group of individuals, such as employees and their dependents. These plans typically offer more affordable premiums and a wider range of benefits.

- Medicaid and Medicare: Government-funded programs providing healthcare coverage to eligible individuals based on factors like age, disability, or income level. These programs are essential for ensuring access to healthcare for vulnerable populations.

Within these categories, there are numerous plan options, each with its own unique set of benefits and coverage limits. Some key considerations when evaluating plan types include:

- Premium Costs: The amount you pay monthly for your insurance coverage. Lower premiums often mean higher out-of-pocket expenses during healthcare visits.

- Deductibles and Copayments: Deductibles are the amounts you must pay out of pocket before your insurance coverage kicks in, while copayments are fixed amounts you pay for specific services, like a doctor's visit or prescription medication.

- Network Providers: Many insurance plans have a network of preferred providers, which can impact your choice of doctors, specialists, and hospitals. Out-of-network care may result in higher costs.

- Benefit Packages: Each plan offers a unique set of benefits, including coverage for routine check-ups, specialist visits, hospital stays, prescription drugs, and more. It's crucial to understand the specific benefits included in your plan.

Key Metrics and Comparative Analysis

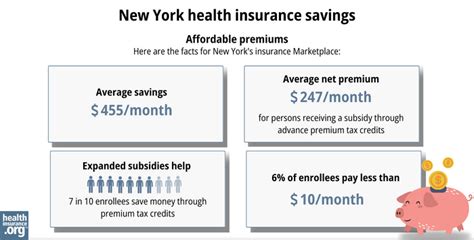

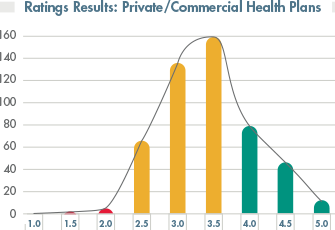

When comparing New York medical insurance plans, it's essential to analyze key metrics to ensure you're selecting the most suitable option. Here's a breakdown of some critical factors to consider:

| Metric | Description |

|---|---|

| Premium | Monthly cost of insurance coverage, which can vary based on age, location, and plan type. |

| Deductible | Amount you must pay out of pocket before insurance coverage begins. |

| Copayment | Fixed amount you pay for specific healthcare services, often determined by the plan's benefit package. |

| Out-of-Pocket Maximum | The most you'll pay out of pocket during a policy year, excluding premiums. This cap provides financial protection. |

| Network Size | Number of healthcare providers and facilities in the plan's network, impacting your choice of doctors and hospitals. |

| Prescription Drug Coverage | Details on prescription drug benefits, including the cost of medications and any restrictions. |

| Specialist and Hospital Coverage | Understanding coverage for specialist visits and hospital stays is crucial for comprehensive healthcare. |

Comparing these metrics across different plans can help you identify the best fit for your healthcare needs and budget. It's important to note that while lower premiums may be attractive, they often come with higher out-of-pocket expenses, so finding the right balance is key.

Real-World Examples and Case Studies

Let’s take a look at some real-world examples to better understand the impact of different plan choices. Consider the following scenarios:

-

Young, Healthy Individual: John, a 25-year-old with no major health concerns, opts for a high-deductible plan with a low premium. This plan suits his needs as he rarely visits the doctor and can afford the higher out-of-pocket expenses when needed.

-

Family with Chronic Illness: The Smith family, with two children and a history of chronic illness, chooses a plan with a higher premium but a lower deductible. This ensures they can access necessary healthcare services without facing significant financial burdens.

-

Senior Citizen: Ms. Johnson, a retiree on a fixed income, selects a Medicare Advantage plan with prescription drug coverage. This plan provides comprehensive coverage while ensuring her medications are affordable.

These examples highlight the importance of aligning your medical insurance plan with your unique healthcare needs and financial situation.

Industry Insights and Expert Tips

Navigating the complex world of medical insurance can be challenging, but with the right guidance, it becomes more manageable. Here are some expert insights and tips to help you make informed decisions:

Understanding Your Needs

The first step is to assess your personal healthcare needs. Consider factors like your age, health status, family size, and any pre-existing conditions. Understanding these needs will help you choose a plan that provides adequate coverage without unnecessary expenses.

Network Flexibility

If you have a preferred doctor or specialist, ensure they are in-network for the plans you’re considering. Out-of-network care can be significantly more expensive and may not be covered by your insurance.

Prescription Drug Coverage

Prescription medications can be a major expense. Review the formulary (list of covered drugs) for each plan and ensure your medications are included. Some plans offer discounts or coverage for specific medications, which can be a significant cost-saver.

Annual Limits and Out-of-Pocket Maximums

Understand the annual limits and out-of-pocket maximums for each plan. These caps can provide financial protection in the event of a major illness or injury, ensuring you won’t be burdened with excessive medical expenses.

Review and Compare

Don’t settle for the first plan that seems suitable. Take the time to review and compare multiple options. Online resources, insurance brokers, and even government websites can provide valuable insights and comparisons to help you make an informed decision.

The Future of New York’s Medical Insurance Landscape

As the healthcare industry continues to evolve, New York’s medical insurance landscape is likely to see significant changes. Here’s a glimpse into the future:

Telehealth and Virtual Care

The COVID-19 pandemic accelerated the adoption of telehealth services, and this trend is expected to continue. Many insurance plans are now offering expanded coverage for virtual healthcare, providing convenient access to medical advice and treatment from the comfort of home.

Value-Based Care

There’s a growing shift towards value-based healthcare, where insurance plans focus on providing high-quality care while controlling costs. This approach aims to improve patient outcomes and reduce unnecessary expenses. Look for plans that emphasize value-based care models.

Expanded Coverage for Mental Health

With an increasing focus on mental health awareness, insurance plans are likely to expand their coverage for mental health services. This includes improved access to therapy, counseling, and medication for mental health conditions.

Technology Integration

Insurance providers are leveraging technology to enhance the customer experience. Expect to see more online portals, mobile apps, and digital tools for managing your insurance coverage, making it easier to access information and make informed decisions.

Regulatory Changes

The healthcare industry is heavily regulated, and changes in federal and state policies can impact insurance coverage. Stay informed about potential changes that may affect your insurance options and benefits.

Frequently Asked Questions

How do I know if I’m eligible for Medicaid or Medicare in New York?

+Eligibility for Medicaid and Medicare in New York is based on a combination of factors, including age, income, disability status, and residency. You can visit the official New York State of Health website to determine your eligibility and apply for coverage.

What happens if I have a pre-existing condition?

+Thanks to the Affordable Care Act, insurance companies cannot deny coverage or charge higher premiums based solely on pre-existing conditions. However, it’s important to disclose all pre-existing conditions when applying for insurance to ensure accurate coverage.

Can I change my insurance plan during the year?

+In most cases, you can only change your insurance plan during the annual Open Enrollment period or if you experience a qualifying life event, such as marriage, birth of a child, or loss of existing coverage. Check with your insurance provider for specific details.

How can I get assistance with choosing the right plan?

+If you need help choosing a plan, consider reaching out to an insurance broker or navigator. These professionals can provide guidance based on your specific needs and circumstances. You can also find helpful resources and tools on the New York State of Health website.