New York State Car Insurance

Navigating the world of car insurance can be a complex task, especially when it comes to understanding the specific requirements and regulations of a particular state. In this comprehensive guide, we will delve into the intricacies of New York State car insurance, providing you with expert insights and practical information to ensure you make informed decisions regarding your automotive coverage.

Understanding New York State Car Insurance Requirements

New York State has implemented a comprehensive set of regulations to ensure that all drivers on its roads are adequately insured. These requirements are designed to protect both the policyholder and other road users in the event of an accident. Let's explore the essential aspects of New York State car insurance.

Minimum Liability Coverage

One of the key components of New York State car insurance is the minimum liability coverage, which is mandated by law. Liability coverage is crucial as it protects you financially if you are found at fault in an accident. In New York, the minimum liability limits are as follows:

- Bodily Injury Liability: $25,000 per person and $50,000 per accident.

- Property Damage Liability: $10,000 per accident.

These limits ensure that you have sufficient coverage to address the medical expenses and property damage resulting from an accident you cause. It's important to note that while these are the minimum requirements, many drivers choose to increase their liability limits to provide greater financial protection.

Additional Coverage Options

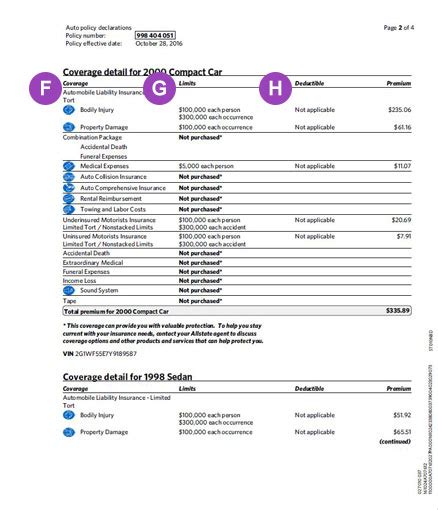

Beyond the mandatory liability coverage, New York State car insurance offers a range of additional coverage options to tailor your policy to your specific needs. Here are some of the key coverages you should consider:

- Collision Coverage: This coverage pays for repairs or replacements if your vehicle is damaged in an accident, regardless of fault. It is especially beneficial for newer or financed vehicles.

- Comprehensive Coverage: Comprehensive coverage protects your vehicle against non-accident-related incidents such as theft, vandalism, natural disasters, or collisions with animals. It provides a comprehensive safety net for your vehicle.

- Uninsured/Underinsured Motorist Coverage: New York State requires insurers to offer this coverage, which provides protection if you are involved in an accident with a driver who has insufficient or no insurance. It ensures you are not left financially burdened by such incidents.

- Personal Injury Protection (PIP): PIP coverage, also known as no-fault insurance, covers medical expenses and lost wages for you and your passengers, regardless of who is at fault in an accident. It is an essential coverage for ensuring prompt medical attention and financial stability.

Factors Affecting Car Insurance Rates in New York State

Car insurance rates in New York State can vary significantly depending on several factors. Understanding these factors can help you make informed decisions when choosing your coverage and insurer. Here are some key considerations:

- Vehicle Type and Usage: The make, model, and age of your vehicle, as well as how you use it (e.g., commuting, pleasure driving, or business purposes), can impact your insurance rates. Sports cars and luxury vehicles, for instance, may have higher premiums due to their higher repair costs.

- Driver Profile: Your age, gender, driving record, and credit score are significant factors in determining your insurance rates. Younger drivers and those with a history of accidents or traffic violations may face higher premiums. Maintaining a clean driving record and improving your credit score can lead to more affordable insurance options.

- Location: Where you live and garage your vehicle plays a role in your insurance rates. New York City, for example, has higher insurance costs due to increased traffic and the potential for accidents and theft. Rural areas, on the other hand, may have lower rates.

- Insurance Company and Policy: Different insurance companies offer varying rates and policy options. It's crucial to compare quotes from multiple insurers to find the best coverage at the most competitive price. Additionally, the specific policy you choose, including the coverage limits and deductibles, will impact your overall premium.

| Coverage Type | Average Annual Premium |

|---|---|

| Liability Only | $1,200 |

| Liability with Collision and Comprehensive | $1,800 |

| Full Coverage (Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, PIP) | $2,400 |

These average annual premium estimates are based on a 30-year-old driver with a clean record, driving a 2018 Toyota Camry in New York City. Actual rates may vary based on individual circumstances and insurer-specific factors.

Shopping for New York State Car Insurance

Now that we've covered the essential aspects of New York State car insurance, it's time to dive into the process of shopping for the right coverage. Here's a step-by-step guide to help you navigate this journey.

Assess Your Needs

Before you begin shopping for car insurance, take the time to assess your specific needs. Consider the following factors:

- Your budget: Determine how much you can comfortably afford to spend on car insurance each month.

- Your vehicle: Research the average insurance costs for your vehicle make and model. Luxury and sports cars often have higher insurance premiums.

- Your driving record: If you have a clean driving record, you may qualify for lower rates. On the other hand, accidents and traffic violations can increase your insurance costs.

- Your desired coverage: Decide on the coverage types and limits that align with your needs and financial capabilities. Consider factors like the value of your vehicle, your daily commute, and your personal risk tolerance.

Research Insurers and Coverage Options

With a clear understanding of your needs, it's time to research insurers and the coverage options they offer. Here are some key steps to take:

- Compare Insurance Companies: Look into multiple insurance providers in New York State. Check their reputation, customer reviews, and financial stability. You can use online resources, consumer reports, and industry ratings to gather information.

- Review Coverage Options: Each insurer offers a range of coverage types and limits. Compare the specific coverages they provide, including liability, collision, comprehensive, uninsured/underinsured motorist, and personal injury protection (PIP). Ensure you understand the differences and choose options that best suit your needs.

- Consider Additional Benefits: Some insurers offer unique benefits or discounts. These could include accident forgiveness, roadside assistance, rental car coverage, or discounts for safe driving or bundling policies. Evaluate these benefits and determine if they align with your preferences.

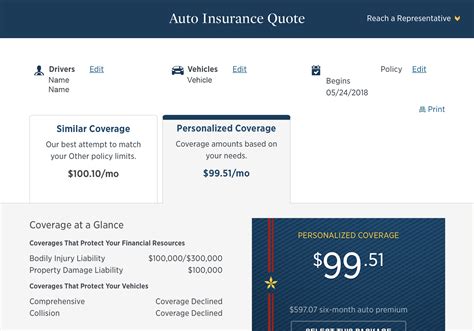

Obtain Quotes and Evaluate Policies

Once you've narrowed down your insurer options, it's time to obtain quotes and thoroughly evaluate the policies. Here's how to proceed:

- Request Quotes: Contact the insurers you've selected and request quotes. Provide accurate and detailed information about your vehicle, driving history, and desired coverage. Be transparent to ensure you receive accurate quotes.

- Compare Quotes: Carefully compare the quotes you receive. Look at the coverage limits, deductibles, and premiums. Consider the overall value and benefits each policy offers. Remember that the cheapest option may not always be the best, as it might have lower coverage limits or higher deductibles.

- Evaluate Policy Details: Dig deeper into the policy details. Review the fine print to understand any exclusions, limitations, or conditions that may apply. Ensure the policy covers the specific risks you want to protect against. Don't hesitate to ask questions or seek clarification from the insurer if needed.

Consider Discounts and Savings Opportunities

Car insurance providers often offer a variety of discounts and savings opportunities to make their policies more affordable. Here are some common discounts you should inquire about when shopping for New York State car insurance:

- Multi-Policy Discount: If you bundle your car insurance with other policies, such as homeowners or renters insurance, you may qualify for a multi-policy discount. This can significantly reduce your overall insurance costs.

- Safe Driver Discount: Many insurers reward drivers with a clean record by offering safe driver discounts. If you've maintained a spotless driving history for a certain period, you may be eligible for this discount.

- Good Student Discount: If you have a young driver in your household who maintains good grades in school, you may qualify for a good student discount. This discount recognizes the correlation between academic achievement and responsible driving.

- Anti-Theft Device Discount: Installing approved anti-theft devices in your vehicle can reduce the risk of theft and earn you a discount on your insurance premium. Check with your insurer to see which devices qualify for this discount.

- Low Mileage Discount: If you drive fewer miles than the average driver, you may be eligible for a low mileage discount. Insurers recognize that lower mileage often correlates with reduced accident risks.

Filing a Car Insurance Claim in New York State

In the unfortunate event of an accident or vehicle-related incident, knowing how to file a car insurance claim is crucial. Here's a step-by-step guide to help you navigate the claims process in New York State.

Report the Incident

Immediately after an accident or incident, it's essential to report it to your insurance company. Here's what you should do:

- Contact Your Insurer: Reach out to your insurance provider as soon as possible. Provide them with your policy number and a detailed description of the incident. Be honest and transparent about what happened.

- Collect Information: Gather relevant information, including the date, time, and location of the incident. Take photos of any damage to your vehicle or the accident scene. Obtain contact details and insurance information from any other parties involved.

- File a Police Report: In certain situations, such as accidents involving injuries, significant property damage, or disputes over fault, it's advisable to file a police report. This official record can be valuable when filing your insurance claim.

Assess Your Coverage

Once you've reported the incident, take the time to review your insurance policy and understand the coverage you have. Here's how to proceed:

- Review Your Policy: Locate and review your insurance policy document. Identify the specific coverages you have, such as liability, collision, comprehensive, uninsured/underinsured motorist, or personal injury protection (PIP). Understand the limits and deductibles associated with each coverage.

- Assess Coverage Eligibility: Determine whether the incident you experienced is covered by your policy. For example, if you were involved in a collision and have collision coverage, you may be eligible for repairs or replacements. Review your policy's exclusions to ensure the incident is not specifically excluded.

- Contact Your Insurer for Guidance: If you're unsure about your coverage or have questions, don't hesitate to contact your insurer. Their customer service representatives can provide clarification and guidance based on your specific policy and the circumstances of your claim.

Initiate the Claims Process

With a clear understanding of your coverage and the incident, it's time to initiate the claims process. Follow these steps:

- Complete the Claim Form: Your insurance company will provide you with a claim form or guide you through the online claims process. Provide accurate and detailed information about the incident, including the date, time, location, and any relevant details. Be as thorough as possible to ensure a smooth claims process.

- Submit Supporting Documentation: Along with the claim form, you may need to submit additional documentation to support your claim. This could include photos of the damage, police reports, medical records (if applicable), and any other relevant evidence. Ensure you have all the required documents before submitting your claim.

- Cooperate with the Claims Adjuster: Once your claim is submitted, a claims adjuster will be assigned to assess the damages and determine the value of your claim. Cooperate fully with the adjuster by providing any additional information or documentation they request. Be open to discussing the details of the incident and any potential issues that may impact your claim.

Handling Claim Settlements and Repairs

As your claim progresses, you'll need to navigate the settlement process and make decisions regarding repairs. Here's what you can expect:

- Claim Settlement: The claims adjuster will evaluate your claim and determine the settlement amount. This process may involve assessing the extent of the damage, estimating repair costs, and considering factors such as depreciation. The adjuster will provide you with a settlement offer, which you can accept or negotiate if you believe it doesn't adequately cover your losses.

- Repairs and Rental Car Coverage: If your vehicle requires repairs, you can choose a reputable repair shop to handle the work. Some insurance policies include rental car coverage, which provides a temporary vehicle while yours is being repaired. Work with your insurer to understand the process and ensure you receive the necessary coverage for your rental car expenses.

- Appealing a Claim Denial: In some cases, your claim may be denied or the settlement offer may be unsatisfactory. If this happens, you have the right to appeal the decision. Contact your insurer's customer service or claims department to discuss your options and understand the appeal process. Provide additional evidence or documentation to support your case.

Frequently Asked Questions (FAQ)

What is the average cost of car insurance in New York State?

+The average cost of car insurance in New York State can vary depending on factors such as the driver's age, location, and driving record. According to recent data, the average annual premium for a minimum liability policy in New York is around $1,200. However, the cost can increase significantly with additional coverage options and for drivers with a history of accidents or violations.

Are there any discounts available for New York State car insurance?

+Yes, there are several discounts available for New York State car insurance. These include discounts for safe driving records, multiple vehicles on the same policy, good student status, and anti-theft devices. Additionally, some insurers offer discounts for paying your premium in full or for bundling your car insurance with other policies, such as homeowners or renters insurance.

What happens if I don't have car insurance in New York State?

+Driving without car insurance in New York State is illegal and can result in severe penalties. If caught, you may face fines, license suspension, and even criminal charges. Additionally, you will be financially responsible for any damages or injuries caused in an accident, which can be extremely costly.

Can I choose my own repair shop for car repairs after an accident?

+Yes, you have the right to choose your preferred repair shop for car repairs after an accident. However, it's important to check with your insurance provider to ensure the shop is within their network of approved repairers. Some insurers may have specific requirements or preferred shops, so it's advisable to discuss this with your insurer before proceeding with repairs.

How long does it take to process a car insurance claim in New York State?

+The time it takes to process a car insurance claim in New York State can vary depending on the complexity of the claim and the insurer's processing procedures. Simple claims with minimal damage and clear liability may be processed within a few days. However, more complex claims involving extensive damage, disputes over fault, or injuries can take several weeks or even months to fully resolve.

Understanding New York State car insurance is crucial for ensuring you have adequate coverage and protection on