Next Insurance Company

In the rapidly evolving landscape of digital innovation and disruptive technologies, the insurance industry is witnessing a transformative shift. Among the pioneers leading this change is Next Insurance, a tech-driven insurance provider that is reshaping the way small businesses and professionals secure their future. This article delves into the innovative strategies, cutting-edge technologies, and customer-centric approach that define Next Insurance's success and explore how they are revolutionizing the insurance sector.

The Rise of Next Insurance: A Digital Revolution in Insurance

Headquartered in the heart of Silicon Valley, Next Insurance emerged as a disruptor in the traditional insurance market. Founded by a team of experienced entrepreneurs and insurance experts, the company set out with a clear mission: to empower small businesses and professionals by offering tailored, affordable, and accessible insurance solutions. With a deep understanding of the evolving needs of modern businesses, Next Insurance has carved a unique path, leveraging technology to provide a seamless and efficient insurance experience.

Next Insurance's journey began in 2016, recognizing the challenges faced by small businesses and professionals in navigating the complex world of insurance. Traditional insurance models often fell short, offering limited flexibility, high costs, and cumbersome processes. Next Insurance aimed to bridge this gap, leveraging the power of technology to create a customer-centric, efficient, and innovative insurance provider.

Key Milestones and Growth

Since its inception, Next Insurance has achieved remarkable milestones, solidifying its position as a leading force in the digital insurance space. The company’s rapid growth can be attributed to its ability to address the pain points of its target audience and provide solutions that are not only effective but also technologically advanced.

In its early stages, Next Insurance focused on building a robust and secure technology infrastructure, utilizing cutting-edge tools and platforms to streamline insurance processes. This foundation allowed the company to offer a wide range of insurance products tailored to the diverse needs of small businesses, from contractors and freelancers to specialty trades and professional services.

| Year | Key Achievement |

|---|---|

| 2016 | Next Insurance founded by entrepreneurs with a vision to transform insurance for small businesses. |

| 2017 | Secured significant funding, allowing rapid expansion and product development. |

| 2018 | Launched its first insurance products, offering liability coverage for contractors and small businesses. |

| 2019 | Expanded its product portfolio, introducing specialized insurance for professionals such as accountants and real estate agents. |

| 2020 | Partnered with major industry players, solidifying its position as a trusted insurance provider. |

| 2021 | Achieved a significant milestone, becoming one of the fastest-growing insurance startups globally. |

Innovative Strategies and Technologies: Transforming the Insurance Landscape

At the core of Next Insurance’s success lies its commitment to innovation and technological advancement. The company has harnessed the power of cutting-edge technologies to revolutionize the insurance experience for its customers.

AI and Machine Learning Integration

Next Insurance has seamlessly integrated Artificial Intelligence (AI) and Machine Learning into its operations, enhancing efficiency and accuracy. AI-powered algorithms enable the company to automate various processes, from underwriting to claims management. This not only reduces administrative burdens but also allows for more precise risk assessment and faster policy issuance.

For instance, Next Insurance's AI-driven risk assessment models analyze a wealth of data points, including historical claims data, industry trends, and client-specific information. This enables the company to offer highly customized insurance solutions, ensuring that small businesses receive coverage that aligns perfectly with their unique needs.

Digital Platform and Online Experience

Next Insurance has developed a user-friendly, intuitive digital platform that serves as a one-stop solution for all insurance needs. The platform allows customers to easily navigate through the insurance process, from obtaining quotes to purchasing policies and managing their accounts. The online experience is designed to be seamless and efficient, saving customers valuable time and effort.

One notable feature of the platform is its interactive quoting tool, which leverages machine learning to provide accurate and instant quotes. Customers can input their business details and receive personalized insurance recommendations, making the process transparent and straightforward.

Mobile App Integration

Recognizing the importance of mobility and accessibility, Next Insurance has developed a comprehensive mobile app that extends the digital insurance experience to customers’ fingertips. The app allows users to manage their policies, submit claims, and access essential insurance-related information on the go.

With the mobile app, customers can instantly report incidents, upload necessary documentation, and track the progress of their claims. This level of convenience and accessibility has been a game-changer for busy professionals and small business owners, ensuring that insurance matters can be addressed promptly and efficiently.

Data Analytics and Insights

Next Insurance leverages advanced data analytics to gain valuable insights into customer behavior, industry trends, and risk patterns. By analyzing vast amounts of data, the company can identify emerging risks, tailor insurance products to specific industries, and provide proactive risk management advice to its customers.

For instance, Next Insurance's data-driven approach enables it to identify emerging trends in certain industries, such as the rise of remote work or the increasing popularity of sustainable practices. By understanding these trends, the company can develop insurance products that cater to the evolving needs of its customers, ensuring they remain protected in an ever-changing business landscape.

Customer-Centric Approach: Empowering Small Businesses and Professionals

Next Insurance’s success is deeply rooted in its unwavering commitment to its customers. The company has placed the needs and preferences of small businesses and professionals at the forefront, designing its insurance products and services to address their unique challenges and aspirations.

Tailored Insurance Solutions

Understanding that small businesses and professionals have diverse insurance needs, Next Insurance offers a wide range of tailored insurance solutions. From general liability and professional liability to workers’ compensation and cyber insurance, the company ensures that its customers can access the coverage they require, no matter their industry or business model.

For example, Next Insurance provides specialized insurance for contractors, offering protection against property damage, bodily injury, and professional errors. Similarly, the company offers comprehensive coverage for freelancers and consultants, addressing their unique risks associated with independent work.

Affordable and Flexible Coverage

Next Insurance recognizes that affordability is a critical factor for small businesses and professionals. The company strives to offer competitive pricing without compromising on the quality of coverage. Through its efficient, technology-driven processes, Next Insurance is able to provide insurance solutions that are not only comprehensive but also highly cost-effective.

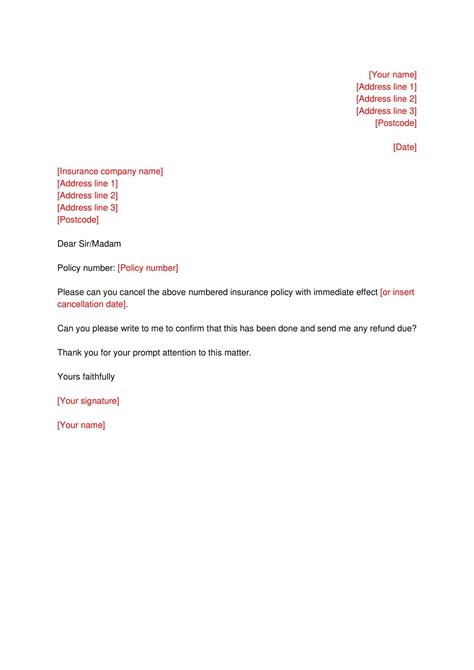

Furthermore, Next Insurance understands the dynamic nature of small businesses. The company offers flexible coverage options, allowing customers to adjust their policies as their business needs evolve. Whether it's increasing coverage limits, adding new endorsements, or canceling policies, Next Insurance provides the flexibility that small businesses require to navigate the ups and downs of their industry.

Exceptional Customer Support

Next Insurance prides itself on delivering exceptional customer support, ensuring that its customers receive personalized assistance throughout their insurance journey. The company’s dedicated support team is readily available to address inquiries, provide guidance, and assist with policy management.

Through its digital platform and mobile app, Next Insurance offers multiple channels for customers to reach out for support. Whether it's live chat, email, or phone support, the company ensures that customers can connect with knowledgeable and friendly representatives who are committed to providing timely and accurate assistance.

Future Outlook and Industry Impact

As Next Insurance continues to thrive and innovate, its impact on the insurance industry is set to become even more profound. The company’s success has not only disrupted the traditional insurance model but has also set a new standard for customer-centricity, technological integration, and digital transformation.

Expanding Product Portfolio

Next Insurance is committed to expanding its product portfolio to meet the evolving needs of its customers. The company is continuously researching and developing new insurance products, ensuring that small businesses and professionals have access to the coverage they require in an ever-changing business landscape.

Looking ahead, Next Insurance plans to introduce innovative insurance solutions for emerging industries, such as the gig economy and e-commerce. The company aims to provide comprehensive protection for businesses operating in these dynamic sectors, addressing their unique risks and challenges.

Enhanced Digital Experience

Next Insurance is dedicated to further enhancing its digital platform and mobile app, ensuring that the insurance experience remains seamless, efficient, and user-friendly. The company is investing in cutting-edge technologies, such as natural language processing and conversational AI, to create an even more intuitive and personalized experience for its customers.

By leveraging these technologies, Next Insurance aims to revolutionize the way customers interact with their insurance provider. The company envisions a future where customers can engage in natural conversations with their insurance policies, receive proactive recommendations, and access essential information with ease.

Industry Collaboration and Partnerships

Next Insurance recognizes the value of industry collaboration and partnerships in driving innovation and growth. The company actively seeks strategic alliances with industry leaders, technology providers, and business associations to enhance its offerings and reach a wider audience.

Through these partnerships, Next Insurance aims to leverage industry expertise, gain access to valuable resources, and develop tailored insurance solutions for specific industries. By working together, the company can create a more inclusive and supportive insurance ecosystem, benefiting small businesses and professionals across various sectors.

Conclusion: Shaping the Future of Insurance

Next Insurance’s journey is a testament to the power of innovation and technological disruption in the insurance industry. By combining cutting-edge technologies with a deep understanding of customer needs, the company has revolutionized the insurance experience for small businesses and professionals.

As Next Insurance continues to lead the way in digital insurance, its impact on the industry will be profound. The company's success has inspired a new wave of innovation, encouraging traditional insurance providers to embrace technological advancements and adopt customer-centric approaches. The future of insurance is bright, and Next Insurance is at the forefront, shaping a more accessible, efficient, and customer-focused industry.

How does Next Insurance’s digital platform enhance the insurance experience for small businesses and professionals?

+Next Insurance’s digital platform offers a seamless and efficient insurance experience. Customers can easily obtain quotes, purchase policies, and manage their accounts online. The platform’s interactive features, such as the instant quoting tool, provide transparency and convenience, making insurance matters more accessible and straightforward.

What are the benefits of Next Insurance’s AI-powered risk assessment models for small businesses and professionals?

+Next Insurance’s AI-powered risk assessment models offer several advantages. They enable the company to provide highly customized insurance solutions, ensuring that small businesses receive coverage tailored to their unique needs. Additionally, these models enhance efficiency, enabling faster policy issuance and more precise risk assessment.

How does Next Insurance ensure affordability for its insurance products?

+Next Insurance strives to offer competitive pricing without compromising on the quality of coverage. By leveraging technology and efficient processes, the company is able to provide insurance solutions that are both comprehensive and cost-effective. Additionally, the company’s flexible coverage options allow customers to adjust their policies as needed, ensuring that insurance remains an affordable investment.