Nj Auto Insurance Quotes

New Jersey, often referred to as the "Garden State," is renowned for its vibrant cities, diverse landscapes, and thriving business scene. Amidst this bustling state, auto insurance plays a pivotal role, offering financial protection and peace of mind to its residents. Understanding the intricacies of New Jersey auto insurance is essential for any driver navigating the roads of this dynamic state. This comprehensive guide aims to unravel the complexities, shedding light on the unique features, regulations, and benefits of NJ auto insurance quotes.

The Landscape of NJ Auto Insurance: Understanding the Basics

In New Jersey, auto insurance is not just a legal requirement but a necessity for every driver. The state mandates a minimum level of coverage to ensure financial responsibility in the event of accidents or other vehicular incidents. This basic coverage includes bodily injury liability, property damage liability, and personal injury protection (PIP). However, the specific requirements and costs can vary significantly, influenced by factors such as the driver’s age, location, and driving record.

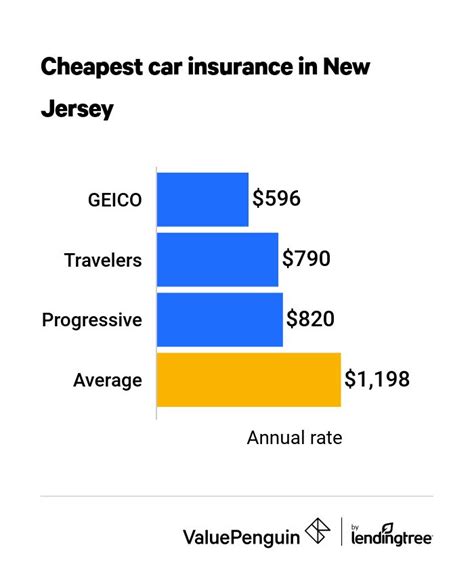

The cost of auto insurance in New Jersey is a topic of much discussion. On average, NJ residents pay around $1,700 annually for auto insurance, which is higher than the national average. This elevated cost is attributed to various factors, including the state's high population density, frequent traffic congestion, and the associated risks of accidents. Additionally, New Jersey's no-fault insurance system, which mandates Personal Injury Protection (PIP) coverage, plays a role in the higher insurance premiums.

The Influence of Location on NJ Auto Insurance Quotes

One of the key determinants of auto insurance rates in New Jersey is the driver’s location. The state’s diverse geography and population distribution result in significant variations in insurance costs across different cities and counties. For instance, urban areas like Newark, Jersey City, and Paterson often see higher insurance premiums due to factors such as increased traffic volume, higher crime rates, and a greater likelihood of accidents. In contrast, suburban and rural areas may offer more affordable insurance rates due to lower population density and reduced accident risks.

Furthermore, the specific neighborhood or zip code within a city can also impact insurance rates. Areas with higher crime rates or a history of frequent accidents may be classified as high-risk zones, leading to increased insurance premiums for residents. Conversely, neighborhoods with a track record of lower accident rates and minimal crime may enjoy more competitive insurance rates.

| City | Average Annual Premium |

|---|---|

| Newark | $2,200 |

| Jersey City | $1,950 |

| Paterson | $1,850 |

| Edison | $1,650 |

| Cherry Hill | $1,550 |

Coverage Options and Customization: Tailoring Your NJ Auto Insurance

While the minimum coverage requirements in New Jersey provide a baseline for auto insurance, many drivers opt for additional coverage to enhance their protection. This can include comprehensive and collision coverage, which offer protection against damage caused by events other than accidents, such as natural disasters, theft, or vandalism. Additionally, drivers can choose to increase their liability limits to provide greater financial protection in the event of a severe accident.

Another aspect of customizing your NJ auto insurance involves selecting the right deductible. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By choosing a higher deductible, you can often lower your insurance premiums, but it's important to ensure you can afford the deductible in the event of a claim.

Discounts and Savings: Maximizing Your NJ Auto Insurance Value

One of the most effective ways to reduce the cost of NJ auto insurance is by taking advantage of various discounts offered by insurance providers. These discounts can significantly lower your insurance premiums and are often based on factors such as your driving record, the safety features of your vehicle, your educational qualifications, and your professional affiliations.

- Good Driver Discount: Many insurance companies offer discounts to drivers with a clean driving record, free of accidents or serious violations.

- Safety Features Discount: Vehicles equipped with advanced safety features like anti-lock brakes, air bags, and anti-theft devices may qualify for discounts.

- Student Discount: Young drivers who maintain good grades or are enrolled in certain safety courses may be eligible for student discounts.

- Professional Affiliation Discounts: Membership in certain professional organizations or affiliations can lead to insurance discounts.

Additionally, bundling your auto insurance with other types of insurance, such as homeowners or renters insurance, can often result in substantial savings. This strategy, known as insurance bundling, is a popular way to reduce insurance costs while maintaining comprehensive coverage.

The Claims Process: What to Expect with NJ Auto Insurance

In the event of an accident or other covered incident, understanding the claims process is crucial. New Jersey’s no-fault insurance system means that, regardless of fault, your insurance provider will cover your medical expenses and a portion of your lost income up to the limits of your Personal Injury Protection (PIP) coverage. However, if your injuries or damages exceed your PIP limits, or if you sustain a serious injury as defined by state law, you may be able to pursue a claim against the at-fault driver.

When filing a claim, it's important to provide detailed and accurate information to your insurance provider. This includes documenting the accident scene, gathering witness statements if applicable, and promptly reporting the incident to your insurance company. Most insurance companies offer online or mobile apps to simplify the claims process, allowing you to track the progress of your claim and receive updates in real-time.

Tips for a Smooth Claims Process

- Document the accident scene with photos and videos, if possible.

- Exchange information with all involved parties, including insurance details and contact information.

- Report the accident to your insurance company as soon as possible.

- Keep all records and documentation related to the accident, including police reports, repair estimates, and medical bills.

- Consider seeking legal advice if your claim is complex or involves significant injuries or damages.

Conclusion: Navigating the NJ Auto Insurance Landscape

Obtaining NJ auto insurance quotes is a critical step in ensuring you have the right coverage at the best possible price. By understanding the factors that influence insurance rates, exploring customization options, and taking advantage of available discounts, you can tailor your insurance coverage to your specific needs and budget. Remember, auto insurance is more than just a legal requirement; it’s a financial safety net that provides peace of mind and protection on the roads of the Garden State.

FAQ

What are the minimum coverage requirements for NJ auto insurance?

+

The minimum coverage requirements for New Jersey auto insurance include 15,000 bodily injury liability per person, 30,000 bodily injury liability per accident, and $5,000 property damage liability.

Can I get auto insurance without a license in NJ?

+

No, you must have a valid driver’s license to obtain auto insurance in New Jersey. However, non-driver residents may be able to purchase other types of insurance, such as renters or homeowners insurance.

How often should I review and update my NJ auto insurance policy?

+

It’s recommended to review your auto insurance policy annually, or whenever you experience significant life changes such as a move, marriage, or purchase of a new vehicle. This ensures that your coverage remains adequate and up-to-date.