Nj Health Insurance

In the diverse landscape of healthcare coverage, New Jersey stands out as a state with a unique and comprehensive approach to health insurance. With a focus on accessibility and affordability, New Jersey's health insurance market is designed to meet the diverse needs of its residents, ensuring that everyone has access to quality healthcare. This article delves into the intricacies of NJ health insurance, exploring its various plans, benefits, and the impact it has on the state's residents.

Understanding the NJ Health Insurance Market

The health insurance landscape in New Jersey is shaped by a combination of federal and state regulations, as well as the unique demographics and healthcare needs of its population. With a strong emphasis on consumer protection and affordability, the state has implemented several initiatives to make healthcare more accessible.

One of the key aspects of NJ health insurance is the Individual Market, which caters to those who are not eligible for employer-sponsored plans or public programs like Medicare or Medicaid. This market is regulated by the New Jersey Department of Banking and Insurance, ensuring that insurance providers offer plans that comply with state and federal laws.

Key Features of NJ’s Individual Market Plans

- Essential Health Benefits: All individual market plans in New Jersey must cover essential health benefits, including ambulatory patient services, emergency services, hospitalization, maternity and newborn care, mental health and substance use disorder services, prescription drugs, rehabilitative services, and more.

- Pre-Existing Condition Coverage: NJ’s health insurance plans cannot deny coverage or charge higher premiums based on pre-existing conditions. This protects individuals with previous health issues from being discriminated against.

- Cost Assistance: For those with low to moderate incomes, New Jersey offers premium tax credits to help make health insurance more affordable. These credits can significantly reduce the cost of monthly premiums.

- Open Enrollment Period: Typically, the annual open enrollment period for individual market plans runs from November 1st to January 15th. During this time, anyone can enroll in a plan without needing a qualifying event.

In addition to the Individual Market, New Jersey also has a robust Employer-Sponsored Market, where businesses provide health insurance plans to their employees. These plans vary based on the size of the business and often include a range of benefits tailored to the specific needs of the workforce.

Health Insurance Options in New Jersey

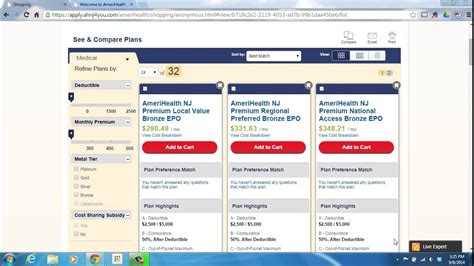

New Jersey residents have a variety of health insurance options to choose from, each designed to cater to different needs and preferences. Understanding these options is crucial in making an informed decision about healthcare coverage.

Individual and Family Plans

These plans are designed for individuals, couples, or families who do not have access to employer-sponsored insurance. They offer a range of benefits and coverages, allowing policyholders to choose the plan that best suits their healthcare needs and budget.

| Plan Type | Description |

|---|---|

| Bronze Plans | These plans typically have lower premiums but higher deductibles and out-of-pocket costs. They are ideal for those who rarely need healthcare services and are looking for basic coverage. |

| Silver Plans | Silver plans offer a balance between premiums and out-of-pocket costs. They are a popular choice as they often come with moderate premiums and deductibles, making them suitable for a wide range of individuals. |

| Gold Plans | Gold plans offer comprehensive coverage with higher premiums and lower deductibles. They are designed for individuals or families who anticipate frequent use of healthcare services and want more financial protection. |

| Catastrophic Plans | These plans are available to individuals under 30 or those who qualify for a hardship exemption. They have low premiums but high deductibles and are best suited for emergency coverage. |

Short-Term Health Insurance

Short-term health insurance plans are a temporary option for individuals who are between jobs, waiting for long-term coverage to start, or simply need coverage for a specific period. These plans offer more limited benefits and typically do not cover pre-existing conditions.

Medicaid and NJ FamilyCare

New Jersey’s Medicaid program, known as NJ FamilyCare, provides health coverage for eligible low-income adults, children, pregnant women, elderly adults, and people with disabilities. It offers comprehensive benefits, including doctor visits, hospital care, prescription drugs, and more.

Medicare and Medicare Advantage

For individuals aged 65 or older, Medicare is the primary health insurance option. Medicare is divided into several parts, each covering different aspects of healthcare.

- Part A (Hospital Insurance): Covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

- Part B (Medical Insurance): Covers outpatient medical services, including doctor visits, lab tests, durable medical equipment, and some preventive services.

- Part C (Medicare Advantage): This is an alternative to Original Medicare, offered by private insurance companies. It combines Parts A and B, often including prescription drug coverage (Part D) as well.

- Part D (Prescription Drug Coverage): Provides coverage for prescription medications. It is typically an optional add-on to Original Medicare or a required component of Medicare Advantage plans.

The Impact of NJ Health Insurance

New Jersey’s approach to health insurance has had a significant impact on the health and well-being of its residents. By ensuring that healthcare is accessible and affordable, the state has been able to improve health outcomes and reduce healthcare disparities.

Access to Care

With a range of insurance options and cost assistance programs, New Jersey has made significant strides in ensuring that its residents have access to necessary healthcare services. This includes preventive care, chronic disease management, and emergency treatment.

Affordability and Cost Assistance

The state’s focus on affordability has resulted in a range of initiatives to make healthcare more financially manageable. This includes premium tax credits for those with low to moderate incomes, as well as programs like NJ FamilyCare, which provides comprehensive coverage to eligible low-income individuals.

Quality of Care

By regulating insurance plans and ensuring that essential health benefits are covered, New Jersey has set a high standard for the quality of healthcare its residents receive. This includes access to a wide range of healthcare providers and specialists, as well as coverage for necessary treatments and medications.

Conclusion

New Jersey’s commitment to providing accessible and affordable health insurance has positioned the state as a leader in healthcare coverage. With a range of plan options, cost assistance programs, and a focus on quality, NJ health insurance ensures that residents can receive the care they need without financial strain.

Whether you're an individual, a family, or an employer, understanding the intricacies of NJ health insurance is crucial in making informed decisions about your healthcare coverage. By staying informed and exploring your options, you can ensure that you have the right plan to meet your unique needs.

Frequently Asked Questions

How do I know if I’m eligible for premium tax credits in New Jersey?

+To be eligible for premium tax credits in New Jersey, your household income must be between 100% and 400% of the federal poverty level. This equates to an annual income range of approximately 12,880 to 51,520 for an individual and 26,500 to 106,000 for a family of four. The exact income limits vary based on family size and the cost of healthcare in your area.

Can I purchase a health insurance plan outside of the open enrollment period in New Jersey?

+Yes, you can purchase a health insurance plan outside of the open enrollment period if you qualify for a Special Enrollment Period. Qualifying events include losing other health coverage, getting married, having a baby or adopting a child, moving to a new area, or gaining citizenship. You must apply for a plan within 60 days of the qualifying event to be eligible.

What happens if I don’t have health insurance in New Jersey?

+In New Jersey, there is no state-level individual mandate requiring you to have health insurance. However, not having health insurance can be financially risky, as it leaves you vulnerable to high medical bills in the event of an accident or illness. Additionally, federal law requires most Americans to have health insurance or pay a penalty, although this penalty has been eliminated as of 2019.