Nj Manufacturers Car Insurance

New Jersey is renowned for its diverse range of vehicle types and unique driving conditions, making it essential for residents to have comprehensive car insurance coverage. The state's Manufacturers insurance program stands out for its specialized approach to meeting the needs of New Jersey drivers. This article will delve into the features, benefits, and intricacies of Manufacturers car insurance, providing an in-depth analysis for those seeking expert guidance on navigating the complex world of automotive insurance.

Understanding Manufacturers Car Insurance

Headquartered in New Jersey, Manufacturers is a prominent provider of insurance services tailored to the state’s residents. With a rich history dating back to 1899, the company has established itself as a trusted name in the insurance industry, offering a comprehensive suite of products including auto, homeowners, and business insurance.

The Manufacturers car insurance program is specifically designed to cater to the unique needs of New Jersey drivers. The state's diverse landscape, ranging from densely populated urban areas to scenic rural roads, presents a variety of driving challenges. Manufacturers recognizes these nuances and has crafted a policy that offers extensive coverage options, ensuring drivers can customize their insurance to fit their specific needs.

Coverage Options

One of the standout features of Manufacturers car insurance is the flexibility it offers in coverage options. Policyholders can choose from a range of coverages, including:

- Liability Coverage: This is a basic requirement in New Jersey, providing protection in the event of an at-fault accident. Manufacturers offers various liability limits to suit different budgets and needs.

- Collision Coverage: This coverage helps repair or replace your vehicle if it’s damaged in an accident, regardless of fault. Manufacturers provides options for deductibles, allowing policyholders to balance cost and coverage.

- Comprehensive Coverage: Protects against non-collision incidents like theft, vandalism, or natural disasters. Manufacturers includes this coverage in its standard policy, ensuring New Jersey drivers are well-protected.

- Uninsured/Underinsured Motorist Coverage: A crucial coverage in New Jersey, this protects policyholders if involved in an accident with a driver who has little or no insurance.

- Medical Payments Coverage: Provides reimbursement for medical expenses incurred by the policyholder and passengers in an accident, regardless of fault.

- Personal Injury Protection (PIP): Required by New Jersey law, PIP covers medical expenses, lost wages, and other related costs for the policyholder and passengers, regardless of fault.

Additionally, Manufacturers offers a range of optional coverages and endorsements to further customize policies. These include rental car coverage, gap insurance, and coverage for custom parts and equipment.

Discounts and Savings

Manufacturers understands the importance of cost-effectiveness for its policyholders. To this end, the company offers a variety of discounts and savings opportunities, helping drivers save money on their car insurance premiums.

- Multi-Policy Discount: Policyholders can save by bundling their auto insurance with other Manufacturers policies, such as homeowners or renters insurance.

- Good Student Discount: Young drivers who maintain a certain GPA can qualify for a discount, encouraging academic excellence.

- Defensive Driving Course Discount: Completing an approved defensive driving course can lead to reduced premiums, promoting safer driving practices.

- Anti-Theft Device Discount: Installing approved anti-theft devices in your vehicle can result in lower premiums, as these devices deter theft and reduce claims.

- Safe Driver Discount: Policyholders who maintain a clean driving record for a specified period can qualify for this discount, rewarding responsible driving.

- Multi-Car Discount: If you insure multiple vehicles with Manufacturers, you can enjoy a discount, making it more cost-effective to insure the entire household.

These discounts, coupled with the flexible coverage options, make Manufacturers car insurance an attractive and cost-effective choice for New Jersey drivers.

Claims Process and Customer Service

Manufacturers is committed to providing exceptional customer service, ensuring policyholders have a seamless experience when filing claims. The company offers a 24⁄7 claims hotline, providing immediate assistance for urgent situations. Additionally, policyholders can file claims online, offering convenience and efficiency.

The claims process is designed to be straightforward and efficient. Manufacturers assigns a dedicated claims adjuster to each claim, ensuring personalized attention and a thorough assessment of the situation. The company strives to process claims quickly, aiming to minimize the stress and inconvenience associated with vehicle accidents or damage.

Roadside Assistance

Recognizing the importance of roadside assistance, Manufacturers offers this service as an optional add-on to its car insurance policies. Policyholders can avail themselves of emergency services such as towing, battery jump-starts, flat tire changes, and fuel delivery. This added layer of protection provides peace of mind for drivers, ensuring they have the necessary support in case of unexpected vehicle breakdowns or emergencies.

Performance Analysis and Customer Satisfaction

Manufacturers has consistently received high marks for its car insurance offerings. The company’s focus on providing comprehensive coverage, coupled with its commitment to customer service, has resulted in positive feedback from policyholders. Manufacturers is known for its prompt and efficient claims handling, with many customers praising the company’s responsiveness and fairness in settling claims.

Additionally, the company's flexible coverage options and extensive discounts have made it a popular choice among New Jersey drivers. The ability to customize policies to fit individual needs and budgets has contributed to high customer satisfaction rates. Manufacturers continues to innovate and improve its offerings, ensuring it remains a top choice for automotive insurance in the state.

Financial Strength and Stability

A key factor in evaluating any insurance provider is its financial strength and stability. Manufacturers has consistently maintained a strong financial position, with a solid rating from A.M. Best, a leading insurance rating agency. This rating signifies the company’s ability to meet its financial obligations and provides reassurance to policyholders that their investments are secure.

The financial stability of Manufacturers is a testament to its sound business practices and long-term commitment to its customers. This stability ensures that policyholders can rely on the company for the long haul, providing peace of mind and confidence in their insurance choices.

Conclusion: Why Choose Manufacturers Car Insurance

Manufacturers car insurance stands out as a premier choice for New Jersey drivers. With its comprehensive coverage options, competitive pricing, and excellent customer service, the company has established itself as a trusted provider in the state. Policyholders can rest assured knowing they have the protection they need, coupled with the convenience and support of a responsive insurance carrier.

As New Jersey's unique driving conditions and diverse vehicle types demand specialized insurance coverage, Manufacturers has tailored its offerings to meet these needs. From customizable policies to a range of discounts and a seamless claims process, the company has demonstrated its commitment to providing exceptional value and service to its customers.

Frequently Asked Questions

What are the minimum car insurance requirements in New Jersey?

+New Jersey requires drivers to carry liability insurance with minimum limits of 15,000 for bodily injury per person, 30,000 for bodily injury per accident, and $5,000 for property damage.

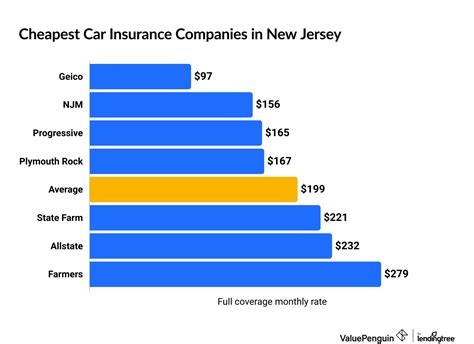

How does Manufacturers compare to other car insurance providers in terms of pricing?

+While pricing can vary based on individual factors, Manufacturers often offers competitive rates, especially when policyholders take advantage of the various discounts available. It’s always recommended to compare quotes from multiple providers to find the best fit for your needs.

Can I bundle my auto insurance with other Manufacturers policies to save money?

+Yes, Manufacturers encourages policyholders to bundle their auto insurance with other policies, such as homeowners or renters insurance, to take advantage of the multi-policy discount. This can result in significant savings on your overall insurance premiums.