Non Owner Car Insurance

Non-owner car insurance is a unique and often misunderstood type of auto insurance coverage. It provides an essential layer of protection for individuals who don't own a vehicle but still require insurance for various reasons. This article aims to delve into the intricacies of non-owner car insurance, exploring its benefits, how it works, and its applicability in different scenarios. By the end, you'll have a comprehensive understanding of this specialized insurance product and its role in the broader auto insurance landscape.

Understanding Non-Owner Car Insurance

Non-owner car insurance, also known as non-owner liability coverage, is designed to offer financial protection to individuals who don’t own a vehicle but frequently drive borrowed or rented cars. This type of insurance provides liability coverage, which means it protects the insured against claims resulting from accidents they cause while driving someone else’s vehicle. It’s particularly useful for individuals who occasionally borrow or rent cars, ensuring they have the necessary coverage to drive legally and safely.

Benefits of Non-Owner Car Insurance

Non-owner car insurance offers several key advantages to those who require it:

- Legal Compliance: In many jurisdictions, it’s mandatory to have some form of liability insurance when operating a motor vehicle. Non-owner car insurance ensures that individuals who don’t own a car can still drive legally and avoid penalties.

- Peace of Mind: By having this coverage, individuals can feel confident while driving borrowed or rental cars, knowing they’re protected against potential financial liabilities arising from accidents.

- Flexibility: This type of insurance is ideal for individuals with varying driving needs. Whether you’re a frequent traveler who rents cars or someone who occasionally borrows a friend’s vehicle, non-owner car insurance adapts to your specific circumstances.

How Non-Owner Car Insurance Works

Non-owner car insurance typically includes liability coverage for bodily injury and property damage. Here’s a simplified breakdown of how it functions:

- Accident Occurrence: Let’s say you’re driving a borrowed car and get into an accident. The non-owner car insurance policy you’ve purchased will step in to provide coverage for the damages caused to the other party’s vehicle and any injuries sustained by them.

- Claims Process: After the accident, you or the policyholder will need to file a claim with the insurance company. The insurer will then assess the damages and determine the liability coverage limits applicable to the claim.

- Payout: Once the claim is approved, the insurance company will provide a payout to cover the costs of the damages up to the policy’s liability limits. This ensures that the insured individual is protected from significant financial losses.

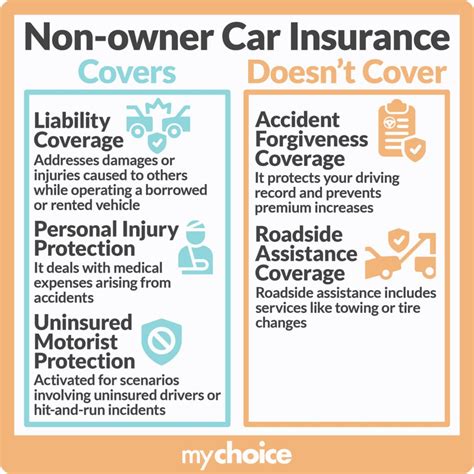

Key Considerations and Exclusions

While non-owner car insurance offers valuable protection, it’s essential to be aware of certain considerations and exclusions:

- Policy Limits: Non-owner car insurance policies typically have lower liability limits compared to standard auto insurance policies. It’s crucial to review the policy limits and ensure they align with your needs.

- No Coverage for Your Vehicle: Non-owner car insurance does not provide coverage for the vehicle you’re driving. It only covers the damages and injuries caused to other parties involved in an accident. If you wish to insure the borrowed or rented car itself, you’ll need to purchase additional coverage.

- Exclusions: Similar to other insurance policies, non-owner car insurance may have certain exclusions. It’s important to carefully read the policy to understand what situations or types of damages are not covered.

When to Consider Non-Owner Car Insurance

Non-owner car insurance is particularly beneficial in the following scenarios:

- Frequent Travelers: If you travel often and regularly rent cars, non-owner car insurance can provide consistent coverage, ensuring you’re protected regardless of the rental company’s insurance policies.

- Occasional Borrowing: For individuals who occasionally borrow a friend or family member’s car, this insurance offers a cost-effective way to ensure you’re covered while driving someone else’s vehicle.

- Ride-Sharing and Delivery Services: Individuals who drive for ride-sharing or delivery services may find non-owner car insurance beneficial, especially during periods when their personal vehicles are off the road or not covered by their standard auto insurance.

Choosing the Right Policy

When selecting a non-owner car insurance policy, consider the following factors:

- Liability Limits: Ensure the policy provides sufficient liability coverage limits to protect you from potential financial risks.

- Additional Coverages: Some policies offer optional coverages like medical payments or uninsured/underinsured motorist coverage. Evaluate if these additional protections are necessary for your specific needs.

- Reputation and Customer Service: Choose an insurance provider with a solid reputation and excellent customer service. This ensures a smooth claims process and timely assistance when needed.

Cost and Premiums

The cost of non-owner car insurance can vary based on several factors, including your driving history, age, and the coverage limits you choose. On average, non-owner car insurance policies are more affordable compared to standard auto insurance, making them an attractive option for those who don’t own a vehicle but still require coverage.

Future Implications and Trends

As the sharing economy and ride-sharing services continue to grow, the demand for non-owner car insurance is likely to increase. Insurance providers are adapting to these trends by offering more comprehensive and tailored policies to meet the unique needs of individuals in the gig economy. Additionally, advancements in technology and data analytics may lead to more accurate risk assessments, potentially impacting the pricing and availability of non-owner car insurance in the future.

Frequently Asked Questions

Can I purchase non-owner car insurance if I own a vehicle?

+Yes, you can purchase non-owner car insurance even if you own a vehicle. This insurance provides coverage for situations where you drive someone else’s car, ensuring you’re protected beyond the scope of your standard auto insurance.

Does non-owner car insurance cover damage to the vehicle I’m driving?

+No, non-owner car insurance primarily covers liability for bodily injury and property damage to other parties involved in an accident. It does not provide coverage for the vehicle you’re driving. If you wish to insure the borrowed or rented car, you’ll need to purchase additional coverage.

How much does non-owner car insurance typically cost?

+The cost of non-owner car insurance can vary based on several factors, including your driving history, age, and the coverage limits you choose. On average, it tends to be more affordable compared to standard auto insurance, making it a cost-effective option for those who don’t own a vehicle.

In conclusion, non-owner car insurance serves as a vital protection mechanism for individuals who don’t own a vehicle but still need insurance coverage. By understanding the benefits, how it works, and when to consider it, you can make informed decisions to ensure your safety and financial well-being while driving.