Normal Price For Car Insurance

When it comes to car insurance, the cost can vary significantly depending on a multitude of factors. Understanding the normal price range for car insurance is crucial for any vehicle owner, as it helps set expectations and allows for informed decisions when shopping for coverage. In this comprehensive guide, we will delve into the intricacies of car insurance pricing, providing you with valuable insights and real-world examples to navigate the world of automotive insurance with confidence.

Factors Influencing Car Insurance Costs

The price of car insurance is influenced by a myriad of variables, making it challenging to pinpoint a single “normal” price. These factors can be broadly categorized into two main groups: personal circumstances and vehicle-related factors.

Personal Circumstances

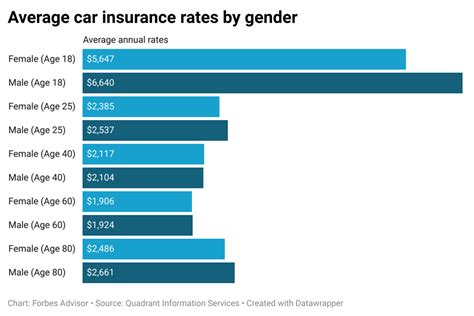

- Age and Driving Experience: Younger drivers, particularly those under 25, often face higher insurance premiums due to their perceived lack of experience. As drivers gain years of accident-free driving, their insurance rates tend to decrease.

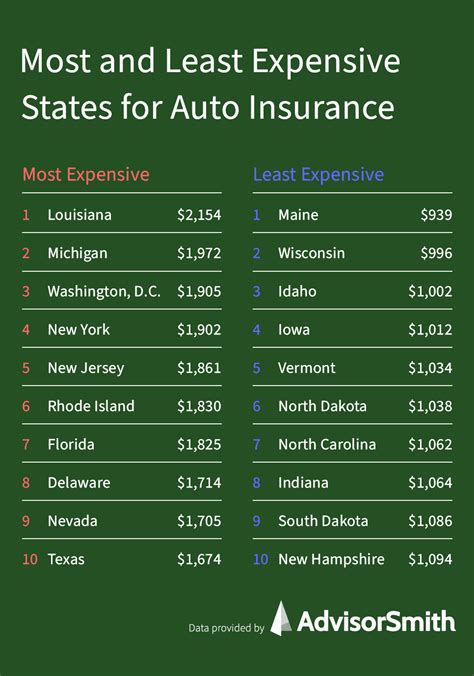

- Location: The geographical area where you reside plays a significant role. Urban areas with higher populations and congestion often result in increased insurance costs compared to rural areas.

- Driving Record: A clean driving record with no accidents or traffic violations is ideal for keeping insurance costs down. A history of accidents or moving violations can significantly raise your premiums.

- Credit Score: Believe it or not, your credit score can impact your insurance rates. Many insurance companies use credit-based insurance scores to assess risk, and a higher credit score may result in lower premiums.

Vehicle-Related Factors

- Vehicle Make and Model: The type of car you drive is a crucial factor. Sports cars, luxury vehicles, and certain high-performance models tend to be more expensive to insure due to their higher repair costs and likelihood of theft.

- Vehicle Age and Value: Older vehicles with lower market values generally cost less to insure. Conversely, new and expensive cars may require more comprehensive coverage, leading to higher premiums.

- Usage: How you use your vehicle matters. If you primarily drive for personal use, your insurance rates will likely be lower than those who use their vehicles for business or commercial purposes.

- Safety Features: Vehicles equipped with advanced safety features like lane departure warning systems, automatic emergency braking, and adaptive cruise control may qualify for insurance discounts, as these features can reduce the risk of accidents.

Average Car Insurance Costs

Given the wide range of factors influencing insurance rates, it’s challenging to provide an exact “normal” price for car insurance. However, we can examine average costs to gain a better understanding of what to expect.

| Coverage Type | Average Annual Cost |

|---|---|

| Liability Only | $500 - $1,500 |

| Full Coverage (Liability, Collision, and Comprehensive) | $1,000 - $3,000 |

| Average Monthly Premium | $80 - $250 |

It's important to note that these averages are just estimates and can vary significantly based on individual circumstances and location. For instance, states with higher accident rates and more frequent claims, such as California or Florida, often have higher average insurance costs.

Comparing Insurance Quotes

To ensure you’re getting the best value for your money, it’s essential to compare insurance quotes from multiple providers. Here are some tips to make the process more efficient:

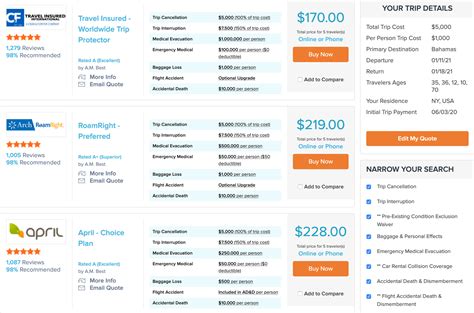

- Online Quote Comparison Tools: Utilize online platforms that allow you to compare quotes from multiple insurers in one place. These tools can save you time and provide a quick overview of the market.

- Check for Discounts: Insurance companies offer various discounts, such as multi-policy discounts (bundling home and auto insurance), safe driver discounts, and loyalty discounts for long-term customers. Inquire about these discounts to lower your premiums.

- Consider Bundle Discounts: If you have multiple vehicles or own a home, consider bundling your insurance policies with the same provider. This can lead to significant savings.

- Review Coverage Options: Carefully examine the coverage limits and deductibles offered in each quote. Ensure you have adequate coverage for your needs without overpaying for unnecessary add-ons.

Tips for Lowering Car Insurance Costs

If you’re looking to reduce your car insurance expenses, here are some strategies to consider:

- Improve Your Driving Record: Maintain a clean driving record by avoiding accidents and traffic violations. A single traffic ticket or accident can significantly raise your insurance rates, so drive safely and obey traffic laws.

- Raise Your Deductible: Increasing your deductible, the amount you pay out of pocket before your insurance coverage kicks in, can lower your monthly premiums. However, be sure you can afford the higher deductible in the event of an accident.

- Choose a Safer Vehicle: Opt for a vehicle with a strong safety record and advanced safety features. These vehicles are often cheaper to insure due to their reduced risk of accidents and lower repair costs.

- Review Coverage Regularly: As your circumstances change, so might your insurance needs. Regularly review your coverage to ensure you're not overinsured or paying for coverage you no longer require.

The Future of Car Insurance Pricing

The car insurance industry is evolving, and new technologies are influencing the way premiums are calculated. Telematics, for instance, allows insurance companies to monitor driving behavior through devices installed in vehicles or smartphone apps. This data-driven approach to insurance pricing, often referred to as Usage-Based Insurance (UBI), rewards safe driving habits with lower premiums.

Additionally, the rise of electric vehicles (EVs) is prompting insurers to reevaluate their pricing models. EVs often have lower maintenance and repair costs, leading to potential discounts for EV owners. However, the higher purchase price of EVs may result in higher insurance premiums for comprehensive coverage.

Conclusion

Understanding the normal price range for car insurance is a complex task, as it heavily depends on individual circumstances and vehicle-related factors. By being aware of the various influences on insurance costs and adopting strategies to lower your premiums, you can make more informed decisions when choosing an insurance provider. Remember, comparing quotes and regularly reviewing your coverage are key to ensuring you’re getting the best value for your money.

What is the cheapest type of car insurance?

+The cheapest type of car insurance is typically liability-only coverage, which provides protection for bodily injury and property damage caused to others in an accident. However, it’s important to note that liability-only coverage may not be sufficient if you own an expensive vehicle or have significant assets to protect.

How can I get a more accurate insurance quote?

+To obtain a more accurate insurance quote, provide detailed and accurate information about your driving history, vehicle usage, and any safety features installed in your car. Additionally, consider speaking with an insurance agent who can guide you through the process and help tailor a policy to your specific needs.

Are there any ways to lower my car insurance costs immediately?

+Yes, there are a few immediate steps you can take to potentially lower your car insurance costs. These include paying your premium annually instead of monthly (some insurers offer discounts for annual payments), removing unnecessary coverage options, and asking your insurer about any available discounts, such as good student or safe driver discounts.