Ny Health Insurance

Health insurance is a vital aspect of life for residents and visitors of New York, offering essential coverage for medical expenses and access to quality healthcare. In this comprehensive guide, we will delve into the intricacies of New York Health Insurance, exploring the various options, plans, and considerations unique to the state. From understanding the healthcare landscape to navigating the enrollment process, we aim to provide a detailed roadmap to help individuals and families secure the right health insurance coverage tailored to their needs.

The Landscape of New York Health Insurance

New York is known for its diverse and robust healthcare system, catering to the needs of its populous and varied population. The state offers a wide array of health insurance options, with both private and public programs available to residents. Understanding the landscape is crucial to making informed decisions about coverage.

Private Health Insurance Plans

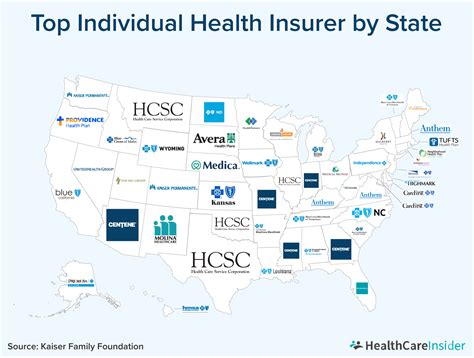

Private health insurance in New York is offered by a variety of carriers, each with its own network of healthcare providers and unique plan designs. These plans typically offer more flexibility in provider choice and may include additional benefits such as vision and dental coverage. Common private insurance providers in New York include:

- Empire BlueCross BlueShield: A well-established insurer offering a range of plans, including PPO and HMO options.

- Aetna: Known for its nationwide network and comprehensive coverage options.

- UnitedHealthcare: Providing a variety of plans with a focus on consumer-driven healthcare.

- Cigna: Offering personalized plans with a strong emphasis on wellness and preventive care.

- Oscar Health: A modern insurer known for its digital-first approach and innovative benefits.

Private plans in New York often come with a variety of deductibles, copayments, and out-of-pocket maximums, allowing individuals to customize their coverage based on their budget and healthcare needs.

Public Health Insurance Programs

New York also offers several public health insurance programs, designed to provide coverage for specific populations or income brackets. These programs include:

- Medicaid: A federal and state-funded program providing coverage for low-income individuals and families. In New York, Medicaid is known as MedicaidNY and offers comprehensive benefits with minimal or no out-of-pocket costs.

- Child Health Plus: A program specifically for children under the age of 19 who do not qualify for Medicaid but cannot afford private insurance. Child Health Plus offers low-cost or free coverage, ensuring access to necessary pediatric care.

- Essential Plan: A state-sponsored program providing low-cost coverage for individuals who earn too much to qualify for Medicaid but cannot afford private insurance. The Essential Plan offers a range of benefits, including primary care, specialist visits, and prescription drugs.

Navigating the Enrollment Process

Enrolling in a health insurance plan in New York involves several steps, each designed to ensure individuals find the right coverage for their needs. The process can be simplified by understanding the key components and timelines involved.

Open Enrollment Period

New York, like many states, operates on an open enrollment period for private health insurance plans. This period typically occurs annually, allowing individuals to enroll, re-enroll, or make changes to their existing coverage. The exact dates of the open enrollment period can vary, but it generally falls between November and December. It’s important to note that missing the open enrollment period may result in limited options for obtaining coverage outside of special enrollment periods.

Special Enrollment Periods

In addition to the open enrollment period, New York residents may qualify for special enrollment periods (SEP) throughout the year. These SEPs allow individuals to enroll in or change their health insurance plans due to specific life events, such as:

- Marriage or divorce.

- Birth or adoption of a child.

- Loss of other health coverage (e.g., job-based insurance or Medicaid eligibility).

- Change in income that affects eligibility for public programs.

It's crucial to document and report these life events promptly to ensure a seamless transition or enrollment during a special enrollment period.

Applying for Coverage

To apply for private health insurance in New York, individuals can use the state’s official health insurance marketplace, NY State of Health. This online platform allows users to compare plans, estimate costs, and enroll in coverage. The application process typically involves providing personal and household information, as well as income details to determine eligibility for subsidies or tax credits.

For public health insurance programs like Medicaid or Child Health Plus, applications can be completed online, by mail, or in-person at local Department of Social Services offices. The application process for these programs may require additional documentation to verify eligibility.

Understanding Plan Types and Benefits

New York health insurance plans come in various types, each with its own network of providers and benefit structure. Understanding the differences between these plan types is essential to making an informed choice.

Health Maintenance Organization (HMO) Plans

HMO plans in New York typically offer lower premiums but require members to choose a primary care physician (PCP) within the plan’s network. PCPs act as gatekeepers, coordinating all non-emergency care and referrals to specialists. HMO plans often have lower out-of-pocket costs but may have more limited provider choices.

Preferred Provider Organization (PPO) Plans

PPO plans provide more flexibility in provider choice, allowing members to see any in-network provider without a referral. PPO plans typically have higher premiums and out-of-pocket costs but offer the convenience of wider provider networks. Some PPO plans in New York may also include out-of-network coverage, although at a higher cost.

Exclusive Provider Organization (EPO) Plans

EPO plans are similar to PPO plans in that they offer a network of preferred providers. However, EPO plans do not provide coverage for out-of-network care, except in emergency situations. EPO plans often have lower premiums than PPO plans but may have more limited provider choices.

Point-of-Service (POS) Plans

POS plans combine elements of both HMO and PPO plans. Members must choose a PCP and receive referrals for specialist care, but they also have the option to see out-of-network providers at a higher cost. POS plans offer a balance between provider choice and cost, making them a popular option for those seeking flexibility.

Health Savings Accounts (HSAs) and High Deductible Health Plans (HDHPs)

HSAs and HDHPs are a unique combination of health insurance and savings plans. These plans typically have lower premiums and higher deductibles, allowing individuals to save pre-tax dollars in an HSA to cover qualified medical expenses. HSAs offer tax advantages and can be a cost-effective option for those who anticipate minimal healthcare needs.

Evaluating Cost and Coverage

When choosing a health insurance plan in New York, it’s crucial to evaluate the cost and coverage to find the best fit for your needs. Here are some key considerations:

- Premiums: The monthly cost of your health insurance plan is known as the premium. It’s important to consider your budget and choose a plan with a premium you can afford consistently.

- Deductibles: The deductible is the amount you must pay out of pocket before your insurance coverage kicks in. Higher deductibles often result in lower premiums, so it’s a trade-off to consider based on your anticipated healthcare needs.

- Copayments and Coinsurance: Copayments are fixed amounts you pay for covered services, while coinsurance is a percentage of the cost you share with your insurance provider. These costs can vary based on the type of service and the plan’s benefit structure.

- Out-of-Pocket Maximum: This is the maximum amount you will pay out of pocket for covered services in a year. Once you reach this limit, your insurance covers 100% of eligible expenses.

- Provider Network: The size and quality of the provider network can impact your access to healthcare services. Consider the providers and facilities included in the plan’s network and whether they align with your healthcare needs.

- Covered Services and Benefits: Review the plan’s summary of benefits and coverage to ensure it includes the services and treatments you anticipate needing. Look for plans that cover preventive care, prescription drugs, and any specific medical conditions or treatments relevant to you.

Making Informed Choices

Navigating the world of health insurance can be complex, but with the right information and resources, New York residents can make informed choices about their coverage. Here are some key takeaways to consider as you evaluate your options:

- Understand the landscape of health insurance in New York, including private and public plan options.

- Familiarize yourself with the enrollment process, including open enrollment periods and special enrollment opportunities.

- Research and compare plan types, benefits, and costs to find the best fit for your healthcare needs and budget.

- Use resources like NY State of Health to estimate costs, compare plans, and enroll in coverage.

- Consider the provider network and covered services to ensure access to necessary healthcare.

- Review your plan’s summary of benefits and coverage annually to stay informed about any changes or updates.

By staying informed and proactive, New York residents can secure the health insurance coverage they need to access quality healthcare and protect their financial well-being.

Frequently Asked Questions

What is the average cost of health insurance in New York?

+The average cost of health insurance in New York can vary based on several factors, including age, location, and the type of plan. As of 2023, the average monthly premium for an individual in New York is approximately 500, while family plans can range from 1,000 to $2,000 per month. However, these averages can fluctuate, and actual costs may be higher or lower depending on individual circumstances.

Are there any subsidies or tax credits available for health insurance in New York?

+Yes, New York offers premium tax credits and cost-sharing reductions to help make health insurance more affordable for eligible individuals and families. Those with household incomes between 100% and 400% of the federal poverty level may qualify for these subsidies, which can significantly reduce monthly premiums and out-of-pocket costs.

Can I keep my current doctor if I switch health insurance plans in New York?

+Whether you can keep your current doctor when switching plans depends on the provider network of your new plan. If your current doctor is in-network with your new plan, you can continue seeing them. However, if your doctor is out-of-network, you may need to find a new provider or pay out-of-pocket for their services.

What happens if I miss the open enrollment period for health insurance in New York?

+If you miss the open enrollment period, you may still be able to obtain health insurance coverage through a special enrollment period (SEP). SEPs are triggered by specific life events, such as marriage, divorce, birth or adoption of a child, or loss of other health coverage. It’s important to document and report these life events promptly to qualify for an SEP.

How do I know if I qualify for Medicaid or other public health insurance programs in New York?

+Eligibility for public health insurance programs like Medicaid or Child Health Plus is based on factors such as income, family size, and immigration status. You can use the NY State of Health website to estimate your eligibility or contact your local Department of Social Services office for assistance. It’s important to provide accurate information to determine your eligibility and avoid any potential penalties.