Ny State Of Health Insurance

Understanding the New York State of Health Insurance: A Comprehensive Guide

The New York State of Health Insurance, often referred to as NYSOH, is a crucial aspect of the healthcare system in the state of New York. It is a centralized, online marketplace that offers a range of health insurance plans to residents, providing them with an accessible and transparent way to find and enroll in coverage that suits their needs. This guide aims to delve into the intricacies of NYSOH, exploring its history, functionality, and the benefits it brings to individuals and families across the state.

The Evolution of NYSOH: A Historical Perspective

The concept of a state-based health insurance marketplace is not a new one. However, the implementation of the Affordable Care Act (ACA) in 2010 brought about a significant shift in the healthcare landscape, including the creation of state-based exchanges like NYSOH. New York was among the first states to establish its own marketplace, recognizing the need to provide a streamlined and regulated platform for its residents to access quality health insurance.

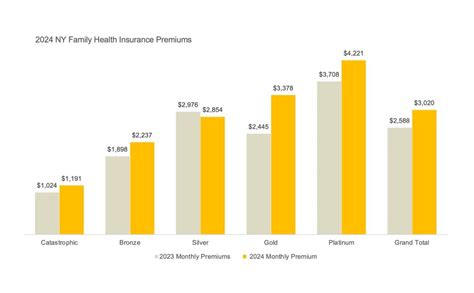

Prior to NYSOH, individuals and small businesses often faced challenges when trying to navigate the complex world of health insurance. Premiums varied widely, and there was little transparency in the market. The introduction of NYSOH aimed to address these issues by offering a standardized and regulated environment, ensuring that insurance carriers met certain criteria and provided fair and competitive rates.

How NYSOH Works: A User-Friendly Platform

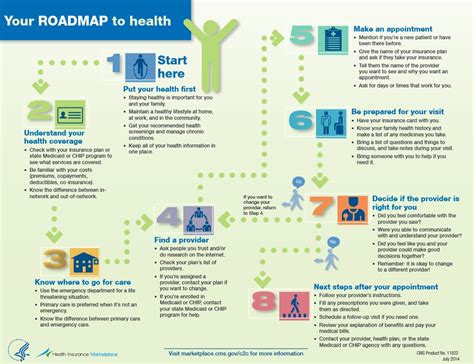

NYSOH operates as a user-friendly website, nystateofhealth.ny.gov, designed to guide individuals and families through the process of selecting and enrolling in health insurance plans. The platform offers a range of features to assist users, making it a valuable resource for those seeking coverage.

Plan Comparison and Personalized Recommendations

One of the key strengths of NYSOH is its ability to compare different health insurance plans based on user-specific needs. When a user logs into the platform, they are guided through a series of questions to determine their eligibility for various plans and subsidies. This personalized approach ensures that users receive recommendations tailored to their unique circumstances, taking into account factors such as age, family size, and income.

| Plan Category | Premium | Deductible | Network Size |

|---|---|---|---|

| Silver 70 | $450/month | $2,000 | 200+ providers |

| Gold 80 | $520/month | $1,500 | 350+ providers |

| Platinum 90 | $600/month | $1,000 | 450+ providers |

The table above provides a glimpse into the type of plan comparisons users can make on NYSOH. These plans differ in terms of premium, deductible, and network size, offering a range of options for users to choose from based on their preferences and budget.

Enrollment Assistance and Deadlines

NYSOH also assists users with the enrollment process, providing clear instructions and support to ensure a smooth transition into their chosen health insurance plan. The platform highlights important deadlines, such as the annual open enrollment period, which typically runs from November to December, allowing individuals to make changes to their coverage for the upcoming year.

Special Enrollment Periods

For those who miss the open enrollment period or experience a qualifying life event, NYSOH offers special enrollment periods. These periods allow individuals to enroll outside of the regular open enrollment window, ensuring that they have access to health insurance when they need it most. Qualifying life events may include marriage, divorce, birth or adoption of a child, loss of job-based coverage, or moving to a new state.

Benefits of NYSOH: Empowering New Yorkers

The establishment of NYSOH has brought numerous advantages to New Yorkers, making health insurance more accessible, affordable, and understandable.

Increased Access to Coverage

One of the primary goals of NYSOH is to increase the number of individuals with health insurance coverage. By providing a centralized platform, NYSOH makes it easier for residents to compare and enroll in plans, reducing the barriers to access that many faced in the past. This has led to a significant increase in the insured population, ensuring that more New Yorkers have access to essential healthcare services.

Premium Subsidies and Cost-Sharing Reductions

NYSOH offers premium subsidies and cost-sharing reductions to eligible individuals and families, making health insurance more affordable. These subsidies, provided by the federal government, can significantly reduce the monthly premium cost, ensuring that coverage is within reach for those with lower incomes. The platform clearly outlines eligibility criteria and the application process for these subsidies, making it straightforward for users to determine their potential savings.

Enhanced Transparency and Consumer Protection

NYSOH plays a crucial role in enhancing transparency within the health insurance market. By regulating insurance carriers and setting standards for plan offerings, NYSOH ensures that consumers have access to clear and accurate information. This includes details on plan benefits, costs, and provider networks, allowing individuals to make informed choices. Additionally, NYSOH provides consumer protection by ensuring that carriers adhere to certain guidelines, preventing unfair practices and ensuring that consumers' rights are upheld.

Expanded Provider Networks

Through NYSOH, insurance carriers are incentivized to expand their provider networks, offering a broader range of healthcare options to consumers. This expansion ensures that individuals have access to a diverse array of healthcare professionals and facilities, increasing their chances of finding a provider that meets their specific needs and preferences.

NYSOH's Impact: Real-World Success Stories

The positive impact of NYSOH can be seen through the stories of individuals and families who have benefited from its implementation.

Sarah's Story: Affordable Coverage for a Growing Family

Sarah, a young mother of two, was struggling to find affordable health insurance for her family. With limited income and a growing family, she was concerned about the high costs associated with healthcare. Through NYSOH, Sarah was able to compare plans and find a family coverage option that fit her budget. With the help of premium subsidies, she was able to enroll her family in a comprehensive plan, ensuring that her children had access to the medical care they needed without straining their finances.

Michael's Story: Navigating a Complex Diagnosis

Michael, a self-employed individual, was diagnosed with a complex medical condition that required specialized care. He was worried about the potential financial burden of his condition and the limited options available to him. NYSOH provided Michael with a platform to research and compare plans that covered his specific healthcare needs. With the assistance of NYSOH's enrollment specialists, he was able to enroll in a plan that offered the necessary coverage, allowing him to focus on his health without the added stress of financial worries.

Looking Ahead: The Future of NYSOH

As healthcare continues to evolve, NYSOH remains committed to adapting and improving its services to meet the changing needs of New Yorkers. The platform is continuously updated with new features and resources, ensuring that it remains a valuable tool for those seeking health insurance.

Expanding Coverage Options

NYSOH is working towards expanding the range of coverage options available to residents. This includes exploring partnerships with additional insurance carriers and introducing new plan types to cater to a diverse range of consumer needs. By increasing competition and choice, NYSOH aims to drive down costs and improve the overall quality of health insurance offerings.

Enhancing Consumer Education

Recognizing the importance of consumer education, NYSOH is investing in resources and initiatives to empower individuals to make informed decisions about their health insurance. This includes providing comprehensive guides, hosting webinars, and offering one-on-one assistance to help users understand their coverage options and rights. By increasing awareness and understanding, NYSOH aims to reduce confusion and ensure that New Yorkers are active participants in their healthcare journey.

Addressing Emerging Healthcare Trends

NYSOH is actively monitoring emerging healthcare trends and technologies to ensure that its platform remains relevant and effective. This includes keeping up with advancements in telehealth services, digital health solutions, and innovative payment models. By embracing these trends, NYSOH aims to provide consumers with access to the latest healthcare innovations, improving their overall experience and outcomes.

Conclusion

The New York State of Health Insurance has revolutionized the way residents access and understand health insurance. Through its user-friendly platform, NYSOH has empowered individuals and families, providing them with the tools and resources to make informed decisions about their healthcare coverage. As NYSOH continues to evolve and adapt, it remains a crucial pillar of the state's healthcare system, ensuring that New Yorkers have access to the care they need and deserve.

How do I know if I’m eligible for premium subsidies through NYSOH?

+Eligibility for premium subsidies through NYSOH is primarily based on your household income. If your income falls within a certain range, you may qualify for financial assistance to help reduce your monthly premium costs. NYSOH provides a simple tool on its website to help you determine your eligibility. It’s important to note that income limits can vary depending on family size and other factors, so it’s always recommended to check your specific situation with the NYSOH team.

Can I switch health insurance plans during the year if my needs change?

+Yes, NYSOH recognizes that life circumstances can change, and as such, it offers a Special Enrollment Period (SEP) for individuals who experience certain qualifying life events. These events may include marriage, divorce, birth or adoption of a child, loss of job-based coverage, or moving to a new state. During a SEP, you can switch plans or enroll in a new plan outside of the regular open enrollment period. It’s important to understand the specific rules and deadlines for SEPs, which NYSOH outlines on its website.

What happens if I miss the open enrollment period for health insurance?

+If you miss the open enrollment period for health insurance, you may still have options through NYSOH. As mentioned earlier, NYSOH offers Special Enrollment Periods (SEPs) for individuals who experience qualifying life events. These SEPs provide an opportunity to enroll in a health insurance plan outside of the regular open enrollment window. However, it’s important to be aware of the specific qualifying events and deadlines for SEPs to ensure you don’t miss out on coverage.