Nys Life Insurance

New York State's life insurance landscape is an intricate and essential aspect of personal financial planning, offering protection and peace of mind to residents across the state. Understanding the nuances of life insurance in New York is crucial, especially considering the diverse range of policies and providers available. This article aims to delve into the specifics of NYS Life Insurance, providing an in-depth analysis to guide residents in making informed decisions about their financial security.

The Importance of Life Insurance in New York State

Life insurance serves as a vital financial tool for New Yorkers, offering protection and support to families and loved ones in the event of an untimely death. It provides a safety net, ensuring that beneficiaries can maintain their standard of living and cover expenses such as mortgages, education costs, and daily living expenses. In a state as diverse and dynamic as New York, with its unique economic and social landscape, having adequate life insurance coverage is more than just a good idea; it’s a responsible financial decision.

New York State has a strong regulatory framework in place to ensure that life insurance policies are fair, transparent, and beneficial to consumers. The New York State Department of Financial Services (NYSDFS) oversees the insurance industry, setting standards and protecting the rights of policyholders. This robust regulatory environment gives New Yorkers confidence that their life insurance policies are secure and compliant with state laws.

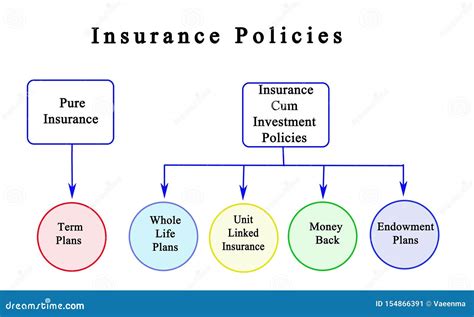

Understanding the Types of Life Insurance Policies

When it comes to life insurance, New Yorkers have a variety of policy types to choose from, each designed to meet specific needs and financial goals. The two primary categories are term life insurance and permanent life insurance, with further variations within each category.

Term Life Insurance

Term life insurance is a straightforward and affordable option, providing coverage for a specified period, typically ranging from 10 to 30 years. During this term, the policyholder pays a fixed premium, and in the event of their death, the beneficiaries receive a lump-sum payment, known as the death benefit. This type of insurance is ideal for individuals seeking coverage for a specific period, such as until their children reach adulthood or until their mortgage is paid off.

One of the key advantages of term life insurance is its flexibility. Policyholders can choose the coverage amount and term length that best fits their needs. Additionally, term policies often offer the option to convert to a permanent life insurance policy, providing an easy transition should financial circumstances change.

Permanent Life Insurance

Permanent life insurance, as the name suggests, provides lifelong coverage, ensuring that beneficiaries are protected regardless of the policyholder’s age or health status. There are several types of permanent life insurance policies, including whole life, universal life, and variable life insurance.

- Whole Life Insurance: This policy offers a fixed premium and a guaranteed death benefit. It also includes a cash value component, which grows over time and can be borrowed against or withdrawn to meet financial needs.

- Universal Life Insurance: Universal life policies offer more flexibility than whole life. Policyholders can adjust their premium payments and death benefit amounts, making it a versatile option for those with changing financial needs.

- Variable Life Insurance: With variable life insurance, the cash value component is invested in separate accounts, allowing for potential higher returns but also carrying more risk.

Permanent life insurance policies are ideal for individuals seeking long-term financial protection and those who want to build cash value over time. They can be more expensive than term policies, but the peace of mind and financial flexibility they offer make them a popular choice among New Yorkers.

Factors Influencing Life Insurance Rates in New York

Life insurance rates in New York, as in any state, are influenced by a variety of factors. These factors are taken into consideration by insurance companies when determining the cost of a policy.

Age and Health

Age and health are two of the most significant factors in determining life insurance rates. Generally, younger and healthier individuals are offered lower premiums, as they are considered less risky to insure. As individuals age and their health status changes, premiums may increase to reflect the higher risk of an insurance payout.

Lifestyle and Occupation

Lifestyle choices and occupation can also impact life insurance rates. For example, individuals who engage in high-risk activities, such as extreme sports or dangerous occupations, may face higher premiums due to the increased likelihood of an insurance claim. Smoking and other unhealthy habits can also lead to higher premiums, as they are associated with a higher risk of health issues.

Policy Type and Coverage Amount

The type of life insurance policy chosen and the coverage amount desired will also affect the cost. Permanent life insurance policies, which offer lifelong coverage and a cash value component, typically have higher premiums than term life insurance policies, which provide coverage for a specified period.

Similarly, the coverage amount, or the death benefit, is a significant factor in determining premiums. Higher coverage amounts naturally result in higher premiums, as the insurance company is taking on more financial risk.

The Process of Applying for Life Insurance in New York

Applying for life insurance in New York is a straightforward process, but it’s essential to understand the steps involved to ensure a smooth application.

Step 1: Research and Compare Policies

The first step in applying for life insurance is to research and compare different policies to find the one that best suits your needs and budget. Consider the type of policy (term or permanent), the coverage amount, and any additional features or benefits offered.

It's advisable to get quotes from multiple insurance companies to compare rates and understand the market. Online tools and insurance brokers can be valuable resources for this initial research phase.

Step 2: Complete an Application

Once you’ve decided on a policy, the next step is to complete an application. This typically involves providing personal information, such as your name, date of birth, and contact details. You’ll also need to disclose your health status, lifestyle habits, and occupation.

It's important to provide accurate and truthful information on your application. Misrepresentations can lead to policy cancellations or reduced benefits.

Step 3: Underwriting Process

After submitting your application, the insurance company will begin the underwriting process. This involves evaluating your application and determining your insurance risk. The underwriter may request additional information, such as medical records or the results of a medical exam, to assess your health status accurately.

The underwriting process can take several weeks, and during this time, you may be required to undergo a medical exam or provide additional documentation. It's important to cooperate fully with the underwriter to ensure a smooth and timely approval process.

Step 4: Policy Issuance

If your application is approved, the insurance company will issue your policy. You’ll receive a policy document outlining the terms and conditions of your coverage, including the premium amount, coverage period, and death benefit.

Review your policy carefully to ensure it aligns with your expectations and needs. If you have any questions or concerns, contact your insurance agent or the insurance company directly.

Maximizing the Benefits of Your Life Insurance Policy

Having a life insurance policy is an important step towards financial security, but it’s equally important to maximize the benefits of your policy to ensure it meets your long-term needs.

Regularly Review and Update Your Policy

Life insurance policies should be reviewed and updated periodically to ensure they remain adequate and aligned with your changing financial circumstances. Major life events, such as marriage, the birth of a child, or purchasing a home, may require an increase in coverage to adequately protect your loved ones.

Consider Additional Riders and Benefits

Many life insurance policies offer additional riders or benefits that can enhance your coverage. These may include accelerated death benefits, which allow you to access a portion of your death benefit if you are diagnosed with a terminal illness, or waiver of premium benefits, which waive premium payments if you become disabled.

Take Advantage of Policy Loans and Cash Value

If you have a permanent life insurance policy with a cash value component, you can borrow against this cash value to meet financial needs. This can be a useful feature in times of financial hardship, but it’s important to understand the potential impact on your policy and premiums.

Consult with your insurance agent or a financial advisor to understand the implications of borrowing against your policy's cash value.

Conclusion

Life insurance is a crucial aspect of financial planning for New Yorkers, offering protection and peace of mind to individuals and their families. By understanding the different types of policies, the factors influencing rates, and the application process, New Yorkers can make informed decisions about their life insurance coverage.

Regularly reviewing and updating your policy, considering additional riders and benefits, and understanding the value of your policy's cash value are all key strategies to maximize the benefits of your life insurance. With the right coverage in place, New Yorkers can ensure their loved ones are financially protected, no matter what the future holds.

How do I choose the right life insurance policy for my needs in New York State?

+Choosing the right life insurance policy involves considering your specific needs and financial goals. Evaluate your financial obligations, such as mortgage payments, education expenses, and daily living costs. Determine how much coverage you need to meet these obligations. Consider the term or permanent life insurance options and choose the one that aligns with your financial situation and goals. It’s also beneficial to seek advice from a financial advisor or insurance agent who can guide you through the process and help you make an informed decision.

Are there any tax benefits associated with life insurance policies in New York?

+Yes, there are tax benefits associated with certain life insurance policies in New York. For instance, the death benefit proceeds from a life insurance policy are generally income tax-free for beneficiaries. Additionally, the cash value component of permanent life insurance policies can offer tax advantages, as it grows tax-deferred. It’s important to consult with a tax professional or financial advisor to understand the specific tax implications of your life insurance policy.

What happens if I miss a premium payment on my life insurance policy in New York?

+If you miss a premium payment on your life insurance policy, the insurance company may provide a grace period, typically 30 days, during which you can make the payment without any interruption in coverage. However, if the premium remains unpaid beyond the grace period, your policy may lapse, and your coverage will be terminated. It’s crucial to keep track of your premium due dates and ensure timely payments to maintain your coverage.

Can I purchase life insurance for my spouse or children in New York State?

+Yes, you can purchase life insurance for your spouse or children in New York State. This is often done to provide financial protection for your family in the event of an untimely death. When purchasing life insurance for your spouse or children, consider their specific needs and financial obligations. Discuss these options with an insurance agent who can guide you through the process and help you choose the appropriate coverage amounts and policy types.