Ohio Automobile Insurance

Ohio's automobile insurance landscape is a crucial aspect of the state's infrastructure and safety regulations. The Buckeye State, with its diverse population and varying road conditions, requires a comprehensive understanding of the insurance policies and options available to its residents. This guide aims to delve into the intricacies of Ohio automobile insurance, providing an in-depth analysis of the policies, coverage options, and legal requirements, all while ensuring a seamless reading experience for both seasoned drivers and those new to the state.

Understanding Ohio's Insurance Requirements

Ohio maintains a minimum liability insurance requirement for all vehicle owners and operators. This is mandated by the state's Financial Responsibility Law, which ensures that drivers are capable of covering potential damages or injuries they may cause in an accident. The required coverage amounts are set at $25,000 for bodily injury or death of one person in an accident, $50,000 for bodily injury or death of two or more people in an accident, and $25,000 for property damage in an accident.

These liability limits are considered the bare minimum, and many drivers opt for higher coverage amounts to ensure they are adequately protected in the event of a severe accident. It's worth noting that Ohio does not require drivers to carry personal injury protection (PIP) or uninsured/underinsured motorist coverage, which are common additions to policies in other states.

Penalty for Non-Compliance

Failure to maintain the required insurance coverage in Ohio can result in severe penalties. These may include the suspension of your vehicle registration and driver's license, along with the requirement to file an SR-22 certificate of financial responsibility with the Ohio Bureau of Motor Vehicles. The SR-22 is a form that proves you have the minimum liability insurance coverage and is typically required for a period of three years.

| Ohio's Minimum Liability Insurance Requirements | Coverage Amounts |

|---|---|

| Bodily Injury/Death for One Person | $25,000 |

| Bodily Injury/Death for Two or More People | $50,000 |

| Property Damage | $25,000 |

Types of Automobile Insurance Policies in Ohio

Automobile insurance policies in Ohio are designed to cater to the diverse needs of its residents. These policies can be broadly categorized into three main types: Liability-Only Policies, Full Coverage Policies, and Customized Policies.

Liability-Only Policies

As the name suggests, liability-only policies provide coverage solely for the damages or injuries you cause to others in an accident. This type of policy is ideal for budget-conscious drivers who are primarily concerned with meeting the state's minimum insurance requirements. It's worth noting that liability-only policies do not cover any damage to your own vehicle or any injuries you sustain in an accident.

Full Coverage Policies

Full coverage policies, on the other hand, offer a more comprehensive level of protection. These policies typically include liability coverage, collision coverage, and comprehensive coverage. Collision coverage pays for damages to your vehicle when you're at fault in an accident, while comprehensive coverage provides protection for non-collision incidents such as theft, vandalism, or natural disasters.

Customized Policies

For those with unique circumstances or specific needs, customized policies can be tailored to provide the exact coverage required. This might include additional coverage options such as rental car reimbursement, towing and labor coverage, or coverage for custom parts and equipment. Customized policies allow drivers to create a unique insurance plan that suits their specific driving habits and vehicle type.

Factors Affecting Automobile Insurance Rates in Ohio

Insurance rates in Ohio, as in any other state, are influenced by a multitude of factors. These factors are used by insurance companies to assess the risk associated with insuring a particular driver and to set the premium accordingly. Here are some of the key factors that impact automobile insurance rates in Ohio:

- Age and Gender: Younger drivers, especially those under 25, are often considered higher risk and may pay higher premiums. Similarly, male drivers tend to be associated with higher rates due to statistical data suggesting they are involved in more accidents.

- Driving Record: A clean driving record is a significant factor in determining insurance rates. Drivers with a history of accidents, traffic violations, or DUI convictions may face higher premiums or even have difficulty finding an insurer willing to provide coverage.

- Vehicle Type: The make, model, and year of your vehicle can impact your insurance rates. Sports cars and luxury vehicles, for instance, often have higher insurance costs due to their performance capabilities and repair costs.

- Credit Score: In Ohio, insurance companies are allowed to consider an individual's credit score when determining rates. Drivers with lower credit scores are often seen as higher risk and may pay higher premiums.

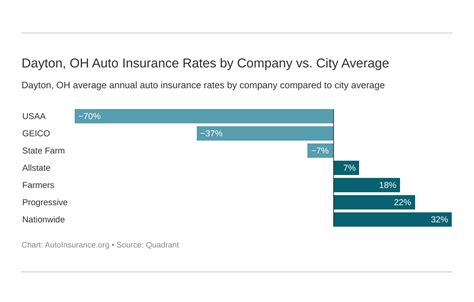

- Location: The area where you live and drive can significantly impact your insurance rates. Urban areas with higher traffic density and crime rates often result in higher premiums compared to rural areas.

- Miles Driven: The more miles you drive annually, the higher the likelihood of being involved in an accident. Therefore, high-mileage drivers may face increased insurance rates.

- Marital Status: Married drivers are often considered lower risk and may benefit from lower insurance rates compared to single drivers.

Strategies to Lower Your Insurance Rates

While some of these factors are beyond your control, there are strategies you can employ to potentially lower your insurance rates. These include maintaining a clean driving record, shopping around for the best rates, and taking advantage of discounts offered by insurance companies. Many companies provide discounts for safe driving, good student status, multiple policy bundles, or even for installing certain safety features in your vehicle.

Choosing the Right Automobile Insurance Provider in Ohio

With a plethora of insurance providers operating in Ohio, choosing the right one can be a daunting task. It's crucial to consider not only the cost of the policy but also the level of coverage and the reputation of the insurer. Here are some steps to help you in your selection process:

- Research and Compare: Utilize online resources and tools to research and compare different insurance providers. Look at their financial stability, customer satisfaction ratings, and the types of coverage they offer.

- Assess Your Needs: Determine the specific coverage you require based on your driving habits, vehicle type, and personal preferences. This will help you narrow down your options and find providers that offer the coverage you need.

- Check for Discounts: Many insurance companies offer a variety of discounts, such as good driver discounts, multi-policy discounts, or discounts for safety features. Make sure to inquire about these discounts and see how they can lower your overall premium.

- Read Reviews: Take the time to read reviews from current and past customers. This can give you valuable insights into the insurer's customer service, claim handling process, and overall satisfaction.

- Consider Local Insurers: While national insurance providers are a popular choice, don't overlook local insurers. They may offer specialized coverage for unique Ohio circumstances or provide better rates for certain types of drivers.

- Seek Professional Advice: Consulting with an insurance broker or agent can be beneficial. They can provide expert advice, compare quotes from multiple providers, and help you understand the intricacies of different policies.

Popular Automobile Insurance Providers in Ohio

Ohio is home to a variety of reputable insurance providers, both local and national. Some of the most popular ones include:

- State Farm

- Progressive

- Allstate

- Nationwide

- Liberty Mutual

- The Cincinnati Insurance Companies

- Erie Insurance

It's important to remember that while these providers are popular, they may not always offer the best rates or coverage for your specific situation. It's always advisable to shop around and compare multiple quotes to find the insurer that best meets your needs.

Understanding Automobile Insurance Claims in Ohio

In the unfortunate event of an automobile accident, understanding the claims process is crucial. Here's a step-by-step guide to help you navigate the process in Ohio:

- Contact Your Insurance Company: Immediately after an accident, contact your insurance provider to report the incident. They will guide you through the necessary steps and provide information on what documentation is required.

- Gather Evidence: Take photos of the accident scene, including any damage to vehicles, property, or injuries sustained. Collect contact information from any witnesses and document the location, weather conditions, and any other relevant details.

- File a Police Report: In cases of serious accidents or hit-and-runs, it's crucial to file a police report. This official record can be invaluable when filing an insurance claim.

- Cooperate with the Claims Adjuster: The insurance company will assign a claims adjuster to investigate your case. Cooperate fully with them by providing all necessary documentation and being transparent about the circumstances of the accident.

- Review the Claim Decision: Once the investigation is complete, the insurance company will inform you of their decision. If you disagree with the outcome, you may have the right to appeal or seek legal advice.

- Consider Legal Action: In cases where the insurance company denies your claim or offers an inadequate settlement, you may need to consider legal action. Consult with an attorney who specializes in insurance law to understand your rights and options.

Tips for Saving on Automobile Insurance in Ohio

Automobile insurance is a significant expense for many Ohio residents. However, there are strategies you can employ to potentially lower your insurance costs. Here are some tips to help you save on your automobile insurance in Ohio:

- Shop Around: Don't settle for the first insurance quote you receive. Take the time to compare quotes from multiple providers. Online tools and insurance brokers can be useful in this regard.

- Raise Your Deductible: Increasing your deductible, the amount you pay out-of-pocket before your insurance kicks in, can lower your premium. However, make sure you choose a deductible amount you can afford in the event of a claim.

- Maintain a Clean Driving Record: A clean driving record is a significant factor in determining insurance rates. Avoid traffic violations and accidents to keep your premiums low.

- Take Advantage of Discounts: Many insurance companies offer discounts for various reasons. These may include good student discounts, safe driver discounts, multi-policy discounts, or discounts for completing a defensive driving course.

- Consider Bundle Discounts: If you have multiple insurance needs, such as home and auto insurance, consider bundling them with the same provider. Many insurers offer significant discounts for bundling multiple policies.

- Review Your Coverage Regularly: Your insurance needs may change over time. Regularly review your coverage to ensure you're not paying for unnecessary features and to take advantage of any new discounts or promotions.

Common Misconceptions about Ohio Automobile Insurance

There are several misconceptions surrounding automobile insurance in Ohio that can lead to confusion and potentially costly mistakes. Here are some of the most common misconceptions, along with the reality of the situation:

- Misconception: Ohio Requires Full Coverage Insurance: Reality: Ohio only requires a minimum level of liability insurance. Drivers are not legally required to carry full coverage insurance, which includes collision and comprehensive coverage. However, it's advisable to have full coverage to protect yourself financially in case of an accident.

- Misconception: Insurance Follows the Car: Reality: In Ohio, insurance typically follows the driver, not the car. This means that if you're involved in an accident while driving someone else's car, your insurance policy will generally cover the damages. However, there may be exceptions, so it's important to review your policy or consult with your insurance provider for clarification.

- Misconception: Insurance Rates are the Same for Everyone: Reality: Insurance rates in Ohio can vary significantly based on individual factors such as age, driving record, vehicle type, and location. Insurance companies use these factors to assess risk and set premiums accordingly.

- Misconception: All Insurance Policies are the Same: Reality: Different insurance providers offer a wide range of coverage options and policy features. It's important to carefully review the policy details to ensure you understand what is and isn't covered.

- Misconception: You Can't Switch Insurance Providers: Reality: Ohio residents have the freedom to choose their insurance provider. If you're unhappy with your current insurer or have found a better deal elsewhere, you can switch providers at any time. Just make sure to maintain continuous coverage to avoid lapses in insurance.

Conclusion

Understanding Ohio automobile insurance is essential for all residents of the Buckeye State. From knowing the minimum liability requirements to exploring the various coverage options and strategies to save on insurance costs, this guide has provided an in-depth look at the world of automobile insurance in Ohio. Remember, it's crucial to tailor your insurance coverage to your specific needs and circumstances, and to always review your policy regularly to ensure it remains up-to-date and adequate.

By staying informed and proactive about your automobile insurance, you can protect yourself and your finances in the event of an accident. Whether you're a seasoned Ohio driver or new to the state, this guide should serve as a valuable resource for all your automobile insurance needs.

Frequently Asked Questions

Can I drive in Ohio without insurance?

+

No, it is illegal to drive in Ohio without valid automobile insurance. The state requires all vehicle owners and operators to maintain at least the minimum liability insurance coverage to ensure financial responsibility in case of an accident. Failure to do so can result in severe penalties, including the suspension of your driver’s license and vehicle registration.

What happens if I’m in an accident and the other driver is uninsured?

+

If you’re involved in an accident with an uninsured driver, your own insurance policy may cover the damages if you have uninsured motorist coverage. This type of coverage protects you in case the at-fault driver does not have insurance. It’s important to review your policy to understand the extent of your coverage in such situations.

Are there any discounts available for automobile insurance in Ohio?

+

Yes, Ohio insurance providers often offer a variety of discounts to help lower your premium. These can include safe driver discounts, good student discounts, multi-policy discounts, and discounts for completing a defensive driving course. It’s worth exploring these options with your insurance provider to see if you’re eligible for any savings.

How often should I review my automobile insurance policy in Ohio?

+

It’s recommended to review your automobile insurance policy at least once a year, or whenever your circumstances change significantly. This could include a change in marital status, the addition of a teen driver to your policy, or a move to a new area. Regularly reviewing your policy ensures that your coverage remains adequate and that you’re not paying for unnecessary features.