Old People Insurance

In the realm of financial planning and healthcare, the topic of Old People Insurance is an increasingly crucial aspect, especially as societies worldwide witness a notable demographic shift towards an aging population. This specialized insurance category is designed to address the unique needs and challenges faced by the elderly, offering comprehensive coverage that goes beyond traditional health insurance. As the average lifespan continues to rise, the demand for tailored insurance solutions that cater to the senior population is more evident than ever.

Understanding Old People Insurance

Old People Insurance, also known as Senior Citizen Insurance or Retirement Insurance, is a dedicated type of coverage that provides financial protection for individuals in their golden years. It encompasses a range of benefits specifically tailored to address the healthcare, long-term care, and lifestyle needs of older adults. This form of insurance aims to ease the financial burden associated with aging, ensuring that seniors can access the necessary medical care, maintain their independence, and enjoy a comfortable retirement.

Key Components of Old People Insurance

This specialized insurance typically includes the following components:

- Health Coverage: Comprehensive medical insurance that covers a wide range of healthcare services, including doctor visits, hospital stays, prescription medications, and preventive care.

- Long-Term Care: Coverage for extended care needs, such as assistance with daily activities, nursing home care, and home healthcare services.

- Income Protection: Financial support to replace lost income in case of illness or disability, ensuring seniors can maintain their standard of living.

- Accidental Injury Coverage: Benefits to cover medical expenses and potential disability resulting from accidents, which can be a common concern for older adults.

- Critical Illness Coverage: Specific coverage for critical illnesses like cancer, stroke, or heart disease, providing a lump-sum payment to help with treatment costs and living expenses.

- Funeral Expense Coverage: A provision to cover the costs of funerals and end-of-life arrangements, easing the financial burden on families.

Each of these components plays a vital role in ensuring that seniors can access the care they need without compromising their financial stability. It's essential to note that the exact coverage and benefits can vary widely depending on the insurance provider and the specific plan chosen.

The Importance of Old People Insurance

As individuals age, their healthcare needs often become more complex and frequent. Old People Insurance is designed to offer peace of mind by providing financial security during a time when medical expenses can be significant. Here are some key reasons why this type of insurance is crucial:

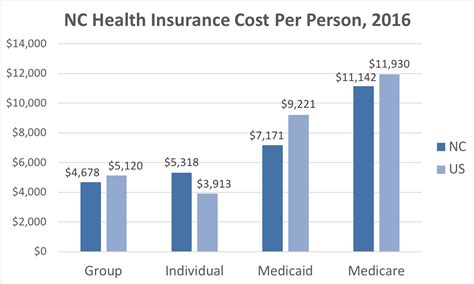

Rising Healthcare Costs

Healthcare costs are a major concern for older adults, as they tend to require more frequent and specialized medical treatments. Old People Insurance helps to cover these costs, ensuring that seniors can access the care they need without depleting their savings or relying on public healthcare systems that may have long wait times.

Long-Term Care Needs

As individuals age, they may require assistance with daily activities or specialized care. Long-term care insurance is a critical component of Old People Insurance, as it provides coverage for nursing home stays, home healthcare services, and other forms of assistance, allowing seniors to maintain their independence and dignity.

Income Stability

Retirement income is often fixed, and unexpected health issues can quickly deplete savings. Income protection coverage ensures that seniors have a stable income stream to cover their living expenses, even if they are unable to work due to illness or disability.

Peace of Mind

Knowing that they have comprehensive insurance coverage can provide seniors with a sense of security and peace of mind. This allows them to focus on enjoying their retirement years without the constant worry of financial strain or uncertainty.

Selecting the Right Old People Insurance Plan

When choosing an Old People Insurance plan, it’s essential to consider several factors to ensure that the coverage meets your specific needs. Here are some key considerations:

Assessing Your Needs

Begin by evaluating your current and future healthcare needs. Consider factors such as your overall health, any pre-existing conditions, and the level of care you anticipate requiring in the coming years. This assessment will help guide your choice of insurance coverage.

Understanding Plan Options

Research and compare different insurance plans to understand the range of coverage they offer. Look for plans that provide comprehensive benefits, including health coverage, long-term care, and income protection. Consider the cost of premiums and any potential out-of-pocket expenses.

Evaluating Reputable Providers

Choose insurance providers with a strong reputation and a history of providing reliable coverage. Look for companies that specialize in senior citizen insurance and have a track record of fair claims processing. Customer reviews and ratings can also provide valuable insights.

Seeking Professional Advice

Consider consulting with a financial advisor or insurance broker who specializes in retirement planning. They can offer expert guidance tailored to your specific situation, helping you navigate the complex world of insurance options.

Real-World Benefits of Old People Insurance

The impact of Old People Insurance can be life-changing for many seniors. Here are some real-world examples of how this type of insurance has made a difference:

Case Study 1: Medical Emergency Coverage

Mrs. Johnson, a 72-year-old retiree, suffered a stroke, requiring immediate medical attention and long-term rehabilitation. Her Old People Insurance plan covered the extensive medical costs, ensuring she received the best care without financial worry. The insurance also provided a caregiver benefit, allowing her daughter to take time off work to assist with her recovery.

Case Study 2: Long-Term Care Assistance

Mr. Smith, aged 80, developed mobility issues and needed assistance with daily activities. His insurance plan included long-term care coverage, which provided funding for a live-in caregiver. This allowed him to remain in the comfort of his own home and maintain his independence, which greatly improved his quality of life.

Case Study 3: Income Protection

Ms. Lee, a 65-year-old retiree, was diagnosed with a serious illness that required extensive treatment. Her Old People Insurance included income protection, which provided her with a regular income stream, ensuring she could continue to pay her living expenses and focus on her health without financial stress.

The Future of Old People Insurance

As the global population continues to age, the demand for specialized insurance solutions will only increase. Insurance providers are likely to continue developing innovative products that cater to the unique needs of seniors. This may include more flexible plans, digital solutions for easy claim processing, and expanded coverage options to address the evolving healthcare landscape.

Additionally, with the rise of remote work and digital communication, insurance companies may offer more convenient ways for seniors to access their benefits and services, ensuring that they can manage their coverage effectively from the comfort of their homes.

What is the average cost of Old People Insurance premiums?

+The cost of premiums can vary significantly depending on the coverage level, age, health status, and location. On average, premiums for Old People Insurance range from 50 to 500 per month, with higher coverage levels typically commanding higher costs.

Are there any government-provided insurance programs for seniors?

+Yes, many countries offer government-funded healthcare programs for seniors, such as Medicare in the United States. These programs often provide basic coverage, but additional insurance may be needed to cover specific needs.

Can Old People Insurance be purchased at any age?

+While it’s ideal to purchase this type of insurance when you’re younger and healthier, many providers offer coverage for seniors up to a certain age, typically 75-80 years old. However, premiums may be higher for those who enroll at an older age.