Online Car Insurance

In today's digital age, many aspects of our lives have seamlessly transitioned online, and the world of car insurance is no exception. The concept of online car insurance has revolutionized the way we protect our vehicles and offers a host of benefits that traditional insurance methods simply cannot match. From the convenience of policy acquisition to the efficiency of claims management, online car insurance has become an attractive and practical option for many drivers.

This comprehensive guide will delve into the depths of online car insurance, exploring its evolution, the advantages it brings, and how it is shaping the future of automotive coverage. By the end, you'll have a clear understanding of why online car insurance is not just a trend but a transformative force in the insurance industry.

The Evolution of Online Car Insurance

The journey of online car insurance began with the advent of the internet and the subsequent digital transformation of various industries. Insurance companies quickly recognized the potential of the web to reach a wider audience and offer more efficient services. The early days saw simple online portals where drivers could get basic quotes and limited policy information. However, as technology advanced, so did the capabilities of online insurance platforms.

Today, the landscape of online car insurance is vastly different. Sophisticated algorithms and data analytics have enabled insurance providers to offer highly personalized and competitive quotes. The entire process, from obtaining quotes to purchasing policies, is now streamlined and can be completed entirely online, often within a matter of minutes. This evolution has not only made car insurance more accessible but has also empowered drivers with the tools to make informed decisions.

Key Advantages of Online Car Insurance

Convenience and Accessibility

One of the most significant advantages of online car insurance is the unparalleled convenience it offers. Drivers can now access insurance services anytime, anywhere, with just a few clicks. Whether it’s comparing quotes, understanding policy details, or purchasing coverage, the entire process can be completed from the comfort of one’s home or on the go using a mobile device. This accessibility is particularly beneficial for busy individuals or those in remote areas, who may otherwise face challenges in obtaining insurance.

Moreover, the online platform provides a transparent and user-friendly interface, allowing drivers to easily navigate through various options and make informed choices. This transparency not only enhances the overall experience but also builds trust between the insurance provider and the policyholder.

Customized Coverage and Competitive Pricing

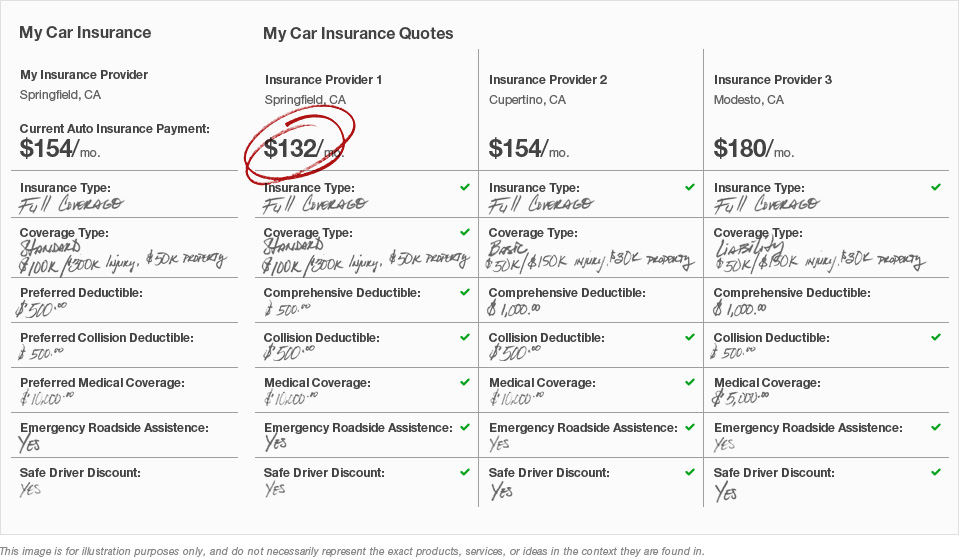

Online car insurance platforms leverage advanced technologies to offer highly tailored coverage options. By analyzing vast amounts of data, these platforms can provide personalized quotes that take into account an individual’s unique circumstances, such as driving history, vehicle type, and geographical location. This level of customization ensures that drivers receive coverage that is not only comprehensive but also competitively priced.

The competitive nature of the online insurance market further drives down prices. With multiple providers vying for customers online, drivers can easily compare quotes and choose the option that best fits their needs and budget. This competition not only benefits consumers but also encourages insurance companies to continuously innovate and improve their offerings.

Streamlined Claims Process

One of the most critical aspects of car insurance is the claims process, and online insurance has significantly streamlined this procedure. In the event of an accident or vehicle damage, policyholders can initiate a claim online, often with just a few clicks. The process is typically faster and more efficient, with real-time updates and direct communication channels with the insurance provider.

Many online insurance platforms also offer innovative features such as digital claim forms, instant claim tracking, and even video or photo upload capabilities, which can expedite the claims assessment and settlement process. This level of efficiency not only reduces the stress associated with filing a claim but also minimizes the time and effort required, allowing policyholders to focus on their recovery or vehicle repairs.

Case Studies: Success Stories in Online Car Insurance

The impact of online car insurance is best illustrated through real-world success stories. For instance, Company X, a leading online insurance provider, has revolutionized the industry with its innovative approach. By leveraging advanced data analytics and machine learning, Company X offers highly accurate and personalized quotes, ensuring that its policies are both comprehensive and affordable.

Furthermore, Company X's online platform provides an intuitive user experience, making it easy for drivers to understand and manage their policies. The company's commitment to transparency and customer satisfaction has resulted in a loyal customer base and numerous industry accolades.

Another notable success story is Provider Y, which has transformed the claims process with its cutting-edge digital solutions. Provider Y's online platform allows policyholders to file claims, upload supporting documents, and track the progress of their claims in real-time. This streamlined process has significantly reduced the average time taken to settle claims, earning Provider Y a reputation for efficiency and customer service excellence.

| Company | Key Innovation |

|---|---|

| Company X | Personalized Quotes using Advanced Analytics |

| Provider Y | Digital Claims Process with Real-time Tracking |

The Future of Online Car Insurance

As technology continues to advance, the future of online car insurance looks promising and full of potential. One of the key areas of development is the integration of telematics and usage-based insurance (UBI). With telematics, insurance providers can gather real-time data on driving behavior, allowing for even more accurate and personalized policies. UBI, on the other hand, offers drivers the opportunity to pay for insurance based on their actual usage, providing a more flexible and cost-effective option.

Additionally, the rise of electric and autonomous vehicles presents new challenges and opportunities for online car insurance. Insurance providers will need to adapt their policies and pricing models to accommodate these emerging technologies, ensuring that drivers of the future are adequately protected.

The future also holds the promise of further digital transformation, with potential advancements in artificial intelligence (AI) and blockchain technology. AI can enhance the efficiency and accuracy of claims processing, while blockchain can provide a secure and transparent platform for policy management and claims settlement. These technological advancements will not only benefit insurance providers but also empower drivers with greater control and peace of mind.

FAQs

How secure is my personal information on online car insurance platforms?

+Online car insurance platforms prioritize data security. They employ advanced encryption technologies to protect your personal information, ensuring it remains confidential and secure. Additionally, these platforms adhere to strict data privacy regulations to safeguard your data.

Can I still speak to a real person if I have questions or concerns about my online car insurance policy?

+Absolutely! While online car insurance platforms offer a convenient digital experience, they also provide multiple channels of communication for customer support. You can often reach out via phone, live chat, or email to connect with a customer service representative who can address your queries.

What if I need to make changes to my policy or add additional coverage after purchasing my online car insurance policy?

+Most online car insurance platforms offer flexible policy management options. You can typically make changes to your policy, add or remove coverage, or update your personal information through your online account. Some providers may also offer assistance via customer support channels to guide you through these changes.